The past few weeks have seen some of the year’s most highly anticipated events for the UK property market,...

UK Property News – June 2022

Welcome to the June 2022 edition of Garrington’s UK property market review.

Activity over the last month has remained brisk, albeit with a growing sense of caution amongst buyers and sellers alike, who have increasingly divided opinions as to what constitutes fair value in a changing market.

On the front line, Garrington is seeing buyers factoring in more risk into their offers, given the increasingly uncertain economic landscape.

Meanwhile, sellers on many occasions feel they still have the upper hand, with demand continuing to exceed the supply of homes for sale.

Latest trends

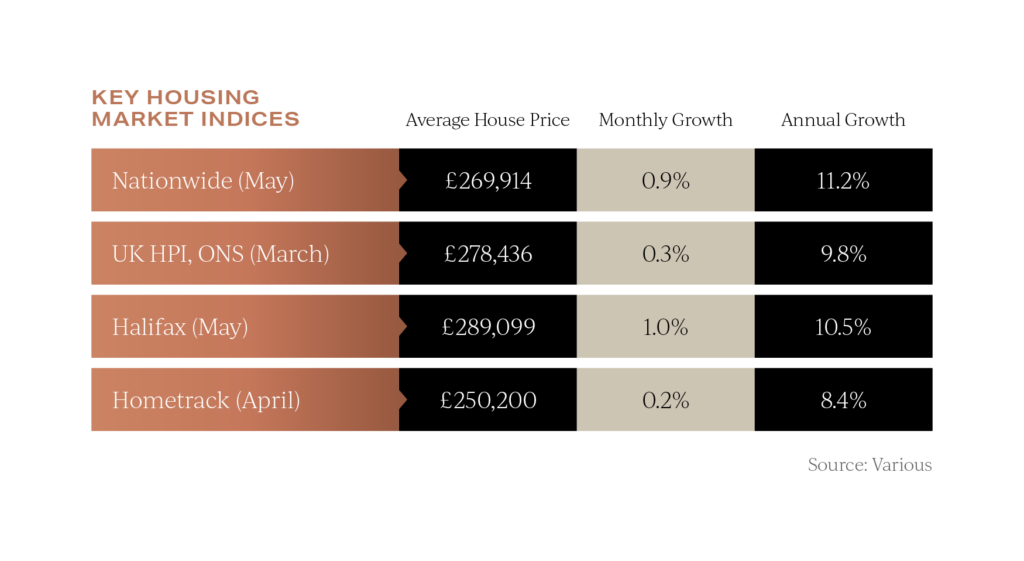

Trying to make sense of contradictory market data and forecasts is adding to the confusion for movers. Most attention has focused on the movement of average house prices.

Both Nationwide and Halifax recorded further growth last month of 0.9% and 1% respectively.

Halifax notes that average house prices have now risen a staggering 74% over the last 10 years. House price data such as the ONS is based on completed transactions, which in most instances were agreed many months prior to their completion date.

Halifax notes that average house prices have now risen a staggering 74% over the last 10 years. House price data such as the ONS is based on completed transactions, which in most instances were agreed many months prior to their completion date.

Looking at price trends found at the start of the sales pipeline provides better forward indicators as to the likely state of the market in months to come.

The number of buyers registering with estate agents has fallen 14% compared to this time last year according to Rightmove.

