The past few weeks have seen some of the year’s most highly anticipated events for the UK property market,...

UK Property News – December 2021

Welcome to the December 2021 edition of Garrington’s UK property market review, our last of the year – and what a year it has been for the UK property market.

At the start of 2021, in the midst of a national lockdown, nobody expected the market to perform quite as strongly as it has this year, with numerous price records being broken month after month.

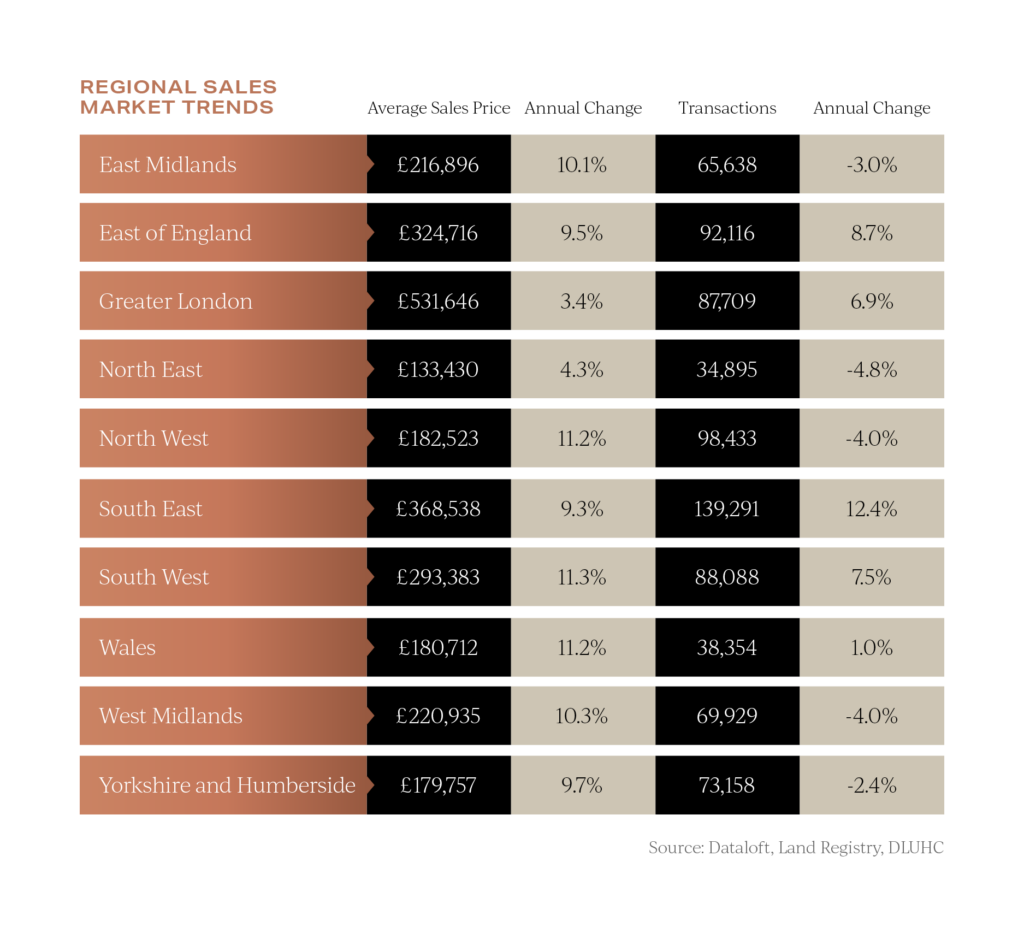

The theme of wanting more space and a reassessment of lifestyle priorities has continued to drive purchaser demand across swathes of the UK, with many regions recording double digit price growth.

However, towards the latter part of the year we have seen a chronic shortage of stock in many prime areas which is holding back transaction numbers, and potentially causing an artificial spike in prices as demand far outstrips supply.

