Welcome to Garrington’s latest Market Review where we explore how the UK property market has performed so far this...

UK Property News – March 2023

Welcome to the March 2023 edition of Garrington’s UK property market review.

It has been a month of mixed messages for UK property and consequently, polarised views of the property market are emerging, ranging from increasingly positive to bearish. Based on the latest data, both views can be justified.

Halifax and the RICS have published similar statements over the last few weeks suggesting “a more stable picture emerging through the course of 2023.”

In the same week as these views were shared, analysts at TwentyCi reported that property values have plunged by a fifth in some UK locations.

On average they record the national average agreed sales price has fallen 7% from a high of £375,000 in June last year to £348,000 last month.

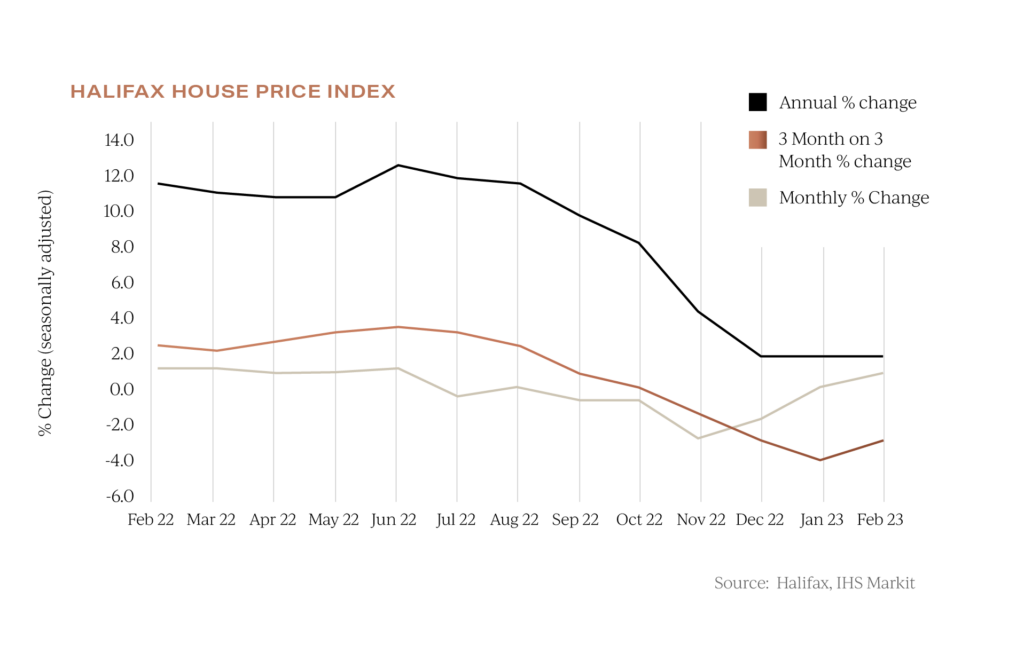

National house price indices from Nationwide and Halifax reported less dramatic data last month, with a monthly fall of 0.5% in average values being reported by Nationwide, and in contrast, a monthly rise of 1.1% being reported by Halifax.

National house price indices from Nationwide and Halifax reported less dramatic data last month, with a monthly fall of 0.5% in average values being reported by Nationwide, and in contrast, a monthly rise of 1.1% being reported by Halifax. Notably, prices are now flat relative to 3 months ago, rather than falling, according to the lenders’ latest data. Whether this marks a turning point, or merely a blip in the market, only time will tell.

Notably, prices are now flat relative to 3 months ago, rather than falling, according to the lenders’ latest data. Whether this marks a turning point, or merely a blip in the market, only time will tell.

The picture Garrington is seeing on the ground is that buyers are increasingly willing to proceed, but that we are now in a price sensitive buyers’ market across most parts of the UK.

Breaking down the budget

It is well understood that there is an intrinsic link between property and a feeling of prosperity. Politicians are aware of this fact, and it is therefore no coincidence that numerous tax and housing policies emerge the closer a General Election date looms.

