Welcome to Garrington’s latest Market Review where we explore how the UK property market has performed so far this...

UK Property News – March 2022

Welcome to the March 2022 edition of Garrington’s UK property market review.

The UK property market has remained exceptionally busy over recent weeks despite the wider influences that have cast a shadow of uncertainty over the world as the appalling situation in Ukraine continues to unfold.

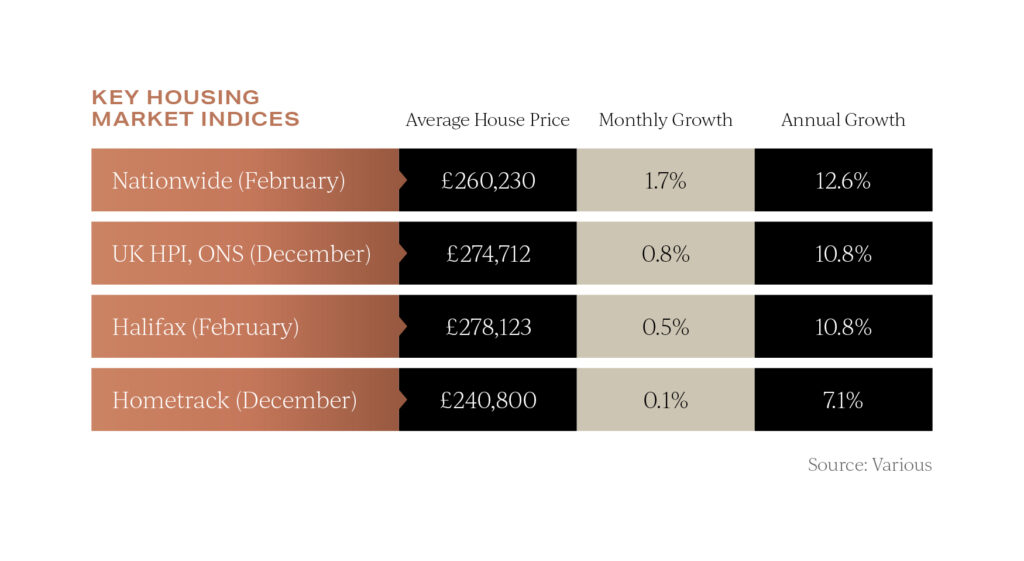

UK house prices have continued to increase at double digit rates of annual growth.

The chronic supply and demand imbalance seen at the beginning of the year has, as predicted, fuelled significant price rises, with Nationwide recording a 1.7% increase in average asking prices last month and Rightmove reporting the highest monthly increase in asking prices at 2.3%, in turn setting a new record of £348,804.

The challenge now facing many purchasers and sellers is trying to make sense of the unpredictable recent trends and making correct assumptions on which to base their moving decisions.

The challenge now facing many purchasers and sellers is trying to make sense of the unpredictable recent trends and making correct assumptions on which to base their moving decisions.

Market drivers

A rising number of enquiries from home movers who have contacted Garrington over recent weeks are being driven by fear or frustration.

Some buyers are fearful of missing new stock about to enter the market, being priced out of getting what they want to purchase, having already accepted an offer on their existing property or do not want to miss what looks to be a closing window of opportunity to secure a mortgage at historically low fixed rates.

There are equally many buyers simply frustrated by the lack of choice of homes for sale in the market, and once something has been seen of interest, subsequently losing out to other competing buyers.

Propertymark have reported that 78% of properties sold above their original asking price in January underlining the sheer competitive nature of the market.

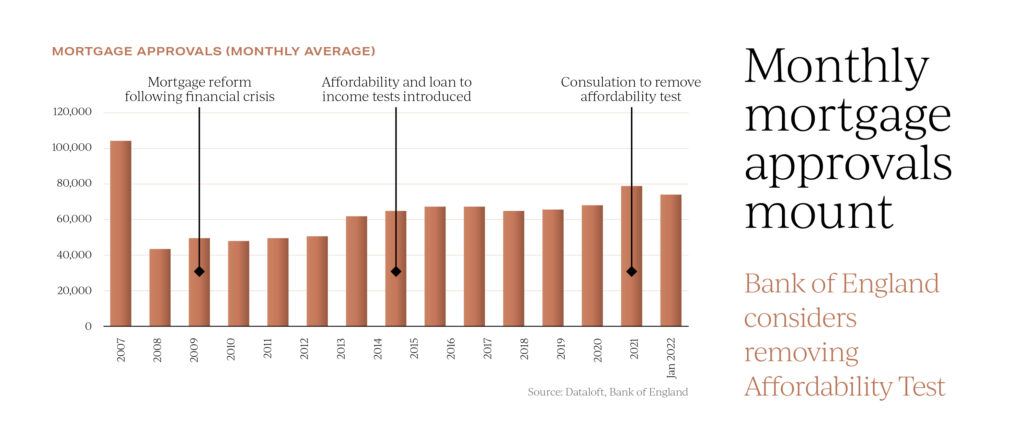

Mortgage approvals, which surged in 2021 on the back of demand from home-movers, have continued to sustain a high level into 2022, continuing to outpace any period since 2008.

Possibly nullifying the effect of rising borrowing costs which will restrict purchasing ability, the Bank of England is considering removing the ‘affordability test’ which tests a borrower’s ability to service their mortgage as interest rates rise.

However, the Loan to Income multiple of 4.5 times income looks set to remain, as this has proved to be more effective at curbing risk during a housing ‘boom’.

