The past few weeks have seen some of the year’s most highly anticipated events for the UK property market,...

UK Property News – February 2021

Welcome to our latest review of UK property news in February 2021.

The start of 2021 has been anything but normal, and the significant disruption brought to everyday life by lockdown is now being reflected in the latest housing market data.

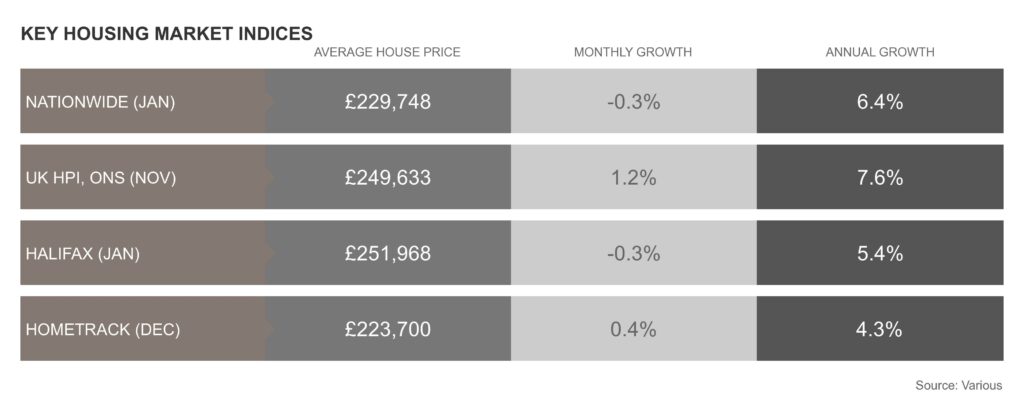

For the first time in six months, Nationwide has reported average monthly property values to have fallen.

The fall of 0.3% is the same rate reported by Halifax, marking the biggest monthly drop in values since April last year.

Headlines of falling house prices will be disconcerting for anyone purchasing a property, posing the obvious questions of “am I paying too much” and “should I wait”, but wider market trends need to be taken into consideration to form a reliable picture of what is really going on.

A three-way market

Sweeping generalisations about the property market can be misleading.

The market comprises of three core components; new buyers, homes for sale, and agreed transactions, and at the moment they are all doing very different things.

A significant number of transactions are still being progressed in the hope of completing before the Stamp Duty holiday deadline. 129,400 homes changed hands in December, a monthly increase of 13%, and 32% higher than a year ago.

According to Zoopla, there were 9% more sales agreed in 2020 than in 2019.

Despite the further national lockdowns, purchaser demand remains strong.

Ironically, the longer people are spending in their current homes the more reflection, dialogue and planning is seemingly taking place to explore moving to a new home.

Rightmove has just reported its busiest ever January for website visitors.

Zoopla has seen a 13% increase in buyers registering with estate agents year-on-year.

This data aligns to Garrington’s own experience of our busiest January ever for new clients wishing to retain our services.

In stark contrast, new property being listed for sale is at chronically low levels.

This is partially explained by the current restrictions, and loss of appetite amongst some sellers to have potential buyers coming into their homes.

Equally, there appears to be a pause for thought amongst some would-be sellers.

Nationally, new listings were down 21% in January compared with last year.

In the more discretionary led prime market, this trend is exacerbated further.

A number of the homes Garrington is currently acquiring for clients are being sold off-market, where sellers have been attracted by this more selective method of sale.

Budget building blocks

All eyes will be on the Chancellor on 3rd March when he presents his Budget to the country.

It is thought that Rishi Sunak will balance the need to claw back much needed funds to pay for the pandemic whilst recognising that the economy remains fragile and the country in lockdown.

The property market has hugely benefited from the stimulus policy of the Stamp Duty holiday and there is pressure on the Chancellor to avoid a ‘cliff-edge’ moment in March and to extend the deadline or announce some form of tapering.

The Scottish government has already announced that it will not be extending its equivalent scheme for its Land and Building Transaction Tax.

