The past few weeks have seen some of the year’s most highly anticipated events for the UK property market,...

UK Property News – August 2022

Welcome to the August 2022 edition of Garrington’s UK property market review.

The UK property market has mirrored recent weather trends seen over the last month; with record highs, a year of dry conditions, yet a sense that things may all be about to change. The summer recess provides many people with a chance to escape day-to-day routines and consider life and financial priorities.

With a new Prime Minister due to be announced in September, eye-watering levels of inflation having forced the hand of the Bank of England to increase the bank base rate to 1.75% – the highest rate increase in 27 years, and their hawkish outlook warning of a long recession, predicting what may happen next in the UK property market remains a challenging task.

Despite these headwinds, for the moment, the property market’s resilience continues to defy expectations.

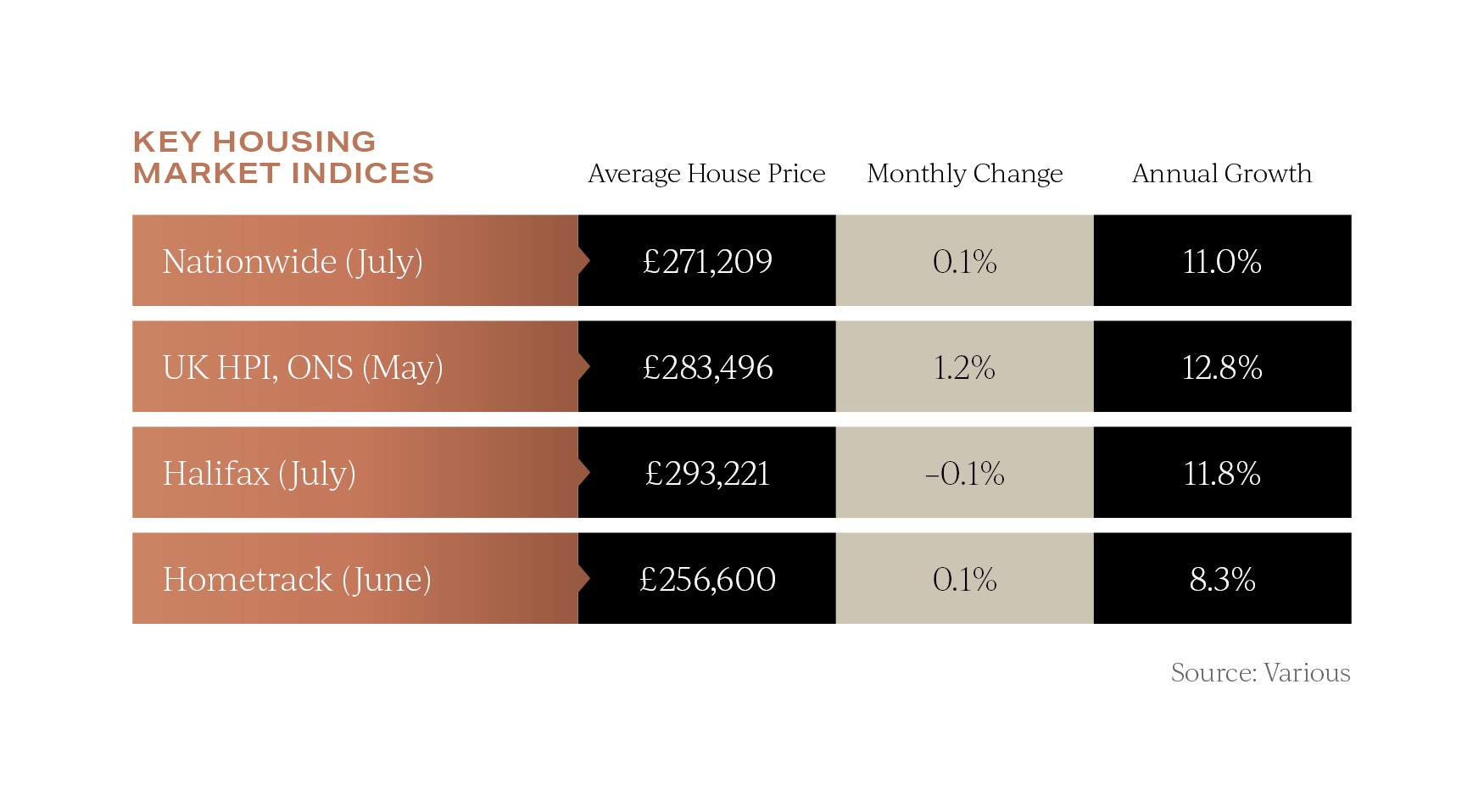

On a monthly basis house prices indices from Nationwide and Halifax have continued to meander, with the former reporting a 0.1% rise and Halifax reporting a marginal fall of -0.1%.

Rightmove revised their annual price growth forecast last month, from 5% to 7% despite cooling levels of activity, citing that constrained stock levels of property for sale will underpin price growth this year.

Despite annual price growth rates remaining positive, throughout the market there is growing awareness that the coming months are likely to bring change, and with it, a heightened sense of caution is prevalent amongst buyers.

