Welcome to the April edition of Garrington’s UK Property Market Review. As spring unfolds, the property market enters a...

2025 UK Property Market – Trends and Insights Shaping the Year Ahead

A very happy New Year from all the team at Garrington, and welcome to our first review of the UK property market in 2025.

This marks our twentieth year of sharing market insights every month, blending the latest data with real-world trends observed by our team of buying agents across the UK.

Our unique perspective is designed to help you navigate the complexities of the property market and make informed decisions about your next move.

The year has certainly started with a flurry of welcome activity, although making sense of this activity is not straightforward.

Determining what the market reality is, as opposed to market expectations, is likely to be an ongoing theme this year.

Record breaking Boxing Day activity for UK property

The festive period frequently acts as a natural reset, inspiring fresh plans and spurring many to start researching their next home.

In terms of a forward indicator of consumer confidence and appetite to buy in 2025, Rightmove, as the UK’s largest property portal, is a fairly safe starting point.

Boxing Day saw record-breaking activity, with a surge in new listings and unprecedented traffic as buyers and sellers alike began laying the groundwork for their 2025 moves.

Even before the festive break, the market was showing signs of resilience.

Sales agreed were 23% higher than the previous year, and the momentum has carried into the early weeks of January.

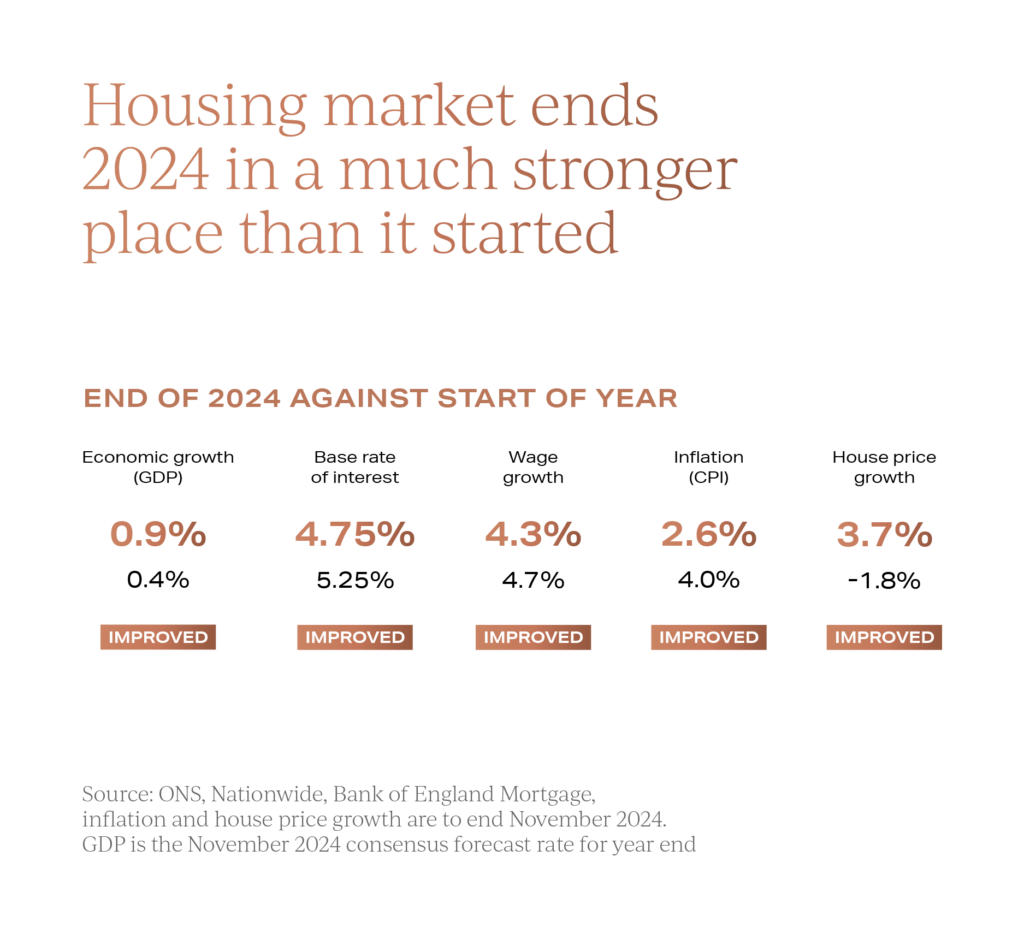

This unseasonal briskness suggests that the UK property market is starting 2025 in a far stronger position than it did a year ago. Much of this improvement can be attributed to better economic conditions in the latter half of 2024. Falling inflation and stabilising interest rates have eased borrowing costs, paving the way for increased transactional activity.

