Welcome to the April edition of Garrington’s UK Property Market Review. As spring unfolds, the property market enters a...

UK property news and election impact

Welcome to the June 2024 edition of Garrington’s monthly UK property market review.

Our last review was published on the same day that the Prime Minister announced the UK general election.

Garrington was able to share some initial expectations based on historical trends but can now offer some deeper insights.

In the days since his announcement, there was a brief pause for thought as to what this meant for the property market, which for many has returned the conclusion that it is unlikely to derail people’s moving plans barring any shock result.

There are currently around 392,000 homes in the UK property sales pipeline working their way through to completion over 2024.

This is 3% higher than this time last year, and Zoopla predict that most buyers will not reverse their purchasing decisions following the election date announcement.

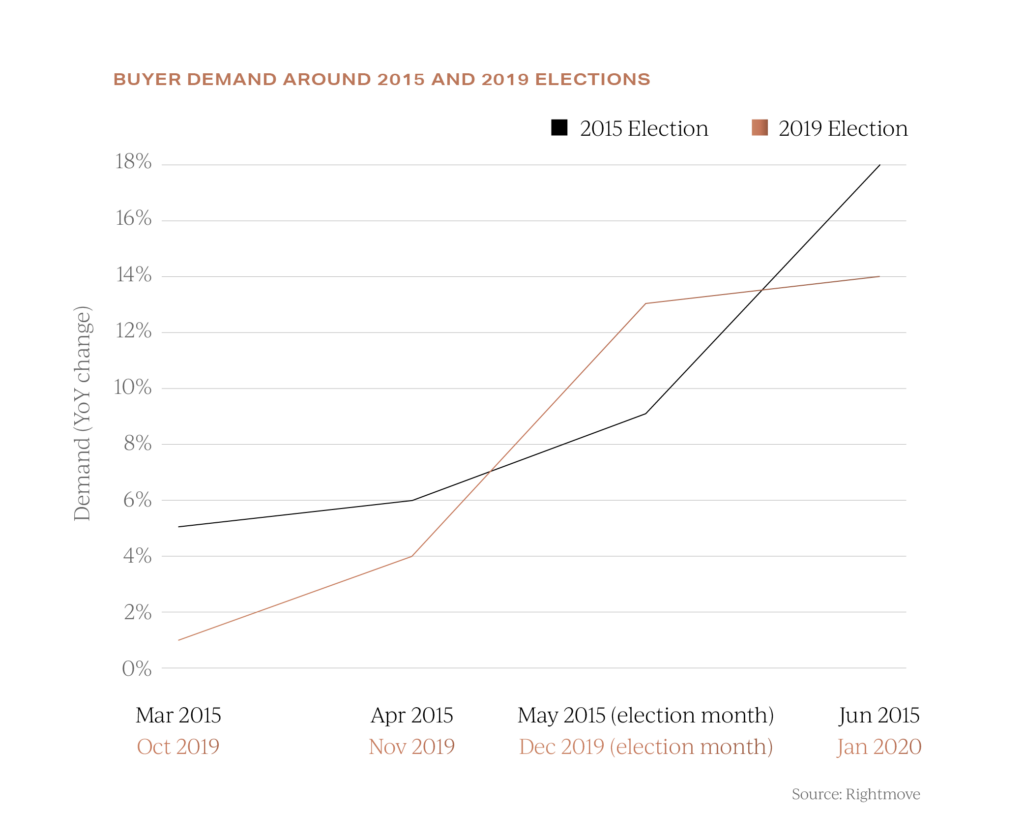

In a survey of buyers using the Rightmove portal the week after the announcement, 95% of respondents said that the upcoming election will not affect their moving plans. Whilst this captures consumer sentiment from those already engaged in the process of moving, it does not account for those at the initial planning stage. As can be seen above, following the two most recent elections, purchaser demand increased in the month after an election result.

Whilst this captures consumer sentiment from those already engaged in the process of moving, it does not account for those at the initial planning stage. As can be seen above, following the two most recent elections, purchaser demand increased in the month after an election result.

If history repeats itself, this trend could be further exacerbated by a widely predicted Bank of England base rate cut in August.

If this does happen, it could be the catalyst for lower cost mortgage products by late summer.

Property politics

Given the financial and emotional importance of where we live, politicians frequently weave property related policies into their party pledges and manifestos, and various announcements are starting to trickle out of Westminster.

Some fear election policy announcements have the potential to pause market activity, but this is typically when a significant policy change is being mooted, for example the previous threat of a Mansion Tax.

So far, nothing of this magnitude has materialised, with neither Rishi Sunak nor Keir Starmer barely referencing housing in their first TV debate.

