A warm welcome to Garrington’s latest UK property market review. After a spring defined by volatility and economic headwinds,...

Property News August 2020 | Market Review

Activity levels in the property market traditionally experience a seasonal lull during the summer holiday period.

However, there has been no such let up in activity this year. Notwithstanding official confirmation that the country is now in a recession, many buyers have seemingly assessed their property and lifestyle requirements and remain undeterred to progress their moving plans this summer.

Mind the gap

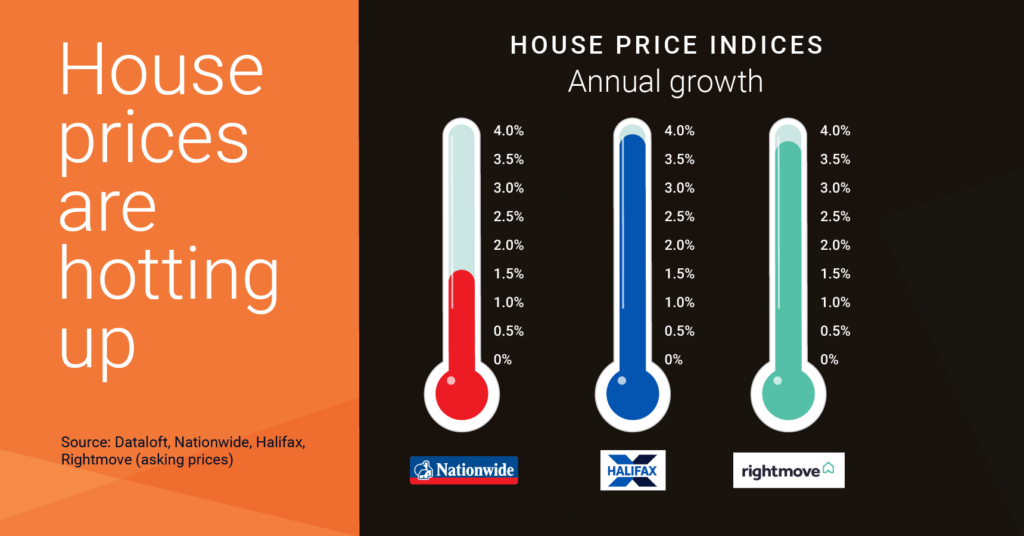

The UK has recently experienced the hottest day in August for 17 years. The weather isn’t the only thing to be hotting up. House price indices report annual growth across the board.

Nationwide July House Price Index reports a 1.5% annual increase in house prices and a monthly increase of 1.7%

Halifax July House Price Index reports a 3.8% annual increase and a monthly increase of 1.6%.

The Rightmove July House Price Index, based on asking prices, reports a 3.7% annual increase.

As we have reported over recent months, national house prices indices have been unreliable for representing ‘real world’ market conditions, due to the data lag associated in their production. Only now is the gap closing and these indices are more aligned to the activity levels currently being seen in the market.

A far from relaxing holiday

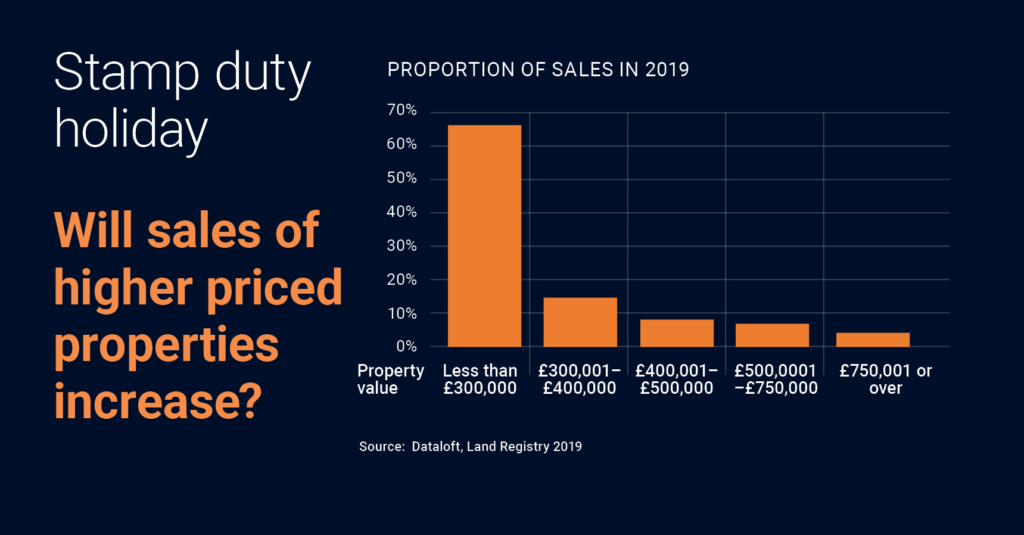

With the stamp duty holiday benefiting homeowners and investors the most, particularly those with bigger budgets, we are likely to see increased demand for higher priced properties over the next seven months.

