The past few weeks have seen some of the year’s most highly anticipated events for the UK property market,...

Property Market Resilience in 2023

Welcome to Garrington’s first research report of 2023 on property market resilience. The New Year brings fresh hope and optimism and for many, it signals the start of putting ambitions of moving home into action.

Navigating the coming market will be by no means a straightforward task, both in terms of finding the right property to purchase and then importantly, having clarity and confidence as to what to pay for that property.

Interest rate rises seen in the second half of last year have fundamentally changed affordability rates and consequently, many purchasers’ property requirements have been revised.

Keen to attract early interest in their homes, growing numbers of sellers lowered their asking prices last month according to Rightmove, who reported a 2.1% fall in average asking prices.

This is a trend we expect to see over the early months of the year until a new equilibrium is reached between the demand for, and supply of, property for sale. Garrington has also seen a significant spike in off-market opportunities over recent weeks as increasing numbers of sellers are tempted to try this method of sale instead of a full marketing campaign.

The Garrington Resilience Index

Of concern to many prospective property purchasers is the strength in the location they have chosen. The residential market is a rich and complex ecosystem, and whilst there are broad trends that apply to the whole market, there will be lots of nuances in the detail too on how locations perform in the year ahead.

Garrington has evaluated a number of factors which help determine which locations will be more resilient in the context of rising interest rates, and those which will be more exposed.

Affordability, as measured by the proportion of monthly earnings it takes to meet mortgage payments, gives a very good indication of when overall house price growth will slow. But when looking at different cities the details can be misleading.

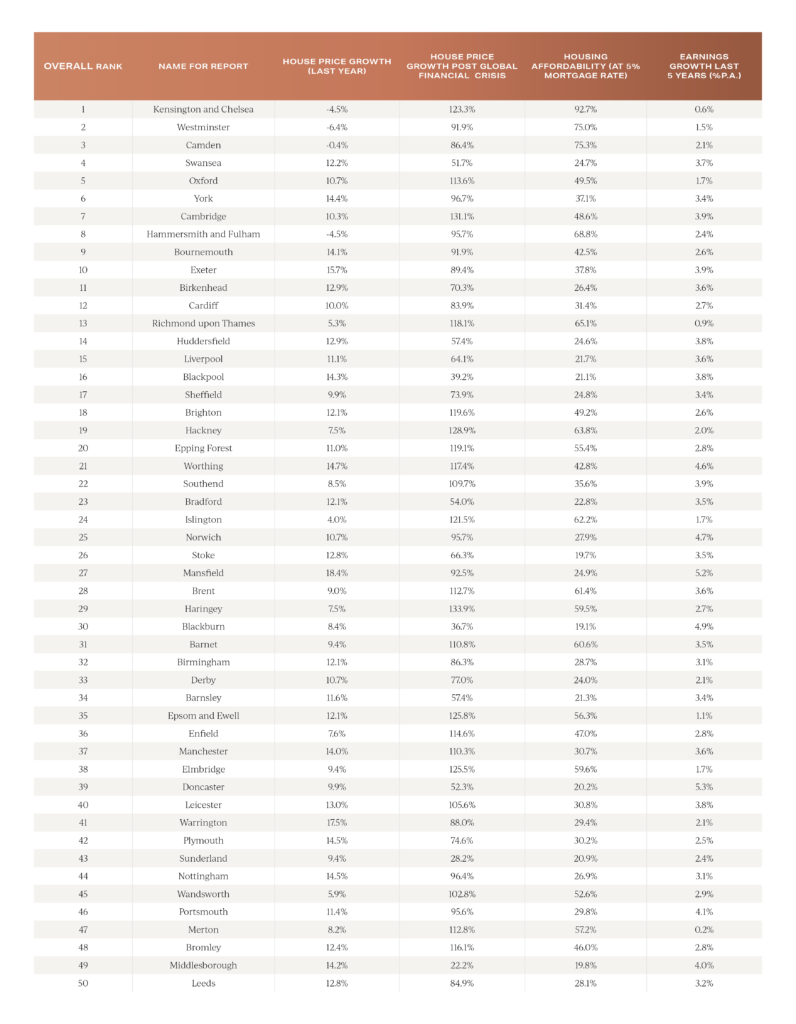

Here is the top 50 results:

We have studied multiple data sources to establish which cities look most resilient to interest rate rises on a broader range of factors. For example, we know that locations with a high proportion of owner-occupiers without a mortgage will be more resilient to interest rate rises, so too locations where cash buyers account for a high proportion of sales. Conversely, we know that locations which have seen mortgage lending rise rapidly and have a high mortgage debt to housing equity ratio will be more exposed.

The scope of our research has looked at our largest cities and towns across England and Wales, also breaking London down into borough level data. This means we are ranking just under 100 locations on these factors. Our results throw up some interesting conclusions and do not necessarily reflect what you might expect.

Property market resilience – the results

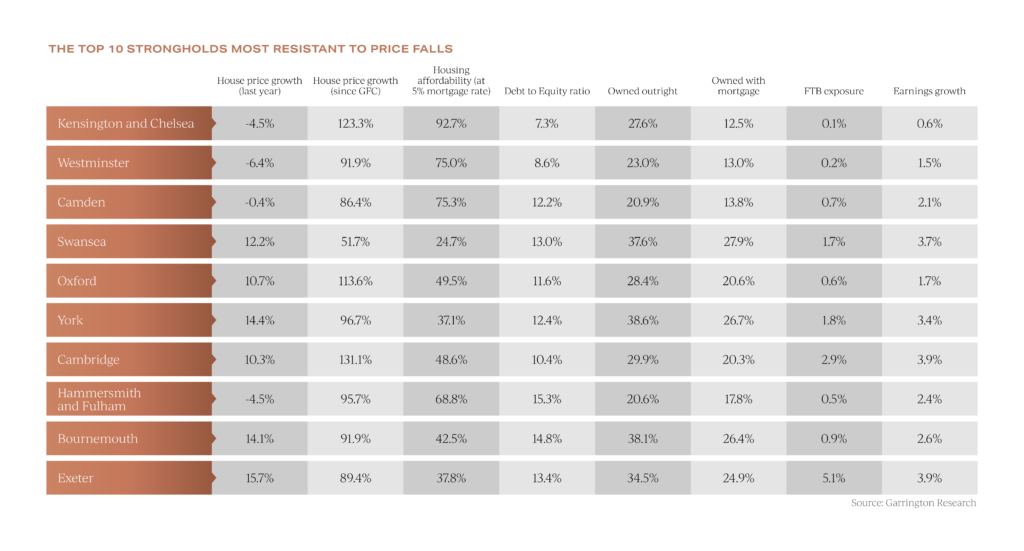

Let’s look at the top 10. Topping the league table in our model for the most resilient location is the Royal Borough of Kensington and Chelsea.

Affluent areas such as this have a high level of properties owned outright, a high proportion of cash buyers and less mortgage debt. Typically, these areas were some of the most resilient in the global financial crisis as forced sales were less common.

Westminster and Camden in London also secure high-ranking positions in our table. Affordability in some of these more affluent areas is extreme, it would take 60% of earnings to meet average mortgage payments in some of these London boroughs, which would be heavily exposed to rising interest rates if more buyers required mortgages in this area.

Prices in these established and other popular locations are more likely to rise with the overall housing market cycle.

There typically isn’t an extra dynamic at play here, like regeneration. Although notably the boost to Life Science investment following Covid will have increased the already strong housing demand for Oxford and Cambridge, but affordability will temper future growth.

Swansea is an outlier in this ranking. With markedly different affordability and house price growth since the global financial crisis, it makes its way onto this list by being highly ranked on the proportion of cash buyers and strong levels of housing affordability.

We hope you find this research useful. If you are looking to purchase a property in 2023 and would like advice from one our experts spanning the UK, please do contact us.