Welcome to the April edition of Garrington’s UK Property Market Review. As spring unfolds, the property market enters a...

UK Property Market 2025: Key Trends, Growth Hotspots & Investment Insights

Welcome to Garrington’s latest Market Review where we explore how the UK property market has performed so far this year.

The early weeks of 2025 have seen a revival in activity, with initial indicators suggesting a stronger than expected start for many parts of the residential sector.

The traditional January bounce did not disappoint as heightened buyer engagement, fuelled by previously reported record traffic across property portals, translated into brisk market conditions throughout last month.

Adding to the momentum, mortgage approvals in December unexpectedly surged, providing a further boost to buyer confidence.

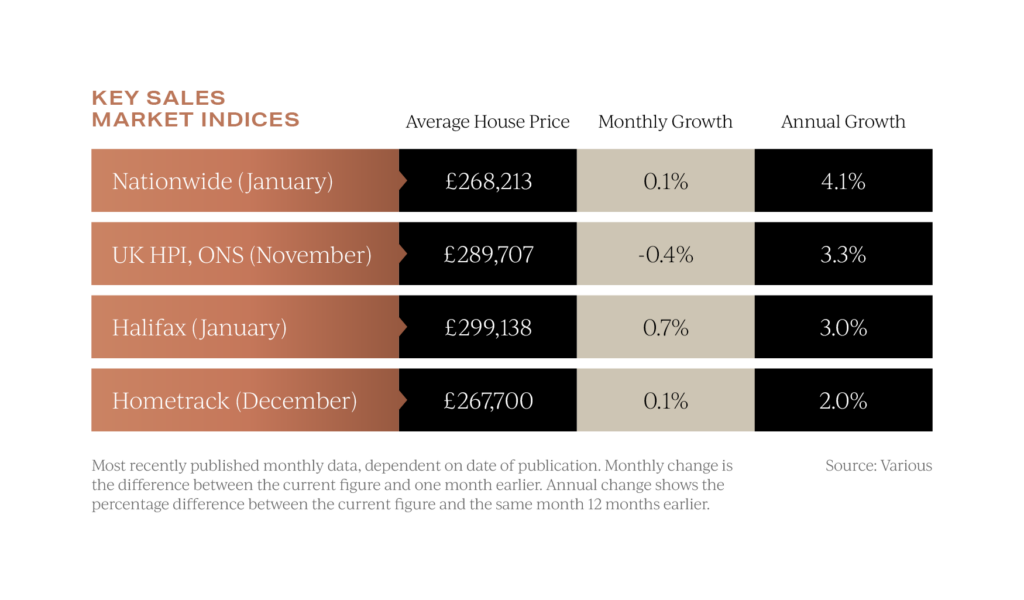

Average UK property prices have continued their modest upward trajectory, though at a measured pace.

Nationwide’s latest data recorded just a 0.1% rise in January, bringing annual house price growth to 4.1%. In contrast, Halifax reported a more pronounced monthly increase of 0.7%, with annual growth reaching 3% – pushing the average UK property price to a new peak of £299,138. However, headline figures only tell part of the story. Beneath the surface, regional disparities remain stark.

However, headline figures only tell part of the story. Beneath the surface, regional disparities remain stark.

While Halifax’s reported national price surge may suggest broad-based acceleration, a closer look reveals that price growth has actually slowed in two-thirds of the UK’s regions.

One trend is unmistakable: the north-south divide is widening. The most robust growth is emerging in the north-east, where house prices have climbed 5.2% year-on-year, being nearly double the rate of London’s price appreciation.

With buyers increasingly prioritising value over prestige, could this shift mark the start of a more sustained rebalancing between historically premium markets and the UK’s perceived value hotspots?

Falling rates and cash buyers

Against the backdrop of sluggish economic growth, the Bank of England’s recent decision to cut the base rate to 4.5% marks a significant shift in monetary policy in an attempt to prevent the economy from entering a recession.

For the thousands of buyers who held back in 2024, the prospect of cheaper borrowing could provide the confidence needed to re-enter the UK property market.

While the Bank’s move tilts conditions further in favour of buyers, its wider market impact is expected to be measured. Affordability constraints remain a key factor, meaning that while borrowing is becoming less expensive, demand is unlikely to surge dramatically in the near term.

