Welcome to Garrington’s latest Market Review where we explore how the UK property market has performed so far this...

UK Property News – July 2023

Welcome to the latest market review from Garrington, where we share the latest trends emerging over the summer in the UK property market.

As the golden hues of summer unfold across the UK, the property market is presenting an unusual contrast to the seasonal warmth. Notably, there’s a cooling trend sweeping across the market, shadowed by the spectre of rising mortgage interest rates, after the Bank of England raised the base rate by 0.5% last month.

It is expected to raise the rate further next month in an attempt to suppress stubborn rates of inflation.

As we move deeper into the summer, what appeared as a transient shift in spring activity levels is emerging as a more pronounced trend.

The changes within the property market can be traced to a myriad of factors, with rising mortgage interest rates playing a critical role.

This increase in rates has changed market dynamics, making home ownership and property investments more expensive.

The initial stirrings of this change might have been dismissed as mere market ripples, but it’s becoming increasingly clear that this is not a temporary aberration but looks to be a shift in the UK property market’s landscape for the second half of the year.

A clearer picture emerges

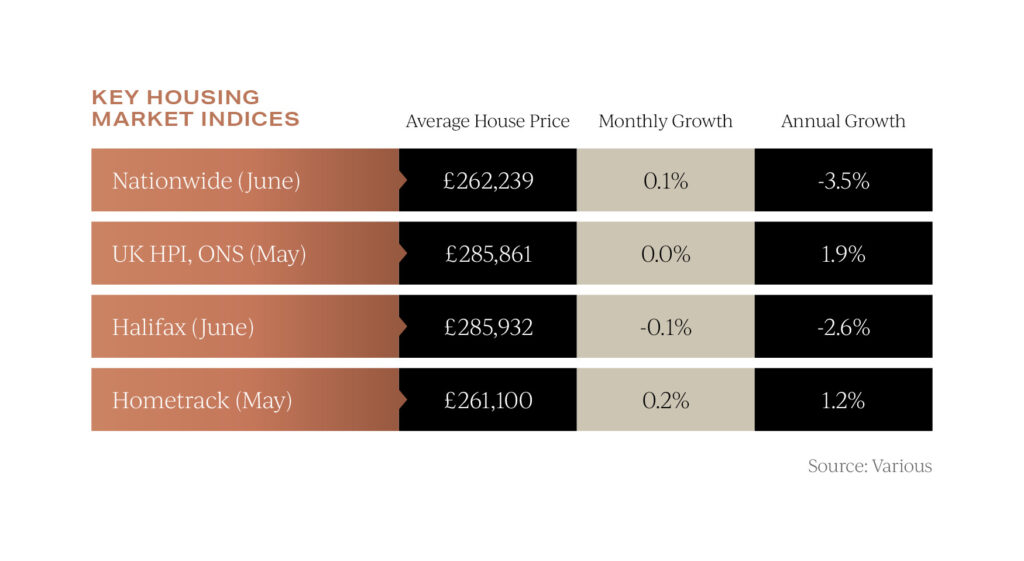

Data from multiple indices has aligned to present a clearer picture of the market. Whilst there are still some exceptions for the best homes and postcodes, overall, this is now a buyer’s market.

Both Nationwide and Halifax report that average prices in June were lower than the same time a year ago. However, it is important to not lose sight of the fact that prices remain significantly higher than at the start of 2021. The lowering of average prices has made buyers more cautious, and a change in market conditions is also filtering through to committed sellers who are adjusting their pricing expectations.

The lowering of average prices has made buyers more cautious, and a change in market conditions is also filtering through to committed sellers who are adjusting their pricing expectations.

For the first time this year, and for the first time at this time of year since 2017, Rightmove recorded a minor fall in asking prices of newly listed properties for sale entering the market last month.

Rightmove’s indices measure over 100,000 asking prices, representing 95% of the UK market, so can be a useful forward indicator of what could happen next.

Rightmove’s indices measure over 100,000 asking prices, representing 95% of the UK market, so can be a useful forward indicator of what could happen next.

The price of overpricing UK property

For properties currently for sale, both of the UK’s largest property portals are cautioning sellers to expect lower offers, and that overpricing will delay their moving plans.