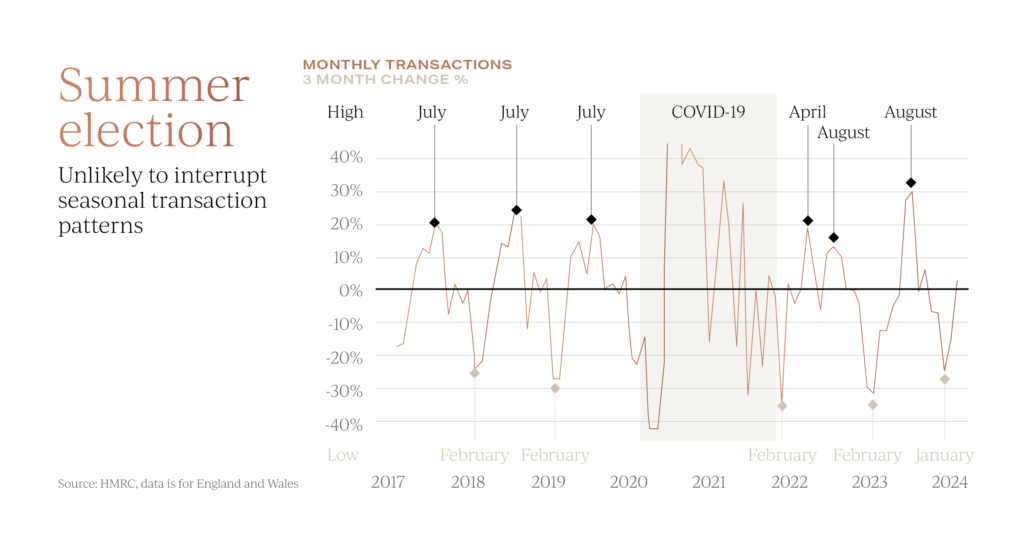

Housing transactions move in seasonal patterns with peak activity usually in July or August. The delay from sale agreed to completion means that the busiest time of the year is therefore normally April and May, but as discussed this could all slide back by several months this year.

The delay from sale agreed to completion means that the busiest time of the year is therefore normally April and May, but as discussed this could all slide back by several months this year.

If elected, Labour is pledging to introduce a permanent scheme for first time buyers known as “Freedom to Buy” whereby the government would act as guarantor for low deposit mortgage products for this sector of the market, which is expected to assist around 80,000 buyers.

The current Chancellor, Jeremy Hunt, has gone on the political offensive calling for Labour to match the Conservative pledge not to increase Capital Gains Tax, Stamp Duty or the number of council tax bands.

Whilst there is no reaction yet from Shadow Chancellor Rachel Reeves, she is understood to have met with TV campaigner Martin Lewis to discuss scrapping Stamp Duty for downsizers.

A report from the London School of Economics and University of Sheffield, argues that older residents are often less likely to downsize due to a lack of financial incentives.

According to the report, the UK’s housing shortage cannot be solved just by building more homes, detailing that current housebuilding targets will struggle to absorb the current demand alongside the predicted increase of 1.6 million households forecasted over the next 10 years.

Current and future UK property trends

In value terms, there is £230 billion worth of housing currently for sale in the UK, 25% more than a year ago, with more properties for sale than at any point in the last 8 years according to Hometrack. The logjam of supply caused by delayed moving plans in 2023 is gradually starting to flow into market activity once again.

