Welcome to Garrington’s latest Market Review where we explore how the UK property market has performed so far this...

UK Property News – August 2021

Welcome to the August 2021 edition of Garrington’s UK property market review.

Despite the ‘Great British Staycation’ being in full swing and a rush of last-minute holiday bookings, the property sector has defied expectations and seasonal norms by remaining remarkably busy for the time of year.

The last month has been somewhat of an acid test for the market in revealing just how inflated activity levels had become due to the Stamp Duty Holiday.

Without question, a significant number of transactions were brought forward with June breaking transaction volume records.

After such a frenzied period, July has been more of a calm ‘change of gear’ rather than any form of ‘cliff edge’ drop in activity.

Market highs and lows

The property market continues to be supported by the availability of historically low interest rate mortgages and the chronic supply/demand imbalance.

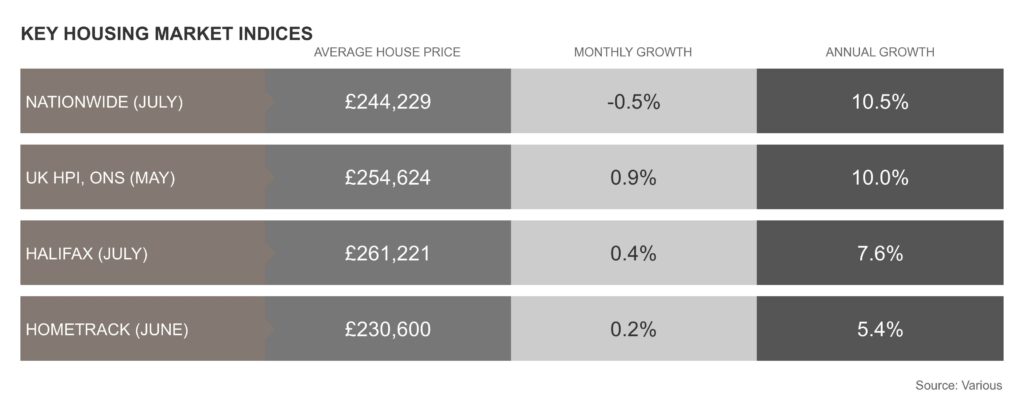

Average property values increased by 0.4% last month according to Halifax, whilst Nationwide recorded a monthly fall of 0.5%, but on an annual basis prices are 10.5% higher than at the same time last year according to the latter.

Despite property values increasing to an all-time high in most parts of the UK, the effect of mortgage rates being close to an all-time low has meant that affordability has remained in line with the long-term average trend.

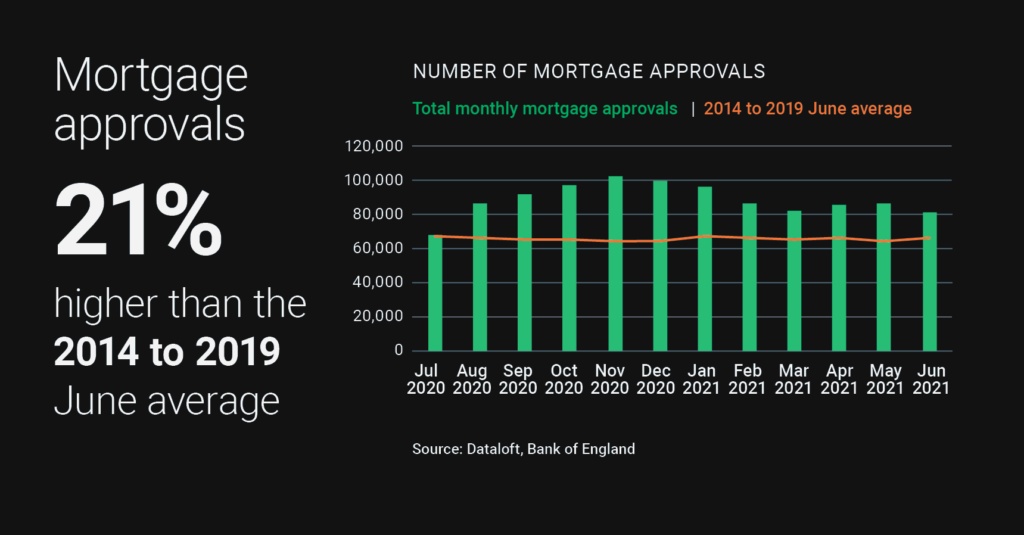

81,338 mortgages were approved in June 2021, 21% above the 2014 to 2019 June average.

Since this time, rates have fallen further and currently a total of 46 fixed rate deals are available at below 1 percent, as lenders aggressively compete for new business.

This is fuelling further purchaser demand at a time when stock levels continue to fall.

