Welcome to the March edition of Garrington’s Market Review, where we explore the latest shifts in the UK property...

Mortgage Rates Drop – Is Now the Time to Buy? UK Property Market Insights

Welcome to the August edition of Garrington’s UK property market review.

As we find ourselves amid the traditionally quieter summer months, the UK property market has been giving out some early signs of rising buyer confidence with pockets of improved sales activity.

Significant constraints on the property market have been removed in the last month.

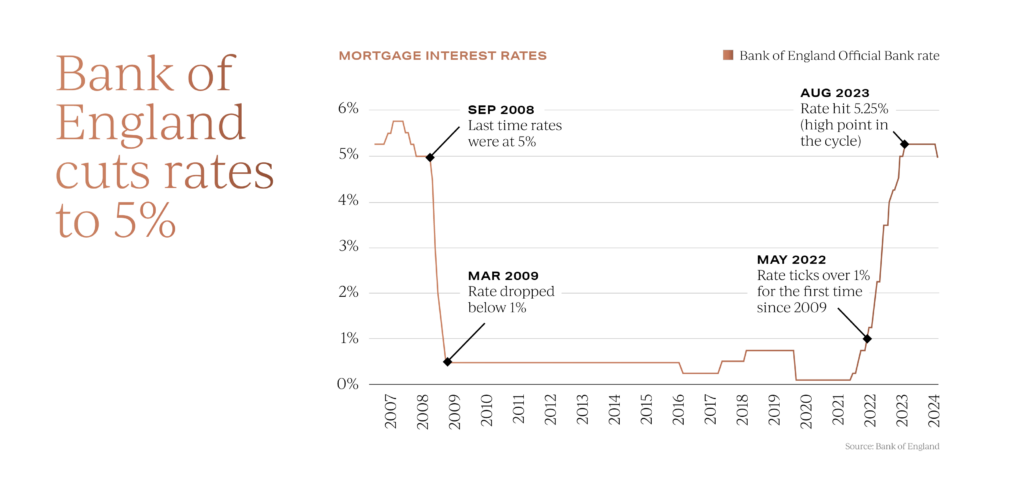

Gone is the election uncertainty, which suppressed activity in May and June, and the recent decision by the Bank of England to cut the Base Rate for the first time in four years has finally allowed mortgage lenders to start reducing the cost of borrowing.

Some lenders have already introduced sub 4% mortgage rate products, and other lenders are expected to follow, especially given the backdrop of five-year swap rates falling to their lowest level since January.

A series of forward indicators also suggests that would-be buyers are starting to re-engage with the market.

Web traffic on Britain’s largest property portals has increased over recent weeks and this trend is being reported by mortgage brokers too, with more online research taking place on the availability, and cost of credit.

For some people who had delayed their moving plans, the pertinent question seemingly being asked is: if not now, when?

A tipping point for the UK property market?

After months of new listings outstripping purchaser demand, could that be about to change?

Whilst the property market undoubtedly remains price sensitive, various datasets point towards the start of a possible shift in market dynamics.

Nationwide and Halifax both recorded average property values rising last month by 0.3% and 0.8% respectively, with Halifax also recording the highest annual rate of price growth since January at 2.3%. In its latest report, Halifax also went on to make the bold prediction that it expects house prices to rise throughout the rest of this year.

In its latest report, Halifax also went on to make the bold prediction that it expects house prices to rise throughout the rest of this year.

Supporting this theory is new property industry research, which records that since the election, just under a quarter of homes that were listed for sale in the first half of July went under offer in two weeks. This represents a 15% uplift compared to the same period last year.

