The past few weeks have seen some of the year’s most highly anticipated events for the UK property market,...

UK Property News – November 2022

Welcome to the November 2022 edition of Garrington’s UK property market review.

After a series of whirlwind events in politics and the financial markets, a sense of stability is gradually being restored as the UK’s third Prime Minister and fourth Chancellor of the year attempt to create a sound economic climate.

Whilst this may have been partially achieved, the property market has nonetheless been adversely affected during this time, and weaker consumer confidence has now fundamentally changed the dynamics of the market.

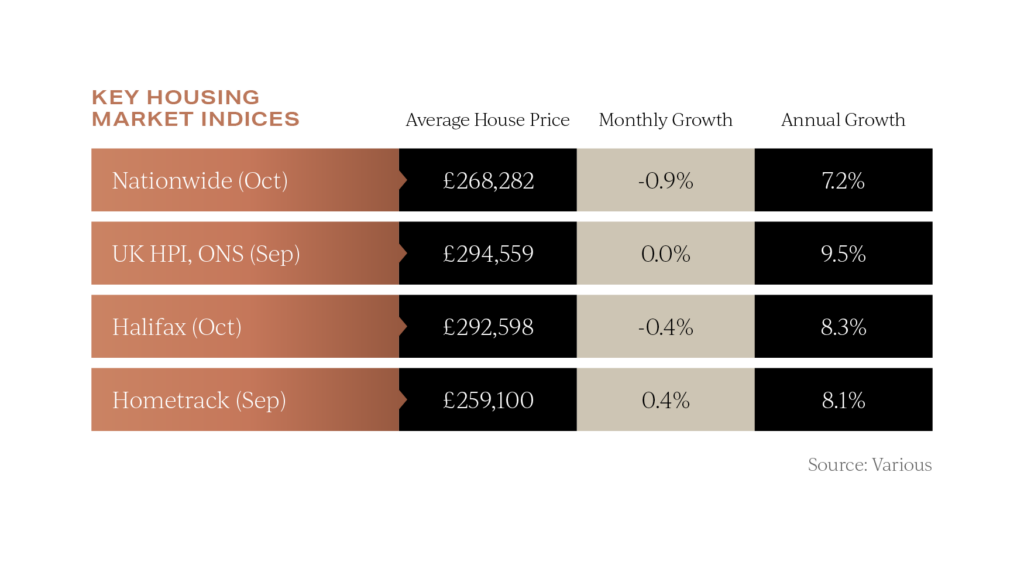

This is evident in all national house price indices, which last month recorded monthly falls in average sale prices. Halifax recorded a 0.4% fall and Nationwide reported a 0.9% fall, with all indices now recording single digit rates of annual growth. For those entering the market, sellers’ expectations are clearly being tempered. According to Rightmove the asking prices for prime property fell by 2.4% last month, a more significant fall than all other sectors of the market combined.

For those entering the market, sellers’ expectations are clearly being tempered. According to Rightmove the asking prices for prime property fell by 2.4% last month, a more significant fall than all other sectors of the market combined.

Such falls are easy to understand given the volatility of financial markets in recent months.