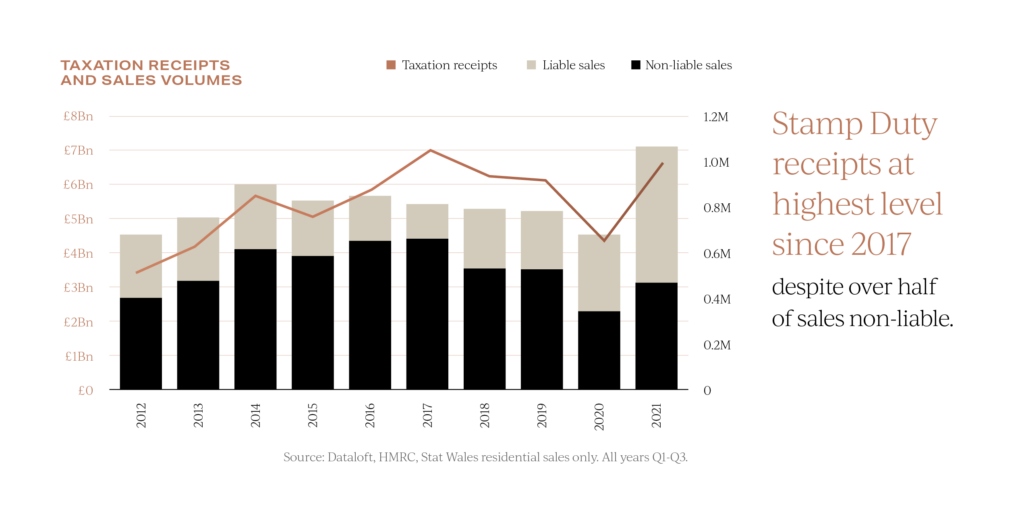

The Government came under criticism from some quarters for extending the Stamp Duty Holiday, but their overall strategy of kickstarting the property market and associated household spending has seemingly worked.

Over £6.6 billion has been collected in residential tax receipts across England and Wales in the first 9 months of 2021, the highest total since 2017.

This is despite the fact that 56% of sales did not pay any tax due to the stamp duty holidays, first-time buyer tax relief, or were sold below the taxation threshold.

This is despite the fact that 56% of sales did not pay any tax due to the stamp duty holidays, first-time buyer tax relief, or were sold below the taxation threshold.

The prime sector of the market has certainly led the way in England, with over 25,600 sales being recorded for £1 million or more.

This is nearly double the 2017-2019 average. 5,500 property sales have been subject to the 2% additional surcharge for overseas purchasers since its introduction in England on April 1st, netting the treasury an additional £44 million in tax.

Future trends

Over recent weeks, Garrington has frequently been asked; what sort of market we are likely to see in 2022?

Recent history has cautioned all forecasters to ‘expect the unexpected’ and there are many variables which could of course influence the early months of the year, including interest rate decisions by the Bank of England, and of course, the Omicron variant, with its potential to disrupt day to day life.

The picture we are currently seeing is a cooling market ahead of the traditional Christmas lull, but still very busy for the time of year by historical standards.

Rightmove has recently recorded for the first time since January this year, a fall of 0.6% in average asking prices of property entering the market.

However, in contrast the portal also reports a 14% increase in the number of homeowners requesting a valuation of their home.

This trend aligns with what Garrington is hearing from sales agents, who have a number of properties poised to enter the market, but not until early 2022.

