Welcome to Garrington’s latest Market Review where we explore how the UK property market has performed so far this...

UK Property News – May 2021

Welcome to the latest edition of our review of the UK property market.

There may have been a chill in the air over the last month but there has been plenty of heat in the UK property market.

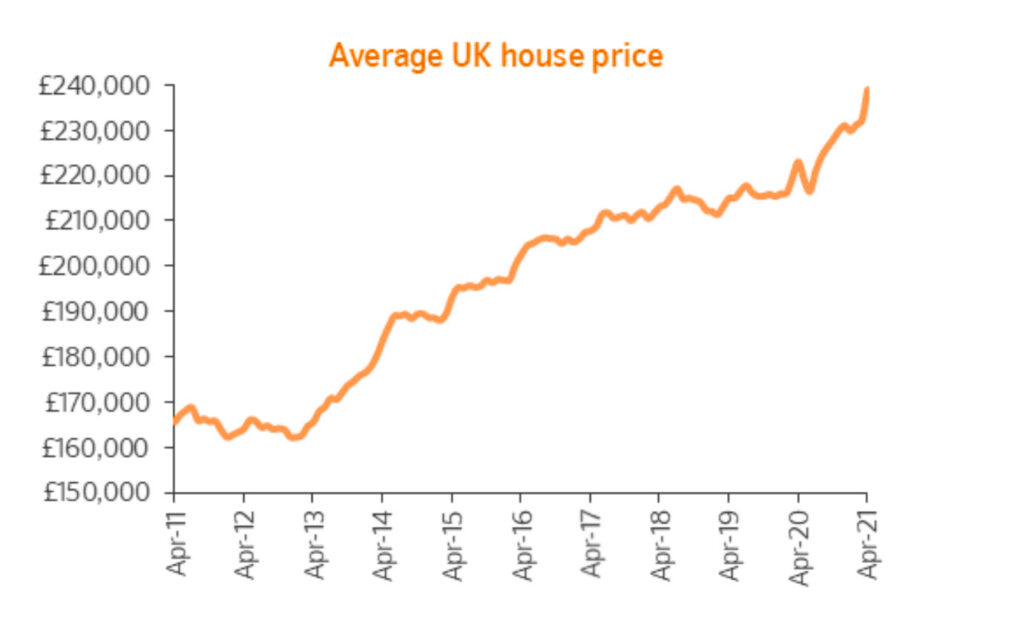

The momentum we reported last month has continued to build, at a rate not seen for several decades, which has led to a number of records being broken.

Across all sectors of the market, the trend is a uniform one; lack of property for sale, unsatiable demand and rising prices.

To put this in context, the value of homes sold in the UK has doubled to £150 billion in the first 15 weeks of the year according to Zoopla.

The number of homes selling within the first week of marketing has reached its highest ever level.

