Welcome to Garrington’s latest Market Review where we explore how the UK property market has performed so far this...

Property News – October 2020

Welcome to the latest edition of Garrington’s UK property market review.

The property market has remained firmly in the media spotlight over the last month, with news of record rates of price growth.

Over £37 billion of sales a month being agreed has led to press headlines of a ‘mini boom’.

However, all is not as it may first appear, and beyond the headlines there is a complex and polarised market with significant differences based on location, property type and sector of the market.

For example, Rightmove has reported record new asking prices in six out of the eleven regions it reports on, whilst at the same time, four other regions have experienced monthly asking price falls.

In London, transaction volumes are just 3% lower than at this time last year, but at a more local level sales are lagging by 14% in Zone 1, as opposed to booming for larger homes in parts of outer London.

At a national level there remains a general flight of equity from city markets, which is driving significant growth in many country and coastal markets, the likes of which have not been seen before.

‘V’ shaped price recovery

Garrington has previously reported that national house price indices were not representative of activity levels at the point when national lockdown restrictions were lifted in May.

Only now can it be argued that they are starting to truly reflect prevailing market conditions.

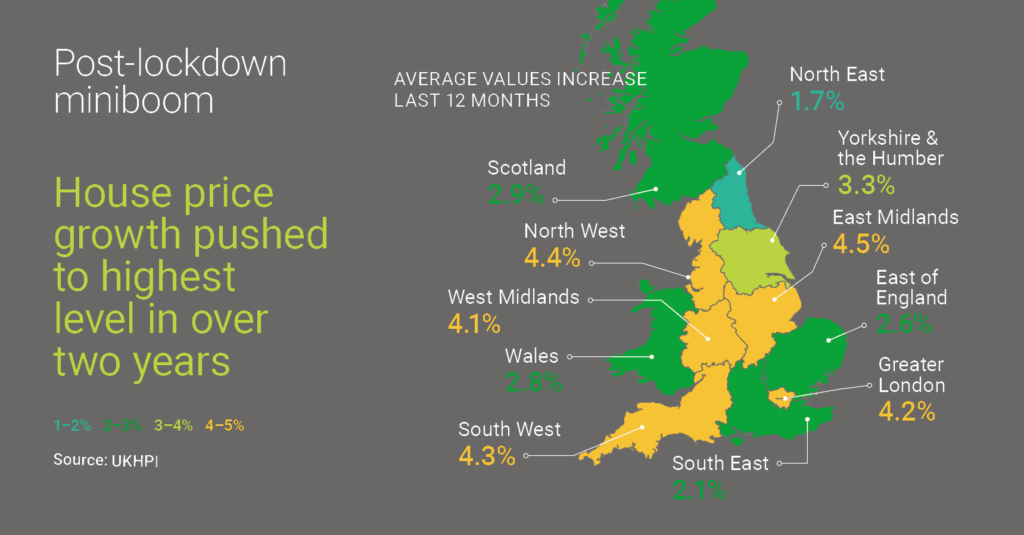

The latest ONS data published last month shows that UK house prices have increased by 3.4% to £237,834 in the year to June 2020.