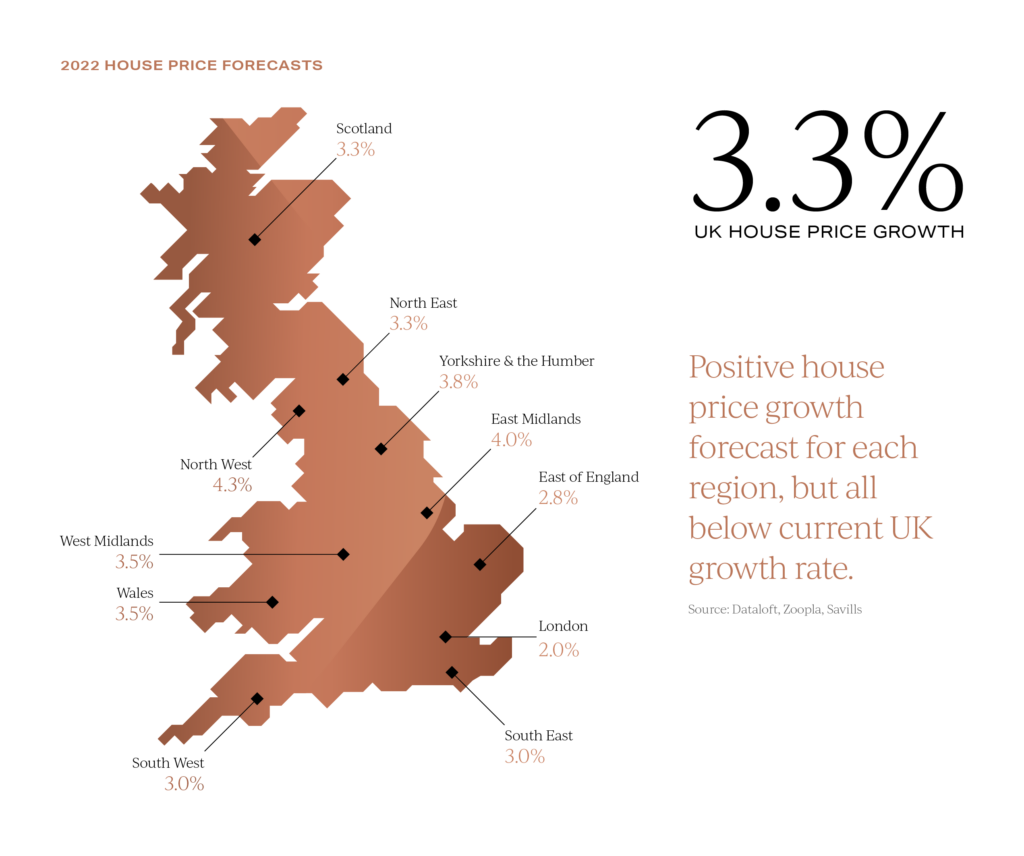

A number of house price forecasts are starting to emerge.

So far, the consensus view is that house price growth is due to slow in 2022, but remain positive, ranging from 2% to 4.3%.

The market is likely to become more polarised in nature and price affordability is likely to start to bite in some locations where house price inflation has been surging well ahead of local wage inflation for several years now.

