Welcome to the April edition of Garrington’s UK Property Market Review. As spring unfolds, the property market enters a...

How Interest Rate Cuts and the Autumn Budget are Influencing the UK Property Market

The past few weeks have seen some of the year’s most highly anticipated events for the UK property market, from the Autumn Budget and the U.S. Presidential Election to a pivotal Bank of England Monetary Policy Meeting.

In just ten days, we’ve moved from speculation to concrete announcements, and the reactions are already rippling through the market.

While the key headlines from the Autumn Budget have been widely discussed, Garrington believes the real story lies in the longer-term impact these measures are already having and are expected to have on the market.

Many of the early fears and rumours proved to be exaggerated.

In fact, a growing consensus among property market experts is that, while the budget may not have been a clear win for the property sector, it also wasn’t as damaging as initially feared.

Curveballs and the long game

Announcements in the Budget saw a noticeable shift in sentiment towards long-term objectives. The Chancellor made it clear that; the focus should be on the next ten years, not just the next five.

Leading up to the Budget, both business and consumer confidence took a hit as the scale of the funding challenge became evident. And while the increased tax burden, primarily through higher employer National Insurance contributions is clear; there are significant initiatives aimed at fostering long-term growth.

One of the major announcements was the £5 billion allocated for housing. This funding will boost the affordable housing sector and provide support for small-scale developers, helping increase supply. In addition, local governments will now keep all receipts from the sale of right-to-buy social housing, allowing them to reinvest and rebuild stock levels. Addressing the ongoing issue of cladding safety, the government has pledged £1 billion to resolve these long-standing concerns.

Addressing the ongoing issue of cladding safety, the government has pledged £1 billion to resolve these long-standing concerns.

A significant tax change for housing was unexpectedly introduced with the increase in the stamp duty surcharge for second homes and buy-to-let investors, rising from 3% to 5%, effective immediately from Thursday, October 31st.

For buy-to-let investors, this move appears to be yet another attempt to deter new entrants into the market.

It’s notable that this comes alongside the previous incentive for landlords to sell off residential properties, taking advantage of the reduced capital gains tax introduced by the former Chancellor, Jeremy Hunt. A steady stream of taxation and legislative changes is gradually squeezing out Britain’s small-scale or “amateur” landlords.

A steady stream of taxation and legislative changes is gradually squeezing out Britain’s small-scale or “amateur” landlords.

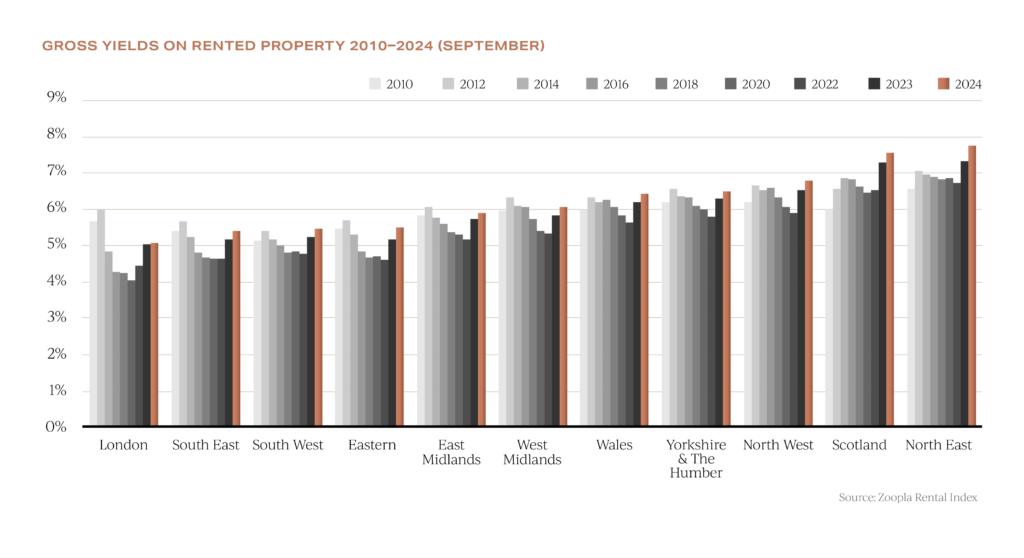

Despite yields rising in many regions, the combination of higher borrowing and entry costs are suppressing real returns for this investor profile.

