The past few weeks have seen some of the year’s most highly anticipated events for the UK property market,...

UK Property News – April 2021

Welcome to our latest review of UK property news in April 2021.

Activity in the property market over recent weeks has been as extreme as the weather over the Easter period.

As predicted in last month’s report, the eagerly awaited spring bounce is in full force and is being further buoyed by the Stamp Duty Holiday extension, a growing realisation that historically low interest rate mortgages will not remain available indefinitely and the gradual lifting of lockdown restrictions.

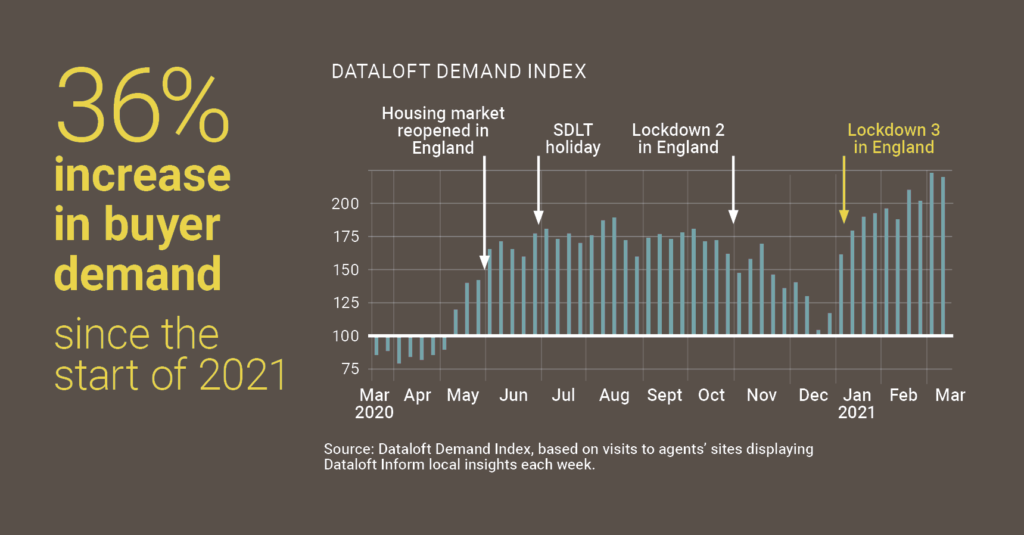

The Dataloft Demand Index shows a 36% increase in housing market demand since the start of 2021, with the traditional spring market set to be busier than ever this year.

Rightmove has reported that sales in the first week of March were up 12% year-on-year. The number of buyers enquiring per available property was 34% higher.

Across the locations in which Garrington operates, from Scotland to Cornwall, our team is seeing more stock for sale entering the market.

This is either openly on portals, or privately available off-market.

In some locations around 40% of sales are being agreed off-market, which is noticeably more than usual for this time of year.

A reversal of the North-South divide

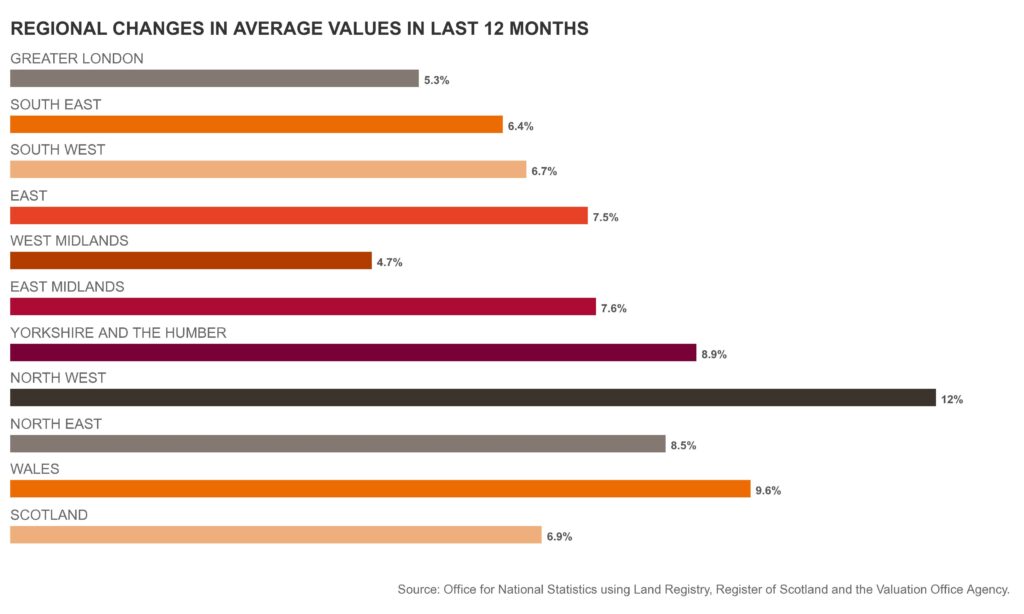

Whilst the headline trend across the UK is one of a busy housing market, in reality local differences are evident as highlighted by last month’s ONS housing market data.