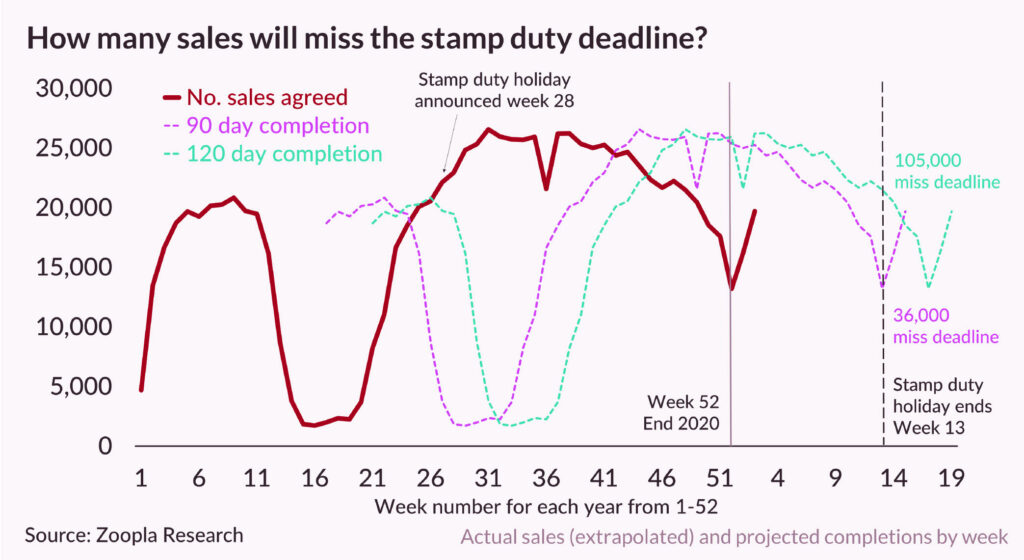

Zoopla’s research suggests that anywhere between 36,000 and 105,000 transactions could miss the current deadline.

This poses the obvious risk of transactions faltering, particularly in chains where there is an over-reliance on the Stamp Duty savings.

In the absence of any further support, the coming weeks are likely to be tinged with great uncertainty for anyone mid-transaction trying to complete before the end of March.

Apart from Stamp Duty, the other significant news will be whether the Budget is biased towards fiscal stimulus or higher taxation.

This could have a profound effect on whether the property market in turn is likely to be challenged or further supported with economic building blocks post lockdown.

Spring bounce or slowdown?

In the short term, Garrington believes that further published data will record a slowdown in agreed sales and average prices.

This is to be expected, reflecting the prevailing market conditions previously outlined.

Lack of stock, safety concerns, lockdowns and bad weather are all compounding to create uncertainty and a period of reflection.

However, based on what Garrington is seeing on the front line in the market, and forward indicators from new buyer demand, we believe this is a blip and not the start of a permanent trend.

With the economy firmly underpinned by the success of the vaccine rollout, the Bank of England has predicted that GDP will “recover rapidly” in 2021 after shrinking by 4.2% in the first three months of the year.

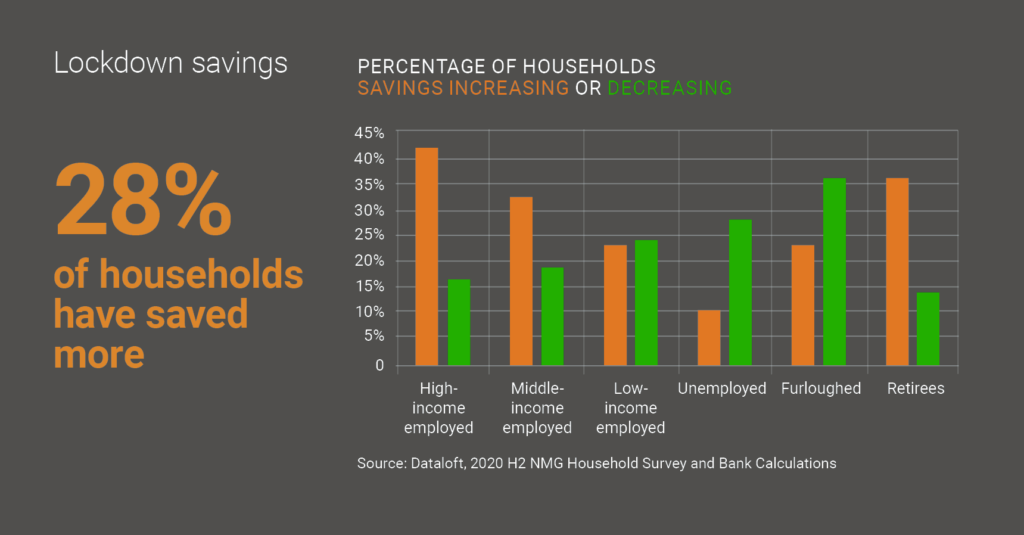

This forecast is based not only on the vaccine, but also on the additional £120 billion estimated to have been saved since the first lockdown.

It has been reported that 28% of households have saved more during the pandemic, particularly in mid to high income family groups, which are also the most active in the property market.

The extent to which we may see a bounce or slowdown will become clearer over the coming weeks as key policy announcements and timescales are confirmed, all of which are likely to create new opportunities and threats for different parts of the property market.

Garrington will provide ongoing commentary as these happen.

If you would like further information about our property finder services, please do get in touch.