Emerging trends

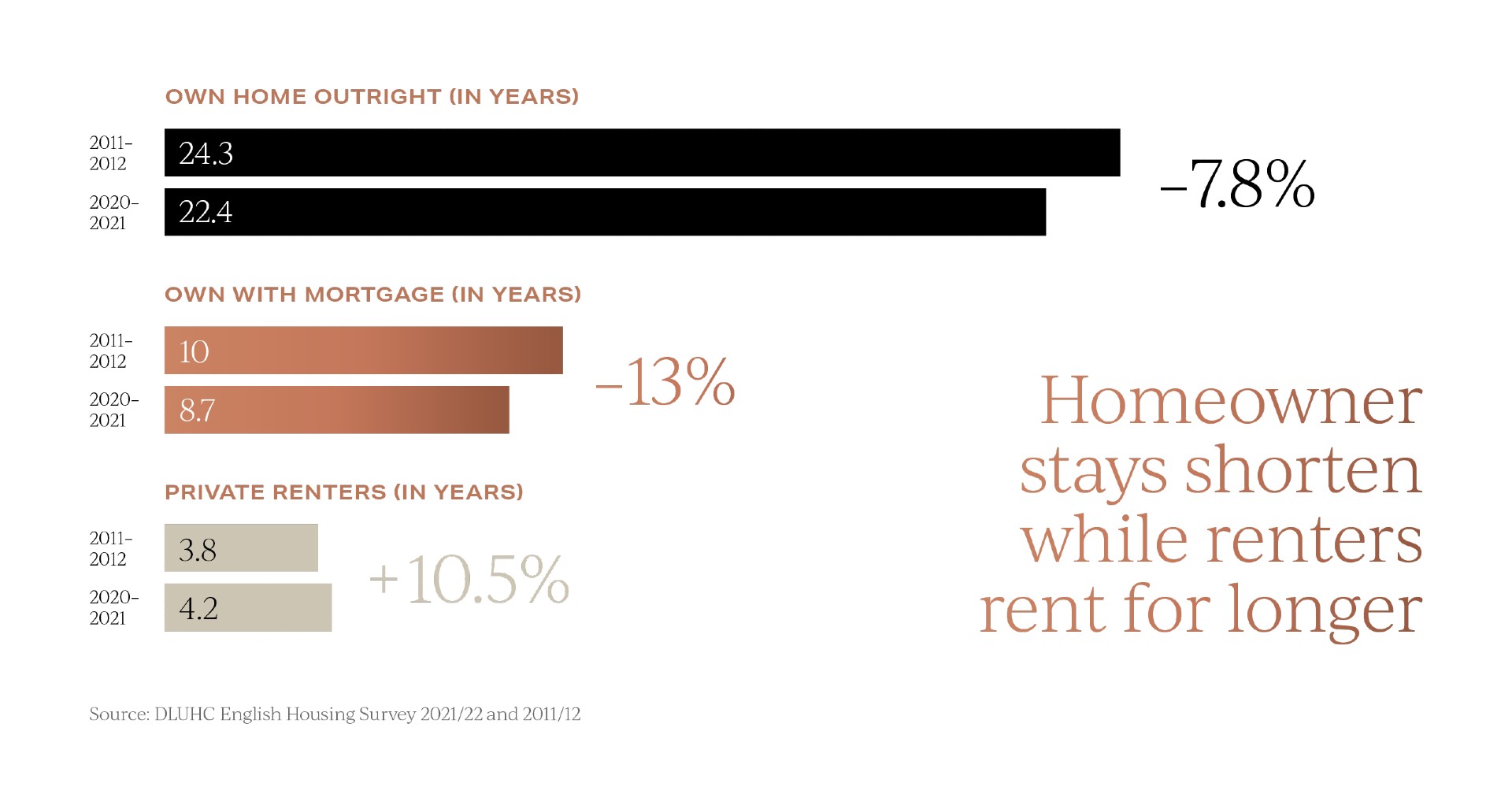

Historically, renting a property for many tenants was considered a shorter-term solution to their housing needs, and buying a home normally meant many years of ownership under one roof.

However, the recently published English Housing Survey data highlights the changing relationship we have with our homes.

Since 2011/2012, owner-occupiers have seen a drop in their length of tenure, from an average of 17.1 years in their accommodation to 16 years in the new survey results. In contrast, private renters have increased their tenure length, increasing from an average of 3.8 years in 2011/12 to 4.2 years in 2020/21.

This slight swing to longer private tenancies comes amidst a new cost-of-living crisis where the English Housing Survey reports 52% of private renters feeling that they are unlikely to now be able to afford to buy a home. In 2011/12, this figure was 41%.

