Welcome to Garrington’s latest Market Review where we explore how the UK property market has performed so far this...

UK Property News – February 2023

Welcome to the February 2023 edition of Garrington’s UK property market review.

The property market has defied many forecaster’s expectations and has been much busier since the start of this year.

Despite more upbeat activity levels, average prices have continued to fall, albeit the rate of descent has so far been gradual, rather than dramatic.

One of the main reasons being cited as shaping the market is the better than expected economic data published over the last month, with inflation having possibly peaked, and economic growth just remaining above a technical recession.

Additionally, despite the Bank of England increasing the base rate further to 4% at the start of this month, mortgage product rates have been steadily falling in recent weeks and we have seen the emergence of the first sub 4% five-year fixed rate.

These factors have all eased some of the headwinds being experienced over recent months and in turn, there are improving levels of cautious optimism amongst movers as we head into spring.

Is now the right time to buy?

One of the questions perplexing many buyers is whether now is the right time to buy.

Trying to time the market is near impossible but conditions at a headline level are looking more favourable with the softening of sellers’ expectations, more stock being listed for sale and the availability and cost of mortgage products improving.

Opinion is divided as to the degree to which the market is gaining fresh traction.

Rightmove reported that in early January the volume of buyers contacting sales agents rose by 55% compared with December, stating that it was the biggest New Year bounce since 2016.

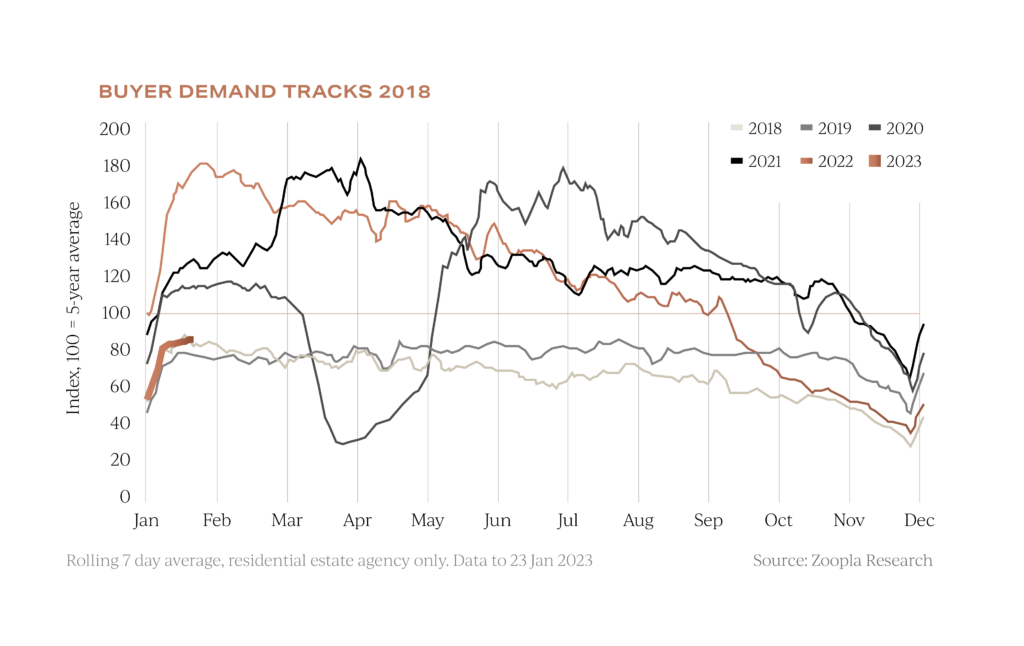

In contrast, whilst Zoopla agree market conditions are improving, they adopt a more measured tone, citing that the year will be a ‘slow burn’ with the longer-term outlook not becoming clear until after Easter and currently buyer demand is tracking patterns seen in 2018.

In contrast, whilst Zoopla agree market conditions are improving, they adopt a more measured tone, citing that the year will be a ‘slow burn’ with the longer-term outlook not becoming clear until after Easter and currently buyer demand is tracking patterns seen in 2018.

Garrington and other property professionals have seen a noticeable increase in the volume of property being made available for sale – both openly on the market and privately off-market.

Whilst the number of homes for sale remains 6% below the five-year average, there are now an average of 23 homes for sale per estate agent compared to just 14 homes at the same time last year according to Hometrack.