With only a limited number of budgets left prior to the next election, Chancellor Jeremy Hunt surprised many commentators by making no announcements on housing policy in his latest Budget.

The Chancellor also announced that the Office for Budget Responsibility forecasts that because of changing international factors, the UK will not now enter a technical recession this year.

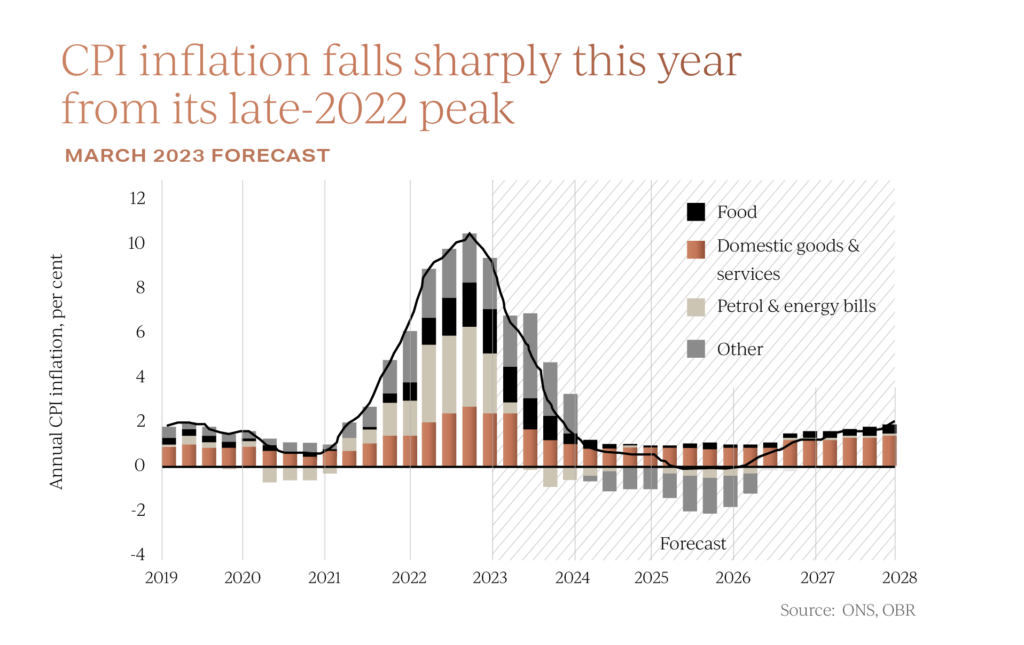

He also said that the recent fall in the rate of inflation will continue and should have dropped to 2.9% by the end of the year, based upon the updated OBR forecast.

He also said that the recent fall in the rate of inflation will continue and should have dropped to 2.9% by the end of the year, based upon the updated OBR forecast.

The improved economic outlook may settle some consumer nerves; however, critics cite that the Budget failed to address key issues in the market; like help for first time buyers, housebuilders cutting back construction levels, support for improving energy efficiency standards and addressing the void of available homes in the rental sector.

UK property – what to expect from the spring market

With the start of meteorological spring at the beginning of March and the clocks going forward later in the month, brings not only lighter evenings, but usually also signals an uptick in activity in the property market.

The answer as to whether this will be a traditional spring market depends on what basis you are making a comparison.

