Welcome to Garrington’s latest Market Review where we explore how the UK property market has performed so far this...

UK Property News – April 2022

Welcome to the April 2022 edition of Garrington’s UK property market review.

With warmer weather and lighter evenings, spring is always a busy time in the property market, with homes being listed for sale and new buyers entering the market. Activity levels this year are in keeping with seasonal norms, and average house prices across the UK continue to defy economic headwinds.

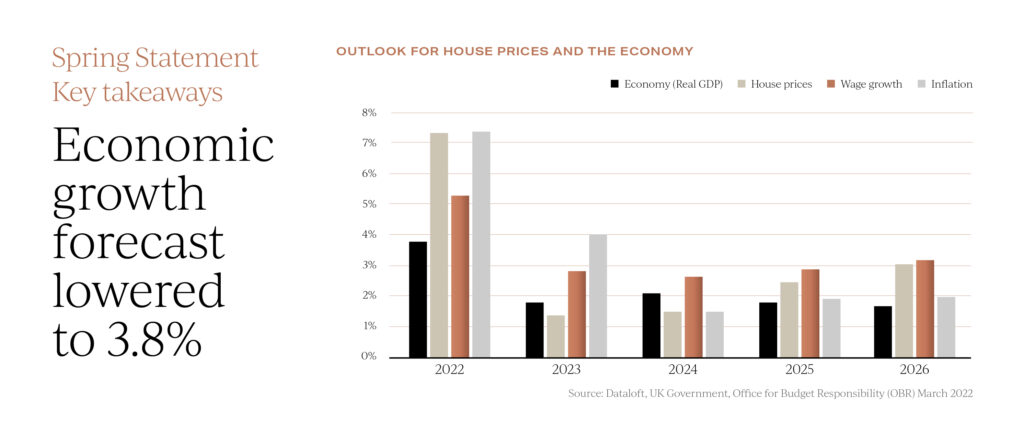

In last month’s Spring Statement, the Chancellor warned that the global economic outlook is ‘challenging’.The OBR has lowered its economic growth forecast to 3.8% this year, down from the 6% forecast it made last October.

Property price growth is expected to outperform economic growth this year, averaging 7.4% over the year, before slowing to 1.3% in 2023.

Property price growth is expected to outperform economic growth this year, averaging 7.4% over the year, before slowing to 1.3% in 2023.

No house price falls are predicted over the next five years. Wage growth is forecast to be higher than average at around 5.2% this year. However, inflation is expected to average 7.4% and not return to below 2% until 2024.

Such factors may still become a drag on the rate of future house price growth, but for now, the spring market is brisk and competitive.

Market reality

The question being posed by many home movers, investors and forecasters alike is, how long will current market conditions continue to be the norm?

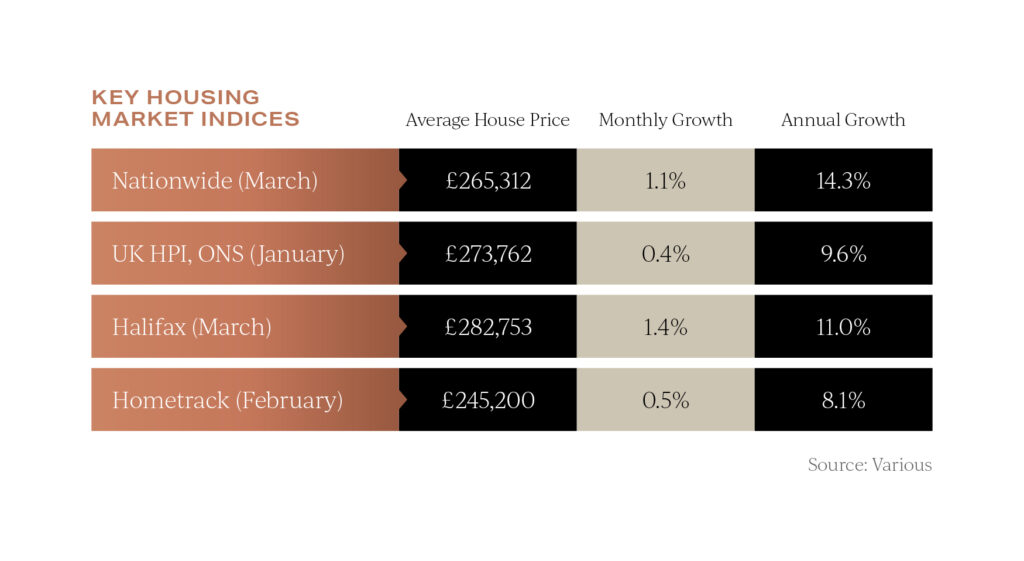

Both Halifax and Nationwide recorded further price growth last month of 1.4% and 1.1% respectively, keeping the annual rate of house price growth for both indices at double-digit levels.

