Welcome to Garrington’s latest Market Review where we explore how the UK property market has performed so far this...

UK Property News – November 2020

Welcome to the latest UK property market news review, brought to you by Garrington.

Traditionally at this time of year we would expect to be reporting a seasonal slowdown in activity.

However, the UK property market has remained exceptionally busy over the last month, despite the re-emergence of initially regional, but now national, lockdowns coming into force.

Lockdown 2 and moving home

For anyone wishing to move, one of the first questions being asked following confirmation of the new restrictions was “can I still move home during the new lockdown?”.

Notwithstanding the serious reasons why a lockdown is having to take place again, the good news for movers is that the government has confirmed the property market will be exempt from the lockdown measures.

Viewings, surveys and moves can all take place, subject to stringent Covid-Safe policies.

In addition to supporting movers progress their plans, it will have been hard for the government to ignore research from Aviva.

It calculates that the value to the UK economy of home movers is in excess of £10 billion per annum in addition to the transaction value.

Early signs from the property sector are that agreed transactions are still proceeding undeterred, and there remains pockets of activity where it appears to be business as usual.

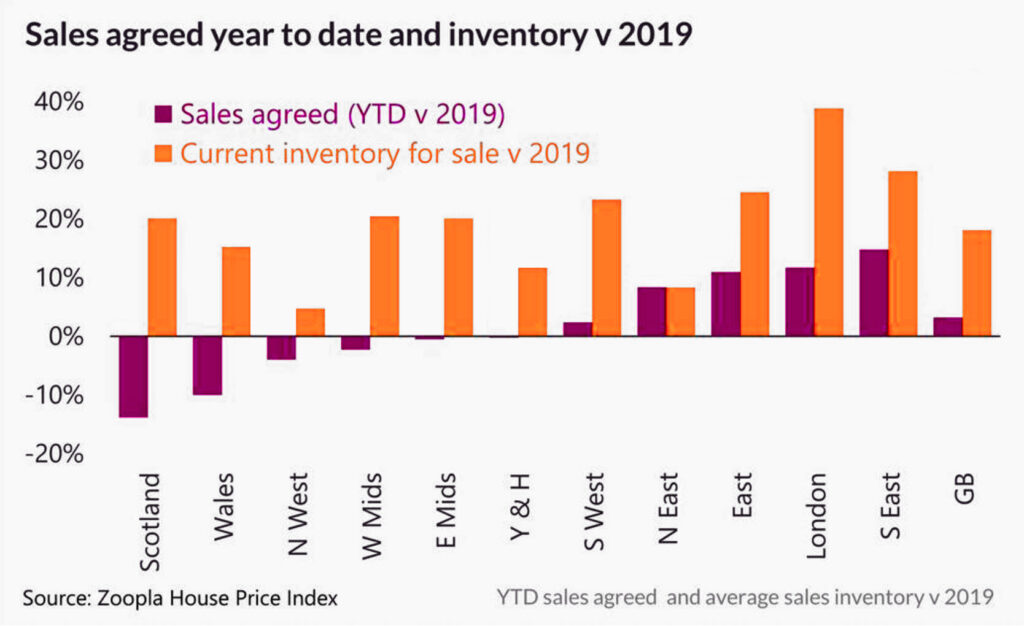

Demand in southern regions and coastal markets remains particularly strong.

However, according to the sales agents Garrington talks to regularly, overall requests for market appraisals and property viewings have both fallen since the lockdown announcement.

Values up despite Lockdown

Despite the re-emergence of lockdown measures the property market has remained robust, and on an upward trajectory over recent weeks.