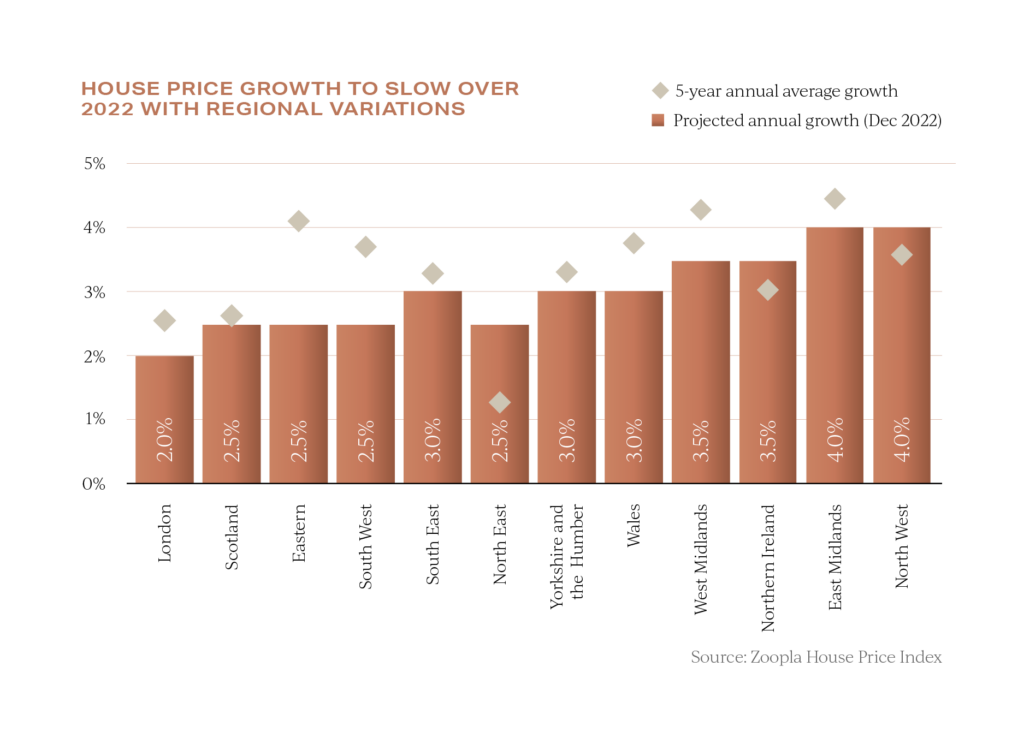

Zoopla has published a regional breakdown of their forecasts.

Growth will be highest in Northern and Midlands regions, where affordability is less constrained, and slowest in London where it is more stretched.

Growth will be highest in Northern and Midlands regions, where affordability is less constrained, and slowest in London where it is more stretched.

Such rises are likely to exceed the historical five-year average growth rates.

A shortage of homes on the market and high levels of equity will be key drivers for house price growth in 2022.

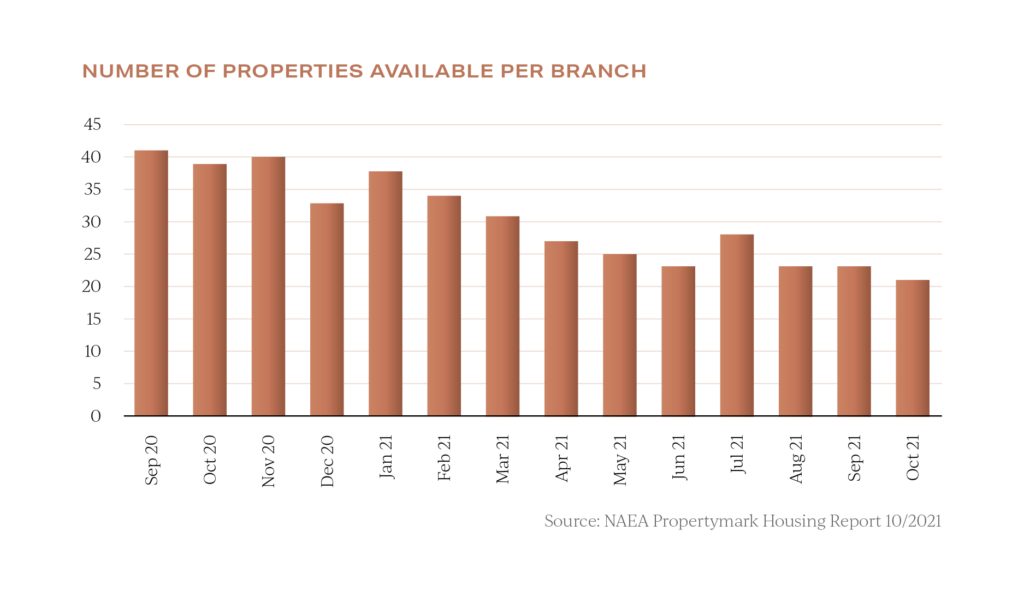

This chronic lack of stock being so far out of kilter with demand levels is being cited as ‘unsustainable’ by Propertymark.

Amongst its member estate agent branches, stock levels have fallen 46% since this time last year to the lowest level since records began.

All of this translates to each estate agent branch having only 21 homes for sale, yet 511 buyers registered, meaning on average, there are now 24 buyers for every available property on the market.

All of this translates to each estate agent branch having only 21 homes for sale, yet 511 buyers registered, meaning on average, there are now 24 buyers for every available property on the market.

Outlook for the UK property in 2022

The New Year is traditionally a time when moving hopes and ambitions turn into a reality and as such, activity levels usually increase.

Historically, Boxing Day is one of the busiest days for website traffic on the main property portals.

Stock levels tend to improve in the New Year, and whether the market follows seasonal norms will be a crucial forward indicator to monitor in January.

