Welcome to the March edition of Garrington’s Market Review, where we explore the latest shifts in the UK property...

April 2025 UK Property Market: Supply Builds, Confidence Splits

Welcome to the April edition of Garrington’s UK Property Market Review. As spring unfolds, the property market enters a traditionally active period, but this year the mood is more considered.

Ongoing economic pressures and rapidly shifting global conditions are keeping confidence in check. While supply is much improved and pricing appears steadier in some areas, many buyers and sellers remain in a holding pattern, waiting to see what happens in the months ahead.

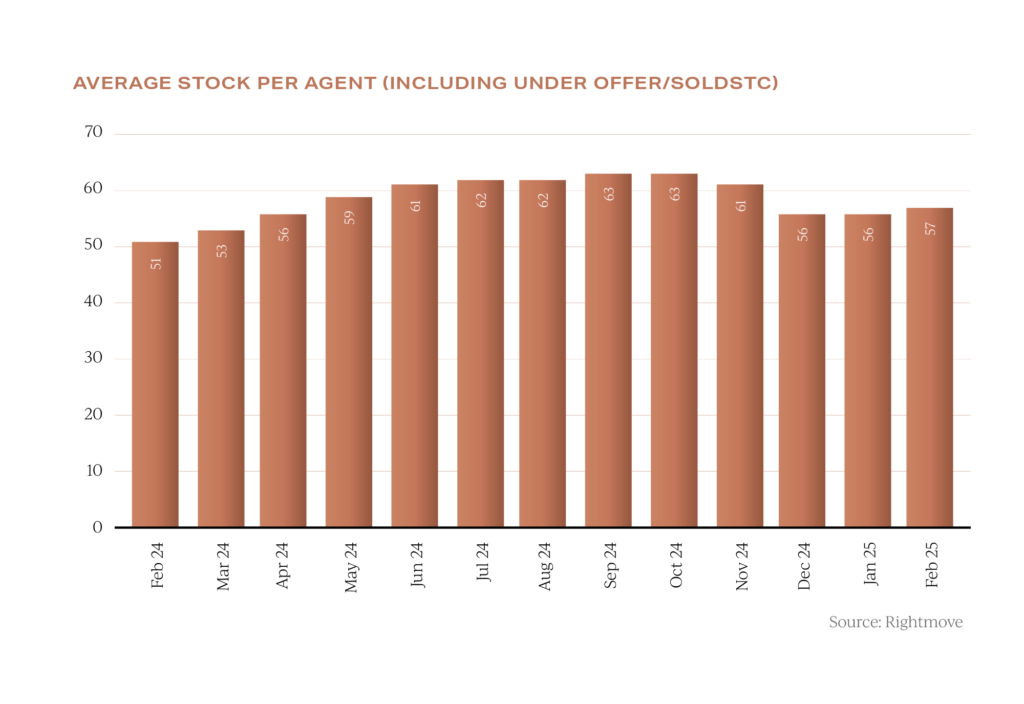

1st April saw the long-anticipated adjustment to Stamp Duty thresholds, prompting a flurry of completions in late March; followed by a more cautious tone as Q2 begins. Yet it is the supply side of the equation that’s delivering the clearest signal of market dynamics right now. According to Rightmove, buyers are currently benefitting from the highest number of available homes for sale at this time of year since 2015, a striking reversal from the stock-starved conditions of recent years.

According to Rightmove, buyers are currently benefitting from the highest number of available homes for sale at this time of year since 2015, a striking reversal from the stock-starved conditions of recent years.

