Welcome to Garrington’s final market review of the year, and what a year it has been for the UK...

UK Property News – September 2023

Welcome to Garrington’s September 2023 market update, where we delve into the latest housing data and on-the-ground trends affecting UK property.

The transition from summer to the academic year ahead typically signifies a return to daily life patterns. For those mulling over a home move this year, this month also means turning plans into action.

This September however, the market’s recovery from the summer lull hasn’t been as robust as usual and Garrington’s observations indicate that new property listings are lower than expected. Nevertheless, the overall picture is of an excess of UK property for sale compared with buyer demand.

The delicate nature of the market is illustrated by key data released over recent weeks.

Firstly, mortgage approvals have fallen further based on the Bank of England’s latest data as seen below. The data for July, released at the start of September, shows that approvals for new home purchases fell to around 49,400, down from more than 54,000 in June.

The data for July, released at the start of September, shows that approvals for new home purchases fell to around 49,400, down from more than 54,000 in June.

Mortgage approvals are now markedly below the average for the decade. Year-to-date transaction volumes also show a downturn, with July transactions 18% below the pre-pandemic 2017-2019 average.

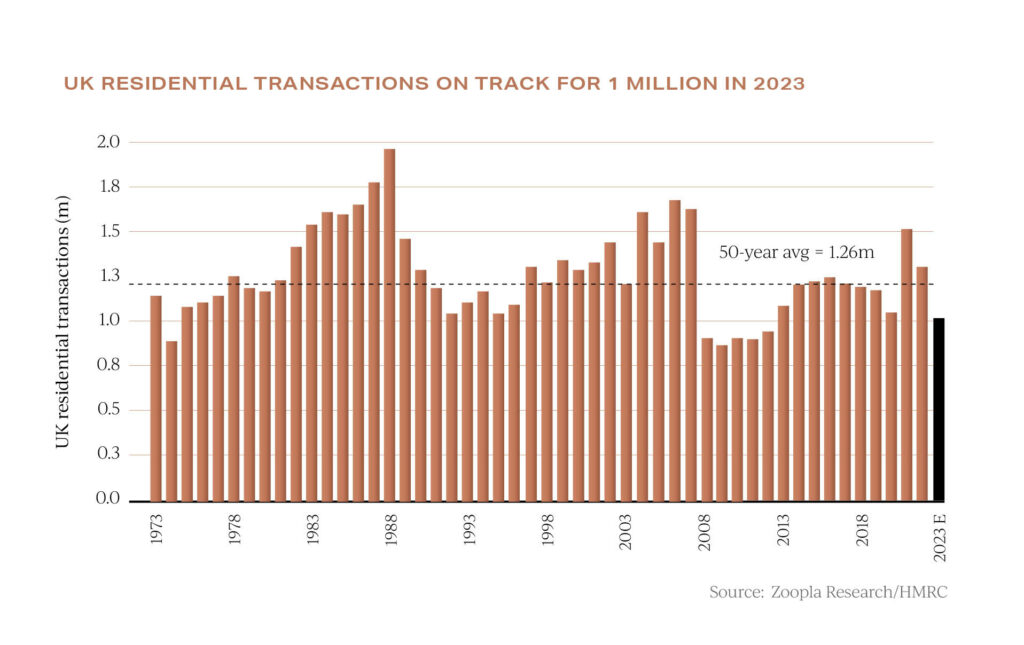

Zoopla made front page news last month with its prediction that there are likely to be only around one million sales transactions in 2023, which would be the lowest figure since 2012, and well below the 50-year average. The validity of this forecast will be tested over the coming months, but irrespective, a consensus is forming among most market commentators that market activity is likely to remain lethargic in nature for the rest of the year.

The validity of this forecast will be tested over the coming months, but irrespective, a consensus is forming among most market commentators that market activity is likely to remain lethargic in nature for the rest of the year.

Prices falling in slow motion

Media speculation on a possible price crash has been rife but, in reality, the rate of fall in real prices has been steady so far this year, but nonetheless progressive in nature.