Much of this improvement can be attributed to better economic conditions in the latter half of 2024. Falling inflation and stabilising interest rates have eased borrowing costs, paving the way for increased transactional activity.

Whilst lower inflation has helped, there remain plenty of headwinds, and economic growth has been unremarkable.

As the property market continues to evolve, understanding the balance between opportunity and challenge will remain key themes in the year ahead.

Will 2025 be a good year to buy a property?

Many a brave property market prediction is shared in January and, as we mentioned last month, whilst useful for evaluating the health and direction of house prices, local nuanced data is of far more value to most buyers when forming their plans.

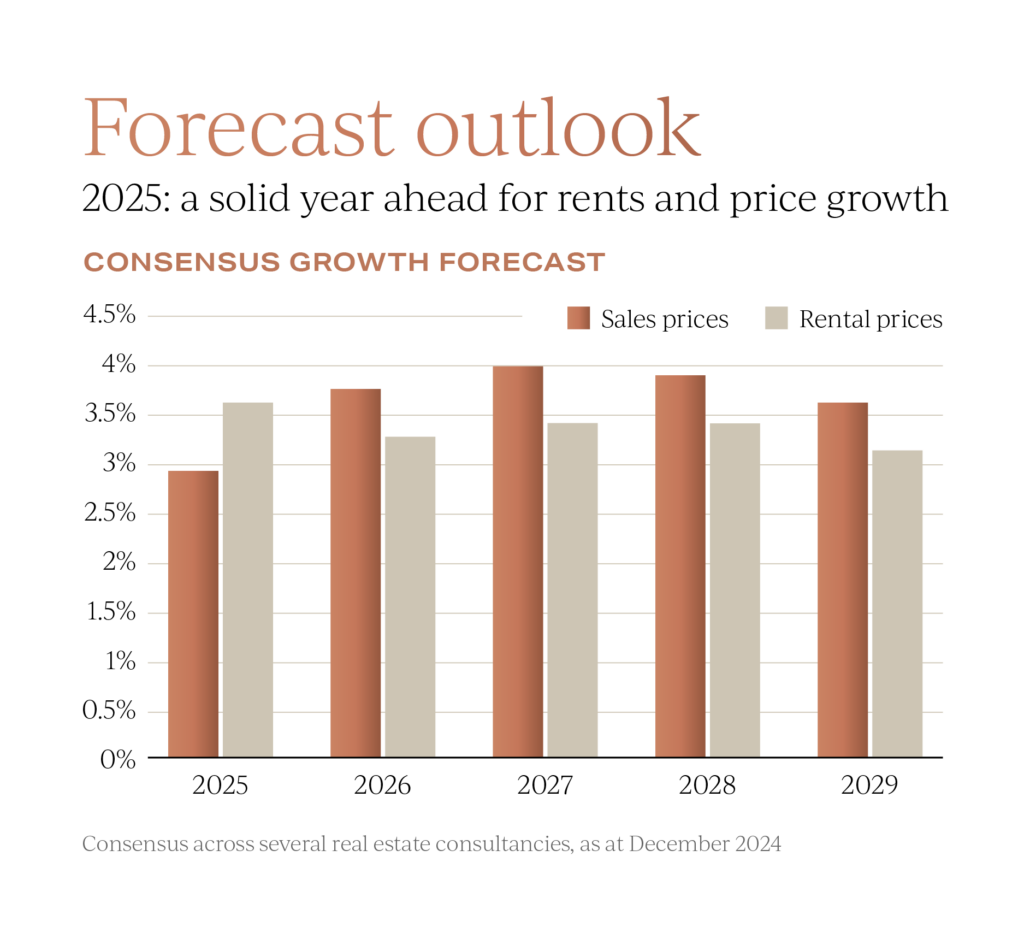

Despite growing unease in the financial markets about the Chancellor’s growth plans for the year ahead, the latest consensus forecasts have all remained positive on price growth for 2025, with house prices expected to rise somewhere between 2.5% and 3%. One of the most significant factors aligned to house price growth is the availability and cost of mortgages, and these are linked to wider economic influences.

One of the most significant factors aligned to house price growth is the availability and cost of mortgages, and these are linked to wider economic influences.

The expectation is for rates to fall, but the timing and extent remain highly uncertain.

The Times reported last week that the consensus of 51 economists polled suggests the Bank of England will be forced to lower the base rate four times this year to counter sluggish economic growth.

If this is accurate, it is short-sighted to assume that this will automatically lead to rising values; the market is more complex than that and other factors will impact market dynamics.