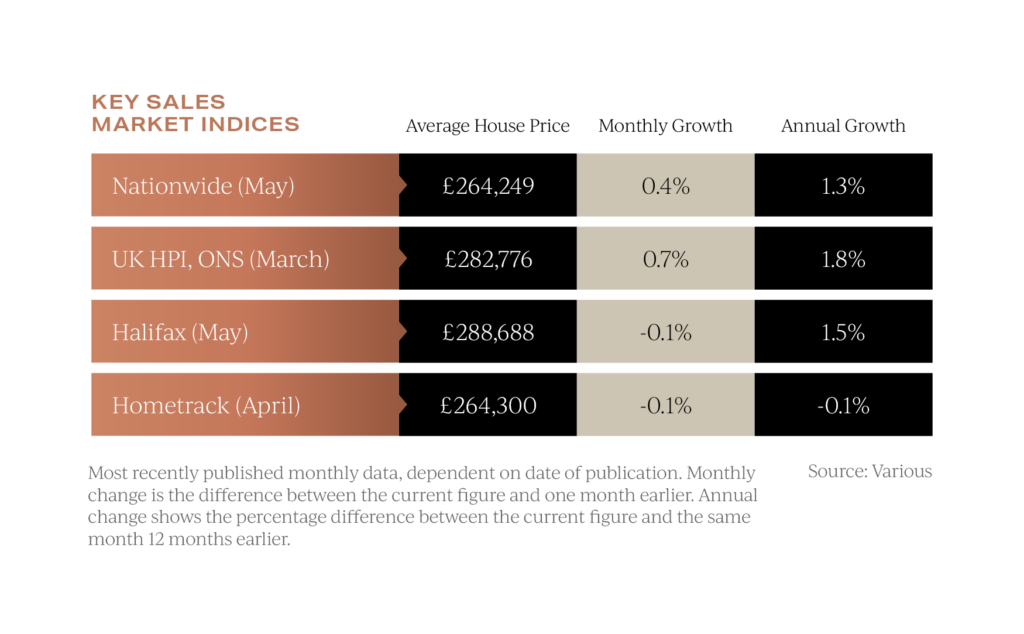

As Garrington discussed in last month’s report, interest rates have suppressed transaction activity this year which is reflected in the latest price data.

Nationwide and Halifax broadly paint a similar picture of market price resilience, with prices neither particularly increasing nor falling. Nationwide records annual price growth at 1.3% and Halifax at 1.5%. The national price trend does mask diverging regional and city trends which Garrington is seeing across the UK.

The national price trend does mask diverging regional and city trends which Garrington is seeing across the UK.

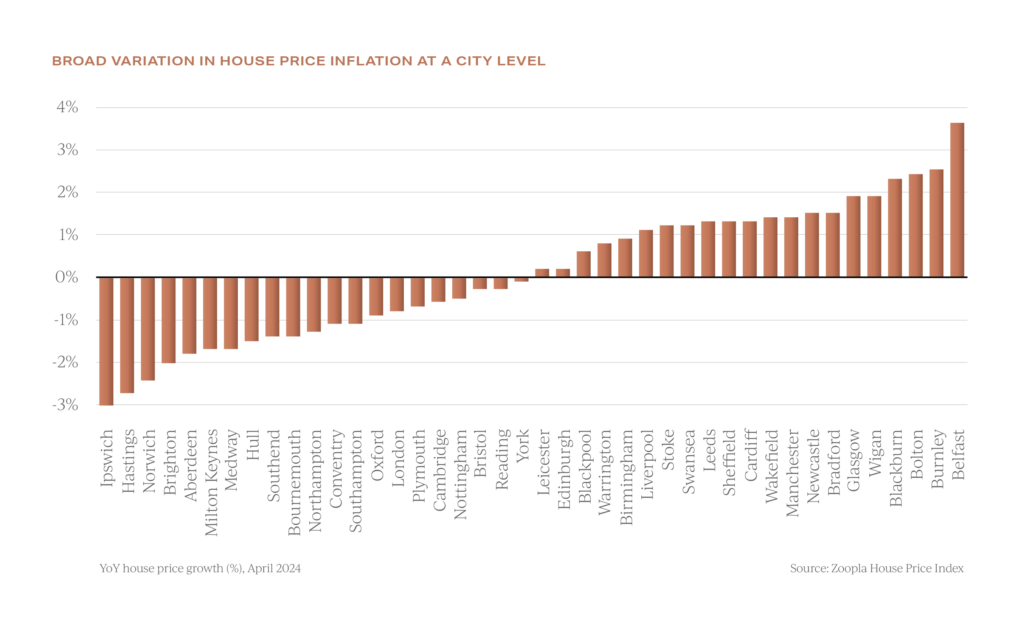

As illustrated by Hometrack below, at a sample city-level analysis on annual house price inflation, price movements range from a low of minus 3% in Ipswich to a high of 3% in Belfast. There is a broadly equal split between cities with rising and falling house prices. The increasingly fractured nature of price dynamics is affected by price-to-earnings ratios, local market demographics and buyers’ reliance on credit.

The increasingly fractured nature of price dynamics is affected by price-to-earnings ratios, local market demographics and buyers’ reliance on credit.

However, the plodding equilibrium is unlikely to last. With both the economy and consumer confidence growing and with thousands of would-be buyers ready to jump back into the UK property market when interest rates start coming down, there is growing evidence that we may see a strong late summer market with a ‘Rishi rebound’ or a ‘Starmer surge’ if the next few months bring cheaper mortgages and a return to political stability.

If you are one of those starting to explore your moving options, don’t forget to visit Garrington’s Best Places to Live in 2024 research. Simply click on the link to see our guide and interactive location explorer.

As ever, if you are contemplating a property purchase this year and would like some expert guidance on what is really happening in the area you want to move to, do get in touch with the team at Garrington.

Garrington look forward to updating you next month on what we believe the known election result could mean for the market.