A warm welcome to Garrington’s latest UK property market review. After a spring defined by volatility and economic headwinds,...

UK Property News – May 2023

Welcome to Garrington’s latest UK property market review with a summary of the latest developments and trends being seen in the market.

Despite a wet start to spring, spirits have not been dampened for those active in the property market.

The challenge now facing many buyers and sellers is how to form an accurate view on which to base their moving plans. This has become increasingly complicated over recent weeks, due in part to the rising tide of conflicting data.

As we have previously reported, the housing market is experiencing a ‘soft landing’, with a steady recovery in demand and consistent growth in new sales agreed over recent months, but at lower prices. So far this year, demand for homes peaked after the Easter break, with a 14% increase compared to 2019 levels according to Zoopla. However, this is still 42% lower than last year. The availability of homes for sale has expanded by 66% compared to a year ago, providing homebuyers with more options, and driving a 6% increase in new sale transactions compared to 2019 levels.

So far this year, demand for homes peaked after the Easter break, with a 14% increase compared to 2019 levels according to Zoopla. However, this is still 42% lower than last year. The availability of homes for sale has expanded by 66% compared to a year ago, providing homebuyers with more options, and driving a 6% increase in new sale transactions compared to 2019 levels.

Conflicting data

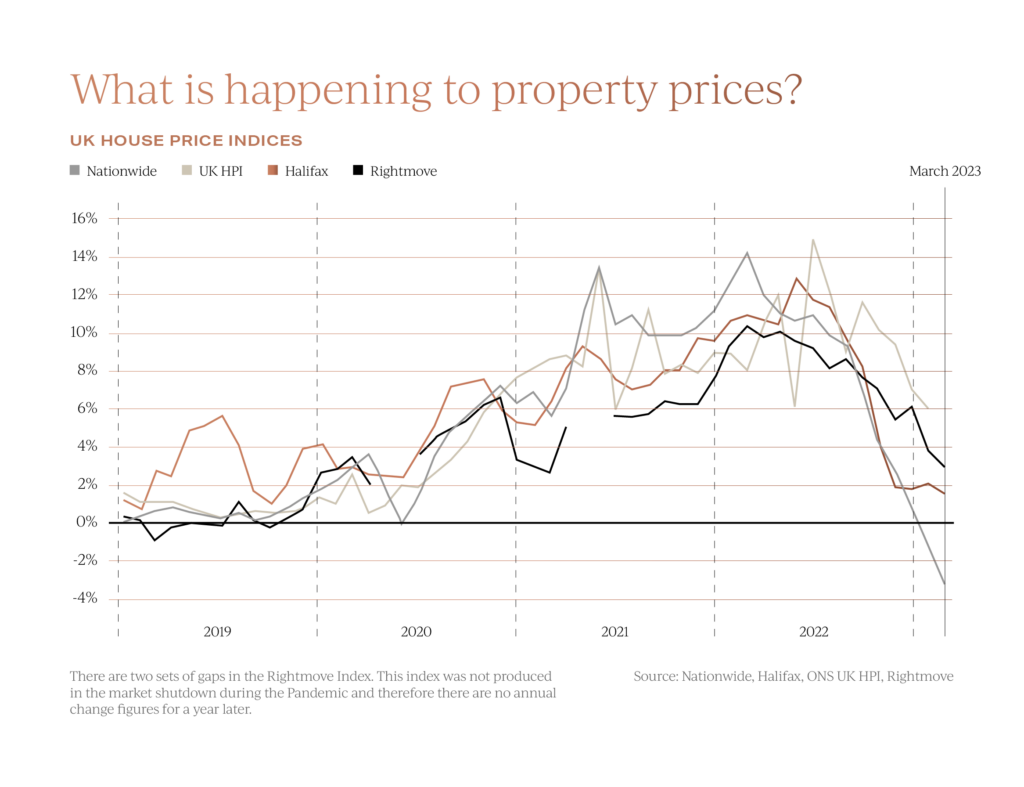

Latest house price data from Halifax reports a monthly fall in average values of 0.3%, yet in contrast, Nationwide recorded monthly growth of 0.5%. Despite this, the latest annual price trend remains one of softening values.

Data differs amongst various organisations due to different calculation methods.

For example, Rightmove uses asking prices of newly listed properties, whilst the ONS HPI relies on final sales prices from the Land Registry. Halifax and Nationwide both use mortgage application data at the approval stage.

Increasingly, Garrington is seeing first-hand that sentiment is improving steadily, and the mood amongst many buyers has shifted from anxiety to cautious confidence.

