Welcome to Garrington’s latest Market Review where we explore how the UK property market has performed so far this...

UK Property News – March 2021

The beginning of March marked the start of meteorological spring, with longer days and the clocks going forward later this month.

The question we posed in last month’s review as to whether the property market was likely to see a spring bounce or a slowdown, now looks easier to answer.

Based on the extent of the policy announcements made by the Chancellor in the Budget last week, there appears to be strong grounds for expecting a spring bounce in the market over the coming months.

Budget reaction

So, what was the impact of the Budget?

The property market has arguably been holding its breath in the weeks leading up to the Budget, not just for news on an extension to the Stamp Duty Holiday, but for many investors and high net worth property owners, clarity on future tax policies.

There was relief that the much-rumoured rise in Capital Gains Tax did not happen.

In what many have called a proportionately balanced Budget, the Chancellor announced that the economy is set to bounce back by mid-2022 and came bearing gifts for the property market.

These were fiscal stimulus policies and the absence of aggressive changes to CGT taxation.

The feared Stamp Duty cliff edge has been averted by an extension to the Stamp Duty Holiday until the end of June in England and Northern Ireland.

The current nil rate up to a £500,000 threshold for primary residences will be tapered to a lower threshold of £250,000 until the end of September, before normal rates then apply from 1st October.

Of note is that the 2% surcharge will still come into force on 1st April 2021 for all non-UK residents.

This will be on top of the 3% additional rate surcharge for any property other than a primary residence.

The other significant housing policy from the Budget was confirmation that the Government will provide guarantees to lenders who provide 95% loan to value mortgages for purchases up to £600,000.

With the risk of falling house prices posed by the pandemic, lenders were swift to reassess their risk exposure and the availability of such loans has fallen from 405 in February last year to just 20 today.

As such, this announcement has been welcomed as an important policy to reignite activity at the bottom of the market, which in turn is likely to ripple through other price sectors.

A further price turning point?

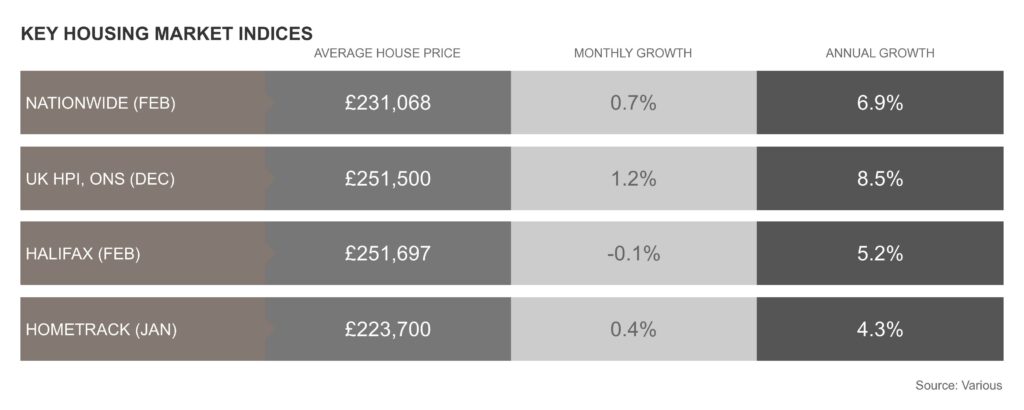

Latest house price data was published just before and after the Budget.

Nationwide recorded a modest rise in average house prices by 0.7%. By contrast, Halifax reported a further fall in monthly average values, but only by 0.1%.

Many commentators are predicting this may mark a turning point, with future months once again recording price rises as purchaser demand heavily outweighs the current supply of property for sale.

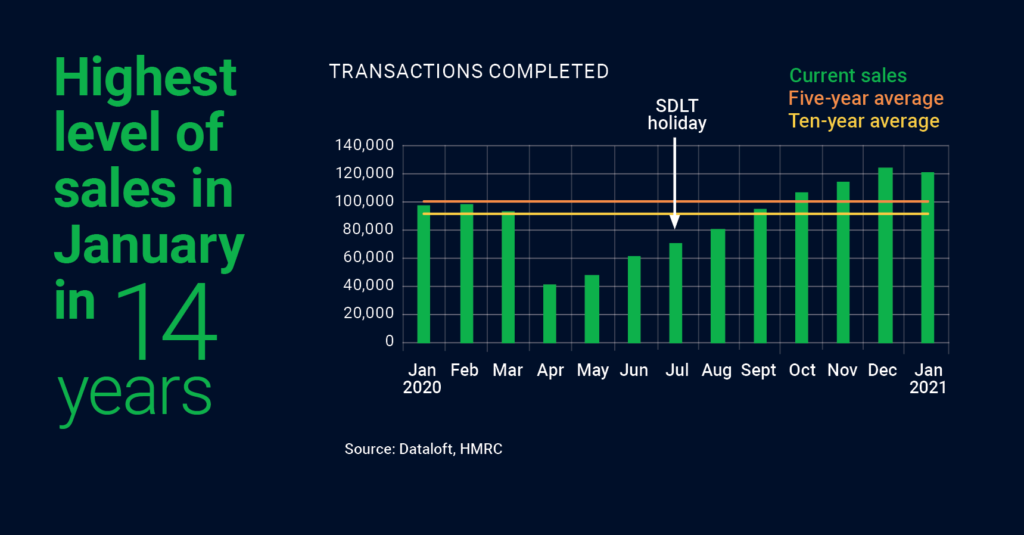

The surge of activity in the market is well documented, but additional recent data highlights this further.