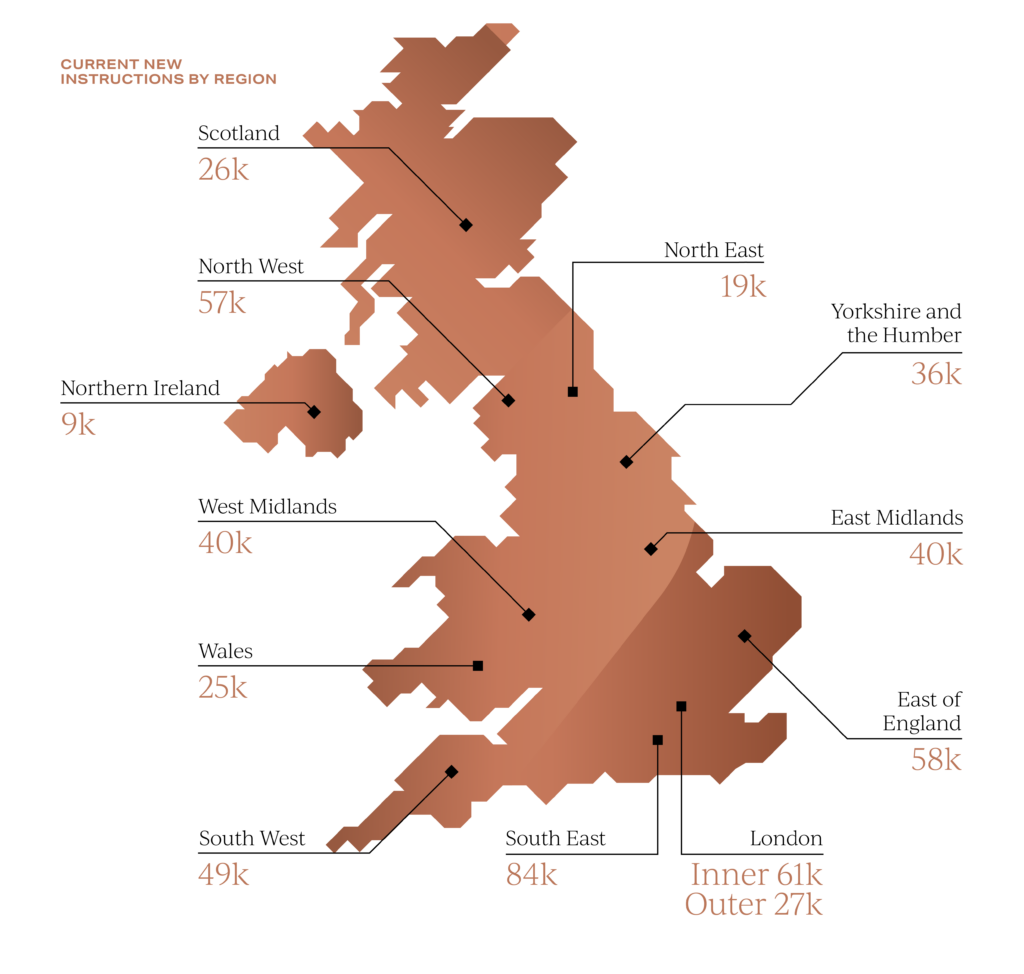

This rising level of supply is not a uniform pattern across the UK though.

As illustrated by research just published by TwentyCi, out of the 529,000 properties available for sale in the UK, the volume of new listings has been highest in London and the South East.

As we approach the traditionally busy spring market, Garrington expect to see further stock being listed for sale.

The acid test is whether this stock will result in more sales being agreed or whether there is a widening gap between sellers’ and buyers’ expectations on price.

What are UK property prices really doing?

Many house price forecasts made at the start of the year were particularly bearish, set against several months of plummeting levels of activity, sharp rises in living costs and higher finance costs, all placing a drag on house prices.

All these factors remain relevant today, but the market has now had time to understand what a ‘new norm’ could look like.

Arguably consumer nerves have also somewhat settled compared with the end of last year in the aftermath of the disastrous mini-budget.

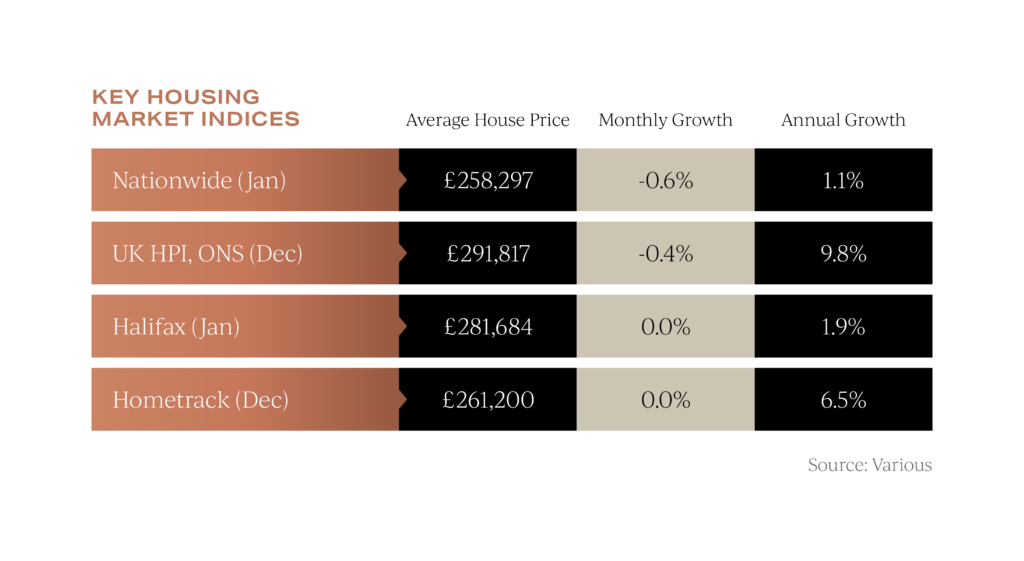

House prices so far this year have fallen steadily, but not crashed as some forecasters had predicted.