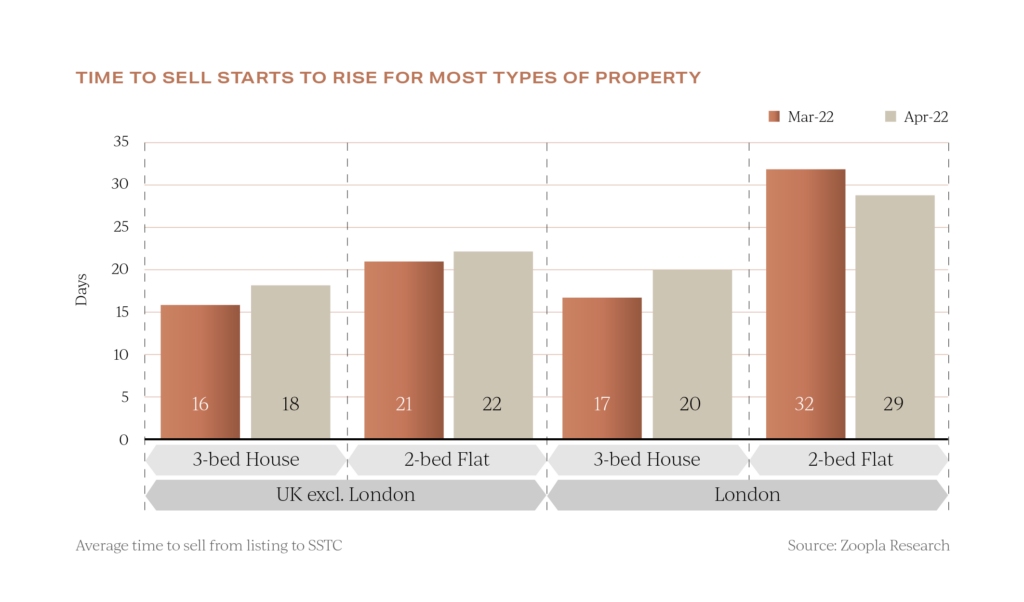

The number of days required to find a buyer is rising according to Zoopla, who also share that the recent uniform pattern of prices only rising appears to be changing, with one in twenty homes having a price cut of 5% or more in the four weeks to mid-May.

Net borrowing of mortgage debt by individuals decreased to £4.1 billion in April, down from £6.4 billion in March. Mortgage approvals for house purchases also decreased to 66,000 in April from 69,500 in March, according to the Bank of England.

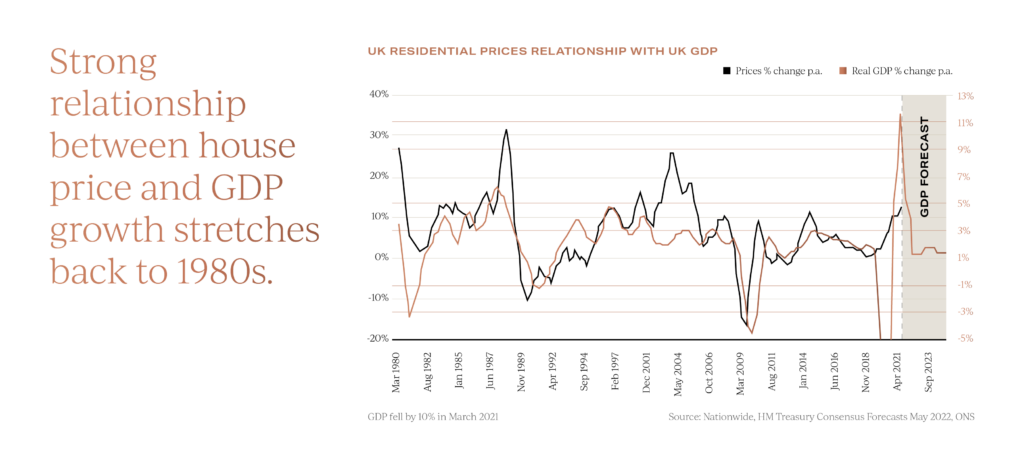

Finally, there is a very strong relationship between GDP growth and house price growth – this relationship stretches all the way back to the early 1980s.

Assuming this historic relationship holds true, we can expect house price growth to slow later this year, as GDP growth slows.

As we mentioned last month, all the signs are that we are not going to see a housing market crash but, based on forward indicators, the rate of price growth could reduce quite dramatically over the coming months.

The home of work

Owner occupiers and tenants alike have reassessed their work-life balance since the pandemic, and this has been cited as one of the drivers for house prices and rents rising as new property requirements have emerged.