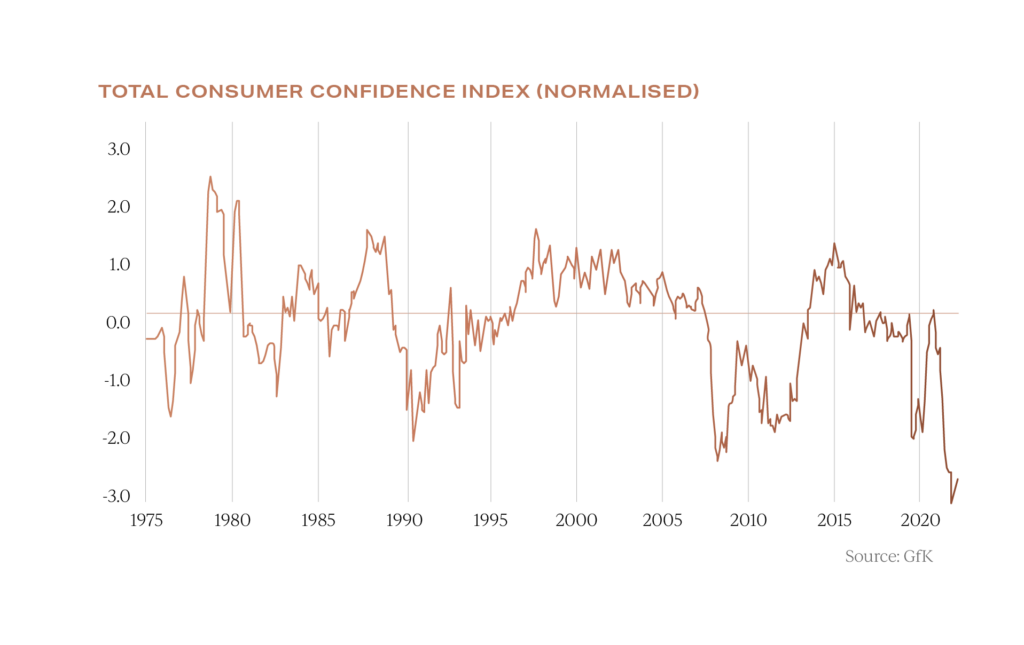

Latest data from the GFK Consumer Confidence Barometer highlights that confidence has fallen dramatically given recent events and the fragile economic landscape. As seen on the above chart, despite consumer sentiment improving in recent months, it is still languishing at levels last seen during the depths of the financial crisis.

As seen on the above chart, despite consumer sentiment improving in recent months, it is still languishing at levels last seen during the depths of the financial crisis.

Low consumer confidence levels, plus higher mortgage costs and limited availability will remain a headwind in the market for some time.

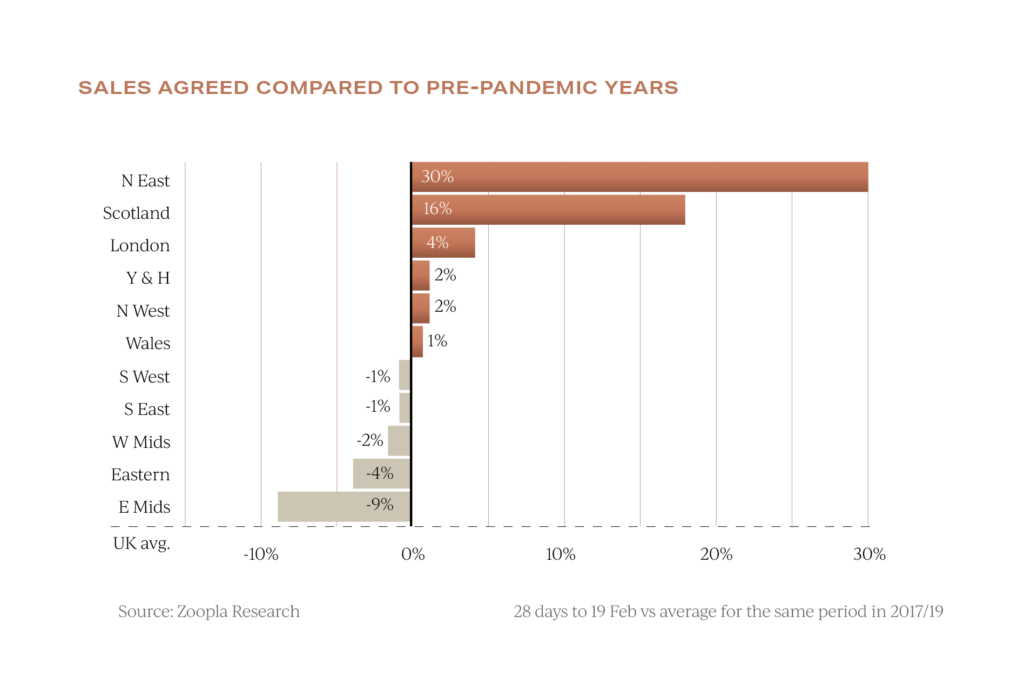

However, a historically low rate of unemployment and improved economic fundamentals will all support the market. As previously mentioned, regional market conditions have now become a tapestry of mixed fortunes, and as seen on this chart, compared to pre-pandemic years, transactions remain higher in more affordable locations but have slipped in more expensive locations, where the cost of servicing higher interest rates has so far hit hardest.