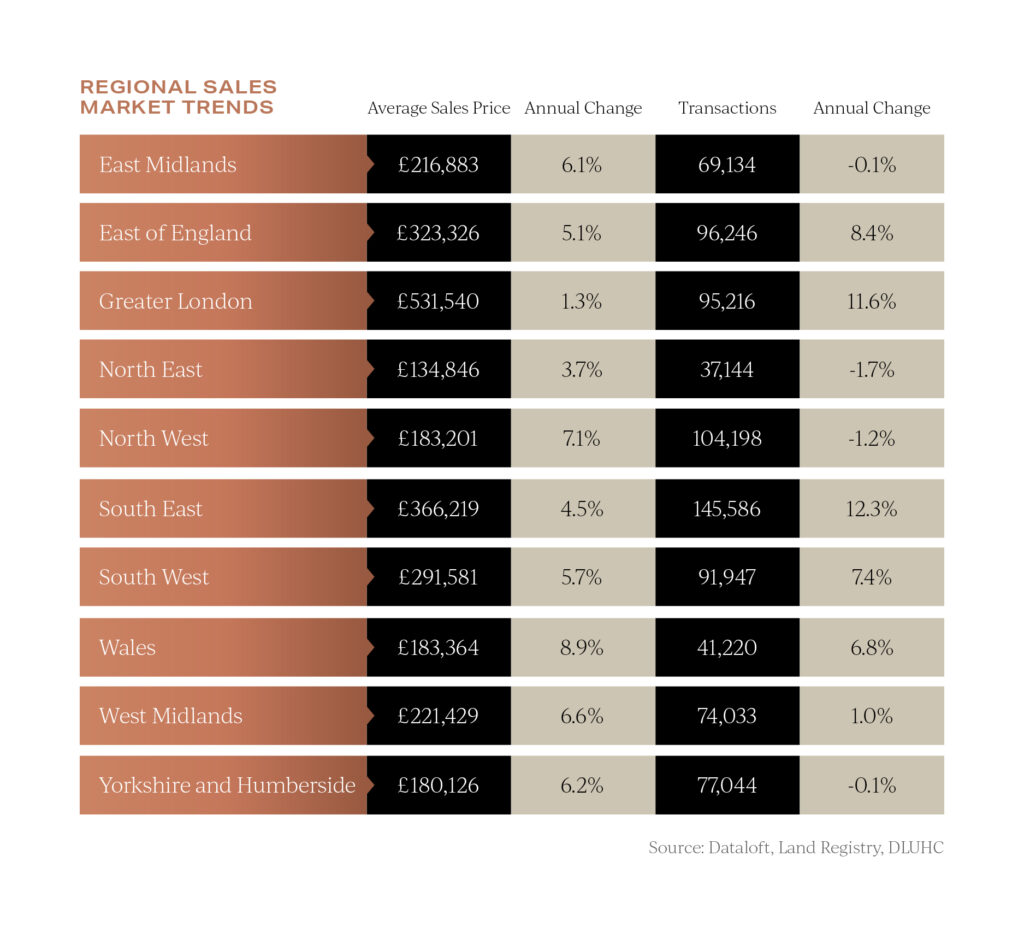

At a regional level, Wales continues to record the highest rates of house price growth and London has the lowest level of growth. However, look beyond the headline data and transactions are increasing in London at one of the fastest rates in the country with some price brackets and boroughs significantly outperforming the average.

However, look beyond the headline data and transactions are increasing in London at one of the fastest rates in the country with some price brackets and boroughs significantly outperforming the average.

Despite wider inflationary pressures and spiralling cost of living expenses, purchaser demand remains resilient and is continuing to drive the market.

Unintended consequences

The Government has previously made it clear that it wants to professionalise the private rental sector and a series of legislative reforms has particularly targeted amateur landlords.

A further wave of measures announced in February by Michael Gove in the Government’s ‘Levelling Up’ White Paper has further highlighted reforms targeting landlords.

As such, the National Residential Landlords Association reports more landlords leaving the private rental sector than entering it.

Capital Economics have warned that the supply of homes in the rental sector could fall by half a million homes over the next 10 years.

With so little stock, rents are rising steeply in many parts of the country and at the fastest rate seen for 13 years according to Zoopla.

Whilst the ambition to implement a so called ‘decent homes standard’ has widespread public and political support, it is already having dire unintended consequences and deepening a rental housing crisis.

For investors willing to embrace change and offer professional grade rental properties, the long-term returns look attractive.

As of the end of February, gross yields for example ranged from 3.1% in Prime Central London to 9.5% in Sunderland.

CBRE have recently published their latest forecast that property prices are set to rise by 19% in London over the next 5 years and rents by 14%.

Looking ahead, the benefits of investing in property appear to remain compelling, but the prospect of being a landlord has, and will continue to be, more complex now, akin to running any other form of professional business, rather than a more ‘passive investment’ as it used to be.

Outlook

The degree to which the market has decoupled from economic reality over the last 2 years, driven by lifestyle choices, has been quite profound.

This sentiment led market will be tested further over coming months, as across the board, cost increases bite into disposable incomes and the economic outlook looks far less certain. This is likely to have a drag on what some forecasters had predicted could be a bumper spring market.

The imminent Spring Statement is likely to clarify how far from previous forecasts the OBR believe the economy has moved and what the near-term prospects now look like.

These factors are all likely to directly feed into the wider outlook for the property market and we will report on these points next month.

In the meantime, if you would like to discuss your own property plans, please feel free to get in touch using the contact details below.