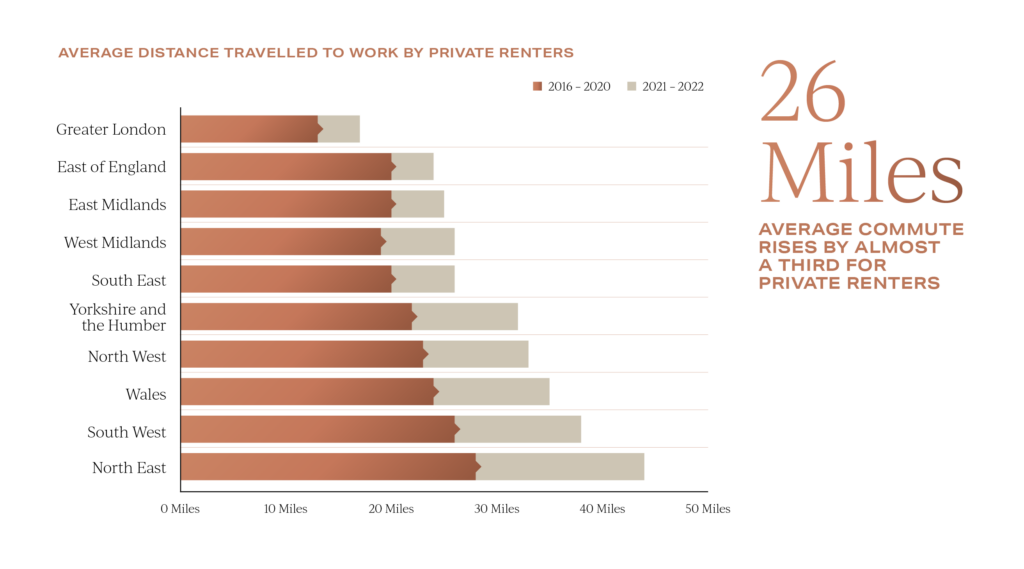

Traditionally, those living in rented homes have tended to live close to their place of work. This is often a lifestyle choice to minimise commute times and cost and to enjoy city living.

Across England and Wales, the distance renters live from their place of work has increased by 31% since the pandemic, from 19 miles to 26 miles, as hybrid and remote working have become options for many.

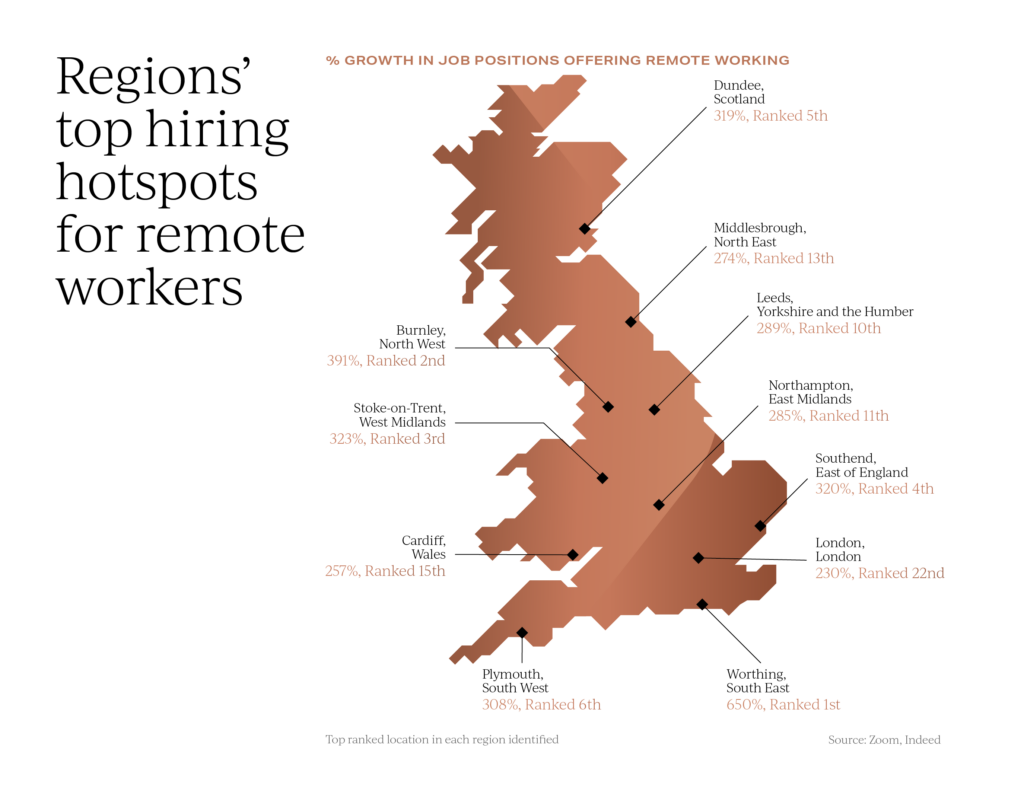

New research records that 22 out of the top 25 remote worker hotspots are outside of London and the South East.