Rather astonishingly, the average UK detached property has now increased in cash terms by around £68,000 since the start of the pandemic according to Nationwide.

Rather astonishingly, the average UK detached property has now increased in cash terms by around £68,000 since the start of the pandemic according to Nationwide.

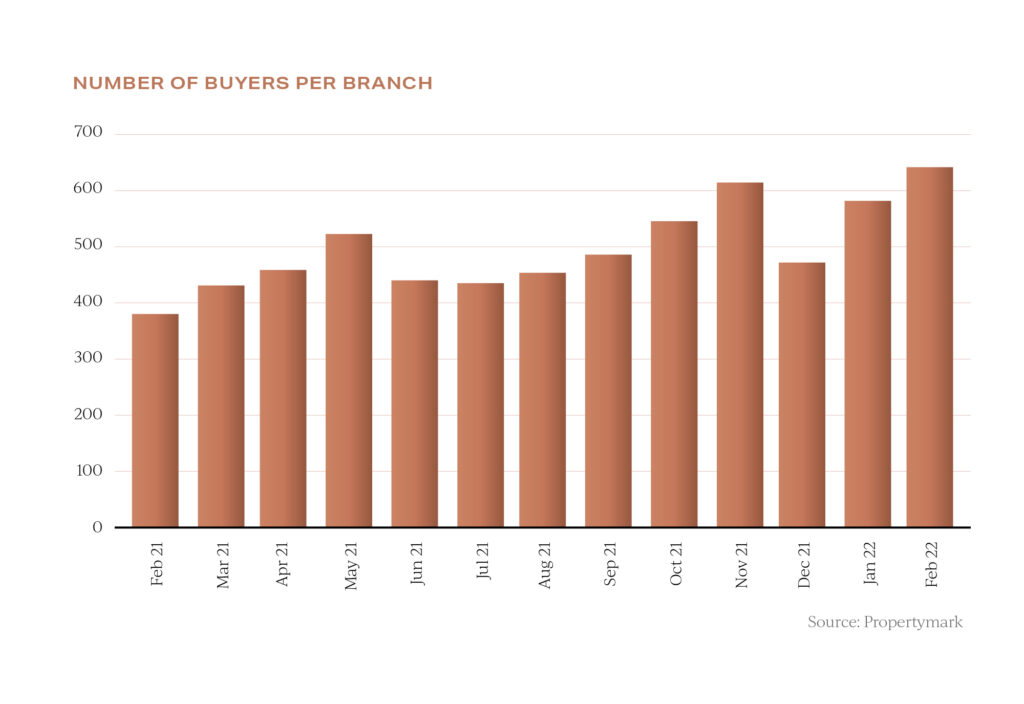

The imbalance between supply and demand has been much publicised over recent months, but many movers are unaware of what this looks like in reality.

Propertymark’s latest data records 590 buyers registered with each branch of its member estate agents. In stark contrast, these branches have an average of just 23 homes for sale, equating to a ratio of 26 buyers for every available property.

After such a sustained rise in house prices and transaction volumes, there is normally speculation as to when the market might reach an affordability tipping point. However, market dynamics have changed and looking at past trends may no longer be helpful.

After such a sustained rise in house prices and transaction volumes, there is normally speculation as to when the market might reach an affordability tipping point. However, market dynamics have changed and looking at past trends may no longer be helpful.