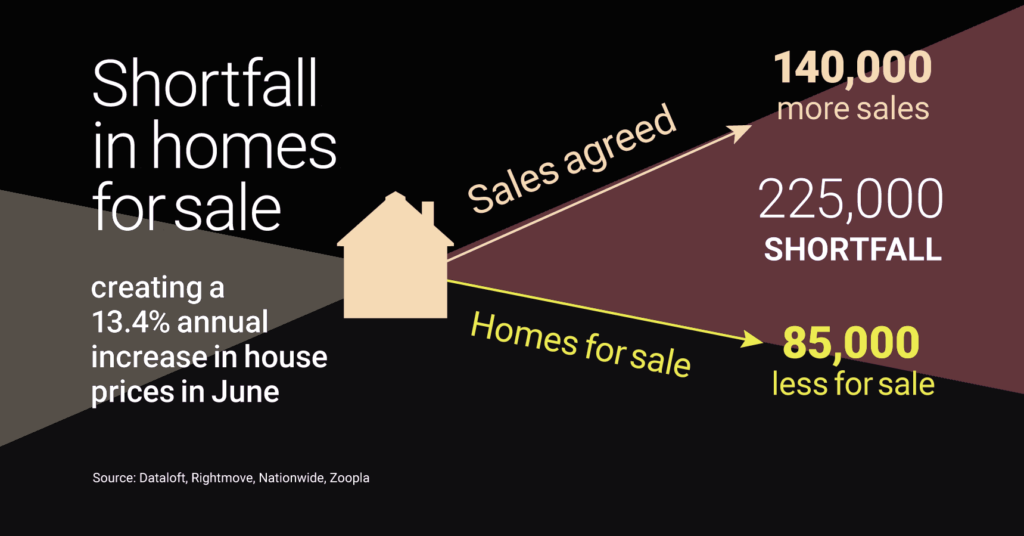

Current estimates are that there is a shortfall of around 225,000 homes for sale in the market.

Across the UK, Garrington is regularly hearing from sales agents that they have never seen listing levels so low.

Ironically, a lot of new buyer registrations are from would-be sellers who continue to hold off listing their homes due to not being able to see anything of interest to move to.

Moving out and moving in

One of the standout trends seen in the market over the last year has been the volume of movers relocating to a completely new area.

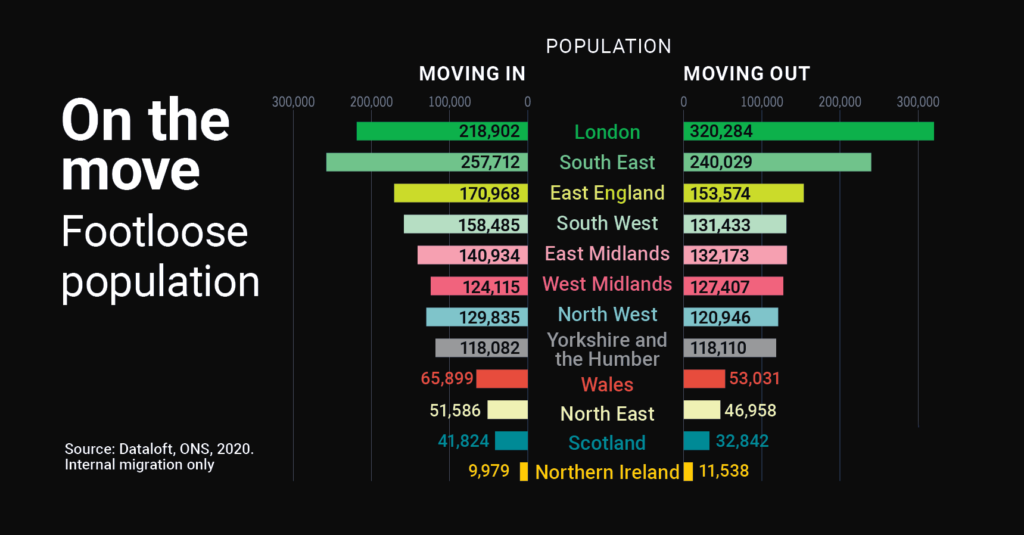

Latest data records nearly 1.5 million people changed region in the UK even before the pandemic.

Hamptons International report that a record 61,830 Londoners purchased homes outside the capital in the first half of 2021.

Proportionally, Scotland, Wales and the South West witnessed the most significant increases in their resident population due to internal migration in the year to June 2020.

Given the influx of buyers to these areas, in addition to existing local demand, it is easy to understand why so many of these locations featured in Rightmove’s Top Hotspots for Sales research of 13 million property listings.

Property in Scotland topped the league table with 89% of sellers agreeing a sale between June 2020 and June 2021.

This compares to 48% in London. The national average was recorded at 68%, which is the highest level ever recorded by the portal.