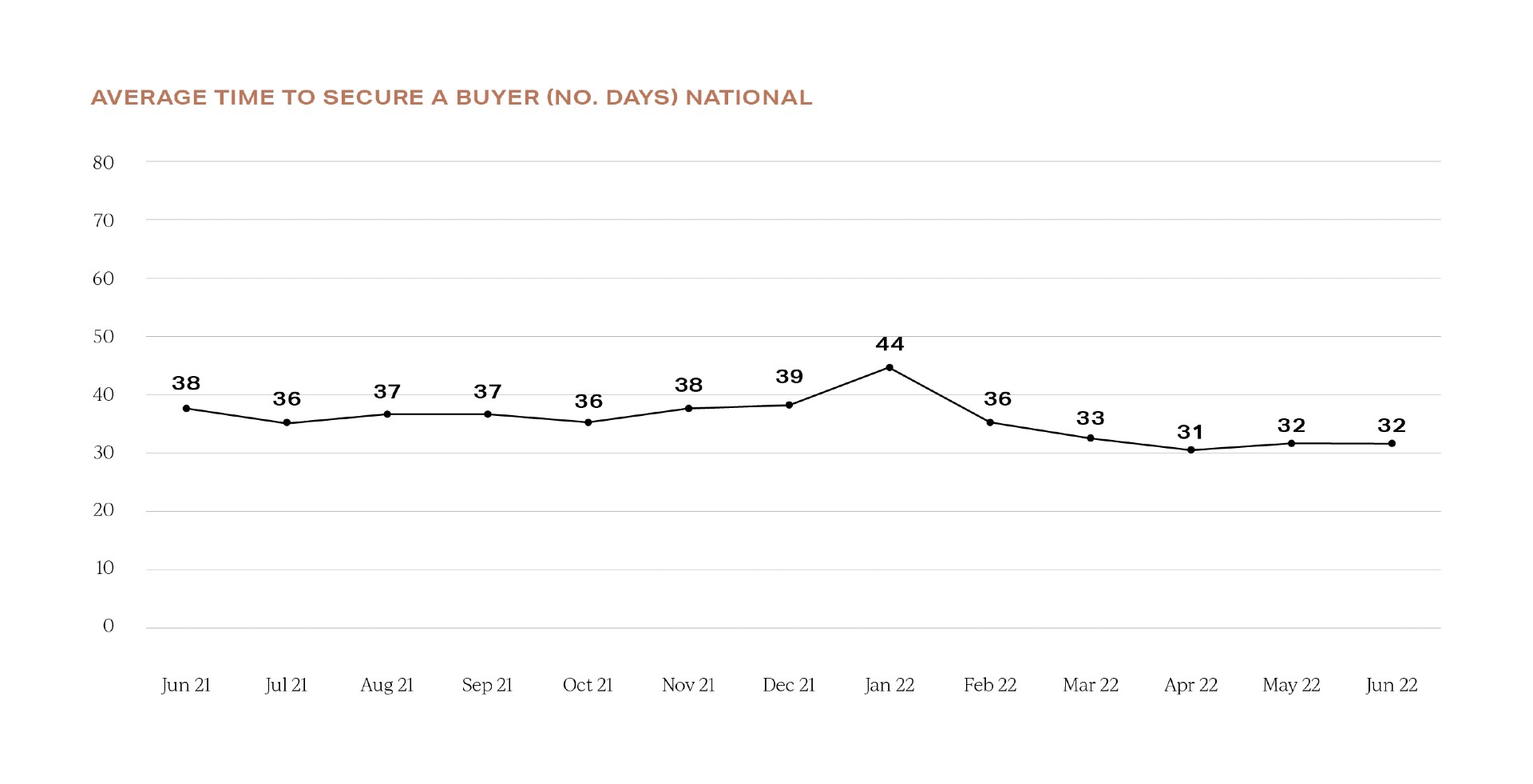

For those going ahead and purchasing a home, finding the perfect property traditionally took far longer than the time taken to progress an agreed transaction through to completion.

Property entering the market for sale is still selling quickly according to the latest available data from Rightmove. The national average is now just 32 days compared with 38 days at the same time last year.

However, agreeing a transaction is only one piece of the home moving puzzle.

The recent transaction boom and surge of existing homeowners re-mortgaging has placed significant pressure on financial and conveyancing providers.

According to recently published industry data, this means that the average time to complete a purchase has now risen by 23%, to a staggering 153 days, the equivalent of over five months.

Topical holiday homes

Many new holiday homeowners will be enjoying their recently acquired properties this summer, whilst hoping that the great British weather is kind. Equally, with the rise of staycations, many visitors to holiday homes may come away considering whether they would like to own a holiday home themselves.

With the potential of double-digit yields, and strong capital growth in desirable locations, the investment appeal of holiday homes remains compelling in many parts of the UK.

However, this sector of the property market has become a hot topic of debate and scrutiny over recent months.

The Government has recently commenced a call for evidence on short term lets in response to mounting pressures from some parts of the country that holiday homeowners are pricing locals out of the market.

Local authorities in some locations have already acted, and in Wales, for example, councils will be able to impose a 300% council tax surcharge from next year. Scotland is also rolling out statutory licensing for all holiday home and short let accommodation owners.

As seen in the wider property investment sector, having stimulated all parts of the property market with a Stamp Duty holiday, the Government now looks poised to restrict parts of the market through tighter regulation including holiday homes.

