Welcome to the April edition of Garrington’s UK Property Market Review. As spring unfolds, the property market enters a...

UK Property Market Review: Resilience, Trends, & 2025 Outlook

Welcome to Garrington’s final market review of the year, and what a year it has been for the UK property market!

The property market typically slows down as the year draws to a close, but 2024 has proven to be anything but typical. Against the odds, activity levels remain remarkably brisk, mirroring the unpredictability of the weather.

If we had to describe this year’s market in one word, it would be resilient.

Despite facing a barrage of challenges, ranging from shock events and high interest rates to geopolitical tensions and economic volatility, the market has defied expectations, finishing the year stronger than it began, based on recent price growth data.

The latest house price indices reveal robust growth over the past month.

Halifax reported a notable 1.3% rise in November, pushing the annual increase in average UK property prices to an impressive 4.8%. Similarly, Nationwide recorded a 1.2% monthly gain, bringing their annual growth rate to a solid 3.7%.

Similarly, Nationwide recorded a 1.2% monthly gain, bringing their annual growth rate to a solid 3.7%.

As with any average data, it’s crucial to dig deeper into the numbers.

This recent spike in growth appears to be fuelled primarily by activity among first-time buyers and the continued trend of the more affordable northern regions outperforming other areas across the country.

How will the housing market perform in 2025

An unexpectedly busy close to the year has fuelled optimism for a more vibrant property market in 2025.

With the factors that drive both favourable and challenging conditions carefully considered, it’s fair to suggest that the foundations are set for a promising year ahead.

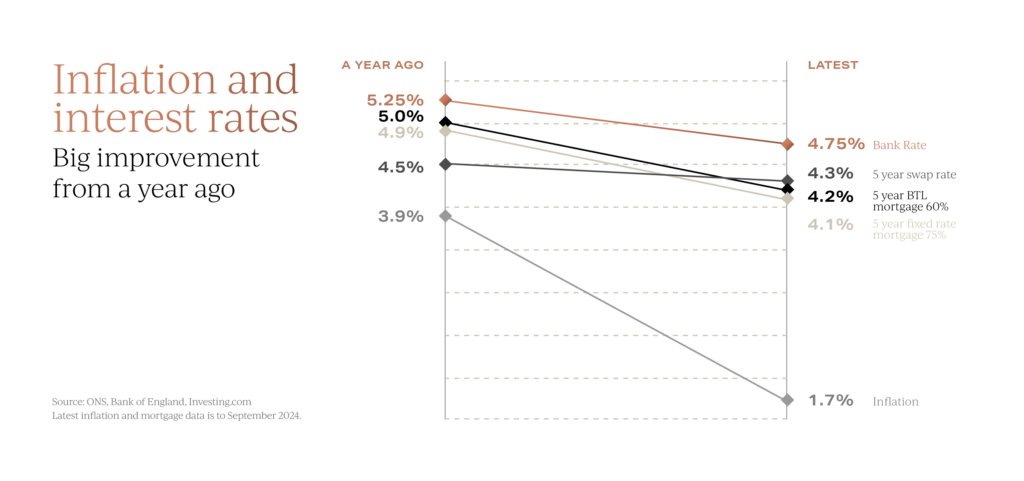

At an economic level, the rate of inflation has steadily fallen for most of the year triggering interest rate cuts and paving the way for further cuts in the year ahead, which could lower borrowing costs for homeowners. Historically, interest rates have acted as both an accelerator and a brake on the UK property market.

Historically, interest rates have acted as both an accelerator and a brake on the UK property market.

Lower rates typically boost confidence and sentiment, creating a ripple effect that encourages increased market activity.