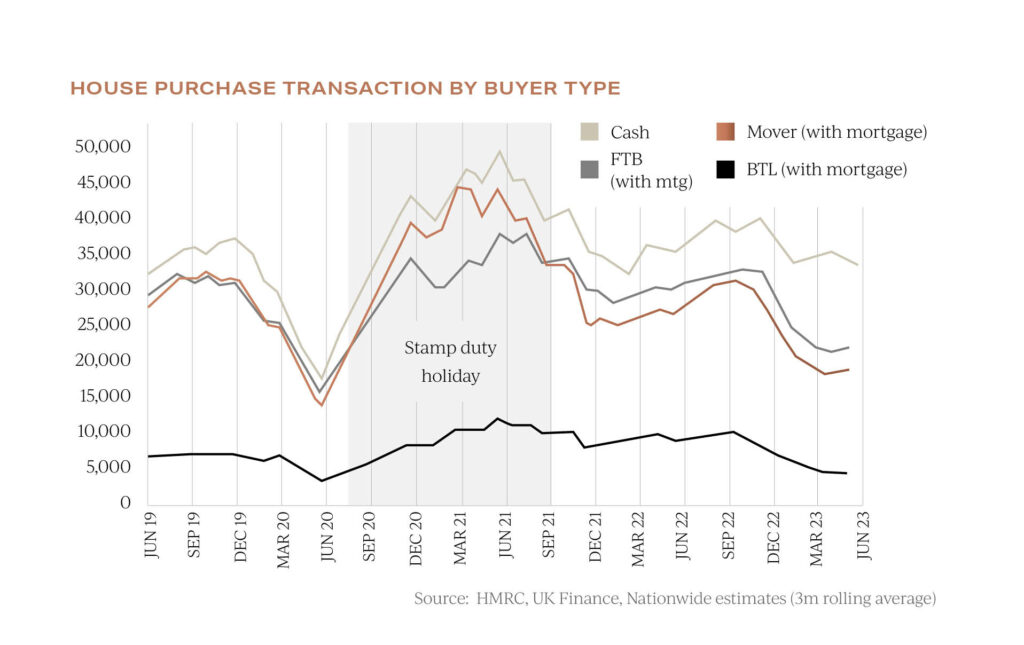

Nationwide’s recent report highlighted a 0.8% drop in house prices last month, with an annual decrease of 5.3%, the most significant since July 2009. Halifax reported a fall in average values by 1.9% in August and a fall of 4.6% over the last year. Consistent with Nationwide’s data, this is the biggest year-on-year fall since 2009. As can be seen above, the current market dynamic is attracting more cash buyers, who are seeking to take advantage of their buying status in return for larger discounts.

As can be seen above, the current market dynamic is attracting more cash buyers, who are seeking to take advantage of their buying status in return for larger discounts.

On a year-on-year basis, across Garrington’s operating areas where a price saving off an asking price has been available, the percentage amount we have saved clients has increased by an average of 17% on prime homes at the top of the market.

Once the price falls seen this year are adjusted for inflation, there has effectively already been an average fall of 12% from the post-pandemic peak.

Savvy buyers are seeing this and, by financially factoring in further unknown risks, are making some captivating purchasing opportunities, which were simply unheard of 12 months ago.

Shaping the future market for UK property

Predicting the UK property market’s trajectory, given the myriad global influences like the Ukraine crisis and China’s economic concerns, is challenging.