UK property outlook

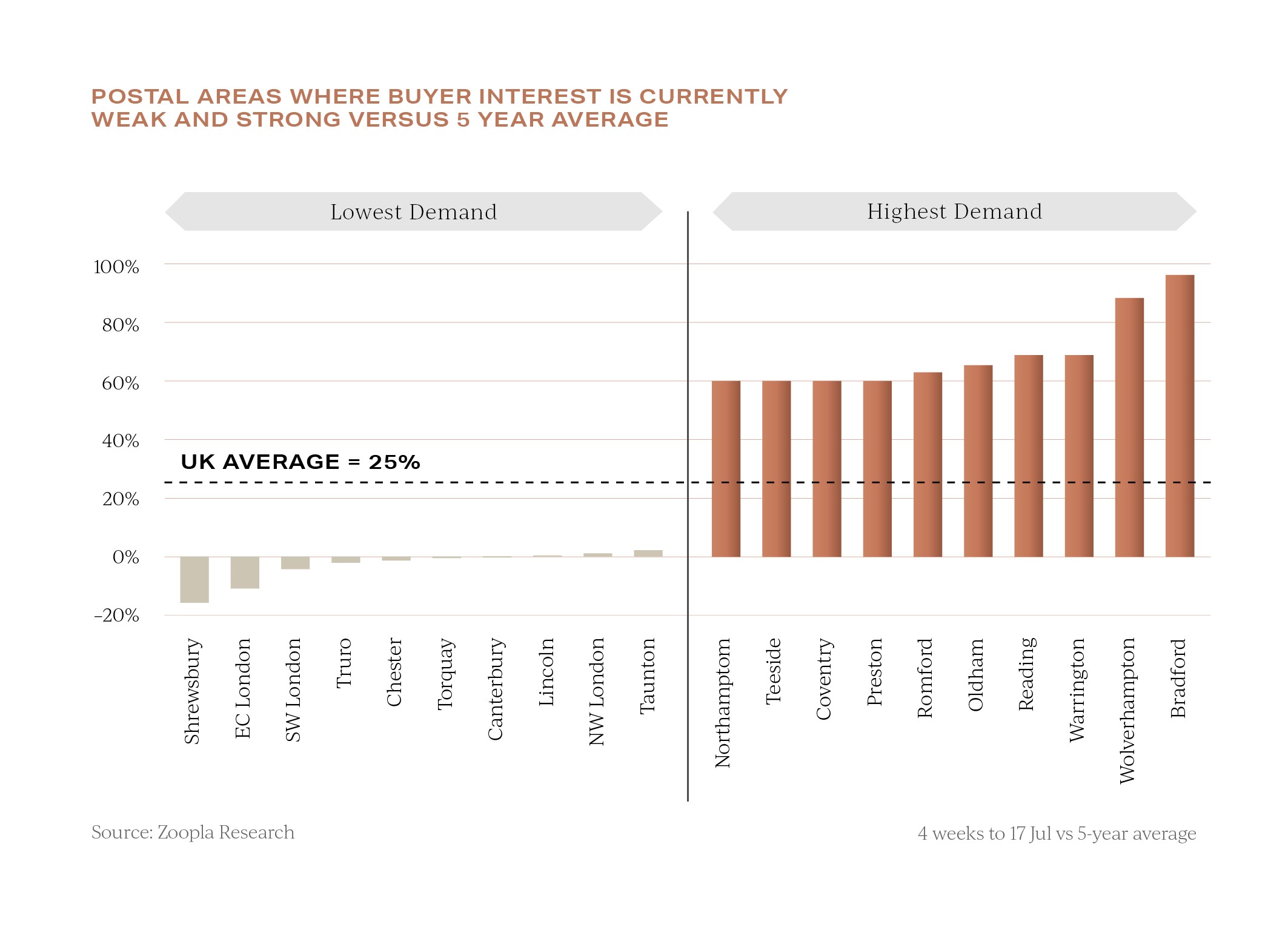

While headline figures show that overall the demand for homes is on a par with this time last year and remains to be 25% above the 5-year average, at a local level buyer demand is more varied.

As mentioned in previous reviews, the market is splintering. The disparities can be seen in this latest research from Zoopla, above, showing the strongest and weakest areas for buyer demand over the last month compared to the 5-year average.

Over the autumn months, as market dynamics change, we expect different areas to perform independently, no longer will we see a uniform trend of upward prices in all locations.

We hope you found our latest update helpful, and if we can assist you with any property requirement and you would like to discuss your own property plans, please feel free to get in touch using the contact details below.