As a result, this sector of the market is increasingly becoming the domain of professional portfolio and institutional investors, along with private equity firms. Around £800 million of sales to this profile of investors were completed in the third quarter of the year, taking the total past £2.4 billion for the year through to September in the UK property market.

The dash to save cash

First-time buyers will benefit from the temporary higher stamp duty threshold of £425,000 until April 2025, allowing them to avoid paying stamp duty on properties up to this amount. From April 2025, this threshold will revert to £300,000.

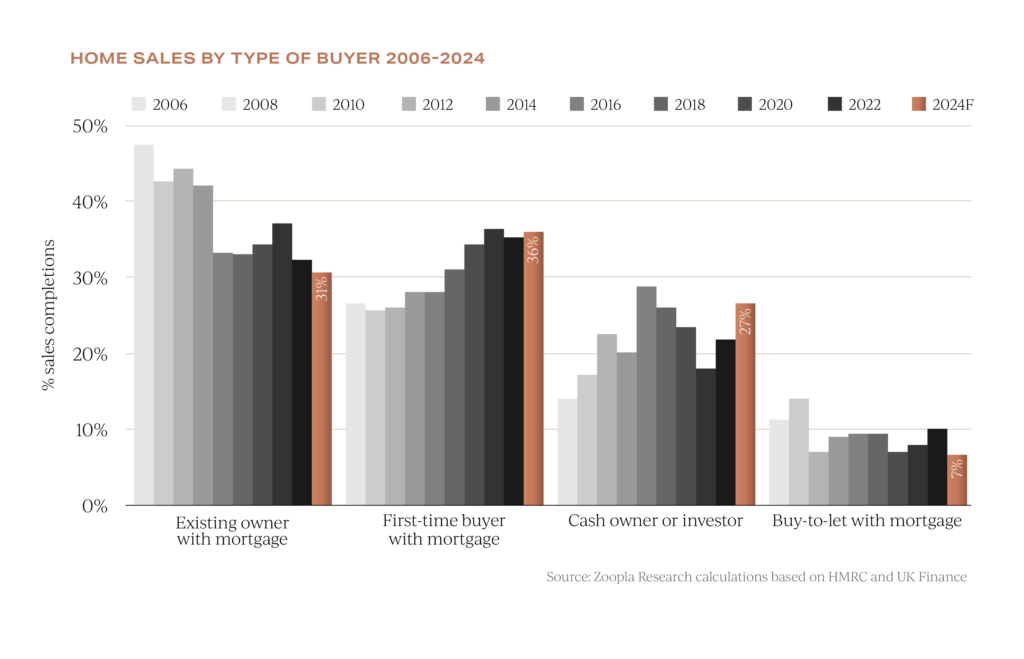

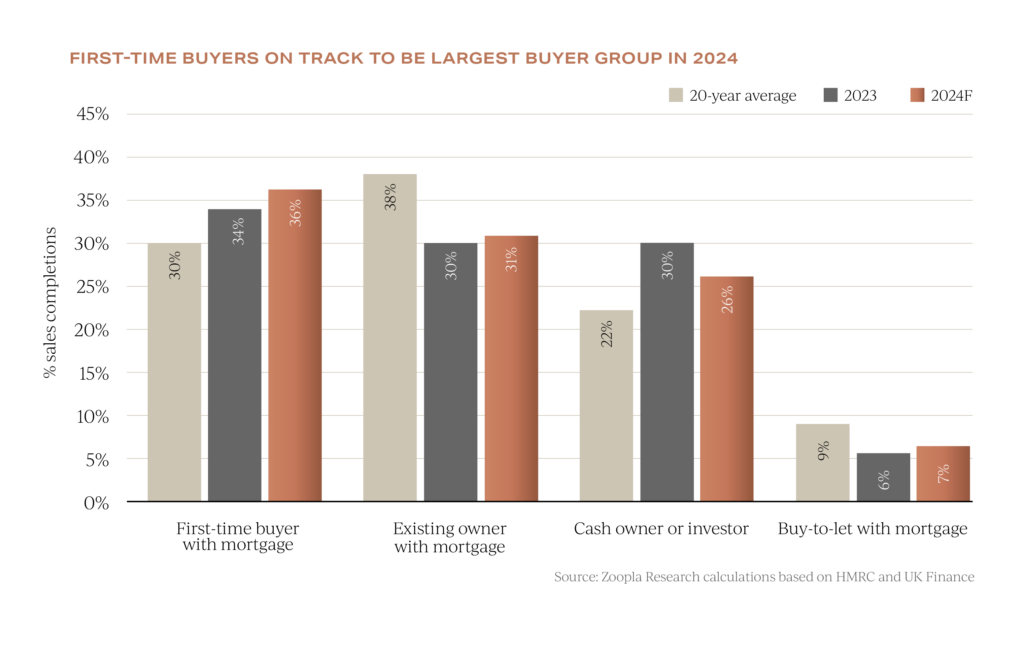

For home movers, the stamp duty threshold of £250,000 will remain in effect until April 2025 before falling back to £125,000. First-time buyers are vital to the health of the property market and are growing in dominance as a group of buyers in the market, as can be seen above. By stepping onto the property ladder, they set off a chain of activity, allowing existing homeowners to move and create further transactions.

First-time buyers are vital to the health of the property market and are growing in dominance as a group of buyers in the market, as can be seen above. By stepping onto the property ladder, they set off a chain of activity, allowing existing homeowners to move and create further transactions. Currently, first-time buyers account for an impressive 36% of all property sales in 2024. As the cost of renting continues to climb, homeownership has become an even greater priority for this group.