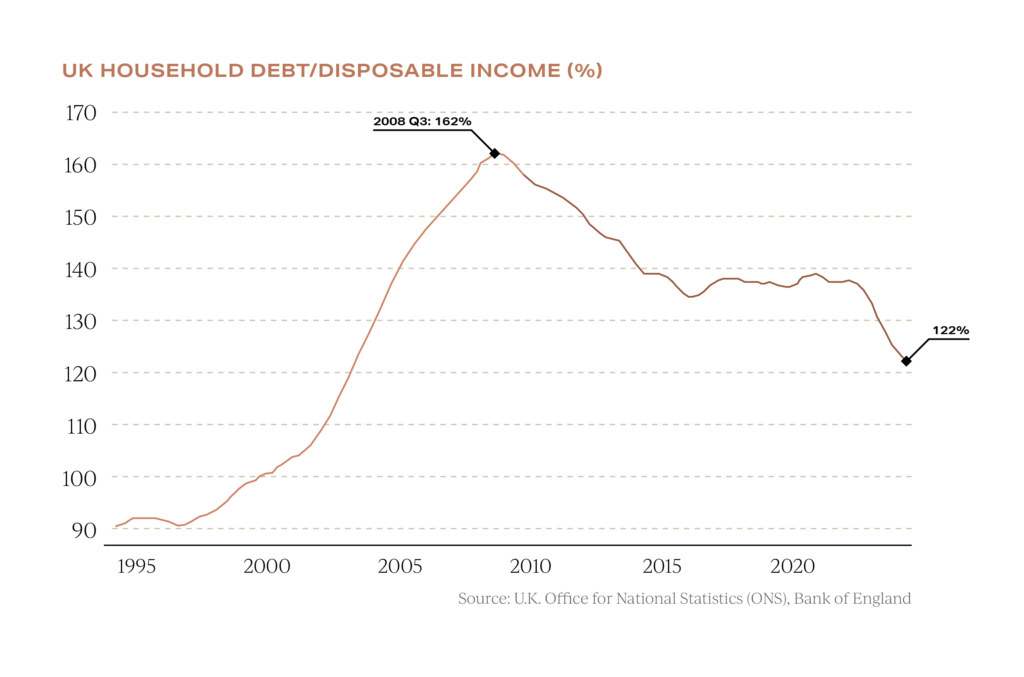

Household balance sheets are also in a particularly strong position compared to historical norms, with debt levels relative to incomes now at their lowest point since the mid-2000s, creating a solid foundation for sustained market resilience. Additionally, the backdrop of low unemployment and steadily rising income levels is likely to foster even more favourable conditions for the property market in 2025.

Additionally, the backdrop of low unemployment and steadily rising income levels is likely to foster even more favourable conditions for the property market in 2025.

According to the latest data from the Office for Budget Responsibility, household disposable incomes rose by an impressive 15% between Q2 2022 and Q2 2024.

By contrast, house prices increased by just 1.5% over the same period, a divergence that has contributed to improving housing affordability without requiring further falls in house prices.

These macro-factors are expected to affect buyer groups and regions differently in 2025.

Affordability will remain a central issue, with first-time buyers likely to accelerate their plans to purchase ahead of the stamp duty land tax threshold changes, coming into effect at the start of April. However, this urgency is not reflected across all segments of the market.

At the higher end, wealthier buyers are recalibrating their strategies in the wake of the Autumn Budget, which brought less favourable conditions for this group.

With a strong supply of high-quality prime homes available, these buyers often find themselves spoilt for choice and in a solid position to negotiate, which is likely to keep price growth in the prime market comparatively modest.

Will UK property prices rise in 2025?

Throughout this year, housing market confidence saw a steady improvement. While the latest Bank of England rate cut didn’t directly translate into lower fixed mortgage rates, it still provided a much-needed boost to market sentiment.

