The past few weeks have seen some of the year’s most highly anticipated events for the UK property market,...

UK Property News – June 2021

Welcome to Garrington’s June 2021 update on the UK property market.

Market conditions have remained brisk over the last month, exacerbated further by the forthcoming phasing out of the Stamp Duty Holiday.

The chronic supply/demand imbalance has led to various indices recording double digit price movements and further new records being set including 32% of properties being sold above their initial asking price in April. This is the highest percentage ever recorded according to the latest data released by Propertymark.

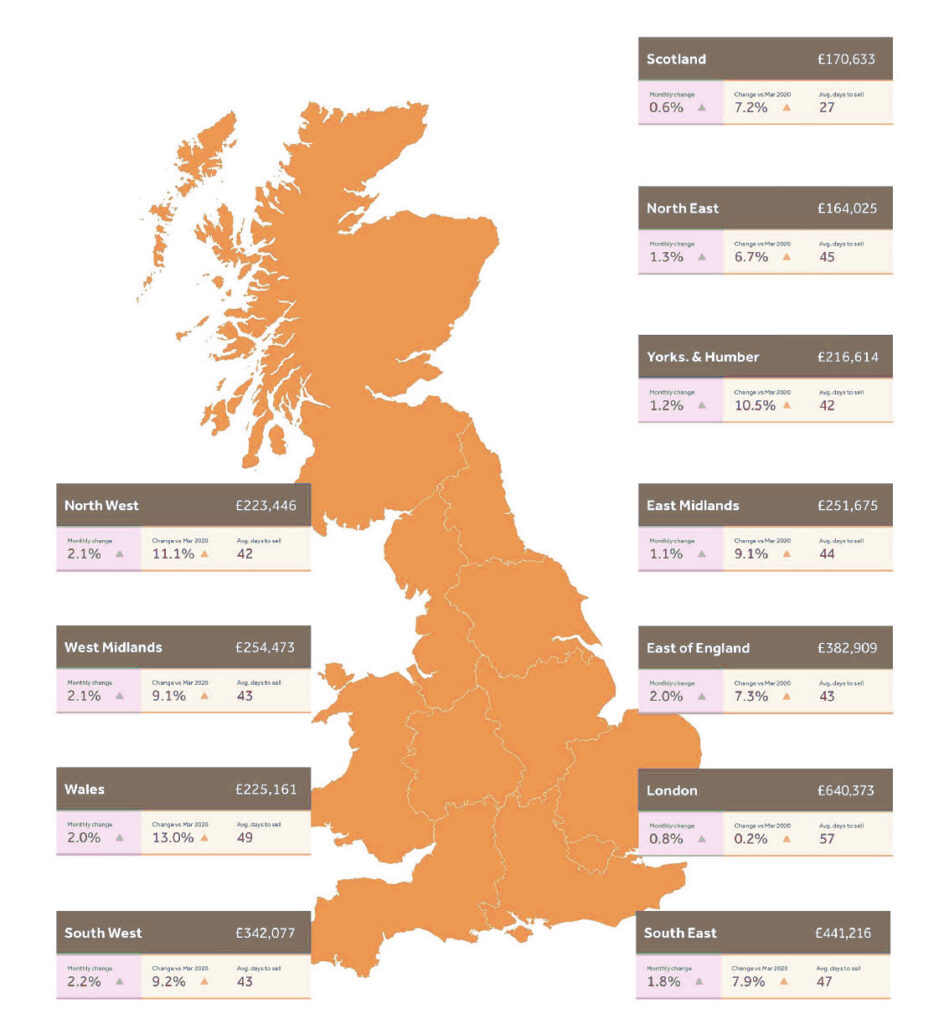

Double digit asking price growth has been recorded across various regions, including Wales at 13%, 11.1% in the North West and 10.5% in Yorkshire and the Humber.

Two key factors are driving purchaser demand in such locations; relative affordability compared to other parts of the country and high levels of relocation, with buyers searching for more for their budget and, on many occasions, a new way of life.

Asking price growth is translating into sale price growth too. Halifax recorded a 1.3% monthly increase in prices, whilst Nationwide recorded a rise of 1.8% last month and that the annual rate of price growth now stands at 10.9%. ONS reported house prices being 10.2% higher than a year ago.

The hidden market

Newly listed properties are flying off the shelves. Most agents in the latest Dataloft subscriber poll said that homes, once listed, are selling in less than 28 days.

22% of agents state most homes are selling in less than a week, with Zoopla reporting that the number of homes selling within the first week of marketing is currently at its highest ever level.

On the face of it, this sounds like positive news supporting a buoyant market, but in reality, it is increasingly deterring would-be sellers from listing their homes for sale.