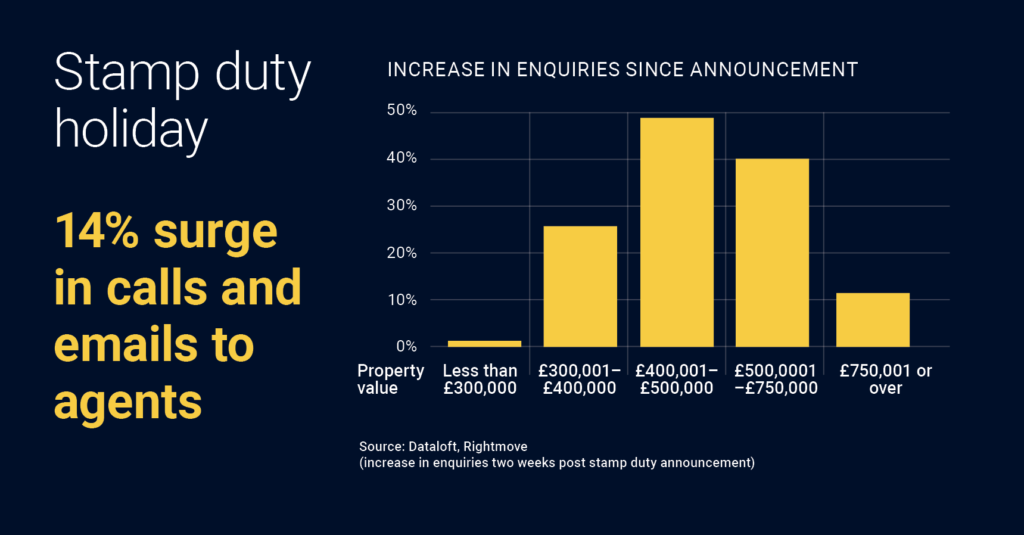

The stamp duty holiday has led to a 14% surge in calls and emails to sales agents.

Properties priced between £400,000–£500,000 have seen the biggest increase in interest.

In 2019 they only represented 8% of sales, therefore we may see a shift in the distribution of transactions in 2020.

Market conditions in certain sectors of the market are highly competitive. Across our operating regions, from Scotland to Devon, so called ‘sealed bids’ for the best homes openly on the market is becoming commonplace.

Of note, is the sheer volume of bidders chasing one home. In three separate instances, sales agents have recently advised us that they have received well in excess of ten ‘best and final’ bids for particular homes, thus further highlighting the apparent supply and demand imbalance of quality property for sale.

Transaction bottlenecks

The recent wave of market activity has led to a spike in newly agreed transactions needing to be progressed. What ordinarily is straight forward, in terms of progressing mortgage applications, surveys and conveyancing is proving far from straight forward at the current time.

Many lenders are overwhelmed with mortgage applications, underwriters are taking more time to assess lending risks and Garrington are aware of several surveyors working seven days a week to keep up with demand and clear a backlog of work.

In an already busy market where both sellers and buyers alike are keen to progress plans, realistic expectations and good communication remain prerequisite to reaching a successful exchange and completion.

Outlook

Current market conditions are showing no sign of changing in the immediate near term. Indeed, the period after the summer holiday break usually marks an increase in activity under normal circumstances.

But these are not normal circumstances, and it is hard to ignore the wider economic news and growing job losses in certain sectors.

Events in the coming months have the potential to both accelerate or suppress current conditions.

On the one hand, those wishing to take advantage of the stamp duty holiday have a limited window of opportunity to take advantage of the scheme, with the end of September widely considered to be the latest timescale to allow for a sale and related purchase to complete, prior to 31st March 2021.

On the other hand, rising unemployment data, the end of the furlough scheme, US election results and the Autumn budget, could all play a part in changing market conditions over the coming weeks and months.

As such, the market is likely to remain characterised with threats and opportunities and we will continue to report latest developments as they become evident.