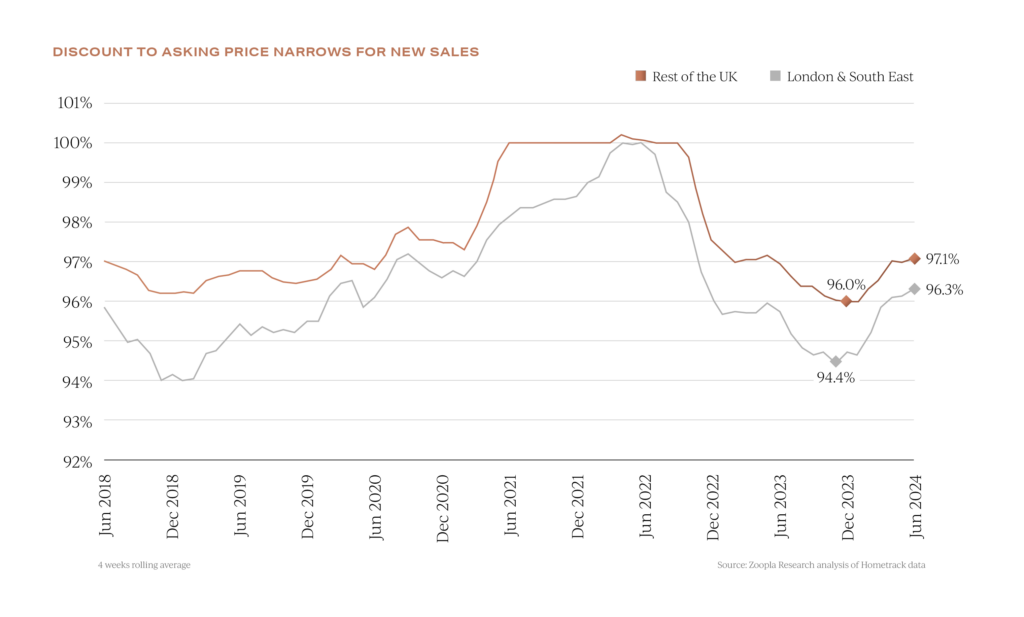

Renewed activity for the best homes is filtering through into the average discount being achieved off an asking price. Sellers are once again achieving a higher percentage of their asking price according to Zoopla, albeit London and the South East lag behind other parts of the country, as can be seen here: Across the UK, Garrington is hearing from many sales agents that a healthy number of listings are being prepared for marketing launches in September, which could mark the return of more buoyant market conditions.

Across the UK, Garrington is hearing from many sales agents that a healthy number of listings are being prepared for marketing launches in September, which could mark the return of more buoyant market conditions.

The cost of back to school

Children returning to school in September is frequently a trigger point for the return of busier market conditions. For some family buyers already at, or considering attending, an independent school, the decision on where to live has become more costly and complex.

The government has pressed ahead with its plans to levy VAT onto private school fees from 1st January 2025.

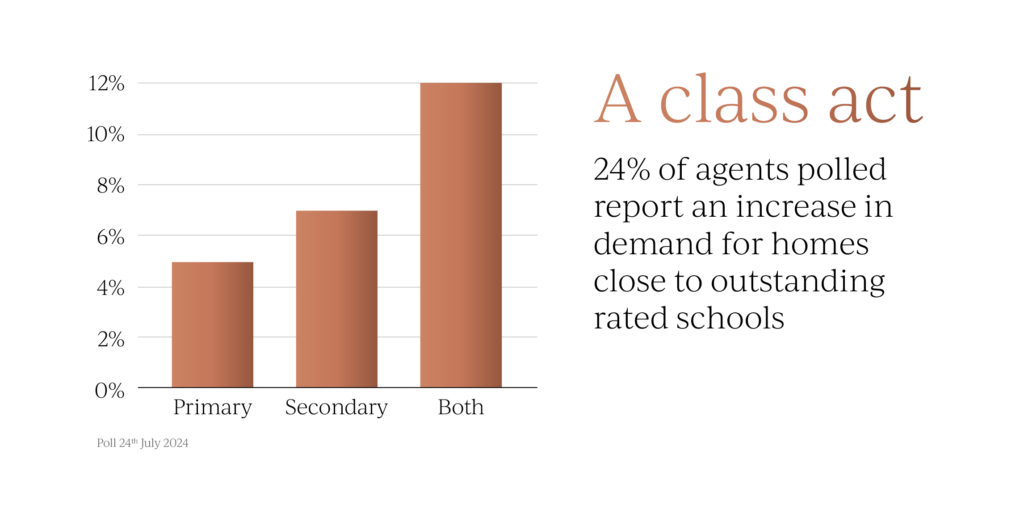

This announcement is already showing signs of affecting buyer behaviour in the property market, with a recent industry poll recording that 24% of sales agents interviewed had seen an increase in demand for homes close to so called ‘outstanding’ rated state schools.

This announcement is already showing signs of affecting buyer behaviour in the property market, with a recent industry poll recording that 24% of sales agents interviewed had seen an increase in demand for homes close to so called ‘outstanding’ rated state schools.

With just 15% of state schools being judged ‘outstanding’ by Ofsted, competition for the scarce number of places is likely to intensify.

As a result, there is an expectation that house prices will increase disproportionately in the associated catchment areas.

Slow but steady for UK property

Whilst the macro-economic picture is looking more encouraging than it has for some time there are various forthcoming events that could help, or harm, any recovery in market conditions.

The timing and amount of any interest rate reduction by other global central banks could impact the UK economy. Recent scares of a slowing US economy have caused a lot of volatility in the financial markets and could necessitate a sooner than expected cut in US interest rates.

Dollar-backed buyers are out in force and, from Scotland to London, Garrington is seeing heightened activity from this group of buyers who could be affected if the US economy and currency weaken.

City analysts are predicting the Bank of England will further lower the base rate, but this is now forecasted to happen in November following the Autumn Budget.

The budget itself could turn into another milestone event, particularly for the prime residential market, depending on the degree to which new tax policies target high net worth individuals.

These, and other factors, all fuel Garrington’s view that a slow and steady recovery in market conditions is more likely rather than any form of significant resurgence in the near term.

If you are considering your own property plans and would like some impartial advice, do get in touch with the team at Garrington.

If however, you are just exploring the market and some location options, don’t forget to visit Garrington’s Best Places to Live research. Simply click on the link to see our useful guide and interactive location explorer.

Next month we will investigate whether the tentative signs of an improving UK property market we have reported are gathering pace.