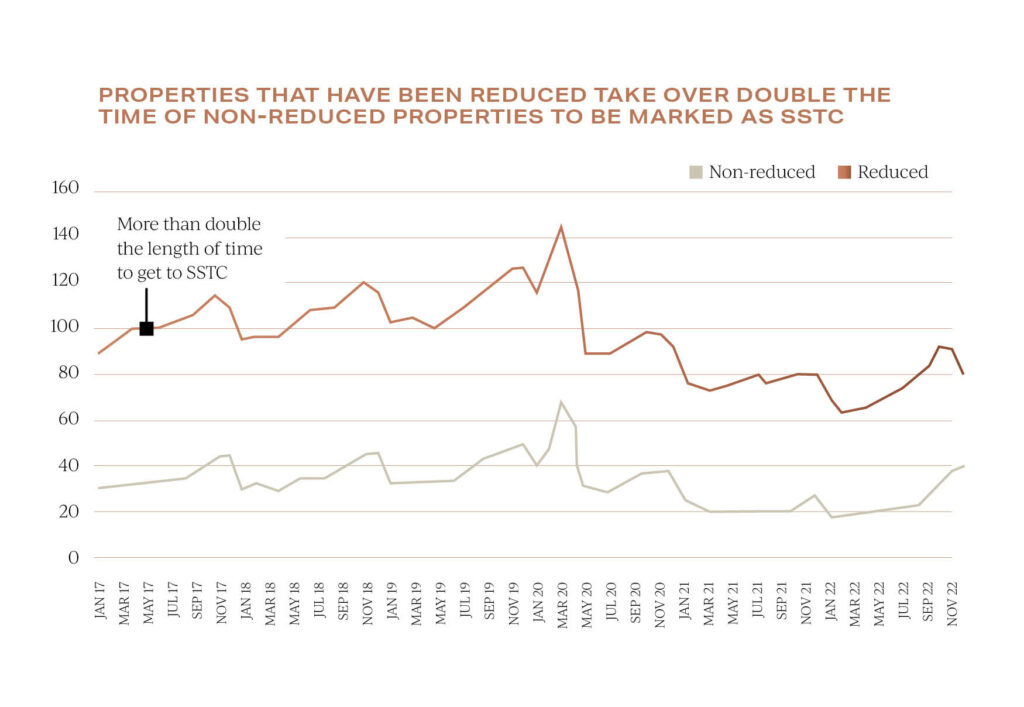

Rightmove recently shared data highlighting that overpriced properties, which subsequently have their prices reduced, consistently take twice as long to sell than properties that are priced correctly to begin with.

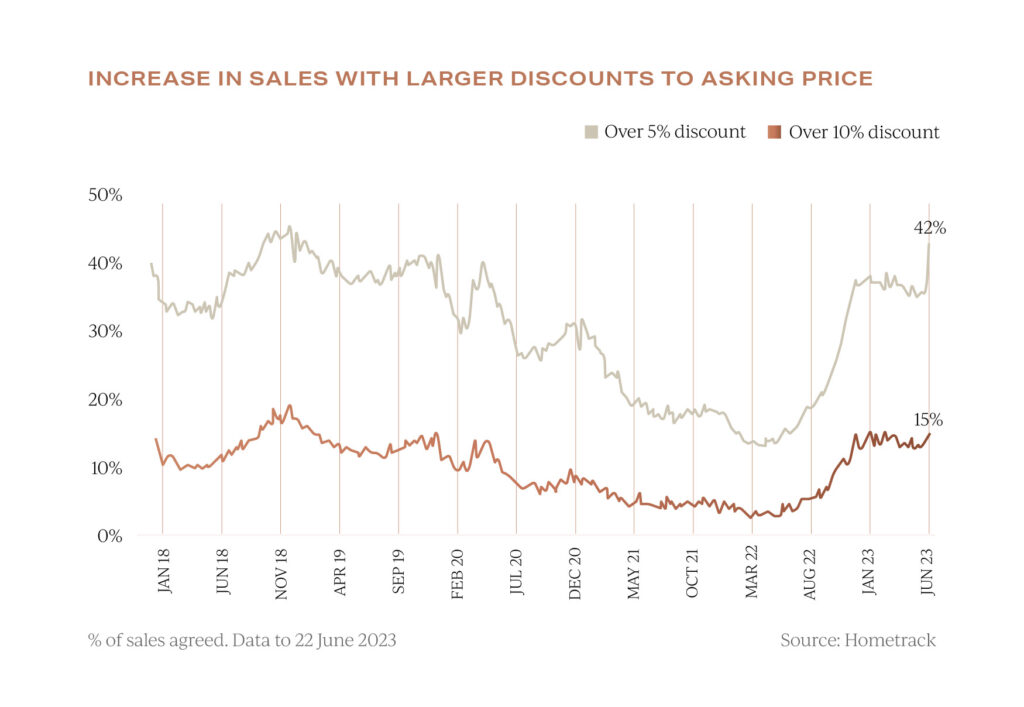

Today’s property market sees purchasers negotiating with increased tenacity, compelling vendors to accept offers averaging 3.8% below the initial asking price, according to data from Hometrack.

A rising trend reveals 42% of sellers are accepting prices more than 5% below their asking price, the most significant proportion since 2018.