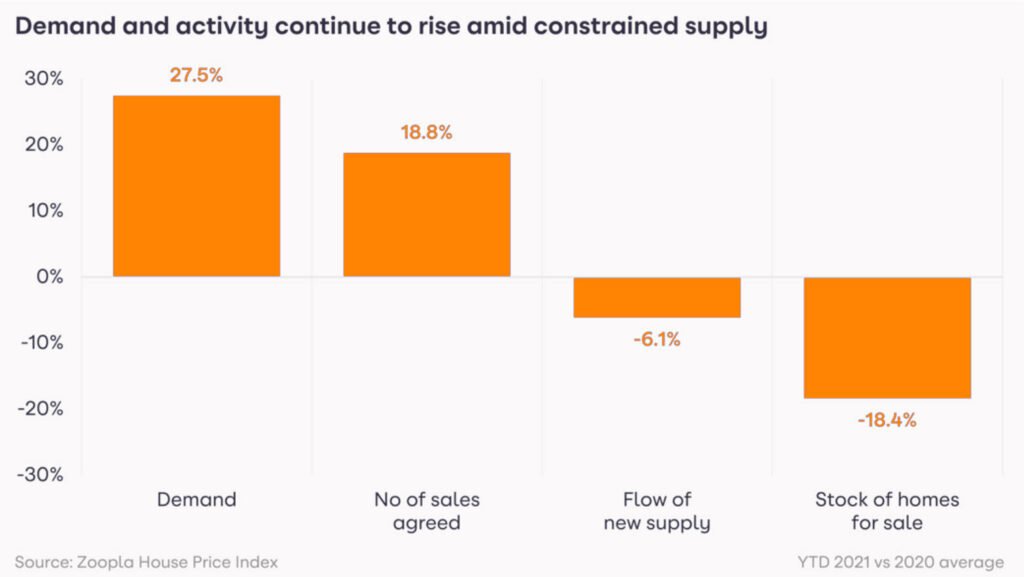

Year on year, demand levels are up 27.5% and the supply of homes for sale is down 18.4% and was 30% lower in April compared with the average number between 2017 and 2019.

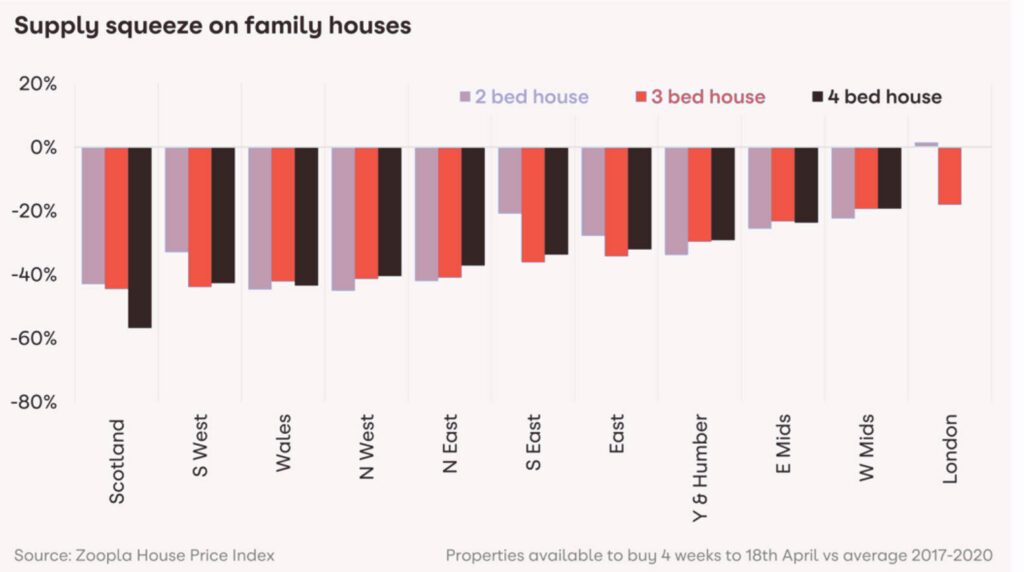

Delve deeper into data from both Zoopla and Rightmove, and there is evidence that the supply/demand imbalance is most chronic for 3 and 4 bedroom family homes.

In places where this trend is most profound, such as Scotland and the South West, is also where market conditions are the most competitive, with multiple buyers chasing each new listing.

Average values in the prime market are outperforming mainstream homes, with asking prices of new stock entering this sector of the market increasing 3.2% last month, taking the rate of annual price growth to 7.4%.

How high and for how long?

Across Garrington’s operating locations around the UK, some of the questions posed by buyers are “how far will prices rise and for how long?”

Historically the property market has been intrinsically linked to changes in the economy, and yet in a year when GDP recorded the largest fall in 300 years, the housing market has just recorded the highest monthly rise in average values since 2004.

The decoupling from traditional economic theory has occurred due to exceptional support measures by the Government.

The forthcoming Stamp Duty Holiday changes in June and September will undoubtedly take some heat out of the market, but this is unlikely to be such a cliff edge moment as first feared.

Many of the enquiries Garrington has received over recent weeks stem from buyers making a material change to their lives.

Most cite the Stamp Duty holiday as a “nice to have” rather than a “need to have” and their personal motivation for moving goes much deeper than a one-off tax relief.