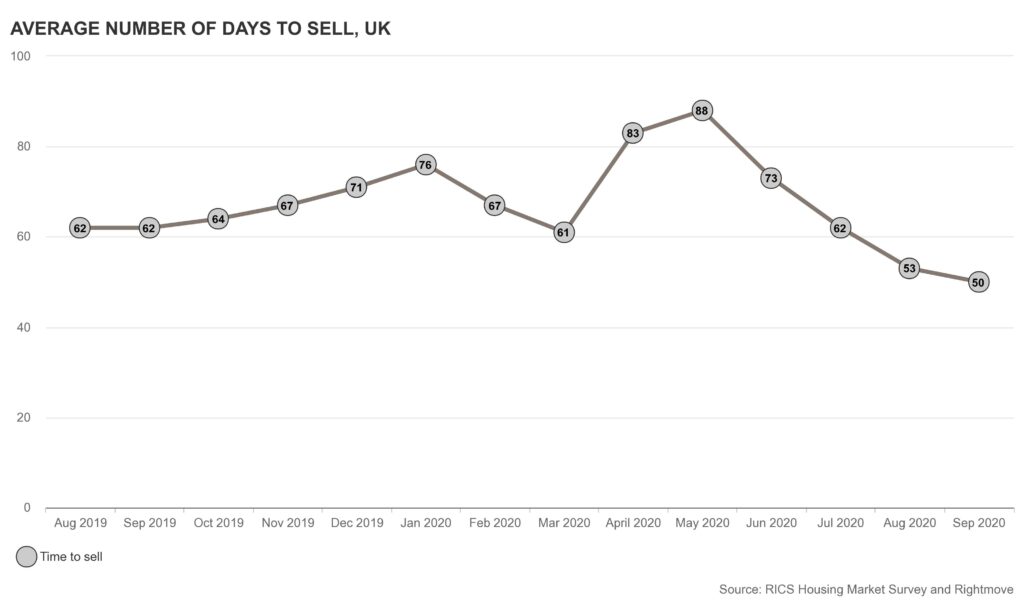

Rightmove has reported the average time to sell a property has fallen to 50 days, which is the fastest ever seen.

Newly agreed sales were up 70% year-on-year in September, and website traffic to the portal saw its biggest annual jump since 2006.

Average asking prices in the prime residential market increased by 2% in October.

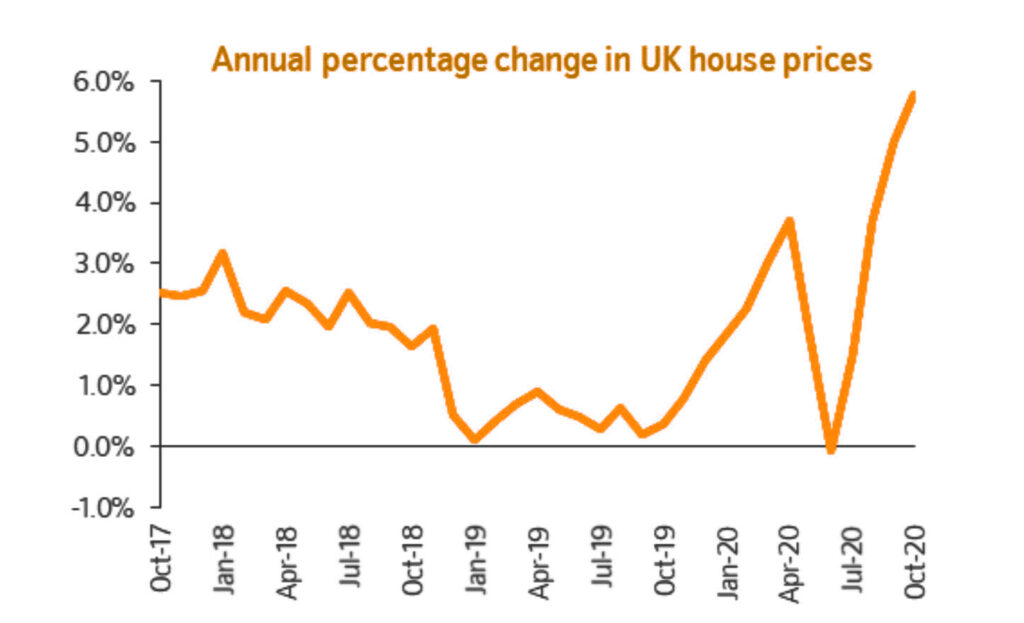

This surge of activity carries over to national house price indices too.

Nationwide recorded prices rising by 0.8% last month, taking annual rate of price inflation to a 5 year high of 5.8%.

However, by their own admission, activity is likely to slow in the coming quarters, perhaps sharply if the labour market weakens as most analysts expect.

Beating the bottleneck

For many people moving, if the challenge of finding and securing the right property at an acceptable price wasn’t challenging enough, there is now a further hurdle to overcome with regards to progressing a transaction through to a successful conclusion.

