Welcome to the March edition of Garrington’s Market Review, where we explore the latest shifts in the UK property...

UK Property News – June 2023

Welcome to the latest UK property market review from Garrington, where we share the latest developments being seen in the market.

The volatile nature of property market data has become as unpredictable as UK politics over recent weeks and is, in turn causing more confusion for homeowners seeking clarity and confidence with their moving plans.

Much of this uncertainty stems from fluctuating average price data and negative news regarding borrowing costs and mortgage availability, as the Bank of England base rate has continued to climb.

Stubborn rates of inflation have made unwelcome reading at Threadneedle Street for the Bank of England.

The realisation that interest rates may have to rise further before they fall has spooked some lenders triggering both product withdrawals and revised pricing of mortgage rates.

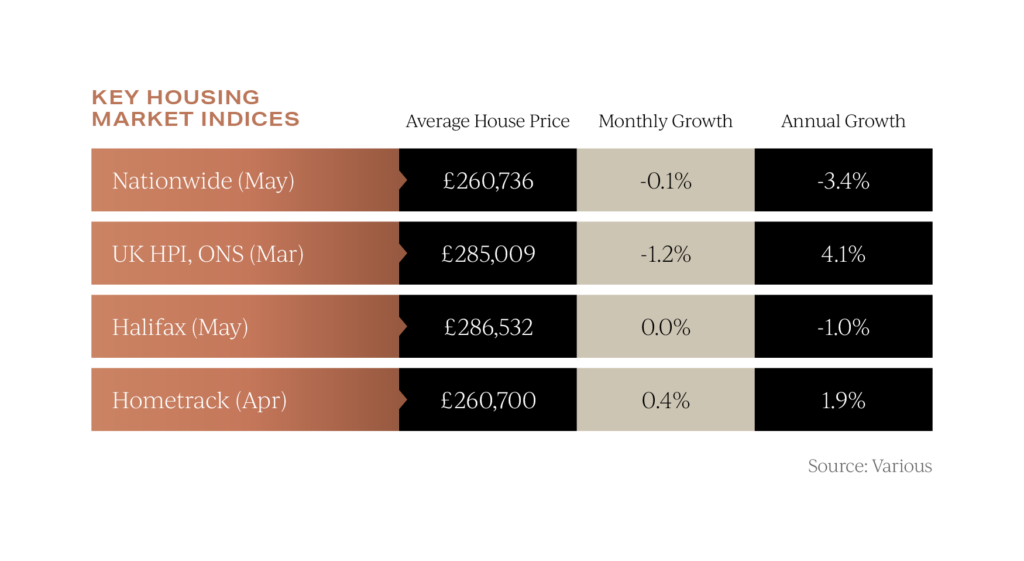

Both Nationwide and Halifax, who rely on data from borrowers, have reported falling average prices last month, and Halifax recorded the first annual fall in house prices for 11 years. This attracted national headlines as might be expected, which was further compounded by the latest data from ONS.

This attracted national headlines as might be expected, which was further compounded by the latest data from ONS.

Whilst they report on both cash and mortgage funded property transactions, their data lags other indices by several months. The data recorded a 1.2% drop in average property prices in March.

