The past few weeks have seen some of the year’s most highly anticipated events for the UK property market,...

UK Property News – December 2022

Welcome to the December 2022 edition of Garrington’s UK property market review.

As we approach the end of 2022, activity levels have slowed as they tend to at this time of the year.

The housing market has remained in the media spotlight over recent weeks with the latest data triggering mixed messages and attention-grabbing headlines about the state of the market.

Media interest has primarily focused on the direction of house prices, both what they are doing right now and what they may do into next year.

National house price indices have reported further monthly falls in average values, with Halifax reporting the fastest monthly fall of house prices since 2008.

Nationwide also reported a more modest monthly fall of 1.4%, but nonetheless, the rate of decline is faster than many analysts had been predicting.

Nationwide also reported a more modest monthly fall of 1.4%, but nonetheless, the rate of decline is faster than many analysts had been predicting.

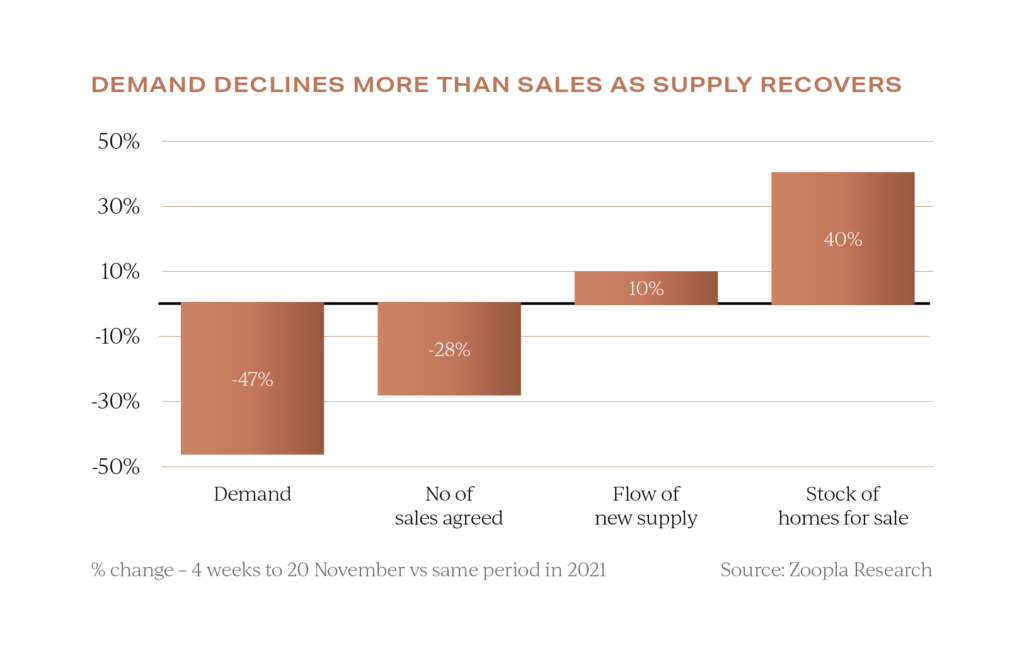

However, these falls need to be seen in the context of the substantial house price gains in recent years fuelled by low interest rates and cuts in Stamp Duty. This data reflects the shift in consumer confidence which has been witnessed during the last few months, with Zoopla recording that purchaser demand is 44% lower than this time last year, whilst the stock levels of property for sale has increased by 40% compared to a year ago.

This data reflects the shift in consumer confidence which has been witnessed during the last few months, with Zoopla recording that purchaser demand is 44% lower than this time last year, whilst the stock levels of property for sale has increased by 40% compared to a year ago.

These polar opposite trends sit at the very heart of why we are seeing downward pressure on house prices and the emergence of a very different market as we head into the new year.

Price predictions

Historically as we enter a new year, market analysts and economists publish their house price predictions for the year ahead.

However, national forecasts on the price of an ‘average property’ serve little value, especially given how fragmented the UK market has become.

It may be more useful to look at both the ‘here and now’ of what prices are doing, and the trends seen over recent weeks.