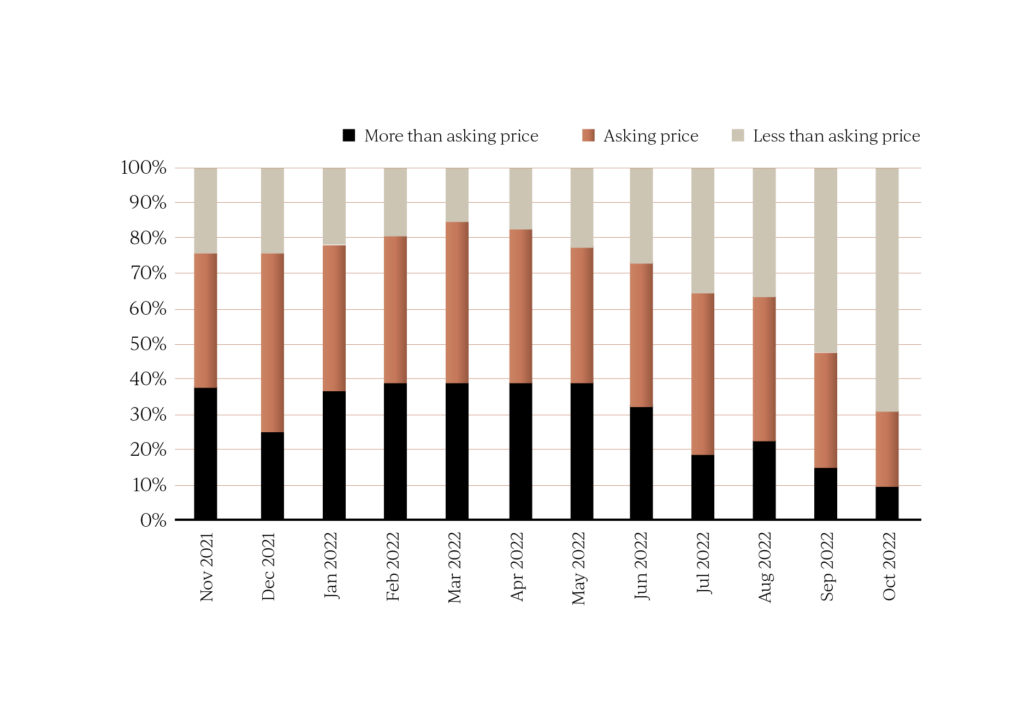

Rightmove’s latest data also records purchaser demand falling 20% in October compared to the same period last year, and Propertymark illustrate how this is now affecting sale values, with 69% of member branches recording sales agreed below asking prices in October. By contrast, just 15% of properties were sold below asking prices in March this year according to the UK’s largest property professional membership body.

By contrast, just 15% of properties were sold below asking prices in March this year according to the UK’s largest property professional membership body.

It comes as no surprise that prices could not continue to boom in the unsustainable way they were for much of the year, but the speed of change has surprised many sellers and buyers alike.

Taxing times

The new Chancellor, Jeremy Hunt, pledged to face the economic storm, as he announced widespread spending cuts and tax rises in his Autumn Statement on the 17th of November 2022, to tackle inflation and escalating interest rates and mortgage costs.

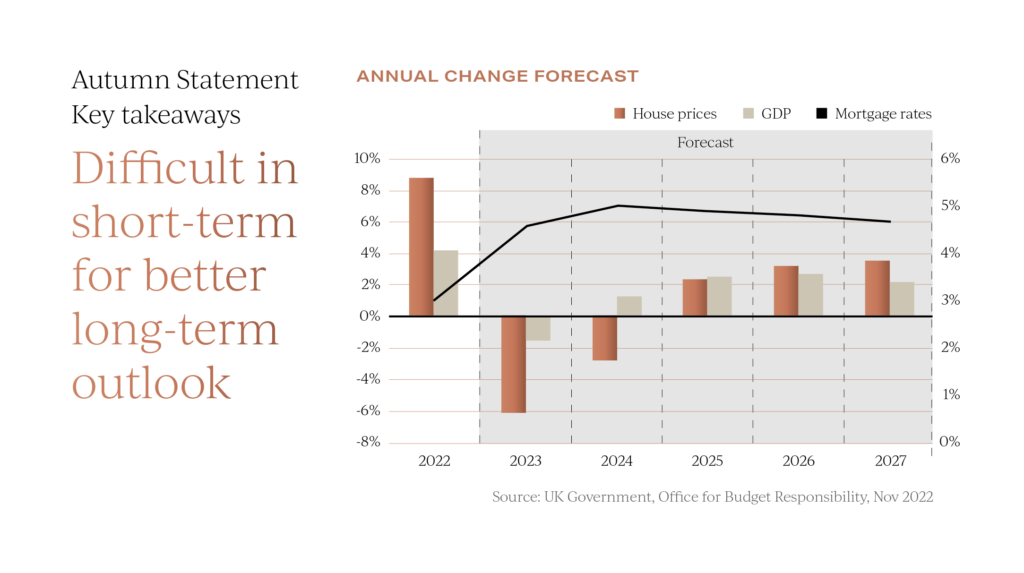

In the short term, GDP is likely to shrink by 1.4% in 2023 but then, due to the new measures being taken, is expected to grow by 9% by the end of 2027.