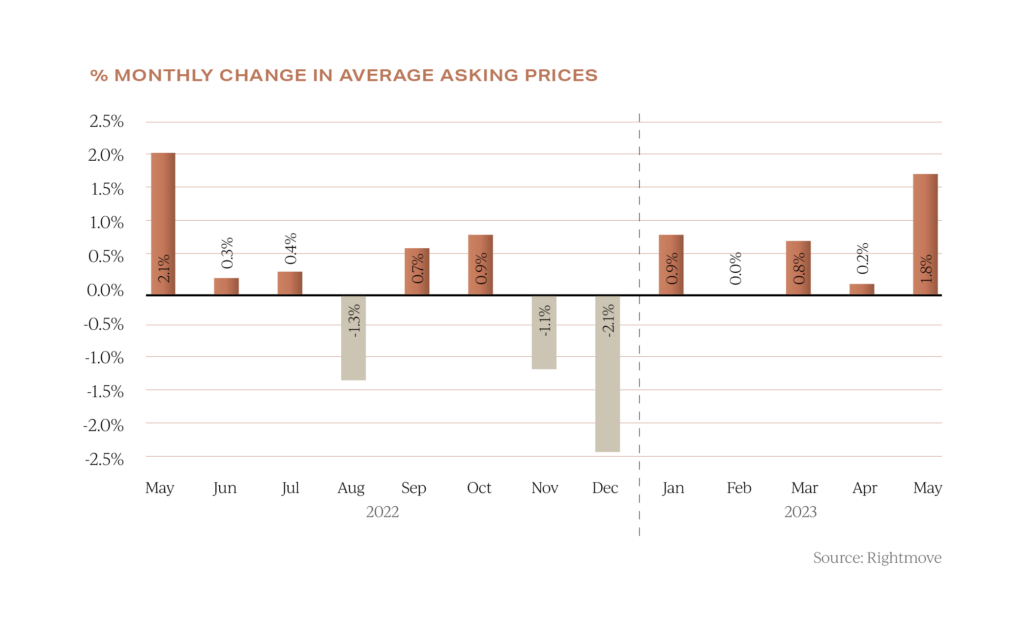

This wasn’t just the fourth month-on-month fall in a row, it was also a sharper drop than those seen in the depths of winter. Given the trends regarding average sale values, the news from Rightmove that the average asking price of property had increased by 1.8% to reach a new record of £372,894 last month surprised many.

Given the trends regarding average sale values, the news from Rightmove that the average asking price of property had increased by 1.8% to reach a new record of £372,894 last month surprised many.

This now triggers the question as to whether we will see a stand-off between buyers and sellers over the summer, and what now constitutes fair value for a property.

Determined purchasers

Despite a more challenging market it is the case that, for some buyers, current market conditions merely mark a moment in time, and lifestyle choices together with other pressing needs continue to act as a catalyst to move home.