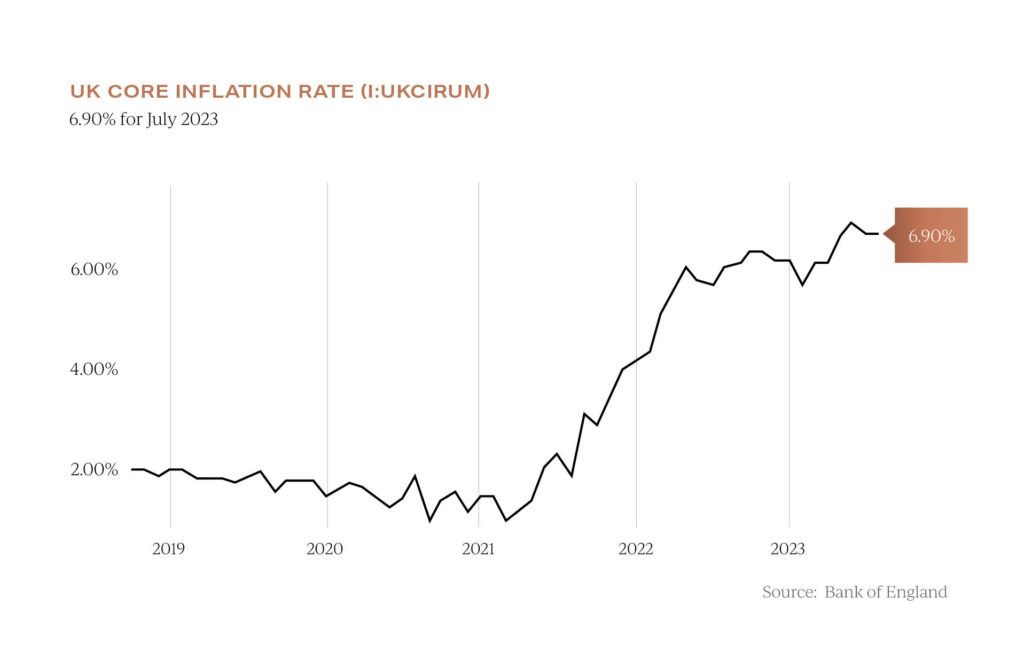

Looking at the headwinds closer to home, which will have a drag on the market and prices, inflation remains towards the top of the list. Latest Bank of England data for July shows the headline level of inflation falling to 6.8% with core inflation remaining stubbornly high and unchanged from the month before at 6.9%. Whilst inflation is falling, by the Bank’s own admission, it remains too high.

Latest Bank of England data for July shows the headline level of inflation falling to 6.8% with core inflation remaining stubbornly high and unchanged from the month before at 6.9%. Whilst inflation is falling, by the Bank’s own admission, it remains too high.

This inflation scenario will impact interest rates, affecting affordability and, consequently, the property market, particularly for buyers relying on credit.