As previously mentioned, regional market conditions have now become a tapestry of mixed fortunes, and as seen on this chart, compared to pre-pandemic years, transactions remain higher in more affordable locations but have slipped in more expensive locations, where the cost of servicing higher interest rates has so far hit hardest.

Garrington has observed that a number of so-called ‘new listings’ entering the market are in fact previously unsold properties which were withdrawn from sale last year and are being relaunched.

As such, and with price sensitivity increasingly evident, understanding local market conditions and pricing realistically is essential when negotiating a transaction.

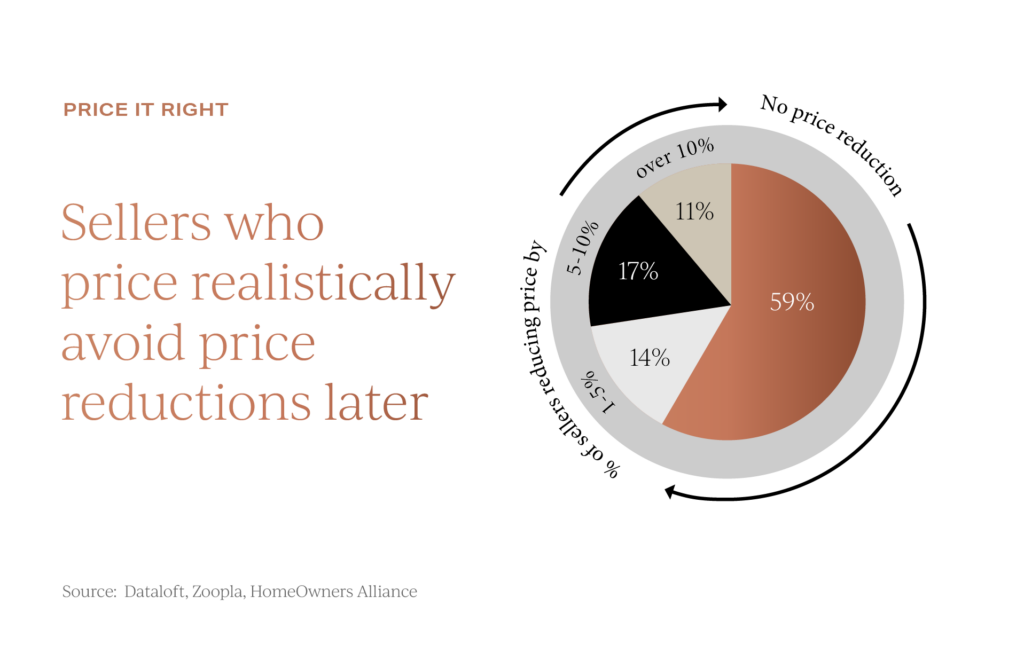

More homes which are struggling to sell are seeing their asking prices lowered to achieve sales. Zoopla report that 59% of listings in February had no price reduction, meaning that the other 41% did.

More homes which are struggling to sell are seeing their asking prices lowered to achieve sales. Zoopla report that 59% of listings in February had no price reduction, meaning that the other 41% did.

In conclusion, the spring market is likely to be markedly different from the conditions experienced just a year ago, but nonetheless much improved from what was being forecasted at the end of last year.

The UK property market remains in a period of transition, with the lingering question firmly dividing opinion; what is the market transitioning to?

We will report on the latest trends being seen next month, but in the meantime hope you found our latest update helpful.

As ever, we hope you found our latest update helpful. If we can assist you with your own property requirements anywhere in the UK, please do get in contact.