Welcome to the March edition of Garrington’s Market Review, where we explore the latest shifts in the UK property...

Monthly Market Review – September 2017

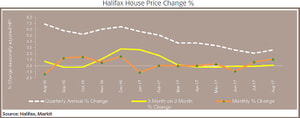

After months of uncertainty there are signs that the property market is slowly finding its feet again.

However, it appears that price rises are being driven by equilibrium rather than energy. The chronic shortage of supply has placed a floor under prices, whilst demand has been underpinned by a combination of benign interest rates and a robust jobs market. As a result, buyer sentiment in many areas remains cautiously upbeat, even if few are rushing, and most will not hesitate to walk away from a property being offered at anything other than a highly competitive price.

The market remains deeply fragile, but the listless limbo that followed the election result is fading as increasing numbers of previously hesitant buyers are piqued into action by the sense that stability, if not normality, is returning. Indeed, the recent jump in mortgage approvals recorded by the Bank of England over the summer is a particularly welcome sign that momentum is returning. More pragmatic sellers recognise the change in the dynamics of the market and adjust their price expectations; a trend that could accelerate as demand nudges further upwards.

On the front line Garrington is witnessing the market become more free-flowing – with the typical summer hiatus in activity being surprisingly short-lived this year. There remain challenges and a degree of artificial stimulus in the market, but overall, post summer activity levels, so far, appear encouraging.

A fractured market

Whether considered by geographic location or market segment, there are cracks across the entire UK residential property sector and they look to be getting wider. Rub the veneer a little and the spectre of government pulling the strings lurks large in the background. With rampart property price inflation, booming buy-to-let and the subsequent difficulty of first time buyers getting onto the market, some would argue that such interference was long overdue, but can a fractured market be sustainable going forwards?

Common wisdom used to hold that London and the South East led the way for the whole country. If those areas did well, then the ripple effect would spread, albeit with more subdued growth the further you went. Likewise, if they fell then the rest of the country would also follow.

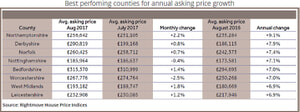

However, the latest House Price Indices paint a very different picture, with London and the South East remaining subdued year on year, whereas seemingly unlikely contenders like Northamptonshire and Derbyshire are leading the annual price growth chart on 9.1% and 7.9% respectively. According to Rightmove, of the English counties exceeding the 3.1% average annual rise, over half are in the mid-regions, in contrast to only a quarter in the north and just a fifth in the south.

With buy-to-let mortgage borrowing remaining high, there is growing evidence that investors are taking note of the additional 3% Stamp Duty Land Tax imposed by the government on second homes; and looking to areas where prices are cheaper and potential returns are higher.

One way of evaluating the effect on market segments is by comparing the fortunes of a couple of the UK’s major housebuilding firms, as reported in the Financial Times. Barratt Developments, the largest housebuilder, have recently announced an increase in profits of 12% to June 2017. This growth in performance is underpinned by 35% of sales coming from first time buyers, who in turn are supported by the government’s Help to Buy scheme. Conversely McCarthy & Stone, the retirement housebuilding specialist, is reportedly not fairing anywhere near as well. They rely upon their clients being able to downsize from their larger homes and the government’s successive Stamp Duty Land Tax rises. This has effectively supressed demand and the number of transactions at the higher ends of the market. The result is that downsizers are struggling to sell and cannot therefore buy retirement property like those built by McCarthy & Stone.

Unless we want to be a nation of small one and two-bedroom new builds you cannot keep enticing first time buyers into the market without the rest of the market being fluid. After all, as those first-time buyers have families, and as they progress in their careers they will look to become second time movers; second time movers look to be third time movers, and so on and so forth. To open the floodgates at one end and place a dam at the other does not look like a sustainable situation for anyone.

Time for Buy-to-Let investors to batten down the hatches … again

Many would argue that buy-to-let landlords would be entitled to already feel a little aggrieved; with changes to mortgage interest relief, a 3% Stamp Duty Land Tax surcharge on additional purchases and Capital Gains Tax (CGT) fixed at 28% for higher rate tax payers on the disposal of residential property, despite a lower 20% CGT rate for other gains.

It will therefore be unwelcome news for this sector of the market, that at the end of this month, the final element of the Prudential Regulation Authority’s (PRA) new underwriting standards for buy-to-let mortgages will come into effect. In short, it is about to become even more difficult for landlords to mortgage their investment properties or to re-mortgage to release equity. From 1st January 2017, lenders have had to apply a higher stress test for affordability checks and they must look at the tax position of the applicant when applying the stress test. The minimum stress test for the Interest Coverage Ratio is 125%, calculated at a nominal rate of 5.5% irrespective of the actual mortgage interest rate on offer. For higher and additional rate tax payers it gets worse with lenders looking for 145% or even 160% cover.

From 1st October, stricter underwriting for landlords with four or more buy-to-let properties will come into effect, whereby portfolios will be considered as a whole. The effect may inhibit existing landlords from being able to purchase new investments or remortgage existing property.

Outlook

As has been the case for several years now; the market remains complex in nature and difficult to predict beyond the short term with an ongoing mix of threats and opportunities influencing market sentiment.

Over the coming months, what is clear though, is that the need for carefully considered information and advice will remain prerequisite to making successful and confident property plans.