Currently, first-time buyers account for an impressive 36% of all property sales in 2024. As the cost of renting continues to climb, homeownership has become an even greater priority for this group.

With the April 2025 stamp duty deadline looming, many first-time buyers will be eager to complete their purchases beforehand, aiming to save significant cash from the savings they’ve accumulated. This sense of urgency is expected to inject momentum and drive sales in the coming months.

U.S. election ripples and UK property

The U.S. election results could create a significant ripple effect in the UK property market, especially in prime London locations.

When political power shifts in the United States, global investors take notice, and UK prime property often becomes a focal point. Why? Because London has long been viewed as a stable haven for high-net-worth individuals seeking to diversify their investments.

In addition, the strengthening U.S. dollar against the pound adds another layer of opportunity for American investors eyeing London property, especially as the market shows signs of softening.

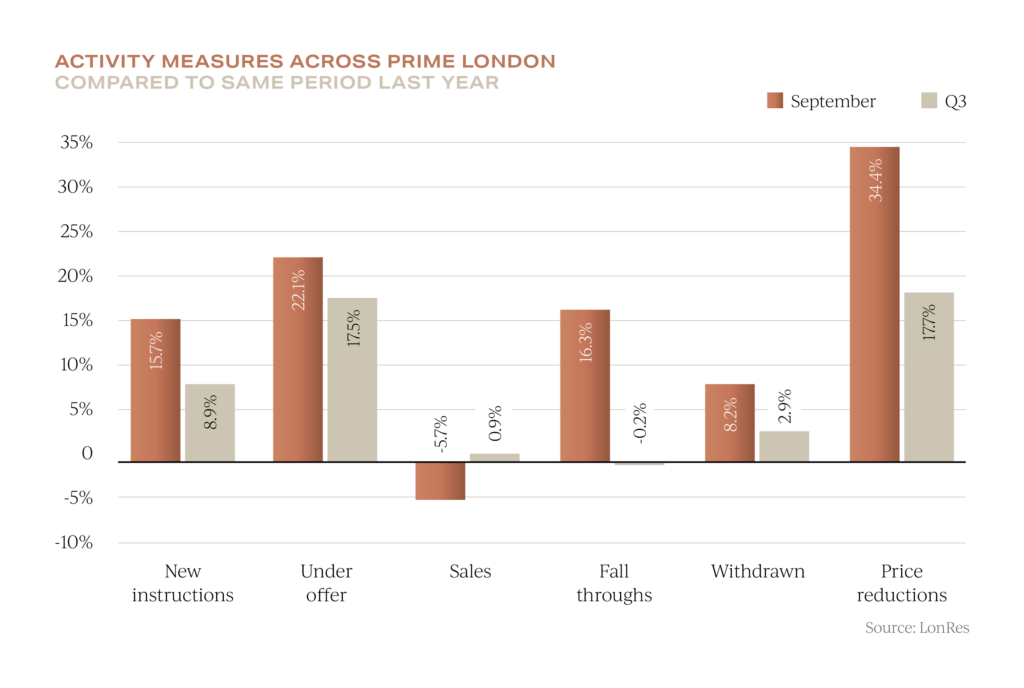

With a 12.7% increase in available stock across prime London by the end of September 2024 – the highest since the pandemic-affected market of mid-2020 – buyers now have more options. While instructions for new listings are rising, the volume of sales has remained static, creating favourable conditions for buyers.