There appears to be rising levels of determination and confidence to proceed with moving and indeed with wider spending.

The PwC Consumer Confidence Index is at its highest level since the index started in 2008.

The first quarter of 2021 marks the first time the index has been in positive territory since pre-pandemic.

Which way next for property prices?

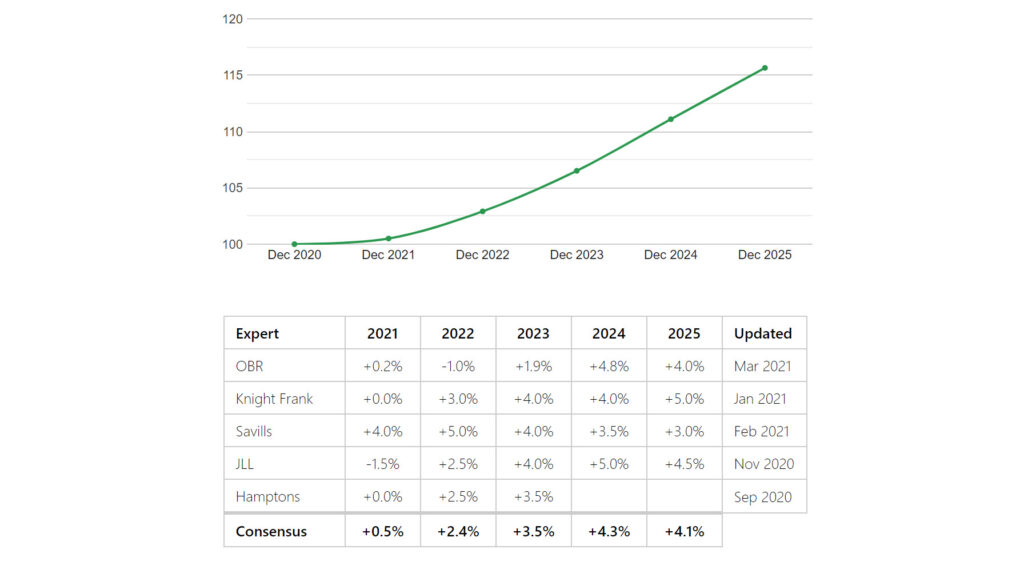

A number of housing market price forecasts have been revised upwards over recent months.

The cumulative consensus forecast is now for average values to rise by 15.6% over the next 5 years.

Cynics might argue that some of these forecasts from property firms might be rose-tinted and self-serving, but are supported by the equally positive Office for Budget Responsibility forecast data.

The previous ceiling on values created by affordability constraints has been partially overcome by the regional displacement of movers relocating to more affordable locations, the improved availability of low interest rate mortgages and the higher ratio of income to savings.

The total saved by households since last March has hit £180 billion, an enormous jump from the £56 billion saved in the 12 months prior.

For those needing high Loan to Value mortgages, the number of 90% LTV loans available had risen to 323 in March, from just 72 last September according to Moneyfacts.

For borrowers with more substantial deposits, mortgage rates below 1% are now available, and 10-year fixed rates are available at just over 2%.

Outlook for UK Property

Whilst regional housing market variations will always exist, in the short to medium term, overall market conditions seem likely to remain strong fuelled by confidence, lifestyle switching and access to funding.

Upbeat economic forecasts will further buoy sentiment. Economic growth is predicted to be at its highest since June 2015, according to estimates from the CBI. The CEO of Barclays has also been quoted as predicting that “the UK economy will grow at its fastest rate since 1948”.

Lack of homes for sale will constrain the market, with many locations having less than half their usual inventory levels and only around 2.2 to 2.6 months of property left to sell, based on current sales rates according to analysts TwentyCi.

There are some early reports from sales agents known to Garrington’s Property Finders that more elderly sellers are now entering the market, after having had their second vaccinations.

In conclusion, we expect busy times ahead, slightly improving stock levels, but prices continuing their upward trajectory for the time being.

If you would like to discuss your own property plans and how our property finder service can help you, please feel free to get in touch.