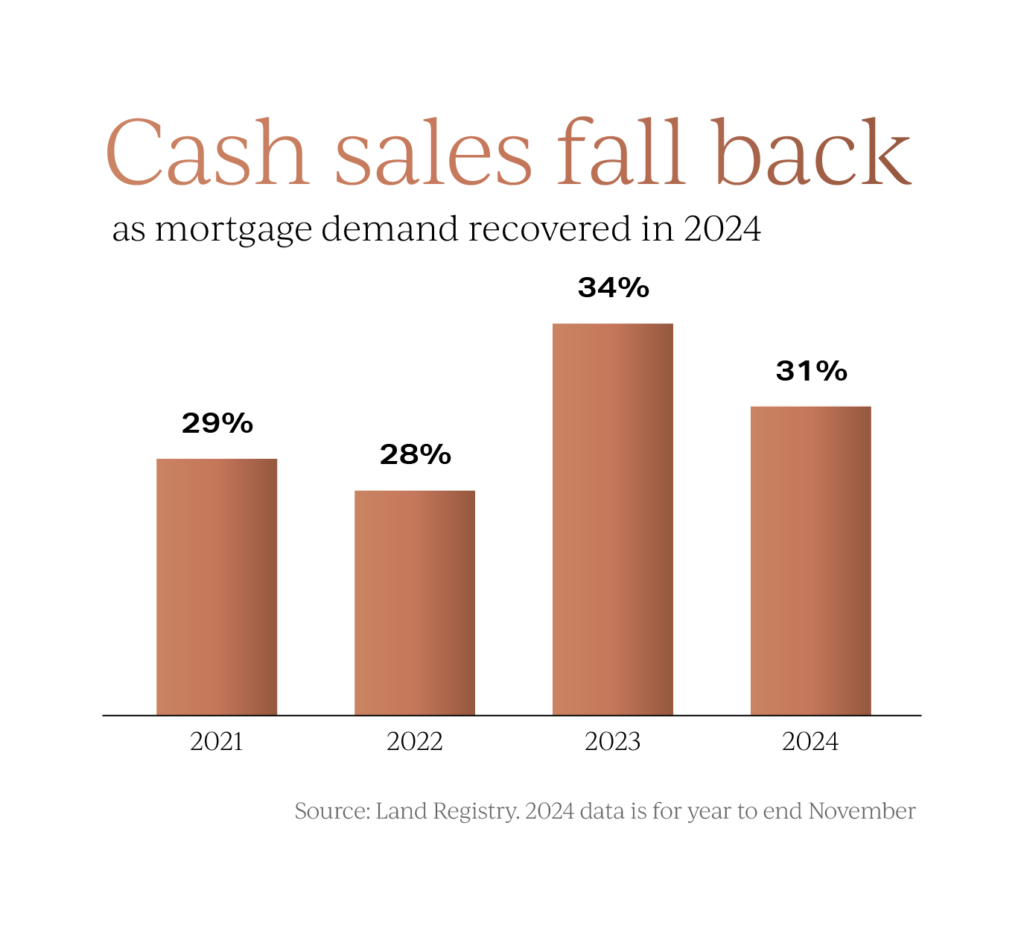

Lower mortgage rates are already reshaping how transactions are being financed.

In 2023, cash buyers accounted for a notably high proportion of purchases, with 34% of transactions in England and Wales completing without a mortgage – well above the five-year average of 28%. However, as borrowing costs eased in 2024, this dynamic began to shift. Cash purchases declined to 31%, while mortgage-backed acquisitions regained a larger share of the market.

However, as borrowing costs eased in 2024, this dynamic began to shift. Cash purchases declined to 31%, while mortgage-backed acquisitions regained a larger share of the market.

This shift suggests that the market moved back towards more typical conditions during the latter half of 2024.

Looking ahead, with further rate cuts anticipated and mortgage affordability set to improve, mortgage-financed purchases are expected to continue increasing throughout 2025.

“Growth, growth, growth”

In what many see as a tacit admission of past mistakes, Chancellor Rachel Reeves has unveiled major investment plans alongside the softening of tax changes in the Finance Bill for non-domiciled individuals.

At the heart of these investment proposals is the multi-billion commitment to a third runway at Heathrow, a project that, if approved, would demolish hundreds of homes, reroute the M25, and increase aircraft noise across affected areas. While boosting jobs and investment, it also raises concerns over local disruption and the environmental impact.