Nationwide records prices falling 0.6% last month and Halifax records prices as flatlining.

Nationwide records prices falling 0.6% last month and Halifax records prices as flatlining.

Rightmove reported asking prices of new listings rising by 0.9% last month, having fallen by 2.1% in December.

This average increase was largely led by homes in the prime market, which increased 1.3%.

There are a significant number of cash buyers in the market, many of which perceive a softer market as offering better purchasing opportunities.

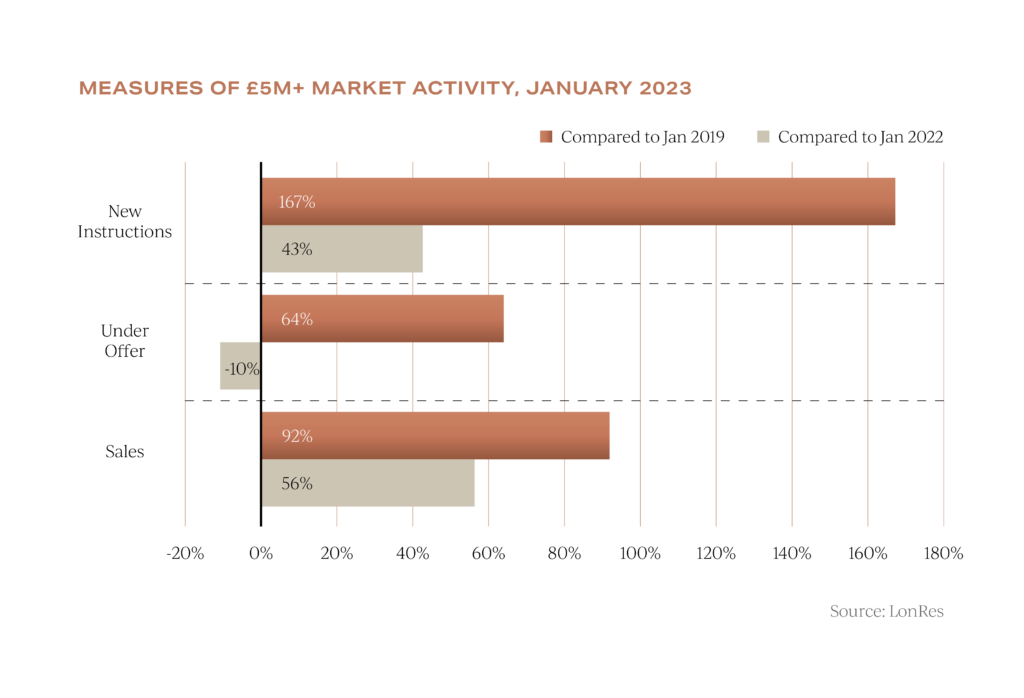

In London, LonRes record that the sale of properties worth over £5 million last month has increased to 92% of the transaction levels seen in 2019, during the so called ‘Boris boom’.

In London, LonRes record that the sale of properties worth over £5 million last month has increased to 92% of the transaction levels seen in 2019, during the so called ‘Boris boom’.

Garrington is seeing a lot of activity at these price points, and several £10 million properties have already been sold in the capital this year.

Whilst the prime market has healthy levels of activity it nonetheless remains incredibly price sensitive.

Outlook

The Chancellor Jeremy Hunt will present his Spring Budget on the 15th March, which will be a pivotal speech.

The unexpectedly large fall in the price of energy will have led to a significant reduction in the cost to the government in its energy support schemes.

As a result, political pressure is mounting to loosen the government’s fiscal policy and lift the tax burden on consumers and businesses.

However, recent history clearly demonstrates the risks of getting any such policies wrong and how this can adversely impact market confidence.

As evidenced by the latest price and transaction data, the property market remains finely balanced, and a number of the government’s policies could tip market conditions in one direction or another over the coming months.

As evidenced by the latest price and transaction data, the property market remains finely balanced, and a number of the government’s policies could tip market conditions in one direction or another over the coming months.

We will report on key announcements from the Budget next month and provide our interpretation on what this all means as we head into the spring market.

As ever, we hope you found our latest update helpful. If we can assist you during this period of change with your own property requirements anywhere in the UK, please do get in contact.