A buyers’ market

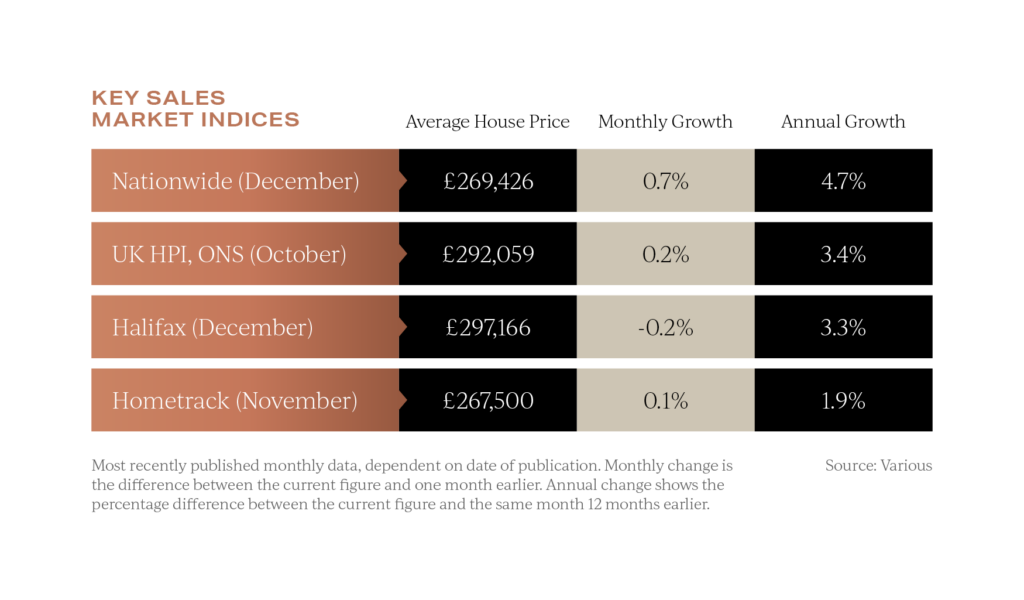

The recent upswing in the supply of property for sale is already restricting house price growth, as evidenced in the latest national UK property price indices. The Halifax House Price Index recorded a 0.2% decline in December 2024, marking the first dip in nine months. This leaves the average UK property price at £297,166, a figure still reflecting 3.3% annual growth.

The Halifax House Price Index recorded a 0.2% decline in December 2024, marking the first dip in nine months. This leaves the average UK property price at £297,166, a figure still reflecting 3.3% annual growth.

Meanwhile, Nationwide’s House Price Index showed a contrasting 0.7% monthly increase for the same period, with annual growth at 4.7%, bringing the average price to £268,144.

Despite improving conditions, the supply of homes remaining higher than buyer demand means we are likely to remain in a buyers’ market in the coming months.

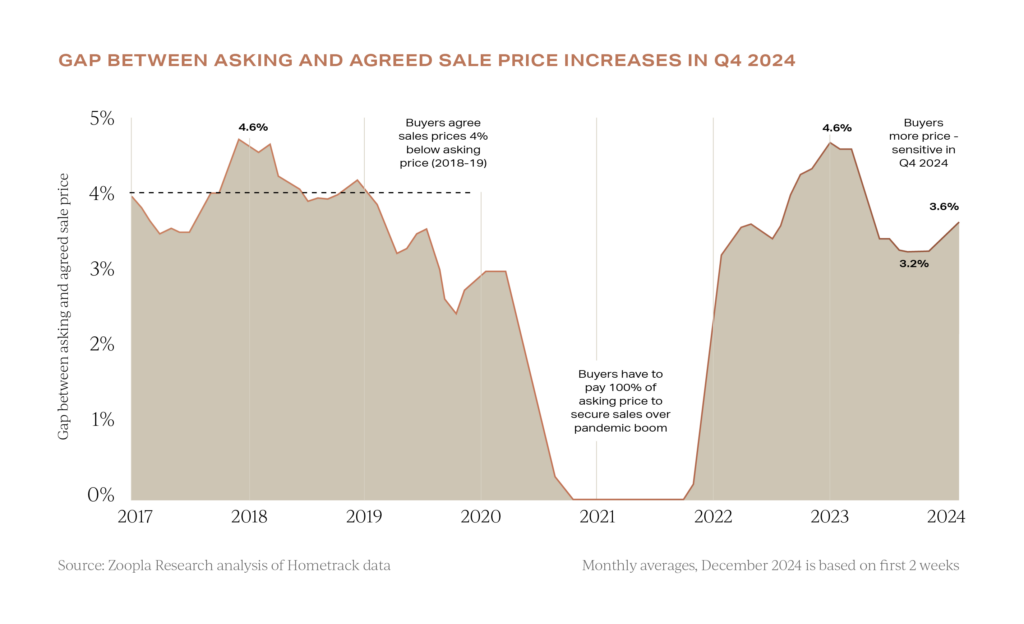

As illustrated above, with excellent data from Zoopla, the gap between asking and sold prices is once again widening.