Whilst some remain wary of overpaying, committed buyers are focusing less on how prices might move in the next month or two and more on how to use their strong hand to secure a sizeable discount now.

Opposing ends of the ladder

In an almost text book example of ‘the law of unintended consequences’, the government’s barrage of reforms to protect tenants’ rights and improve housing standards has seen a much-published exodus of landlords leaving the rental sector.

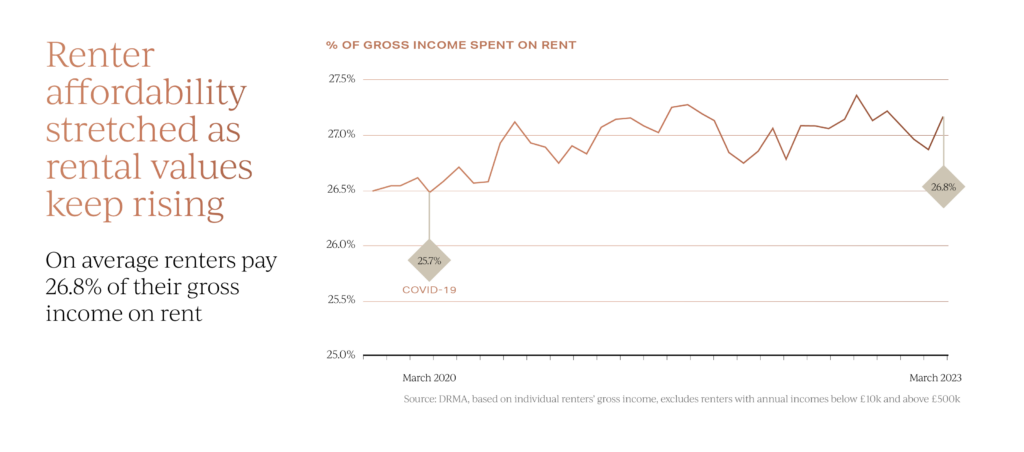

The resulting diminished supply of homes to rent has stretched affordability as rents soar.

On average, renters now pay 26.8% of their gross income on rent, compared to 25.7% three years ago. Annual rental growth in the UK was 9.8% in the year to March, for new private tenancies, whilst growth of 4.9% was recorded by the ONS, which includes pre-existing tenancies and new lets.

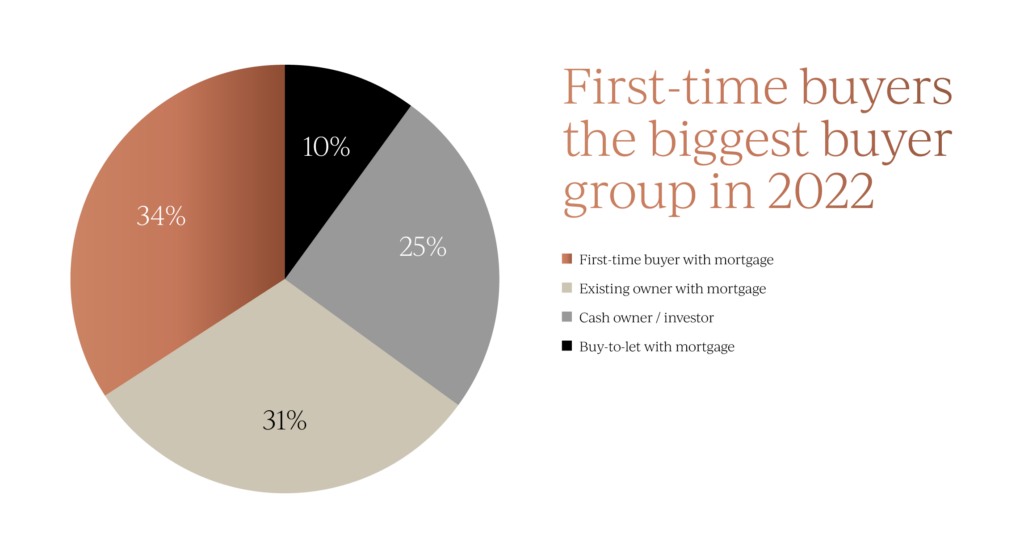

Given these challenges, increasing numbers of would-be tenants are entering the market as buyers and taking their first step on the property ladder. Some good news for such first-time buyers is that average mortgage rates have been falling over recent weeks.

There are also now 16 lenders willing to offer deposit free 100% mortgages, which they argue offer first-time buyers a chance to overcome the frequent challenge of saving for a deposit, whilst paying, on many occasions, more in rent than the equivalent monthly mortgage repayment.