The expected 9% increase in house prices for the whole of this year is likely to be countered by a fall over the course of 2023-24. Price growth is set to resume in 2025 according to the latest forecast by the Office for Budget Responsibility. The Chancellor also announced that the previously announced cut in Stamp Duty Land Tax will end from 31st March 2025. He further announced that the Capital Gains Tax allowance will fall to £3,000 from April 2024, in what has been cited as a blow to landlords and property sales.

The Chancellor also announced that the previously announced cut in Stamp Duty Land Tax will end from 31st March 2025. He further announced that the Capital Gains Tax allowance will fall to £3,000 from April 2024, in what has been cited as a blow to landlords and property sales.

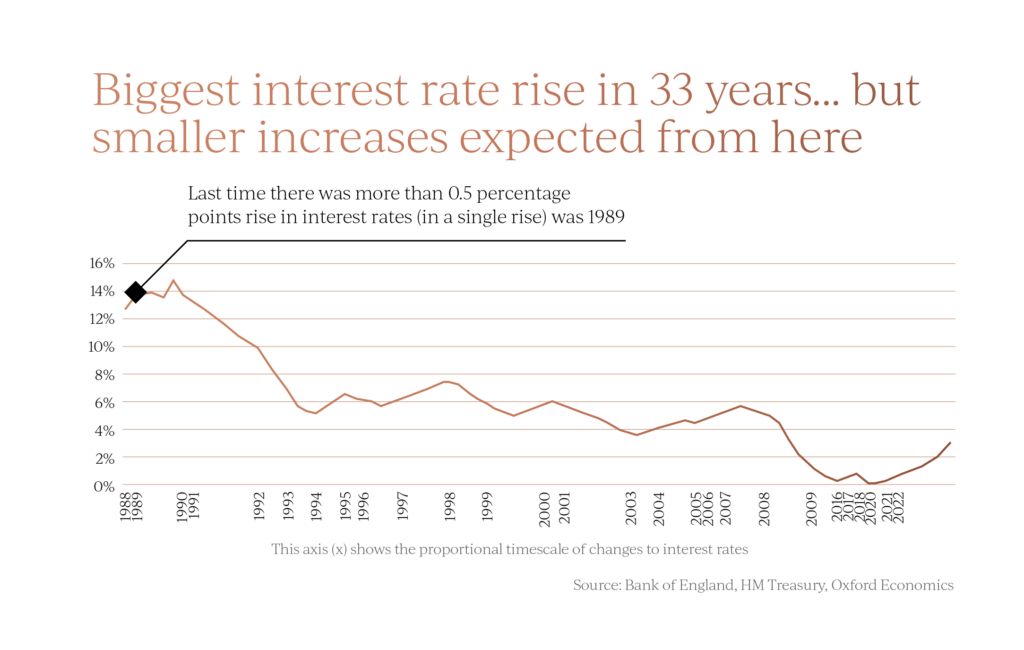

Earlier this month, the Bank of England’s Monetary Policy Committee voted to raise interest rates by a further 0.75 percentage points to take interest rates in the UK to 3% to try and curb inflation. This is the biggest increase in 33 years. Only last month, the prediction was that UK interest rates would rise by 1 percentage point in November, so the increase is smaller than the market was previously expecting as sentiment has calmed after the change of Chancellor and Prime Minister.

Only last month, the prediction was that UK interest rates would rise by 1 percentage point in November, so the increase is smaller than the market was previously expecting as sentiment has calmed after the change of Chancellor and Prime Minister.