This shows that new hotspots are emerging and burning bright, with average prices across Northern England rising at well over 8% per annum.

With the North-South divide now in reverse, prices in the North are not so much levelling up as flying up.

At a more regional level, the North West had the highest annual house price growth, with average prices increasing by 12.0% in the year to January 2021.

This is the highest annual growth rate the North West has seen since June 2005.

A perfect storm of regional inward investment, corporate relocations, second home purchases and lifestyle switching are all driving demand, and in turn, pushing house prices upwards.

London by contrast recorded the second lowest rate of price growth, yet this is still up 5.3% year on year, which by any measure, given London’s average values and noticeably absent foreign buyers, remains strong.

This latest data underlines both the strength of the market and the widening performance gap between different parts of the UK.

Work from home – for now or forever?

Now that there is some light at the end of the tunnel with the gradual lifting of lockdown restrictions, more questions are being asked as to what the ‘new normal’ may look like.

The almost forced experiment of digital commuting from home has proved successful for many employers and employees alike, and indeed, has been cited as one of the reasons so many people are moving to a new property or location – or indeed, both.

Nationwide confirmed last month that their 13,000 staff are being empowered with choosing where they wish to work; whether that be from home, an office or combination of the two.

They are not alone in making this decision and many other blue-chip firms have confirmed a similar flexible approach to future working locations.

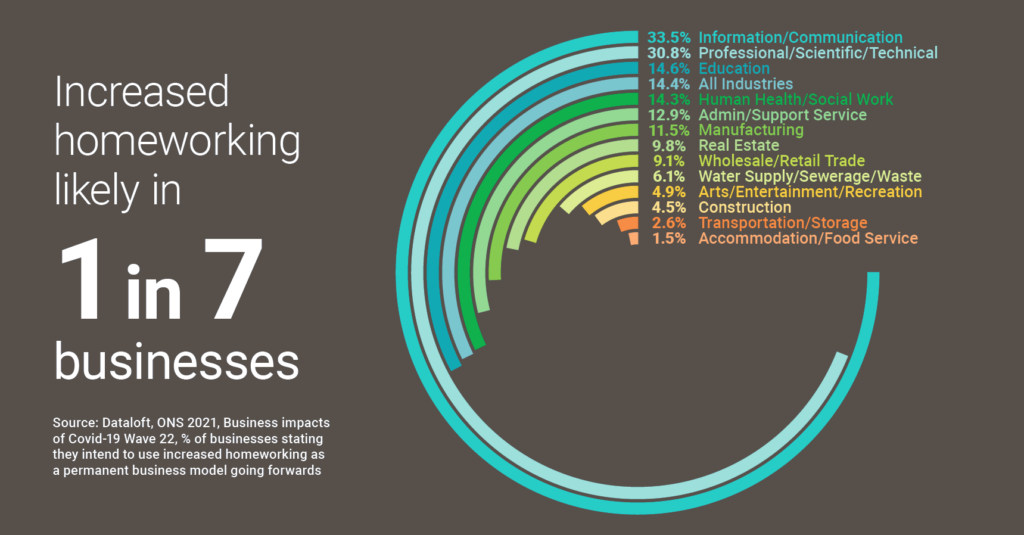

Despite these early adopters, currently just 1 in every 7 firms surveyed by ONS proposes using increased home working as a permanent business model.

During the recent third lockdown, 28% of businesses had more staff working from home because of the pandemic, with figures much higher in traditional office sectors such as professional services and IT.

The last year has seen the daily commute disappear for many.

The degree to which employees return to ‘the office’ has a significant impact on the property industry, high streets, and transportation networks. The coming months will therefore be critical in identifying the nature of more lasting trends.

A paradigm shift on house values?

Intrinsically linked to having the ability to work from home is of course access to reliable and fast broadband.

The surge in using broadband for work purposes over the last year has highlighted just how dependent many have become on the availability and reliability of such services.

Garrington has seen first-hand, properties that would have been snapped up just 5 years ago, may now struggle to sell if they are in a poor location for broadband.

The extent to which this affects purchaser demand can be likened to a more traditional feature, like access to transport networks, as a factor determining the desirability and value of a property.

This was also highlighted by The Sunday Times in their annual survey of Best Places to Live. Stroud was crowned overall winner, with reference specifically being made to superfast broadband and full fibre services available from Gigaclear, adding to the existing appeal of the location.

The Government announced last month a £5 billion infrastructure investment, known as ‘Project Gigabit’. More than one million hard to reach homes and businesses will benefit from next generation gigabit broadband.

Up to 510,000 homes and businesses in areas such as Cambridgeshire, Cornwall, Cumbria, Dorset, Durham, Essex, and Northumberland will be the first to benefit.

Outlook

The coming weeks are likely to be characterised by the transition the country is going through, brought by the lifting of lockdown measures.

This transition will further influence market activity, although we have every reason to believe conditions will remain fast paced until at least the summer.

Of course, significant regional variations will apply, as will differences by price bracket. If you have an interest in a specific part of the country and would like the latest information, please do get in touch.