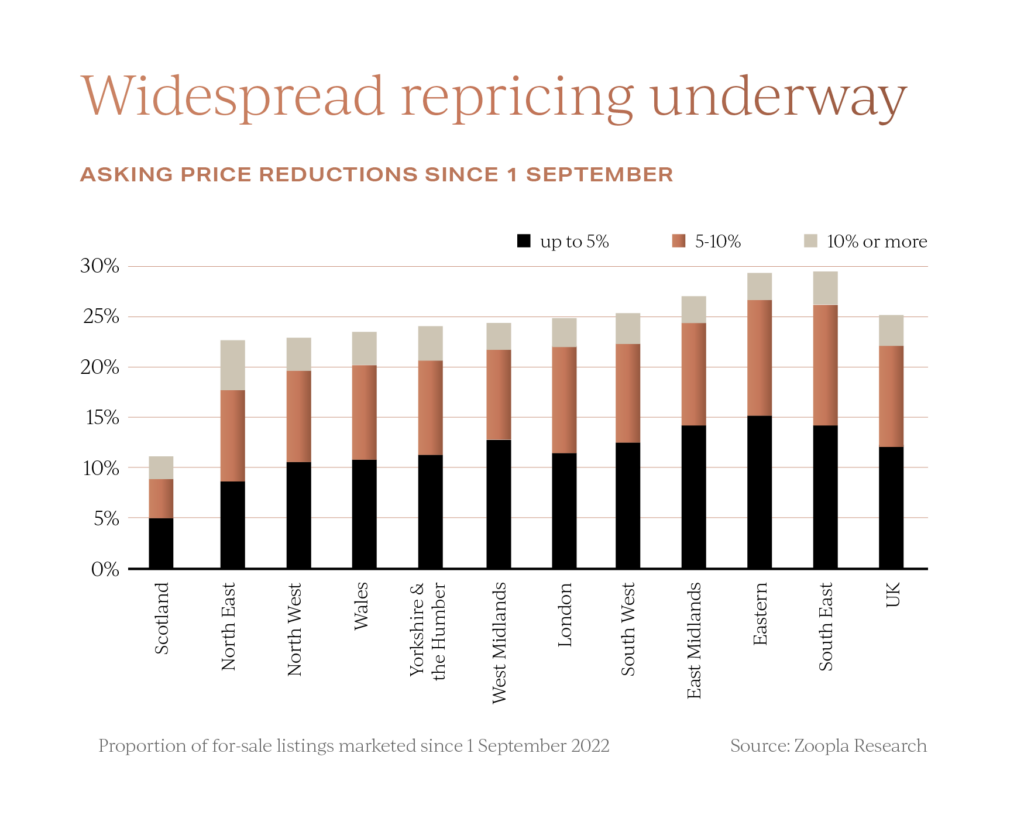

During the final months of the year there has been a widespread repricing taking place, but the scale of reductions currently remains lower than those seen in 2018 during the Brexit period of uncertainty. Nationally, over one in ten properties has now been reduced in price by 5% or more. However, one in three homes in the east and south-east have been reduced, where buyer interest has also fallen the most.

Nationally, over one in ten properties has now been reduced in price by 5% or more. However, one in three homes in the east and south-east have been reduced, where buyer interest has also fallen the most.

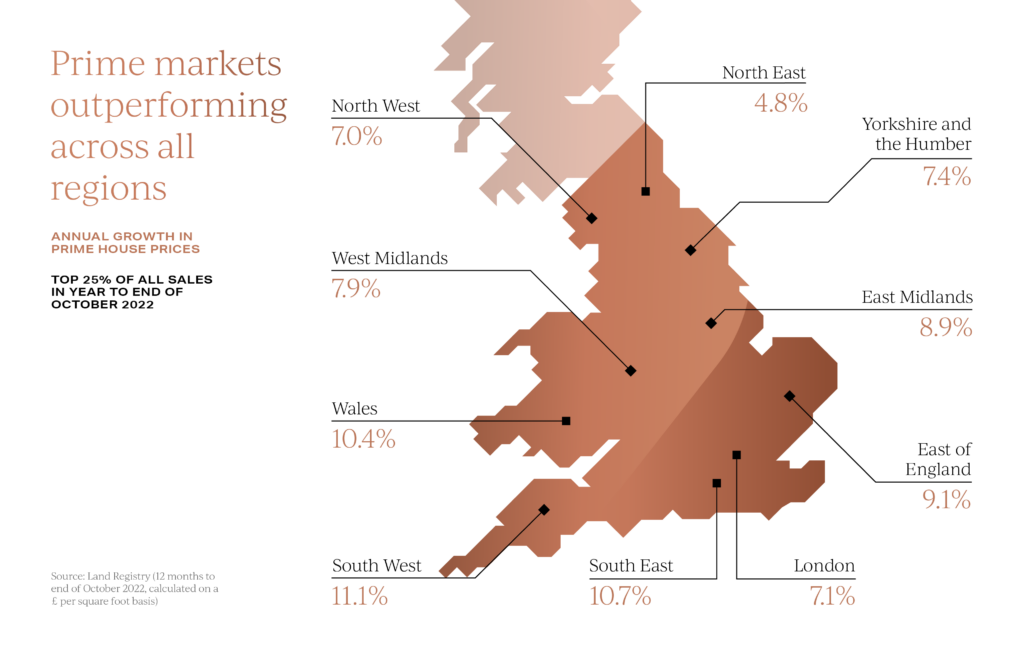

By price band, the prime end of the market (being the top 25% of sales) has continued to outperform other sectors, by a rate of 2.7% across the whole market.

At a regional level, this ranges from 4.8% growth in the north-east to 11.1% in the south-west. The average rate of annual growth for the top quartile of the market stands at 8.4%.

At a regional level, this ranges from 4.8% growth in the north-east to 11.1% in the south-west. The average rate of annual growth for the top quartile of the market stands at 8.4%.

Prime markets are not immune to wider economic influences, but buyers typically have more equity and are less reliant on mortgage finance. These factors are expected to support this part of the market next year.

UK property outlook for 2023

Many moving plans were derailed in the Autumn by shock interest rate rises and the speed of change witnessed across the entire market.

A significant number of these movers still have a desire to move and are hoping the early part of the new year will offer improved levels of clarity and calm in the market to provide a way forward.

Despite the Bank of England increasing the bank base rate last week, mortgage rates have been falling over the final weeks of the year.

If they continue their descent to under 5% in the new year, this may well be the catalyst for many people to restart their property searches, and/or listing homes for sale.

If you are not already subscribed to receive our Market Updates, please do register, as we have further interesting research being released in January about the year ahead. This will focus on which specific locations are likely to perform best next year.

We hope you found our latest update helpful. In the meantime, if you would like to discuss your own property plans, please feel free to get in touch using the contact details below, and from all the team at Garrington, we wish you a wonderful festive break.