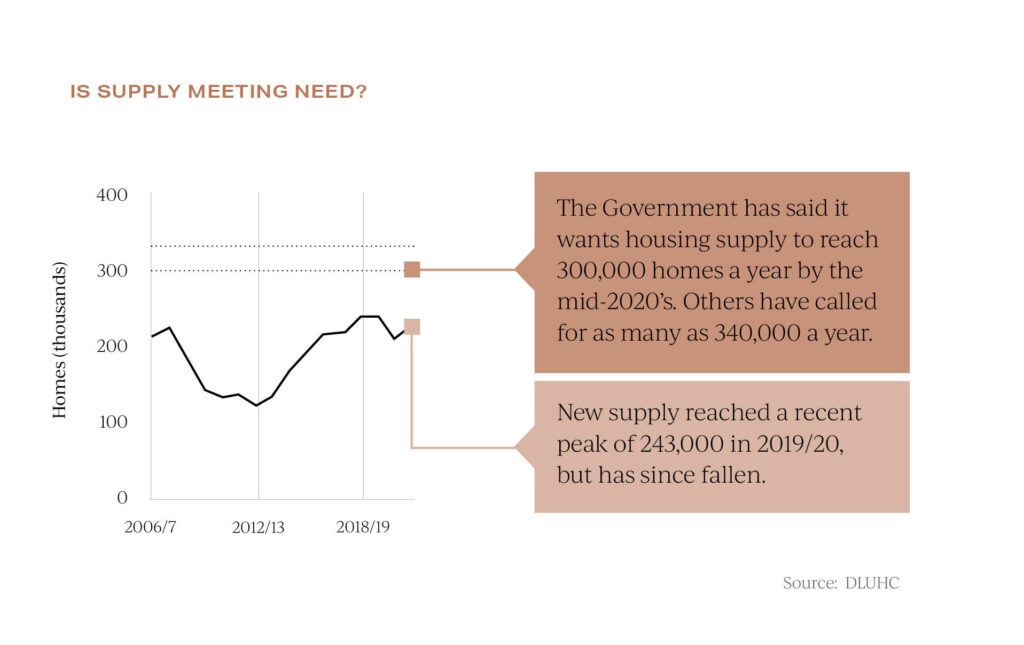

Factors that could support the market include a chronic under-supply of new homes, potentially becoming more pronounced as developers reduce output due to a softer sales environment.

The Government has previously calculated that over 300,000 new homes need to be constructed per annum to satisfy growing household demand. Successive governments have failed to meet these targets, thus deepening the housing crisis, and housebuilding is predicted to fall to its lowest level since the second world war.

Finally, post pandemic, the number of people now available to work has fallen, putting pressure on wage inflation as employers seek to attract and retain increasingly elusive talent.

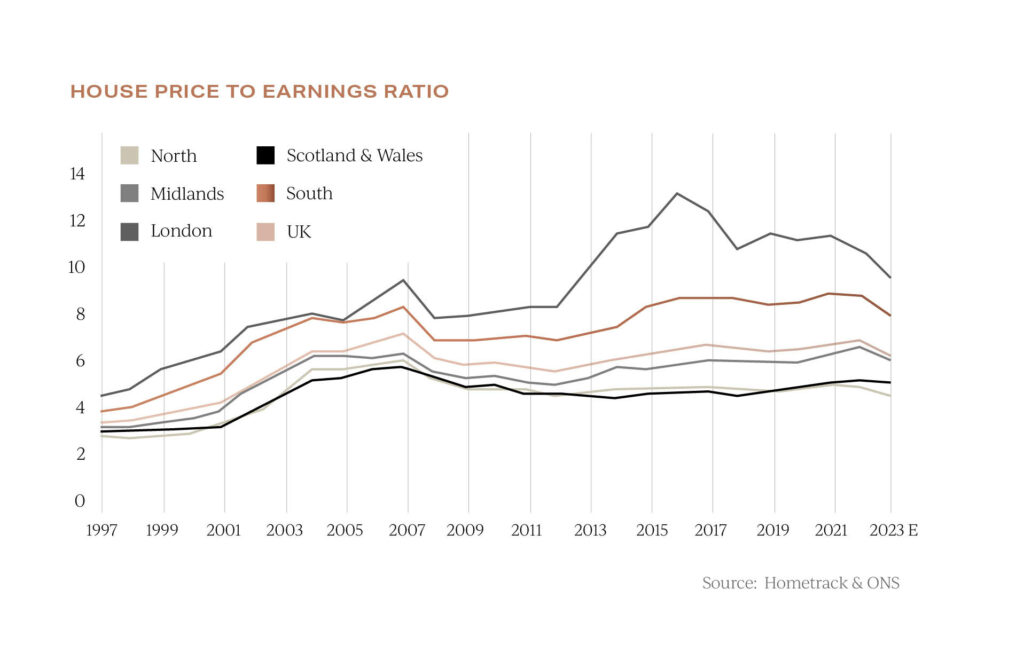

With wage inflation outstripping house price inflation, affordability is slowly starting to improve and price earnings ratios have started to fall as reported by Hometrack last month.

These, and wider economic factors, are likely to shape market dynamics in the upcoming months.

These, and wider economic factors, are likely to shape market dynamics in the upcoming months.

The Chancellor confirmed last week that his Autumn Statement and latest OBR report will be announced on 22nd November – time will tell whether by this point there is a brighter outlook to share.

In the meantime, if we can assist you with your own property requirements anywhere in the UK, please do get in contact.