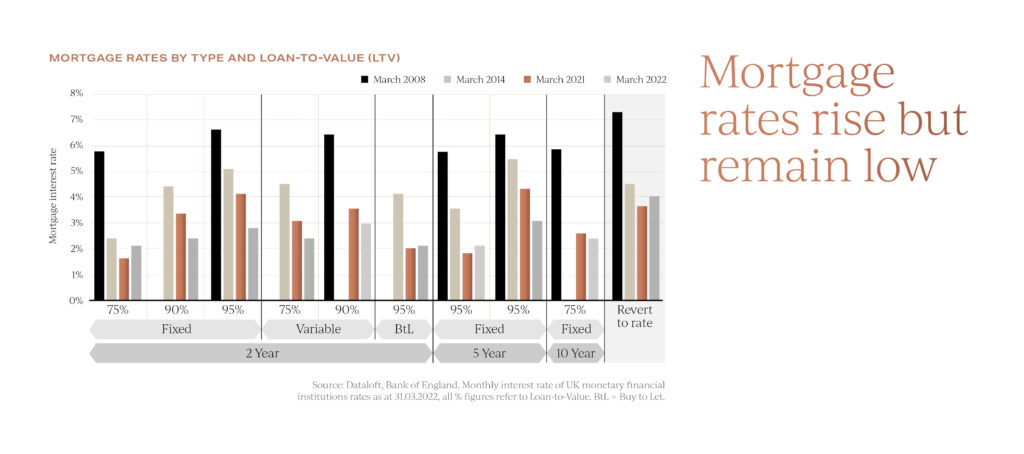

Despite recent interest rate increases, many mortgage rates remain attractive by historical standards.

Back in 2008 when the base rate was last at 0.75%, and in 2014 when affordability tests were introduced, mortgage rates were far higher.

Back in 2008 when the base rate was last at 0.75%, and in 2014 when affordability tests were introduced, mortgage rates were far higher.

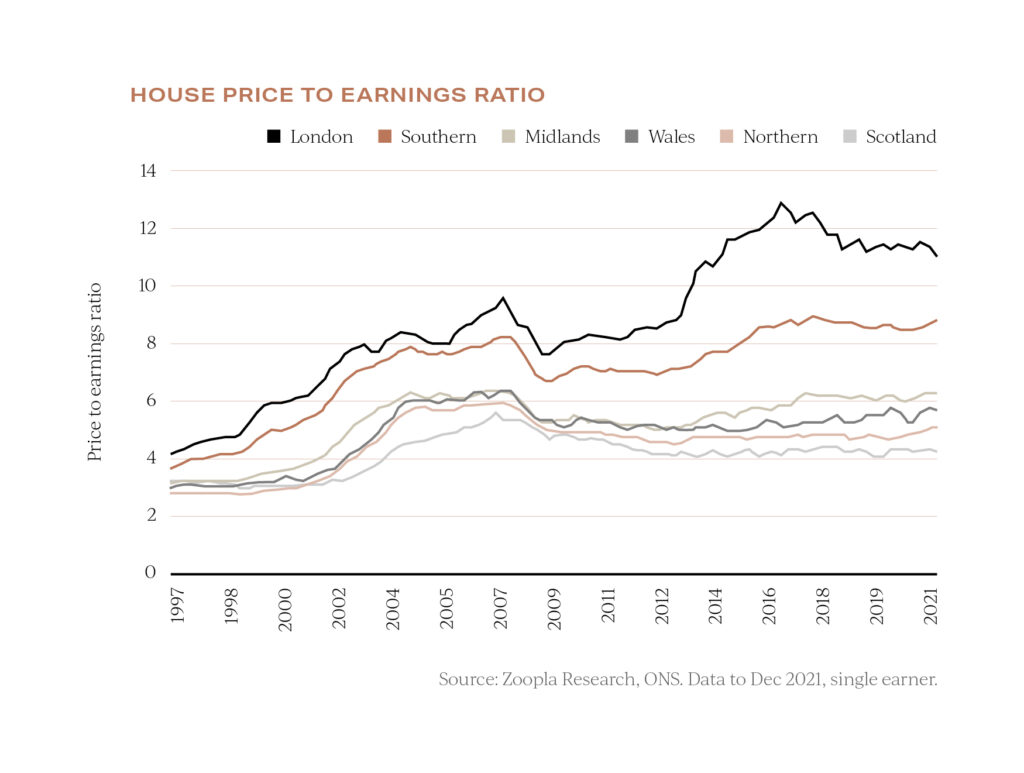

Traditional theories on house price to earnings ratios as a measure of affordability may now be a less reliable means by which to predict future trends.

The affordability of property differs widely by UK region. London remains the least affordable location where the average house price is 11 times the average income. By contrast, average house prices in Northern regions are 5.1 times average earnings according to Zoopla and the ONS.