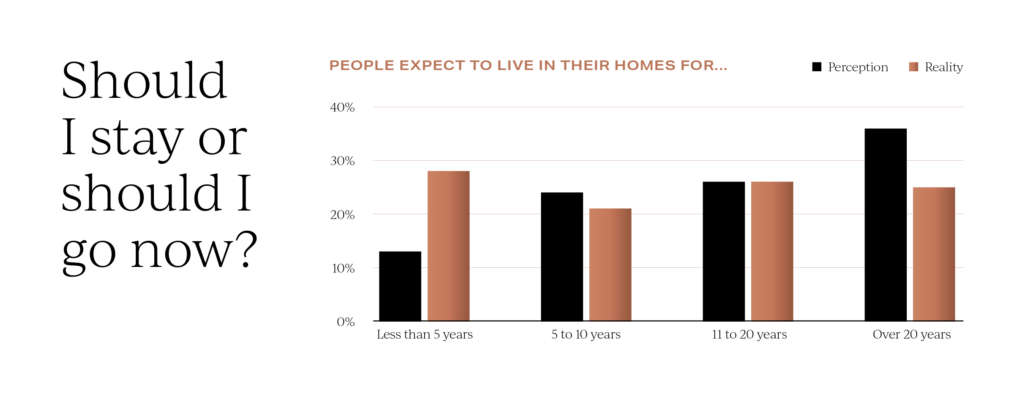

Whilst many movers next year will be buying what they consider to be a ‘forever home’ the reality is that just one in four will stay for over 20 years.

A key finding of the recently published Home Moving Trends Survey records that more people move more often than they expect to.

A key finding of the recently published Home Moving Trends Survey records that more people move more often than they expect to.

While just 13% of home movers expect to move within the next 5 years, the reality is that 28% are likely to do so.

For anyone contemplating a winter move and the associated practical issues with the weather, according to the Met Office, the UK averages 3.9 days of snow and sleet in December, compared to 5.3 days in January.

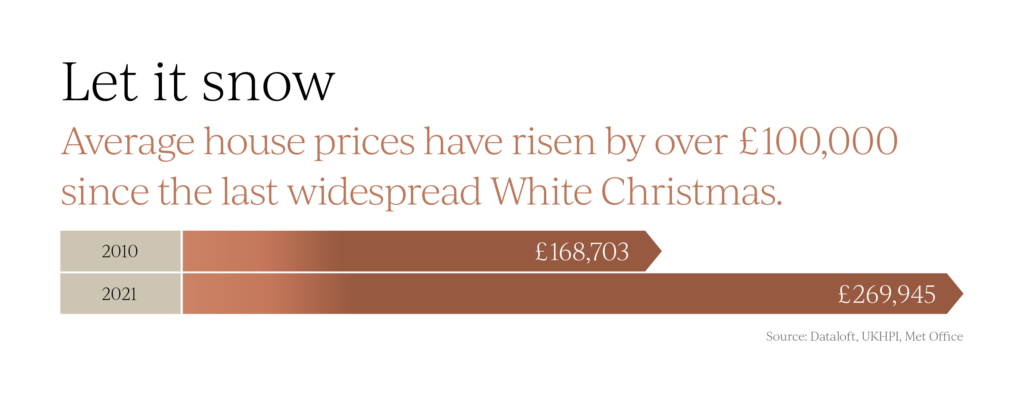

Looking ahead to the festive period, the last widespread white Christmas in the UK was in 2010, when 83% of weather stations reported snow on the ground.

The average price of a property has risen by just over 60%, the equivalent of £101,000 since that date.

Over the last 50 years snow has fallen on just 15 Christmas Days, 2020 the most recent white Christmas after snow fell overnight across parts of the UK.

Over the last 50 years snow has fallen on just 15 Christmas Days, 2020 the most recent white Christmas after snow fell overnight across parts of the UK.

We wait to see what will happen this year and look forward to updating you on market conditions in the New Year.

In the meantime, from all the team at Garrington, we wish you a wonderful festive break.

If you would like to discuss your own property plans for 2022, please feel free to get in touch using the contact details below.