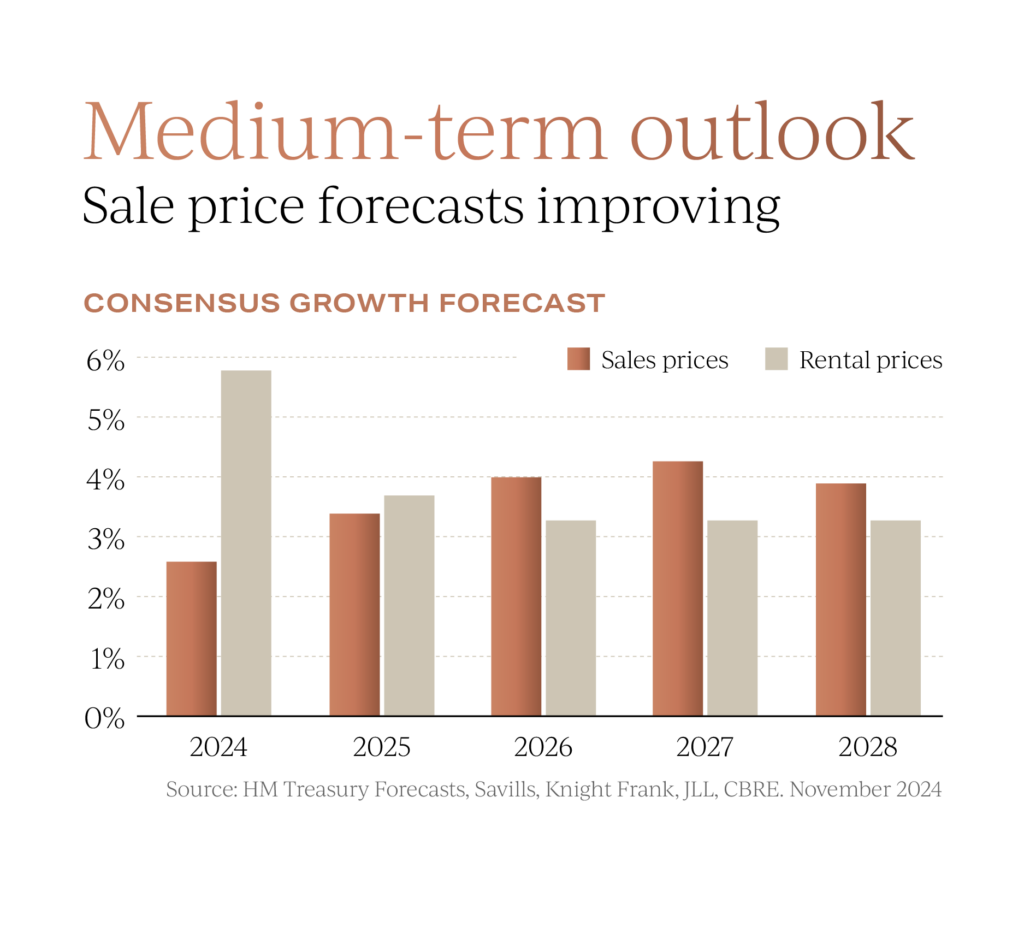

Looking ahead to 2025, consensus forecasts suggest house price growth of 3.4%, with further gains of 4% anticipated in 2026, painting a more stable and positive outlook for the market. The rental market, after experiencing a period of exceptionally high growth, is expected to return to a more sustainable trajectory. Rental growth forecasts indicate a rise of 3.7% in 2025, followed by 3.3% in 2026, as the market begins to stabilise.

The rental market, after experiencing a period of exceptionally high growth, is expected to return to a more sustainable trajectory. Rental growth forecasts indicate a rise of 3.7% in 2025, followed by 3.3% in 2026, as the market begins to stabilise.

House price growth in cities during 2025 is expected to reflect the dynamics of supply and demand, with population growth playing a critical role.

Recent data highlights that areas with strong job markets and affordable housing, such as Coventry, Milton Keynes, Leicester, Exeter and Telford, are attracting significant inward migration, which is likely to support increasing property values. Milton Keynes and Exeter benefit from thriving job markets, while Telford and Leicester rank highly on affordability.

Milton Keynes and Exeter benefit from thriving job markets, while Telford and Leicester rank highly on affordability.

Coventry and Exeter also stand out for their ability to attract and retain young residents. This sustained population growth, coupled with robust demand, positions these areas as prime locations for those seeking value, long-term capital growth prospects, and could prove attractive to investors.

In summary, house prices are expected to see growth in the year ahead.

Most house price forecasts point to steady rather than dramatic increases in 2025.

While several headwinds are likely to temper the pace of progress, there is an encouraging and growing number of positive factors that suggest market momentum will continue to build as 2025 unfolds.

If you are considering your own property plans for 2025 and would like some impartial advice, do contact the team at Garrington.

If however, you are just exploring the market and some location options, don’t forget to visit Garrington’s Best Places to Live research. Simply click on the link to see our useful guide and interactive location explorer.

We look forward to returning in January with our first update of the year, where we will share the findings from our latest UK property research.

Until then, from everyone at Garrington, we wish you a wonderful festive season and a happy New Year.