With a 12.7% increase in available stock across prime London by the end of September 2024 – the highest since the pandemic-affected market of mid-2020 – buyers now have more options. While instructions for new listings are rising, the volume of sales has remained static, creating favourable conditions for buyers.

Notably, there has been a 17.7% annual increase in price reductions in Q3 and a sharp 34.4% spike in September alone, signalling that sellers are highly motivated.

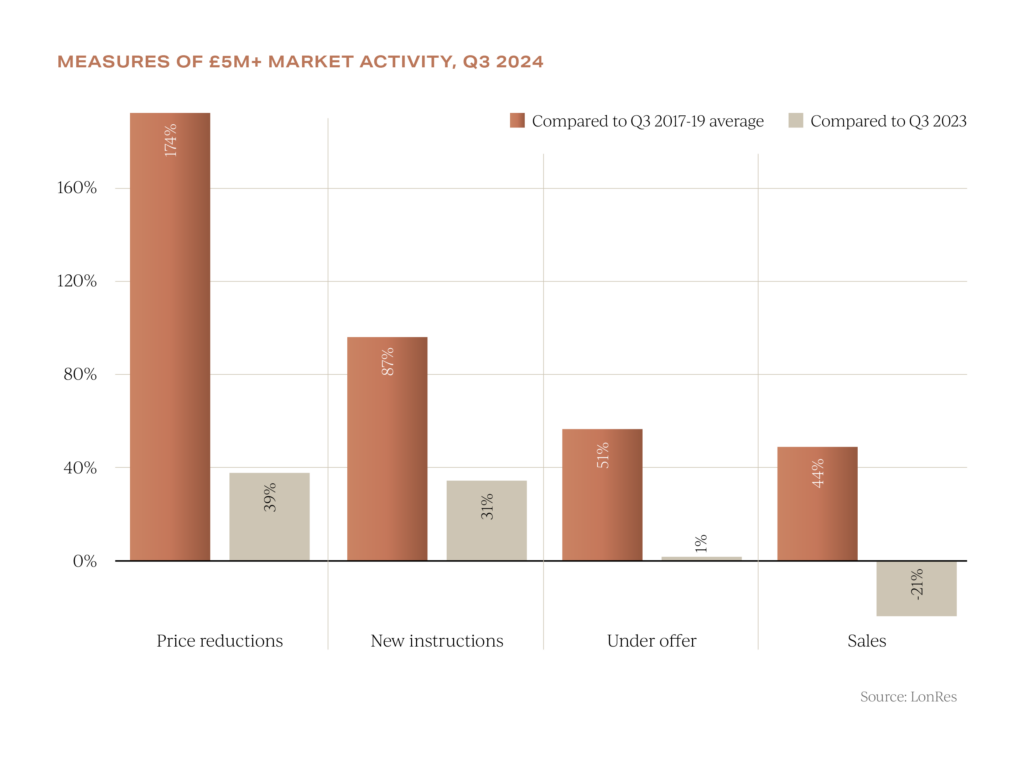

High-value properties, such as those in the £5m+ bracket, have seen a surge in supply, with 27.8% more listings compared to a year ago and a 31.5% increase in new instructions.

High-value properties, such as those in the £5m+ bracket, have seen a surge in supply, with 27.8% more listings compared to a year ago and a 31.5% increase in new instructions.

Yet, despite this high supply and softer demand, there is a silver lining; relative to pre-pandemic averages, the market is growing.

This suggests that while activity has returned to more typical levels after the boom years, the market still shows considerable underlying strength.

For dollar-backed buyers benefiting from favourable exchange rates, this presents a window to invest strategically in London’s prestigious postcodes and other parts of the UK property market.

Outlook for UK property

Activity in the market at this time of year tends to gradually slow in the weeks ahead.

However, the Bank of England’s recent decision to cut the base rate to 4.75% is sparking fresh optimism. Lower mortgage costs are expected to boost buyer confidence, making homeownership more accessible and encouraging more activity. This could provide a much-needed lift to property transactions at a traditionally quieter time.

Arguably, the factor most likely to shape the UK property market in the coming months will be consumer confidence. Recent events have stalled property decisions, but now that we appear to be through the eye of the storm, it will soon become clear whether there is enough clarity and confidence for the market to normalise and flow more freely.

If you are considering your own property purchasing plans and would like some impartial advice, do get in touch with the team at Garrington using the contact details below.

Equally, if you are considering selling a property and want to know more about an off-market sale, do contact us, as one of our existing retained clients may be interested in your property.