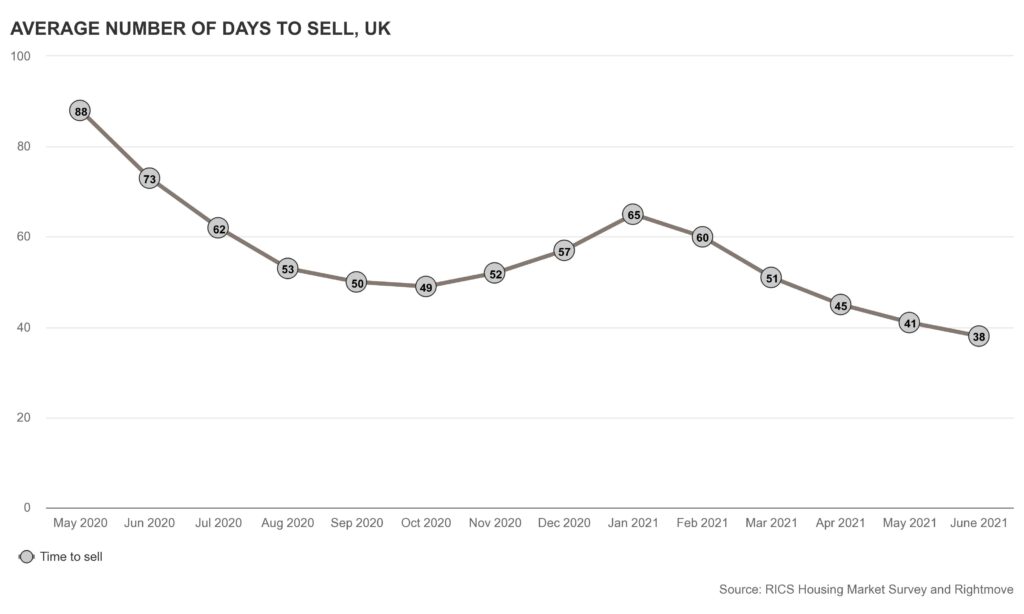

The average number of days to sell a property fell to 38 days in June, as against 74 days just 12 months ago, further illustrating just how fast paced the property market has become over the last year.

Across Garrington’s operating areas around the UK, clients moving for lifestyle reasons has remained the number one cited reason for moving home over recent months and this trend looks likely to continue for some time to come based on current research.

Outlook

As previously mentioned, the normal summer market is looking anything but normal this year and busy market conditions look set to continue.

Lack of stock is further exacerbating fast paced sales at escalating values.

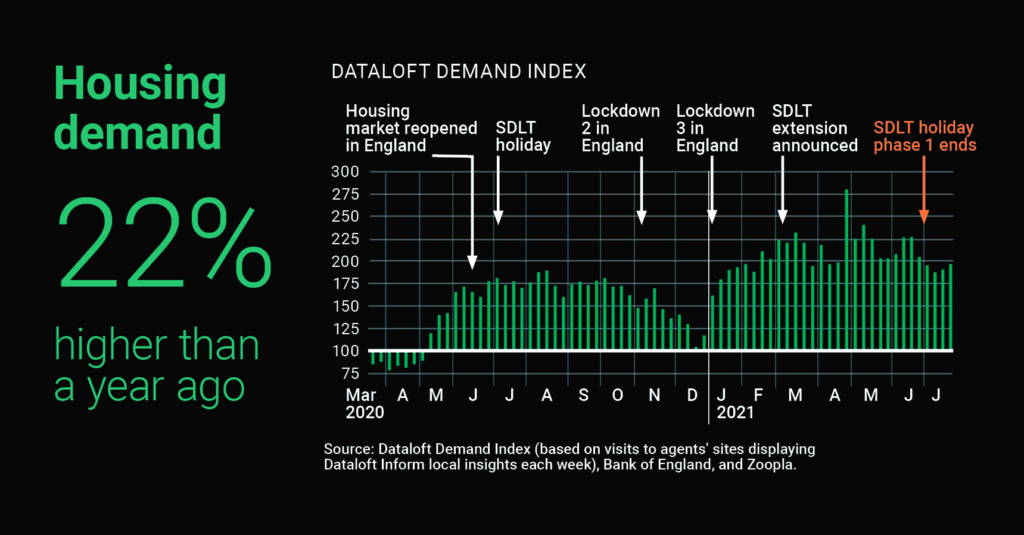

Purchaser demand is 22% higher than a year ago and barring any shock events over the coming months, this demand looks set to fuel autumn house sales.

By comparison with many parts of the country London has been languishing at headline levels, both in terms of sales volumes and values, with one noticeable exception.

Sales of homes worth more than £5 million have seen a significant uptick over recent months as domestic buyers in search of larger homes take advantage of less competition from overseas buyers.

Garrington is already seeing more interest from international buyers wishing to acquire UK property and expect this trend to gather momentum as travel corridors begin to reopen into the Autumn.

Garrington will continue to closely monitor and report emerging trends, which are certain to bring both opportunities and threats to those wishing to purchase a property this year.

If you would like to discuss your own property plans, please feel free to get in touch using the contact details below.