As one of the most popular home counties, with so many locations that offer more than simply an easy...

Should I move house?

With external forces likely shaping decision making, buyers might wonder should I move house now?

The changing face of the UK property market has brought about significant changes to not only when people are moving home, but also how long they typically stay in one property. This is according to fascinating data just published within the English Housing Survey.

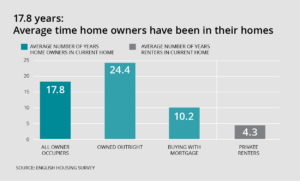

Garrington has studied the findings and the report highlights some very interesting – and very different – stories. It may surprise you to know that homeowners have been in their homes an average of 17.8 years.

The data also shows how this number varies massively across different sectors. Outright owners have been in their home for 24 years on average. Homeowners with a mortgage have been in their home for ten years. And private renters just four years.

Who is moving, and why?

This is all against a backdrop of 2.1 million moves in the previous year. As the average occupancy suggests, those moving most are within the private rented sector. Renters accounted for 55% of moves for a total of 1.2 million.

It’s possible that the outright owners have passed through the category of having bought with a mortgage and now own their homes outright – which would imply a longer time period. It would also include those downsizing who are buying outright with the proceeds of a larger house as they prepare for a long and settled retirement in the same house.

We know from previous home moves information that large amounts of housing stock is under-occupied by the over 65s who are looking for – but failing to find – suitable downsizing properties. This raises the distinct possibility that not all of this long term occupation is ideal or desirable. It could reflect people wanting to move but not being able to do so for various reasons including there not being the right housing for them to move to.

People move house for a variety of reasons. Some positive, some negative, and some perfectly neutral. Probably not for the entertainment value, as moving home is often said to be one of the most stressful things you can do.

The broad strokes of these numbers mean it is impossible to see the finer detail. Where in the country are these people moving to? How many miles away? Are they moving to larger or smaller properties? For what reasons? That’s not just nosiness asking, but it is data that’s not available from this particular home moves information.

How the rental market fits in

Private sector rental tenants don’t always get to make their own choices on moving house. Their tenancy is dependent on the owner of the house – if the owner decides to sell, the tenants may have little choice but to move on. The average length of residence shows a huge gap between the experiences of renters and that of owner-occupiers, with far more frequent moves.

Flexibility and the much shorter time scale of finding new accommodation and moving out of a previous tenancy is a big advantage for the private rental sector. Perhaps part of the reason that occupancies are shorter is that it’s easier to move when you are renting – especially if your accommodation is furnished. So tenants might consider a move that would not have been possible or worthwhile if they owned the house.

Some of those 653,000 people making owner-occupier home moves will be moving out of rented accommodation and into owning their own homes, most likely with a mortgage. We already know there is a large market catering to these first time buyers coming out of the private rental market. First time buyers made up 42% of all new mortgages for home purchases in 2016 – plenty of movement going on there.

It’s not so much what these statistics are now, but the direction they are trending in. Keeping an eye on home moves information and this aspect of the market can help spot problems or opportunities in advance. What does this mean for the housing market, and for those in and around it?

If you are thinking about moving home and wondering how these issues affect you – and how to take the stress out of the process – get in touch with Garrington to see how we can help.