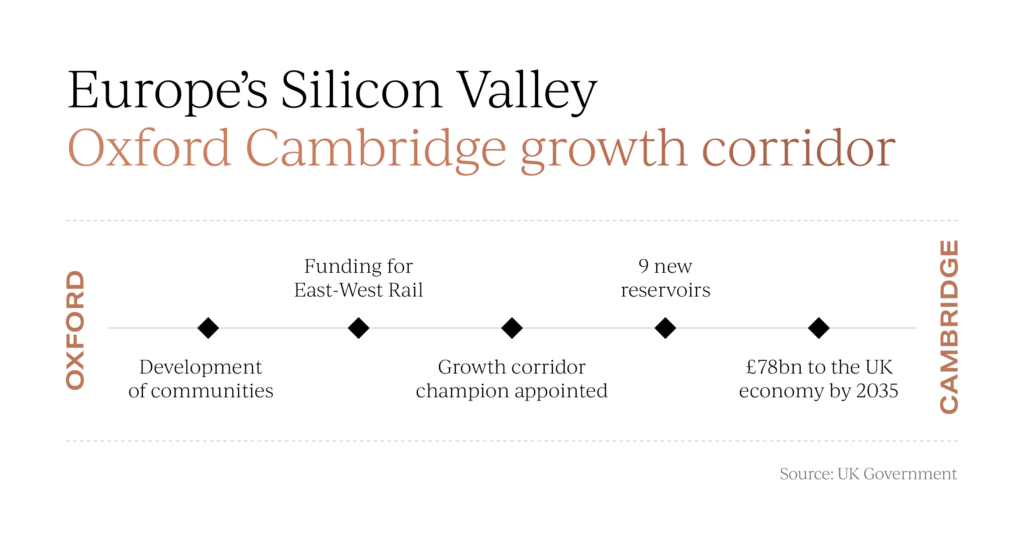

Meanwhile, the government is pushing to make the UK the home of Europe’s Silicon Valley, with the Oxford-Cambridge Growth Corridor projected to add £78 billion to the economy by 2035. The plan includes expanding transport links and housing supply, yet both Oxford and Cambridge remain among the least affordable cities in the UK.

The plan includes expanding transport links and housing supply, yet both Oxford and Cambridge remain among the least affordable cities in the UK.

With demand far outpacing supply, property prices in the corridor could outstrip regional counterparts.

Further strengthening the UK’s tech dominance, the Prime Minister’s AI Opportunities Action Plan aims to accelerate AI adoption, with the first AI Growth Zone (AIGZ) designated in Culham, Oxfordshire. Meanwhile, powerful AI supercomputers in Bristol and Cambridge will support AI innovation from spring 2025.

As high-value jobs cluster in these hubs, local property markets will likely see rising demand and price pressures.

Government policy shifts always create both opportunities and risks for home movers.

Investment in infrastructure and technology hubs could drive regional price growth, yet local opposition, particularly in rural areas, may slow progress.

The challenge for UK property buyers and investors will be identifying which areas stand to gain the most.

The path ahead for UK property

However much the government may wish to accelerate growth, its latest proposals remain long-term in nature, with little immediate impact on economic conditions or the housing market.

In contrast to conflicting media narratives, the latest HM Treasury forecasts provide a clearer picture of what 2025 may hold.

Economic growth is expected to be modestly stronger than in 2024, though the pause in GDP expansion during Q4, alongside lingering downside risks, means forecasts remain tentative. Inflation, while still slightly above target, is significantly lower than the peak levels of 2023 and early 2024, and, crucially, not high enough to deter the Bank of England from easing monetary policy.

Inflation, while still slightly above target, is significantly lower than the peak levels of 2023 and early 2024, and, crucially, not high enough to deter the Bank of England from easing monetary policy.

Current projections indicate that the Bank of England will continue reducing interest rates, following the recent drop to 4.5%, with expectations of reaching 3.75% by year-end. While much of this anticipated shift is already reflected in fixed mortgage rates, further gradual reductions in borrowing costs remain possible.

For the UK property market, this economic backdrop suggests a more stable and active year ahead. Transaction volumes should remain solid, while house price growth is expected to track a similar pace to 2024, reflecting a gradually improving lending environment and steady demand.

If you are forming your own property plans for 2025 or have been searching for some time without success, the Garrington team is here to help. To discuss how we may be able to assist with your UK property search, please do get in touch .