Job adverts offering the flexibility to work remotely have tripled compared to pre-pandemic levels in the top ranked so-called ‘Zoom towns’, creating new opportunities for high streets and local economies.

Societal changes in employment patterns are also likely to impact future housing patterns.

Those looking to change jobs may opt for a longer commute on “office workdays” rather than relocating “lock stock and barrel”, and as we reported last month, Garrington is seeing more demand for pied-a-terre properties for those working part-time in cities during the week.

UK property summer outlook

As we approach the longest day of the year, and its halfway point, there appears to be every possibility that market dynamics may shift to a year of two very different halves. The second half of the year is likely to be far less frenzied in nature, but nonetheless to remain busy by historical standards.

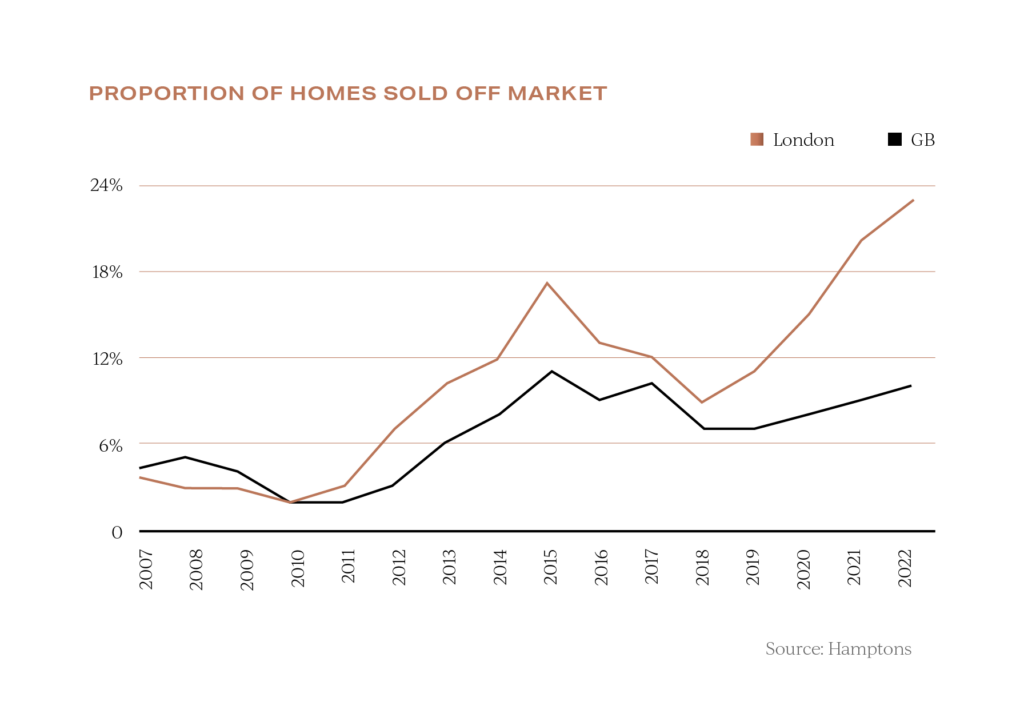

More transactions are occurring than property portals would suggest.

Industry data records that one in ten properties are now being sold off-market, and that during the first five months of this year 23% of sales in London have been off-market, and 24% of sales in the prime country market.

Garrington has also been offered far more off-market opportunities over recent months than is typical for the time of year.

Where once the decision to sell off-market was typically driven by the desire for discretion, now it’s likely to be about practicality as much as privacy, and we expect this trend to continue over the summer.

Changing market conditions over the summer will bring threats and opportunities for buyers, underlining the need for tailored advice on which to base purchasing decisions with clarity and confidence.

We hope you found our latest update helpful, and if we can assist you with any property requirement and you would like to discuss your own property plans, please feel free to get in touch using the contact details below.