Garrington is seeing this first hand; buyers have a will and a way to buy a property, but not at any cost and they remain price sensitive.

This is tempering sellers’ expectations, and Rightmove’s House Price Index adds further depth to this narrative with a reported 1.7% drop in average asking prices in December.

So, will 2025 be a good year to buy a property? Ultimately this depends on so many personal factors but, at a macro level, it could be argued that a property market with fairly stable price levels, a greater choice of homes for sale, and more favourable mortgage rates, will benefit buyers who have been waiting patiently for the right moment to strike.

Emerging trends for the UK property market in 2025

Whilst it is very early in the year to confirm any definitive trends, Garrington is already seeing a clear pattern of behaviour in certain markets and buyer groups, which is likely to continue in the months ahead.

First, Britain’s so called ‘golden postcodes’ in catchment areas close to top-performing grammar and state schools are likely to outperform their local peers.

The introduction of VAT on independent school fees is already influencing financial decisions for family buyers, prompting many to reassess their priorities and focus on securing homes near excellent state education facilities.

Next, a new trend of ‘financial downsizing’ is emerging within the prime market.

Unlike traditional downsizing, which is often driven by changing space requirements, this behaviour is motivated by rising tax burdens and disproportionately high borrowing costs. For some, these pressures have created a tipping point, leading to pragmatic decisions to rebalance household finances by moving to more cost-effective homes.

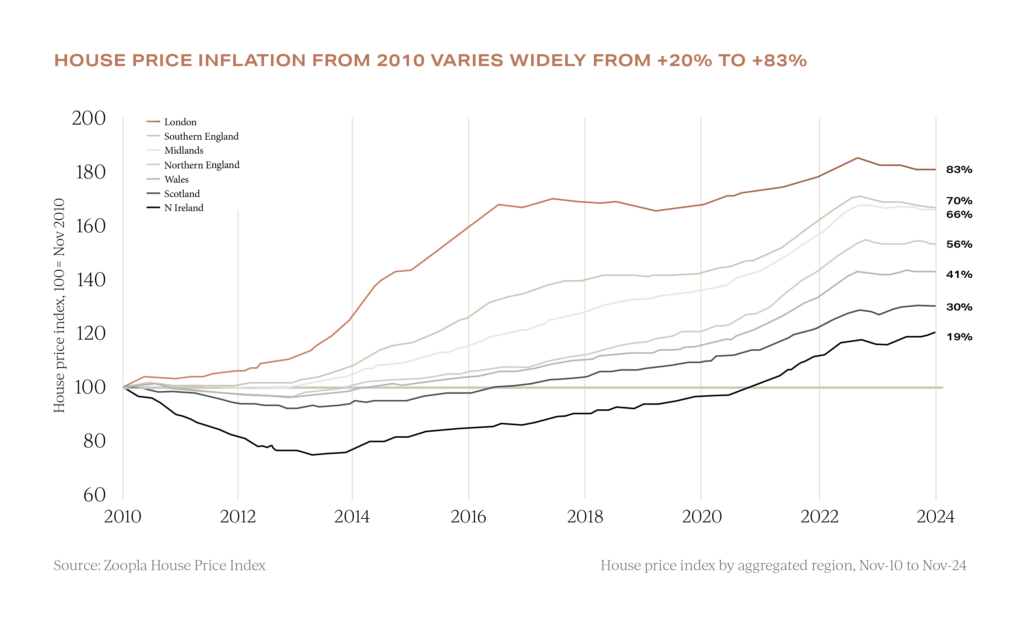

Finally, in a continuation of a theme seen last year, more affordable locations are likely to outperform more expensive areas. As can be seen above, house prices in London still sit 83% higher than in 2010, compared to 30% in Scotland and 41% in northern regions, thus illustrating the relative affordability and scope for prices to once again rise at above average rates this year.

As can be seen above, house prices in London still sit 83% higher than in 2010, compared to 30% in Scotland and 41% in northern regions, thus illustrating the relative affordability and scope for prices to once again rise at above average rates this year.

Whether you are just starting to consider your own UK property plans for 2025, or have been looking for some time without success, do get in touch with the team at Garrington, to learn how we may be able to assist you.