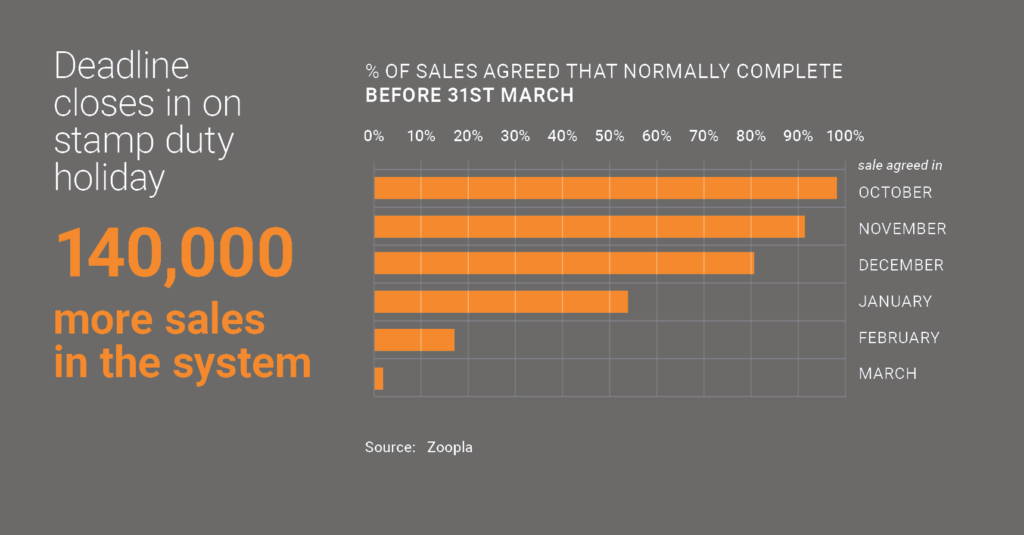

With the stamp duty holiday set to end on 31st March 2021, buyers need to remain focused on progressing transactions if they want to take advantage of stamp duty savings of up to £15,000.

Under normal market conditions, most sales agreed before the New Year would complete by 31st March. Only 54% of sales agreed in January would make the deadline, 17% in February and 3% in March.

Increased buyer demand over the summer has led to 140,000 more sales in the conveyancing system than usual according to Zoopla.

This has put huge pressure on lenders, valuers and conveyancers and is likely to cause delays in sales exchanging, and in some cases could mean required completion dates not being met.

Pandemic blip or paradigm shift?

One of the questions currently being asked by analysts is whether the current flight of equity from cities to country markets will continue, once life returns to some sort of normality.

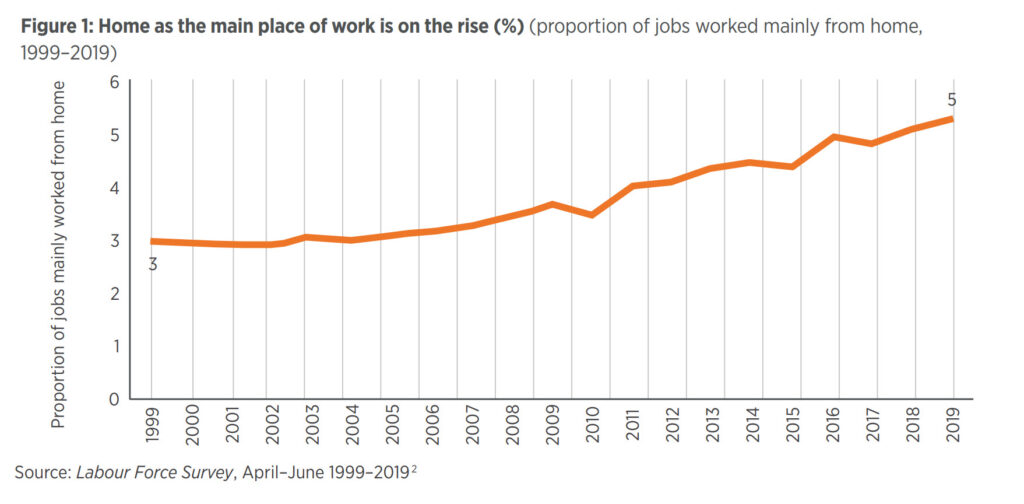

The adoption of digital technologies and remote working was well underway before the pandemic, which has significantly intensified the rate of adoption.

As such, many home workers have no intention of returning back to their former way of working and living.

As a consequence, we may well see a wider trend of localisation in 2021 and beyond, thus overtaking the previous trend of urbanisation witnessed over recent decades.

Which way next?

Opinion remains divided about what will happen next in the property market.

Rumours are circulating about a possible extension of the Stamp Duty holiday beyond the end of March and also potential changes to the ‘Help to Buy’ scheme to include established homes, not just new homes.

More bearish opinions cite the recently announced extension to the furlough scheme as masking the true extent of already rising levels of unemployment.

It is also hard to imagine that the new lockdown measures will not significantly set back the economic recovery.

However, with mortgage approvals rising by 272% over the last quarter and research from TwentyCi stating that the volume of households in the ‘Want to Move’ and ‘Moving Soon’ segments has risen to over 930,000 households, there appears to be forward indicators of an enduring interest in moving home over the coming months.

Looking back to earlier this year, the last lockdown created a period of reflection and thereafter saw the property market decoupling from economic reality.

Whether this will again be the case will become clearer over the coming weeks.

In the meantime if we can help with any property related matter or you would like to know more about our property finder service please do contact us.