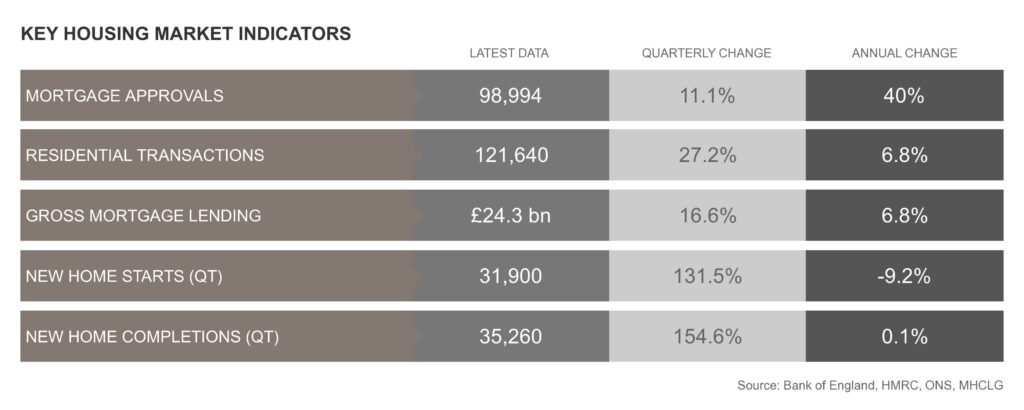

An estimated 121,640 transactions completed in January, the highest January total since 2007 and a 24.1% increase on 2020, according to HMRC.

Excluding 2020, current monthly sales volumes are 21% above the 5-year and 32% above the 10-year average, with predictions that up to 1.3 million sales may complete this year.

A forward indicator for such predictions is that the volume of mortgage approvals is now 40% higher than a year ago.

Immediately following the Budget, property portal Rightmove said that the 3rd of March was its busiest day ever on record for traffic, with over 9 million visits on its site.

The big question now, is whether online activity will actually filter into market activity.

Navigating the spring market

For those wishing to take advantage of the extended Stamp Duty Holiday, time is of the essence to progress moving plans.

Many of the sales agents which Garrington talks to regularly have confirmed an increase in both valuation requests and confirmation of instructions to proceed with marketing.

The compound effect of children returning to school, and a number of more mature sellers now having received at least their first vaccine, will exacerbate this trend further in the coming weeks.

As stock levels improve and some form of gradual normality returns post lockdown, the property market is likely to become more free flowing.

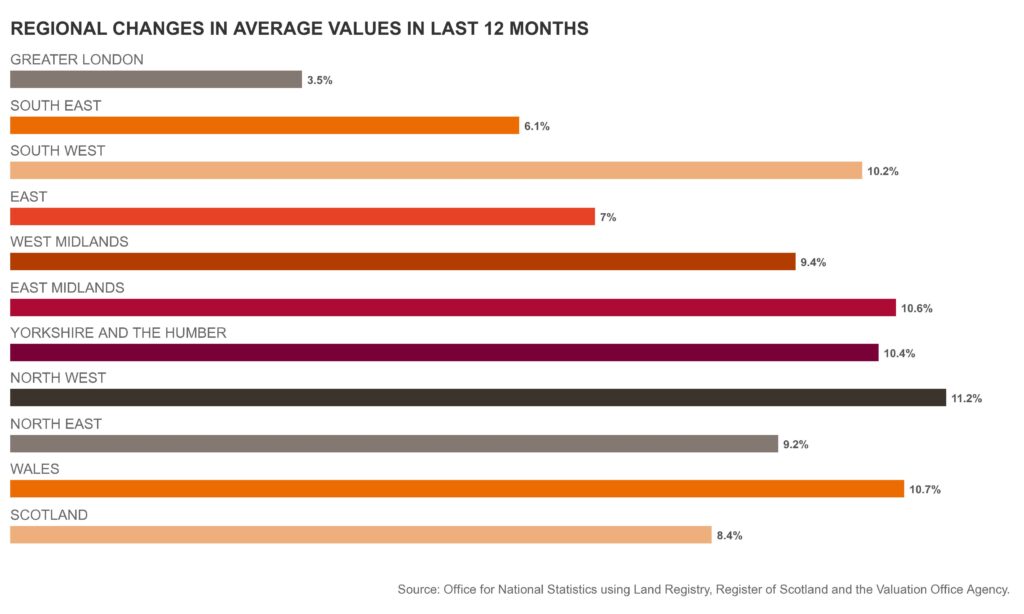

Pricing is likely to be somewhat erratic with distinct regional differences, as seen over the last 12 months. Local affordability issues have now become less pronounced, with more equity rich buyers moving to new locations.

The London market is unlikely to benefit from the spring bounce to the same extent as some parts of the country.

The Capital relies on international buyers more heavily and these are not likely to return in significant numbers until the second half of the year when travel restrictions start to ease.

By contrast, domestic demand is likely to fuel further activity in coastal and country markets – both for primary residences and second homes.

Garrington will of course continue to share the latest trends in the property market next month.

In the meantime, we hope this update has been useful and if you require any further information or advice about how we can assist with your property plans, please do contact us.