Many estate agents have significant pipelines of potential stock, blocked by sellers who cannot find anywhere to move to themselves.

These potential sellers trying to form an impression of the market from property portals, are not seeing a true picture though.

Garrington is seeing significantly more off-market opportunities than it would typically see at this time of the year.

So, whilst sales activity looks constrained in some locations, the ‘iceberg nature’ of hidden off-market sales runs much deeper than many people realise.

Prime market leads the UK property market

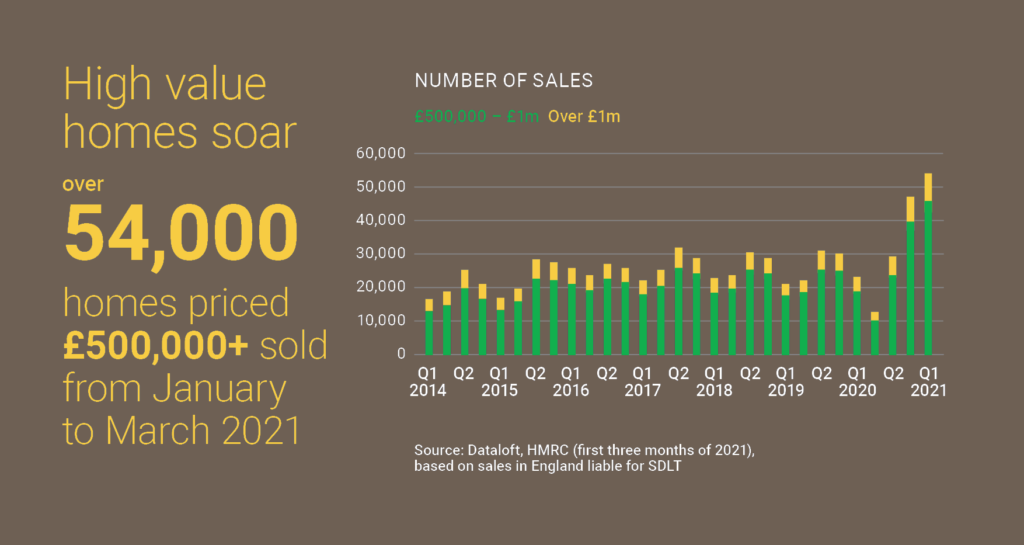

Data released last month from HMRC records a significant jump in high value sales during Q1 this year.

Over 54,000 homes sold in England alone with a price tag more than £500,000 in the first three months of 2021, which is more than twice the recent historical average from 2015-2019. A similar trend has been seen in Scotland and Wales.

Across the UK, top of the ladder properties are currently seeing the strongest level of price growth across the market according to Rightmove, which recorded a further monthly increase of 3.1%.

So called ‘best of breed’ homes remain short in supply in both city, country and coastal markets.

In London, sales of £5 million plus homes were up 65% in April compared to April 2019 and transaction volumes were at their highest since the previous peak in 2014 according to LonRes.

Holiday Lets time to shine

Beyond some home movers completely shifting their entire work-life structure, one of the most active groups of purchasers in the market are holiday home buyers.

Second homes used to be the preserve of the cash buyer, but mortgage products for holiday lets have increased by 45% over the last 6 months according to Moneyfacts, with over 149 holiday let mortgages now available in addition to second home mortgages.

Purchase motivations vary from wanting a rural or coastal retreat to pure investment.

The holiday home sector has been further buoyed by the booming staycation market, record occupancy rates, double digit yields, and favourable tax structures compared to traditional residential investments.

Coast and country remain in predictable demand for this profile of buyer and Garrington has already this year successfully acquired some of the finest homes of this type.

Outlook for UK property

As we approach the halfway mark of 2021, the coming weeks could arguably have a profound effect on what the second half of the year may look like for the property market.

Core to so many market and business forecasts is the degree to which we remain on track to fully lift restrictions and social distancing, the continued success of vaccinations and that new variants remain under control.

Inflation remains a real and growing concern. The Chartered Institute of Procurement and Supply says that price inflation for raw materials is now at a 24 year high.

Double digit house price inflation has led the Bank of England to say that ‘it is watching the housing market closely’.

If house price growth fails to ease, there is the possibility of some form of intervention by the Bank of England.

However, putting up interest rates by even 0.5% could slam the brakes on not just the housing market but also a still fragile and recovering economy.

Learning from the lessons of 2008, the Bank may therefore tighten lending criteria, either by reducing the income multiplier lenders use to assess borrowers’ suitability for loans or by limiting the LTV ratio they can offer.

Garrington will continue to closely monitor and report emerging trends in future updates, which are certain to bring both opportunities and threats to those wishing to purchase a property this year.

If you would like to discuss your own property plans and how our property finder service can help you, please feel free to get in touch.