Mortgage rates are now expected to peak at 5% according to the OBR.

Such predictions are already starting to filter through to mortgage products with some 5-year fixed rates available below 5% again following rates skyrocketing in the days following the notorious mini-budget.

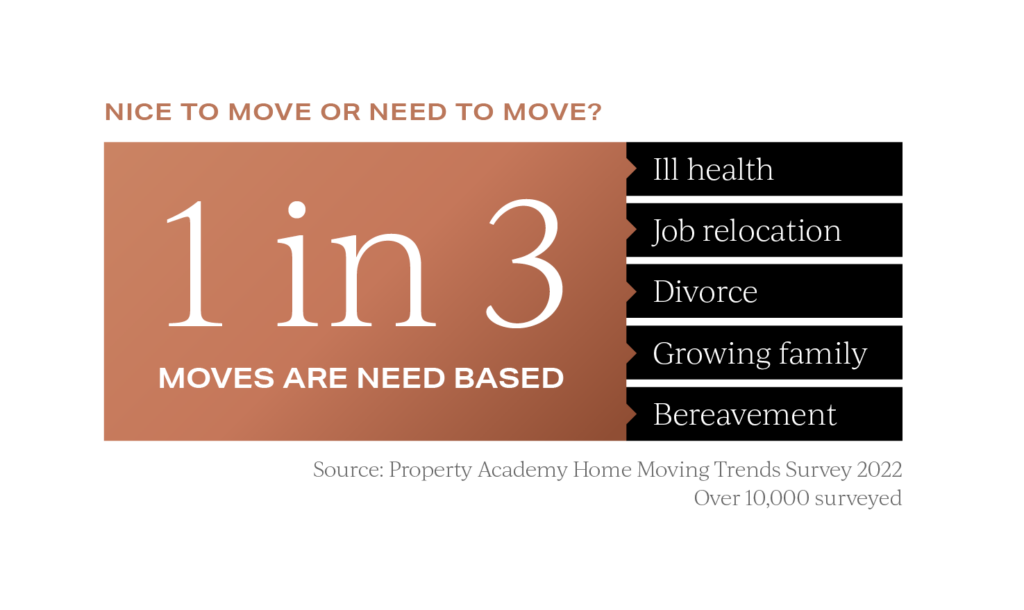

A needs-based market

Almost a third of moves this year were ‘needs-based’ according to a survey of 10,400 home movers by the Property Academy in summer 2022. Moves have been prompted by a growing family, job relocation, divorce, ill health, or bereavement. Periods of volatility and an uncertain outlook create hesitation in the market, with one buyer’s perceived threats becoming another buyer’s opportunity.

Periods of volatility and an uncertain outlook create hesitation in the market, with one buyer’s perceived threats becoming another buyer’s opportunity.

Garrington has already been contacted by a number of buyers who had paused their purchasing plans during the midst of the post-pandemic boom.

Now the market is cooling, they are reassessing their options set against more stock entering the market for sale, and fewer competing buyers. Such buyers are seeking value and frequently expecting to offset higher borrowing costs against lower purchase prices.

UK property market outlook

Recent events have all come about at a time where the property market expects to see a seasonal downturn in activity.

Fully understanding which trends are seasonal norms and which signal a weaker market is therefore a more challenging task than normal.

By any measure, the market has changed, and will therefore end the year in a very different way compared with how it began.

Whilst the Government may have started to address the crisis of confidence in the financial market, the compound effect of raising taxes, high borrowing costs, and higher cost of living costs will all place a drag on prices for the rest of this year and into next.

The degree to which this creates a threat or opportunity depends on individual buyers’ attitude to risk and ownership plans.

Underpinning any decision will be the growing need for tailored advice on which to base well informed purchasing plans.

We hope you found our latest update helpful. In the meantime, if you would like to discuss your own property plans, please feel free to get in touch using the contact details below.