Additionally, over one in six sellers are conceding to discounts greater than 10% below their initial asking price. These changes all point to a period of further transition in the market over the summer months.

Additionally, over one in six sellers are conceding to discounts greater than 10% below their initial asking price. These changes all point to a period of further transition in the market over the summer months.

Growing interest in rates

The Bank of England’s monetary policy committee next meets on the 3rd of August and, leading up to the meeting, speculation will be rife as to what to expect.

The Governor Andrew Bailey gave a less than subtle hint during his recent London Mansion House speech on inflation stating the Bank must ‘see the job through’ to hit its target of 2% inflation, suggesting further rate interest rises are coming.

As we look towards the future, the prospect of mortgage rates remaining over 5% in the months ahead appears to be a likely scenario.

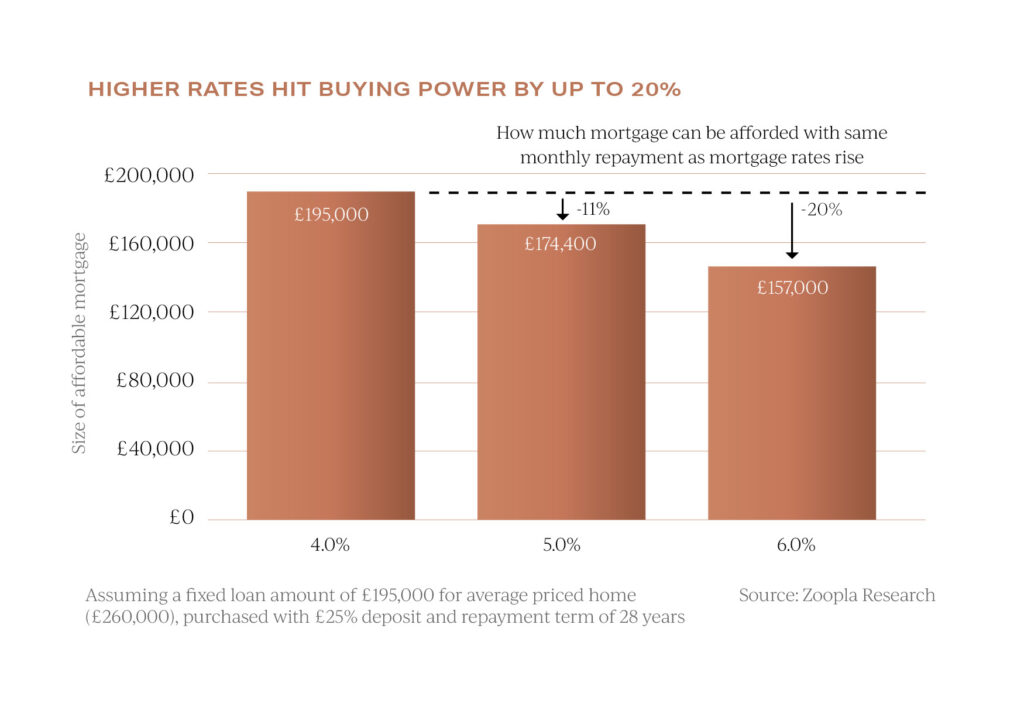

This anticipated trend may prove challenging for mortgage-dependent property buyers, who represent a substantial 70% of all purchases. However, it is crucial to note that a shift in money market expectations and swap rates could potentially usher in a fall in mortgage rates. The impact of higher mortgage rates on an average buyer’s ability to purchase can be seen above. The data draws a compelling picture – a rise in mortgage rates from 4% to 5% corresponds with an 11% erosion in buying power. Furthermore, this reduction amplifies to 20% if mortgage rates rise from 4% to 6%.

The impact of higher mortgage rates on an average buyer’s ability to purchase can be seen above. The data draws a compelling picture – a rise in mortgage rates from 4% to 5% corresponds with an 11% erosion in buying power. Furthermore, this reduction amplifies to 20% if mortgage rates rise from 4% to 6%.

However, these shifts don’t directly translate into house price changes.

The effect of borrowing costs climbing from 2% to 4% has primarily slowed the velocity of price growth, rather than triggering substantial year-on-year price drops.

To counterbalance shrinking buying power, purchasers are now faced with considering increasing their deposit levels or taking longer mortgage terms.

UK property outlook

Despite the looming uncertainties, there’s still a feasible chance for a relatively mild market correction, contingent on the broader economy’s performance aligning with the expectations of most economists.

The labour market is anticipated to retain its resilience with unemployment rates below 5%, complemented by robust income growth.

If wage inflation outstrips house price inflation and mortgage rates moderate later this year, this may underpin the market as affordability starts to improve.

If we can assist you with your own property requirements anywhere in the UK, please do get in contact.