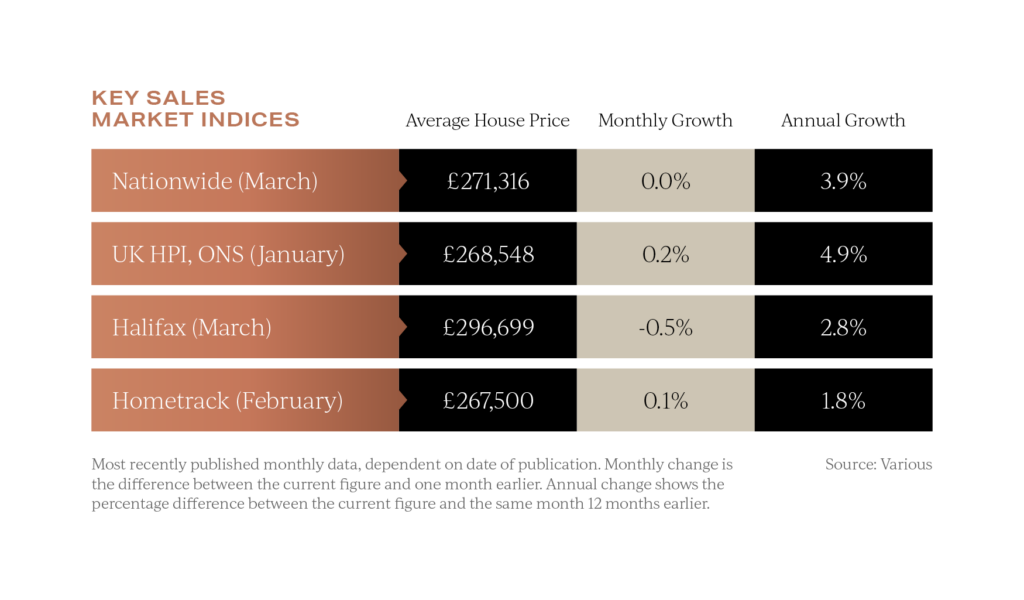

With the market now awash with choice, buyers are under little pressure to rush decisions or pay premium prices. This is starting to be reflected in headline values. Nationwide’s latest index shows zero monthly growth in March, with annual gains holding steady at 3.9%. Halifax, meanwhile, recorded a 0.5% fall in prices over the month, reinforcing the sense that the post-pandemic price surge continues to moderate.

Nationwide’s latest index shows zero monthly growth in March, with annual gains holding steady at 3.9%. Halifax, meanwhile, recorded a 0.5% fall in prices over the month, reinforcing the sense that the post-pandemic price surge continues to moderate.

As we move into Q2, the market appears well supplied but more finely balanced, a shift that brings opportunity for well-informed buyers, yet also demands discernment.

No bounce in Spring Statement

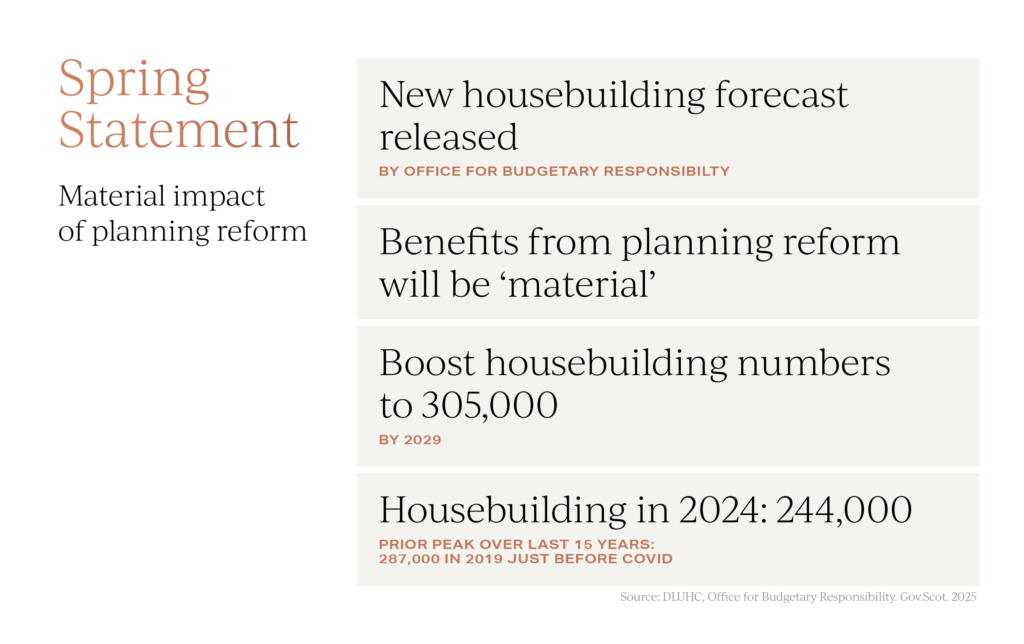

Despite hopes for market-stimulating measures, this year’s Spring Statement offered little immediate comfort for the UK property sector. The UK’s economic growth forecast for 2025 was cut to just 1%, reflecting a measured and subdued outlook. One of the few glimmers of positivity came from the Office for Budget Responsibility (OBR), which published new forecasts on housebuilding levels.

The OBR now expects that last year’s planning reforms will have a material effect on housing supply. Annual housebuilding could rise to over 305,000 by 2029, up from around 244,000 completions in 2024. The last major peak was in 2019 when 287,000 homes were built, the highest figure in at least 15 years. However, before any improvement takes hold, a further dip in delivery is anticipated.

Annual housebuilding could rise to over 305,000 by 2029, up from around 244,000 completions in 2024. The last major peak was in 2019 when 287,000 homes were built, the highest figure in at least 15 years. However, before any improvement takes hold, a further dip in delivery is anticipated.

While a gradual rise in supply will be welcome, especially in affordability-challenged markets, it also raises fresh concerns in rural areas. Changes to planning classifications are raising risks for some buyers. Permitted development rights and evolving local plans could alter the character of locations long considered protected from large-scale development.