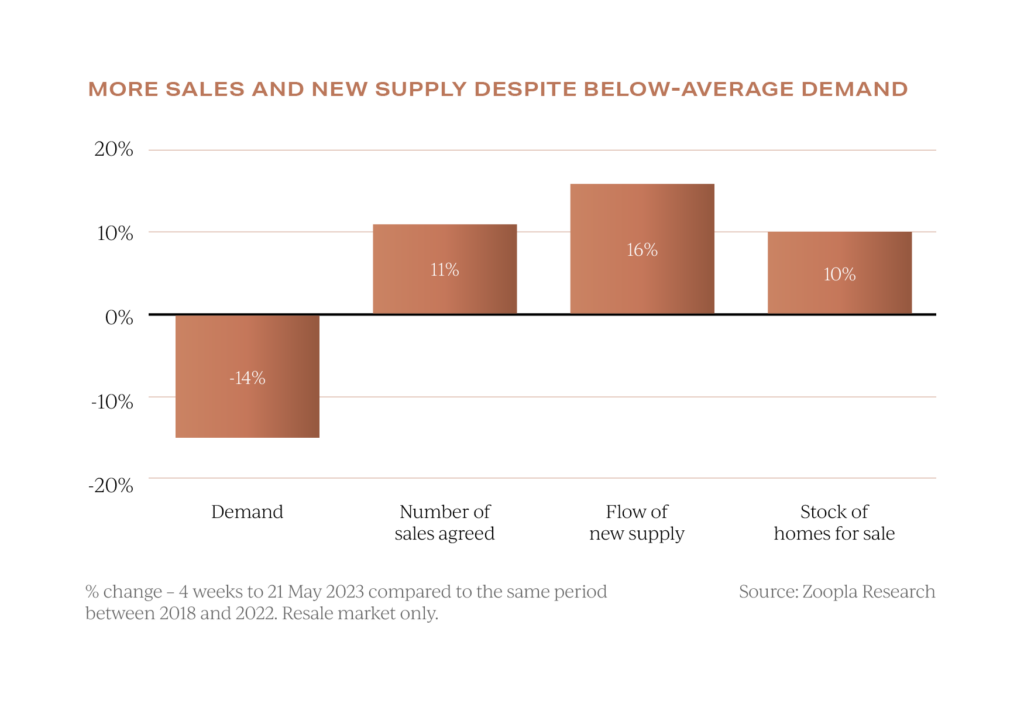

The flow of newly available property for sale is 16% higher compared to the average seen between 2018 and 2022, with 10% more property now available to purchase. However, demand compared to the same period is today 14% lower. Hometrack predict that mortgage rates of 4-5% will support annual house price growth in a range of plus 2% and minus 2%, and around 1 million transactions. However, they caution that if mortgage rates rise much above 5% this will have a greater drag on the market and place downward pressure on prices.

Hometrack predict that mortgage rates of 4-5% will support annual house price growth in a range of plus 2% and minus 2%, and around 1 million transactions. However, they caution that if mortgage rates rise much above 5% this will have a greater drag on the market and place downward pressure on prices.

Regional variations

National trends may prove a helpful barometer snapshot of the market as a whole, but local market data is an essential on which to base decisions.