The first-time buyer segment usually makes up over one-third of total transactions in the market, frequently initiating sales chains. Therefore, news of rising transaction numbers is beneficial for the overall market’s well-being.

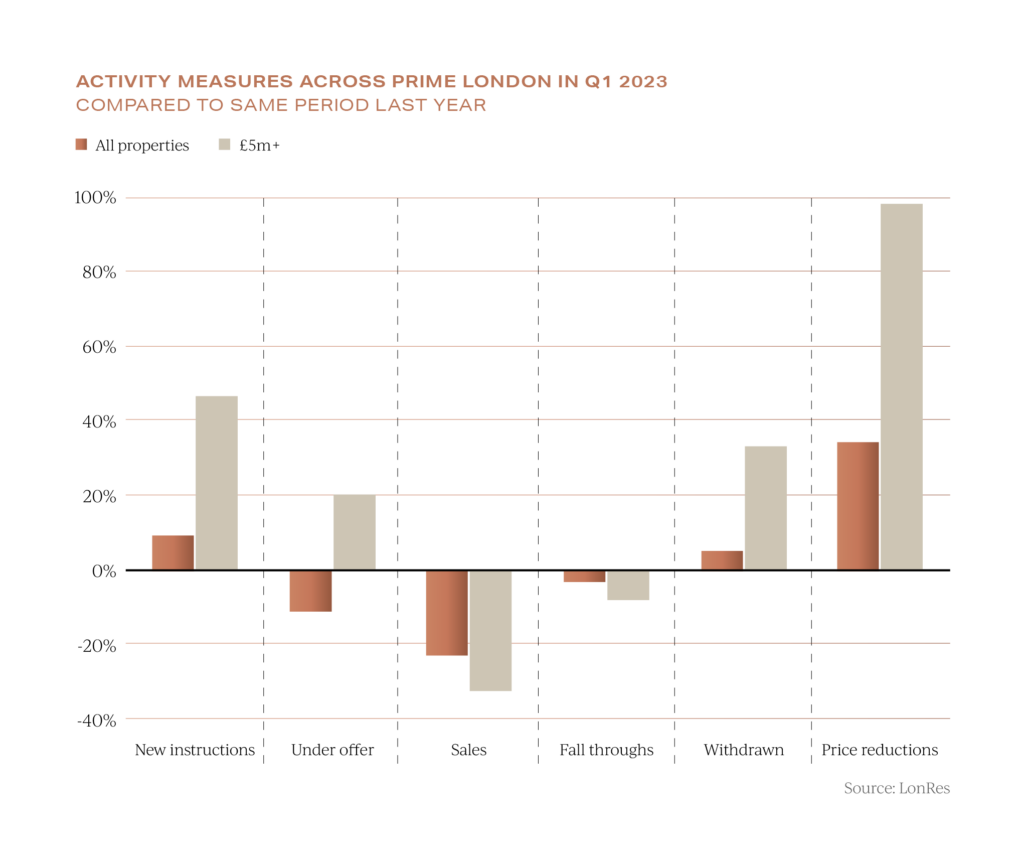

At the very top of the market, London remains one of the top five most expensive cities globally in which to acquire a property, and the spring market has seen several high profile launches of landmark properties for sale, including what is currently the UK’s most expensive open-market listing at £75 million.

Sales in the Prime Central London Market were 21% lower in Q1 this year compared to last year. However, more sales were recorded during this period than in any first quarter between 2017 and 2020, and the number of properties priced at £5 million and above going under offer has increased by 20% in the first quarter of the year.

With consumer confidence levels rising and international visitor arrivals into London back to pre-pandemic levels, astute wealthy buyers are increasingly sensing that the ‘window of opportunity’ to secure attractive discounts may be closing and have consequently shown renewed interest over recent weeks.

Outlook for the UK property market

Whilst the property market remains subdued relative to recent years, there are signs of resilience. However, cost of living concerns and the impact of higher interest rates will likely continue to exert downward pressure over coming months.

Despite this, there appears to be a growing consensus amongst economists and forecasters that the market may have passed the worst of the pricing adjustment phase.

Garrington referenced last month the emergence of a ‘new-norm’, and all the latest data suggests that the market is more balanced between supply and demand than in previous years, with a variety of demographic and social factors driving the motivation to move.

Whilst there clearly remain threats facing the market, there is evidence of shifting perceptions that these threats may ironically also be creating opportunities for the well-informed purchaser.

If we can assist you with your own property requirements anywhere in the UK, please do get in contact.