The affordability of property differs widely by UK region. London remains the least affordable location where the average house price is 11 times the average income. By contrast, average house prices in Northern regions are 5.1 times average earnings according to Zoopla and the ONS.

The paradigm shift in remote working has disrupted affordability models, with work being more focused on what workers do each day, not where they do it. As a result, more high paying jobs traditionally found in London with associated salary weightings are now being done by employees working from home in more affordable locations, thus distorting price earning ratio patterns by postcode and further supporting regional markets.

UK property – City markets blossom

Renewed interest in city locations is translating into high rates of house price growth. Liverpool has the highest rate of annual growth at 10.3% and average property values have increased by 32% over the last 5 years. According to Zoopla, sales in London in Q1 this year exceeded those in the same period last year.

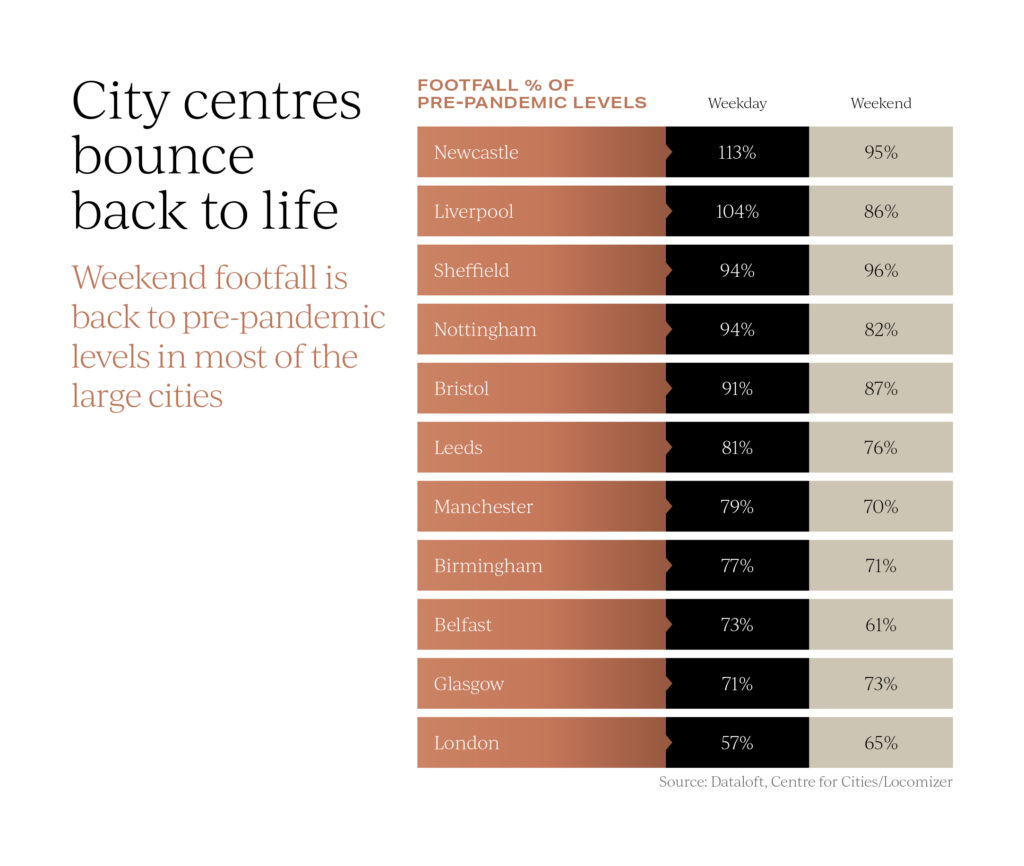

Total footfall averaged across the UK’s 63 largest city centres for February is as high as it has been for two years.

Total footfall averaged across the UK’s 63 largest city centres for February is as high as it has been for two years.

Weekend footfall is back to pre-pandemic levels in most of the large cities and weekday activity is also recovering.

According to Halifax’s latest data, house prices in London have started to climb once again after a period of slower growth, as young home buyers return to the city.

Prices in the Capital have risen 5.9% year-on-year, to an average of £534,977. While the growth in London is modest by national standards, it’s a huge acceleration compared to where it was at the end of 2021 – and a clear indication of some buyers’ growing interest in city living.

We hope you found our latest update helpful. In the meantime, if you would like to discuss your own property plans, please feel free to get in touch using the contact details below.