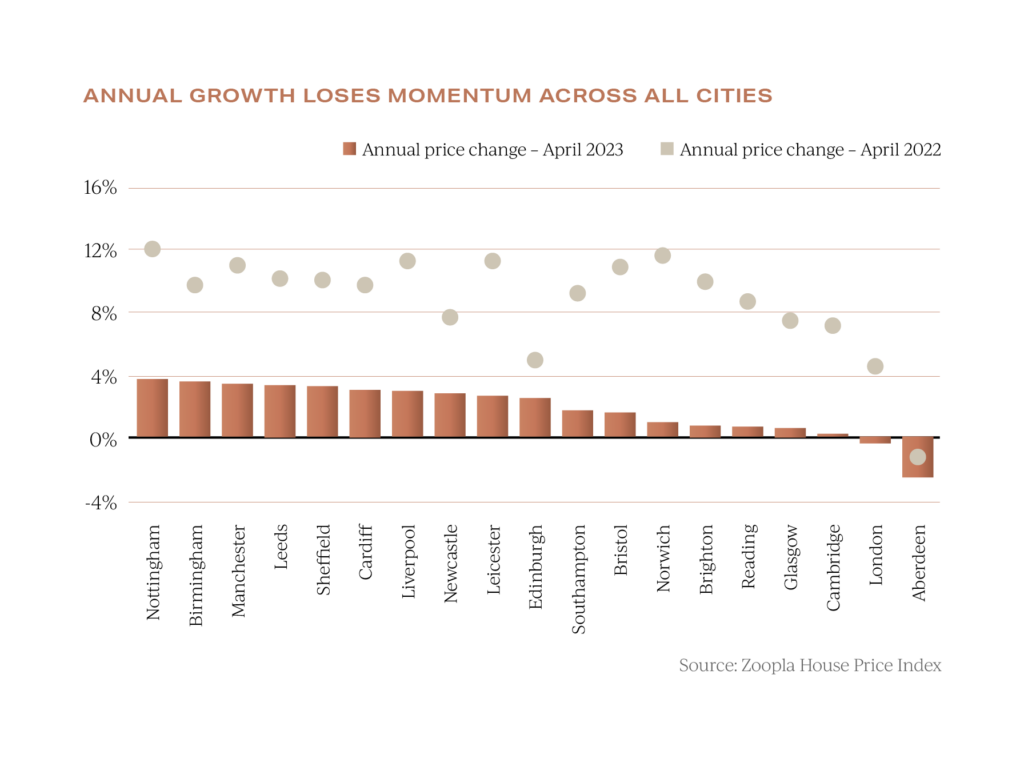

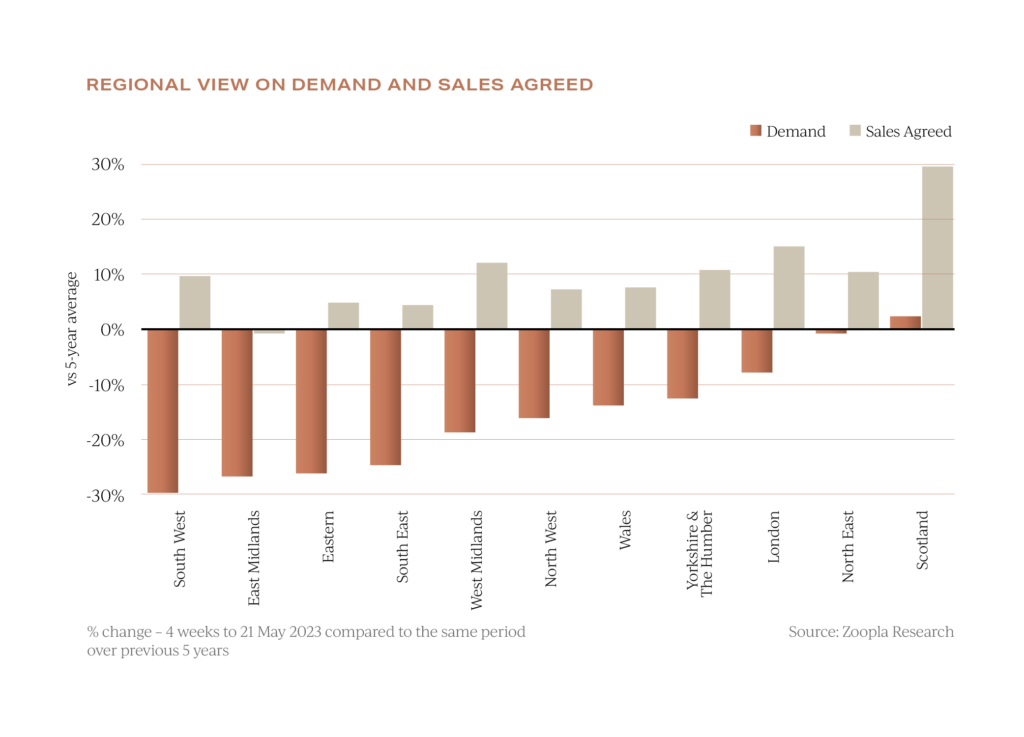

As can be seen below, the loss of momentum in annual price growth across cities around the UK is a uniform trend when compared to both earlier this year and indeed a year ago. Despite this, market conditions vary quite dramatically across the country. Purchaser demand and transaction volumes are currently strongest in Scotland, the North East and London.

Despite this, market conditions vary quite dramatically across the country. Purchaser demand and transaction volumes are currently strongest in Scotland, the North East and London.

These locations all enjoy above average demand and sales rates which are around 10% higher than the national average as seen here. By contrast, purchaser demand has fallen below the national average in the South and Midlands according to Zoopla.

These locations enjoyed exceptional price growth over the last 3 years and now the ‘perfect storm’ of higher interest rates, increased cost of living and higher house prices has disproportionately affected these locations.

Despite this, the volume of sales agreed remains above the 5-year average albeit at reduced numbers compared to the recent past.

Outlook

Based on political and financial events so far this year and the near-time forecasts for the mortgage landscape, there is inevitably more caution amongst buyers. As such, the property market looks set to remain a ‘deal makers’ market, where some participants will flourish whilst others will flounder.

Key to the summer outlook will be wider economic influences. The rate of inflation has been widely forecast to recede over the summer and the degree to which this does, or does not, happen will impact interest rates and, in turn, the property market. The cost of borrowing is also intrinsically linked to the business sector, and will therefore have a part to play in whether the economy avoids a recession and unemployment rates stay low.

Notwithstanding affordability, waning consumer confidence poses the greatest threat to market stability, a point which will no doubt be weighing heavily on the Bank of England’s MPC committee minds when they meet on the 22nd of June. We will of course be reporting on the latest developments as they unfold next month.

If we can assist you with your own property requirements anywhere in the UK, please do get in contact.