Welcome to Garrington’s latest Market Review where we explore how the UK property market has performed so far this...

UK Property Market Review – July 2020

To the surprise of some, market conditions have remained exceptionally brisk over the last month. As a result, opinions are increasingly divided as to whether the property market is enjoying a temporary blip in activity due to the released pent-up demand, or whether what is being witnessed is a ‘once in a generation’ event, as people change how they live and what they want from a property.

The rest of the UK’s devolved regions’ property markets have now reopened, with strict social distancing rules. These locations are equally busy and the Garrington property finders in Scotland, for example, have been advised by prime agents of ‘hundreds of viewing requests’ in the initial week of the market reopening.

Mixed messages

Given the previously referenced brisk conditions, data from house price indices is likely to be creating confusion. Nationwide for example reported a monthly fall in average prices of 1.4%, taking the annual rate into negative territory for the first time in 8 years.

This recorded fall in values was specifically cited by the Chancellor in his summer statement as a reason for supporting the property market. However, with parts of the UK only just reopened, the data cannot legitimately claim to give a comprehensive and reliable picture of the market.

As we outlined last month, the market is currently incredibly polarised. Sellers however appear to remain bullish, with average asking prices on new listings rising by 1.9% in June, according to Rightmove. At the top of the market asking prices were some 3.3% higher in June than in March.

Within the prime market there is strong competition for ‘best in class’ country homes, and across many of Garrington’s operating areas we have also seen strong demand for second homes in coastal and country locations.

Within London, domestic demand is driving activity in the market up to the £2,000,000 level, where gazumping and competitive bidding has been seen. Above this price level, the market is more reliant on international buyers who are currently noticeably absent and therefore there is opportunity for some.

Stamp Duty holiday

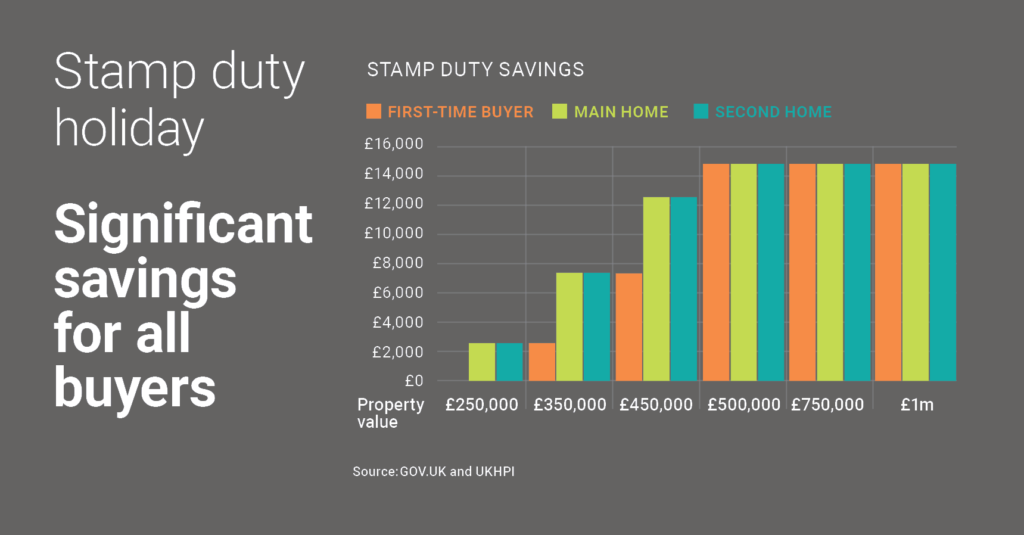

We referenced last month the possibility of a Stamp Duty holiday and the Chancellor confirmed in his summer statement the decision to slash Stamp Duty. There was huge relief that the changes were effective immediately. Delaying implementation would have stalled transactions and had the opposite effect to that intended.

The tax-free nil rate band on residential purchases has been temporarily increased from £125,000 to £500,000 until the 31st March 2021. Above £500,000, the standard rates and thresholds continue to apply.

The existing 3% additional dwelling surcharge will continue to apply, so buyers of second homes will pay stamp duty at only 3% up to £500,000.

Overall, the measure will provide savings of up to £15,000 for both standard and additional rate payers.

Planning opportunities and threats

In a month that has seen a raft of stimulus measures being tabled by the government, as part of his ”build-build-build” speech, Boris Johnson has announced the most radical reforms to our planning system since the Second World War.

Under the new rules, which will become law in September, a wider range of commercial properties can be converted into residential housing more easily, in a move to kick start the construction industry. Builders will also no longer need a normal planning application to demolish and rebuild vacant and redundant residential and commercial buildings if they are rebuilt as homes. Property owners will also be able to build additional space above their properties via a fast track approval process, subject to neighbour consultation.

This creates opportunities for open minded buyers not heavily reliant upon traditional mortgage finance, to explore the potential of new types of self-build properties, conversions or refurbishments.

Equally, these changes underline the need for extensive due diligence ahead of purchasing any property, with what appears to be ‘established’ surroundings. Protection afforded by current planning laws may cease to apply in some situations and thus increases the need for buyers to be alert to a new set of risks.

The shape of things to come

There has been much speculation over recent weeks about what the future of the economy and property market looks like.

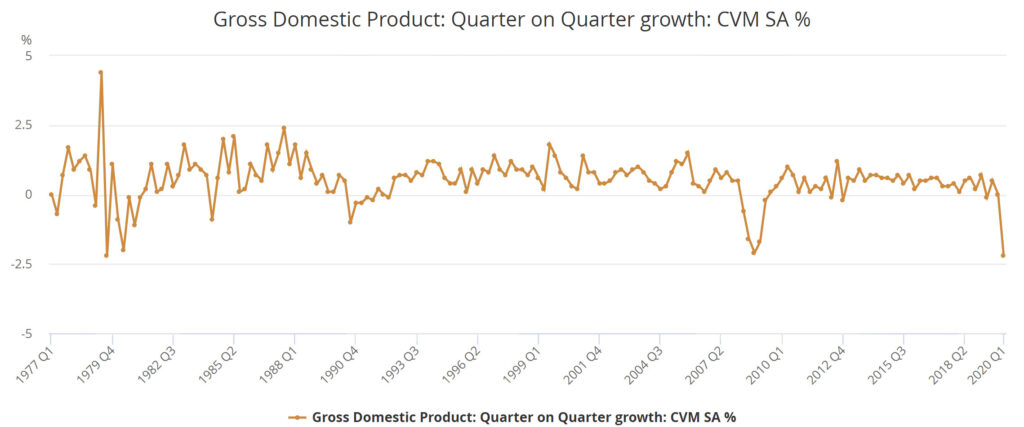

The UK economy has seen its worst fall in GDP since Q3 1979. However, Bank of England economist Andy Haldane said in a speech at the end of June that the recovery had come “sooner and faster” than expected and the UK economy is still on track for a so called V-shaped recovery.

Rising unemployment levels remain a primary concern over the coming months. As such, the geographic concentration of worse affected industry sectors is likely to disproportionately further polarise local property markets.

The comprehensive measures being introduced to protect and create jobs is unlike anything seen before and only time will tell the cushioning effect this will have on the economy and in turn on the property market.

Irrespective of these uncertainties, a core of pragmatic buyers appear determined to progress their moving plans this summer and we watch with interest to see what effect new stimulus measures have in shaping the property market over the coming weeks.