Planning reform may be an essential lever to support future supply. Yet for buyers seeking the certainty and landscape quality that rural settings offer, it introduces a more complex and less predictable purchasing dynamic.

Trade tensions and the UK property market

At the time of preparing this review, global events are shifting almost daily. The announcement of new US trade tariffs at the start of April has unsettled financial markets, fuelling renewed volatility and raising fresh questions about the global economic outlook.

Uncertainty of this kind is rarely welcomed by property markets, and the UK is unlikely to be insulated from the wider ripple effects.

Confidence could be dented, and there is a risk that higher import costs, especially for raw materials, could feed through into inflation, placing further strain on the construction sector and broader economy.

Ordinarily, rising inflation would limit the Bank of England’s room to manoeuvre on interest rates. However, in this instance, there is growing speculation that policymakers may have no choice but to respond by lowering rates to stimulate domestic growth.

Sterling overnight indexed swap rates have already fallen, and analysts are now projecting as many as three Base Rate cuts before the end of the year. If realised, this would likely ease mortgage pricing and improve affordability for buyers.

Ultimately, the key question is whether improved affordability can offset wider economic nerves. For some, global instability may reinforce a wait-and-see approach. For others, a shift in borrowing conditions could provide just enough encouragement to re-enter the market.

Outlook for UK property

The weeks following Easter often mark a natural reset in the UK property calendar. With time to reflect and make plans, many households use the holiday period to reassess their goals for the year ahead. It’s not unusual for this to spark a renewed flurry of activity, both in terms of homes coming to market and buyers stepping up their searches.

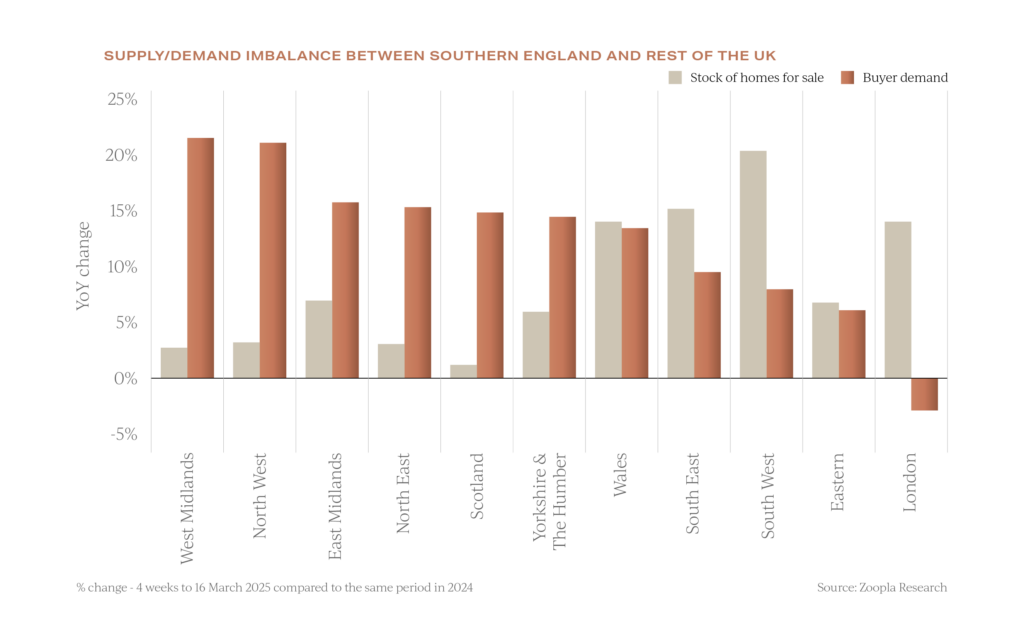

Whether this seasonal lift will take hold in 2025 remains uncertain. What is clear, however, is that the market is becoming increasingly divided. According to the latest HomeTrack data, supply is now outpacing demand across much of southern England, while in areas such as the Midlands, the North West, and Scotland, demand continues to exceed available stock.

What is clear, however, is that the market is becoming increasingly divided. According to the latest HomeTrack data, supply is now outpacing demand across much of southern England, while in areas such as the Midlands, the North West, and Scotland, demand continues to exceed available stock.

Alongside these domestic shifts, Garrington is seeing a notable rise in enquiries from US-based buyers. Traditionally focused on prime central London, American interest is now spreading with purchasers exploring a broader range of UK locations.

For those at the early stages of planning a move, Garrington’s newly released Best Places to Live 2025 research provides a valuable resource. The interactive tool allows users to compare locations across the UK based on a range of lifestyle and investment factors, helping buyers shape their thinking and refine their search.

As the spring market continues to play out, confidence and clarity will remain essential. For those ready to act, improved affordability and greater choice may offer a timely opportunity. If you would like to discuss your property plans, please get in contact. The team at Garrington would be happy to help.