As one of the most popular home counties, with so many locations that offer more than simply an easy...

First time buyers active in the property market

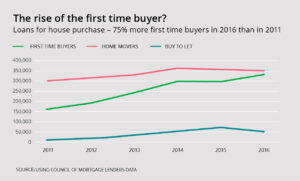

Did you know that nearly half of all house purchase loans last year were for a first time buyer mortgage? It’s true, and first time buyer mortgage loans have increased 75% from 2011. The Council of Mortgage lenders says that last year over 339,000 loans were given to first time buyers, underlining that first time buyers are active in the property market.

How did this happen? This huge increase in first time buyer mortgages is thought to be partly due to the success of government schemes and initiatives aimed at first time buyers. Increasing employment and low mortgage rates are also big factors. First time mortgages are now only slightly less than the number of mortgages to those moving home and are by far the biggest growing part of the mortgage sector.

The financial market for first time buyer mortgages is massive. Last year 42% of all house purchase loans were first time buyer mortgages – house purchase loans as opposed to including remortgaging. That’s compared to 34% in 2011, so just six years to see a big jump. Compare that to prior to the global financial crisis – the number was 30% in 2007.

First time buyers and deposits

However, it’s It’s not only the mortgage that the first time buyer must contend with. The best first time buyer mortgages come with seriously hefty deposit requirements. In 2015 the average deposit for a first time buyer was £32,297 – and three times that amount in London.

The most recent English Housing Survey has estimated that 29% of first time buyers received help financing their deposit from family and friends. The “Bank of Mum and Dad” has certainly seen an increase in demand over the past years.

But if the current generation of first time buyers are relying on their parents where does that leave the net generation? Well, the average age of first time buyers is 32. Nearly half of first time buyer mortgages are for more than 30 years.

So those mortgages will still be being paid into the buyers’ sixties – probably along with their student loans.

The term length on first buyer mortgages is worth considering. 40% of first time buyer mortgages are over 30 years. One quarter are for over 35 years. These long terms help lower the monthly cost of a first time buyer mortgage when there are plenty of other monthly outgoings to be paid. But, of course, they do lead to more being repaid over the life of the loan. Monthly outgoings will be loan, but the loan overall will be more – possibly a lot more.

Other factors for first time buyers

The private rental market has a really high turnover. A good proportion of those moves will be from people making the transition from renting to becoming first time buyers.

Another important consideration is the pitter patter of tiny feet. While the average age of a first time buyer is 32, the average age of a first time mother is 28. Over half of all babies born in 2015 were to women over 30, and two-thirds to men over 30. Starting a family is now falling well before becoming a homeowner for many people.

There are a whole array of government schemes and initiatives available to first time buyers. These include Help to Buy ISAs, First Steps London, shared ownership, shared equity schemes, equity loans, the Starter Home scheme and mortgage guarantees. Quite a list. Private builders may also offer incentives and provision such as shared ownership. Other factors for first time buyer mortgages include a lack of available housing stock across the country, but especially in London and the South East.

So we can see how the challenges for first time buyers reflect on the housing market at large and how first time buyer mortgage trends are an important indicator. Despite these challenges record numbers of first time buyers are taking out loans and getting onto the property ladder.

Are you or a family member looking to buy a first home? Call Garrington for expert advice