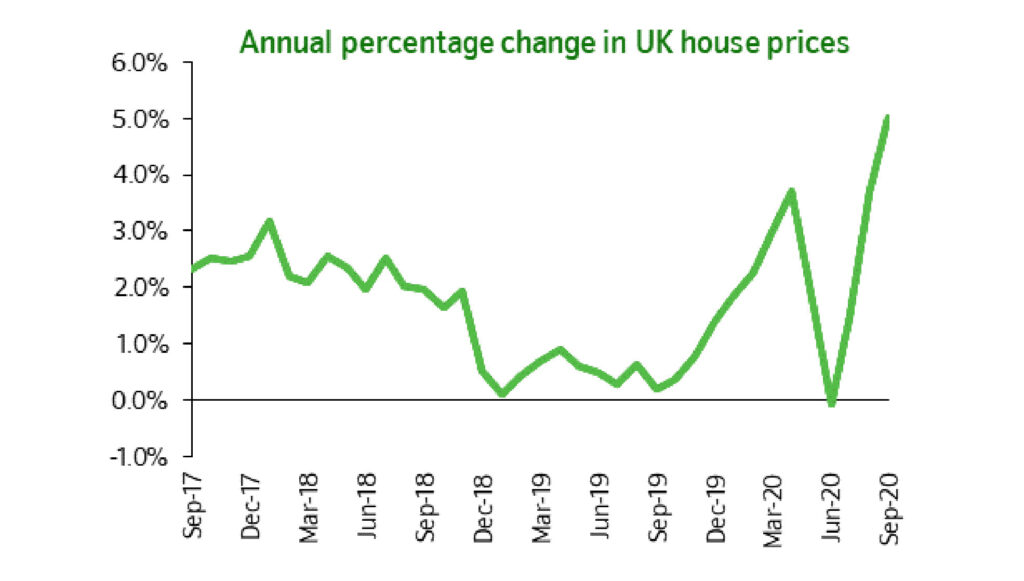

The mini post lockdown boom has pushed house price growth to the highest level since March 2018.

House prices in East Midlands saw the largest annual increase, 4.5% followed by the North West, 4.4% and the South West 4.3%, although the latter has seen strong demand since June.

Both Halifax and Nationwide have reported sharp monthly rises in average values. A 2% rise was reported by Nationwide in August, marking the highest monthly rise in 16 years.

A further 0.9% growth last month means the annual rate of price growth is at 5% – the highest level recorded by Nationwide since September 2016.

As can be seen from the following chart, this certainly suggests a so-called ‘V’ shaped recovery of property prices, which is made all the more remarkable given that the UK officially remains in a recession.

The obvious question now being asked is, how sustainable is this price growth and what is likely to happen over the coming months?

Factors driving market activity

Whilst the reasons for moving home are always going to be personal to an individual or family, there does now appear to be evidence supporting common themes amongst those who have decided to move home in 2020.

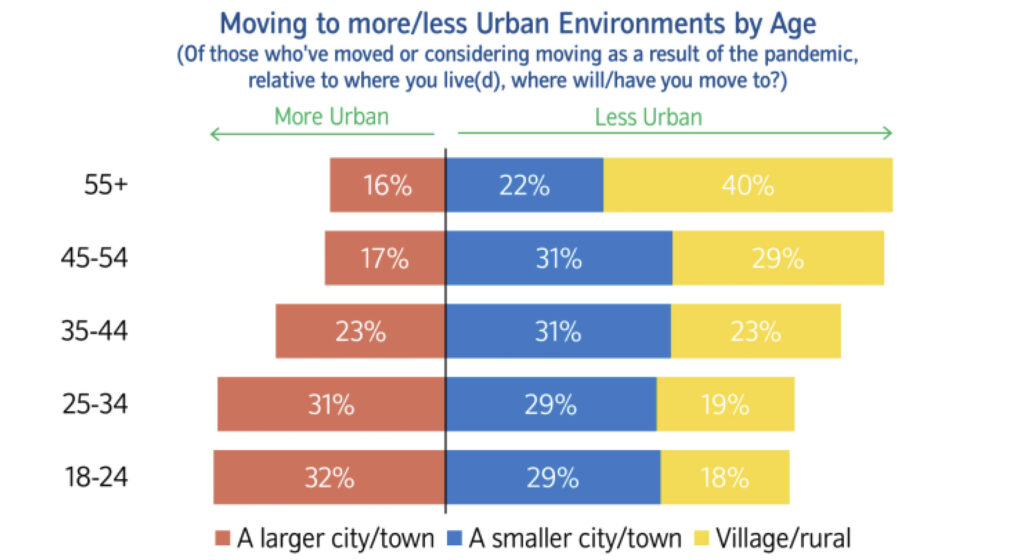

New research from Nationwide records that relocating to a new area is a primary driver amongst those it surveyed.

Of note though is the sheer volume of those moving to a less urban location. This trend is exacerbated amongst older age groups.

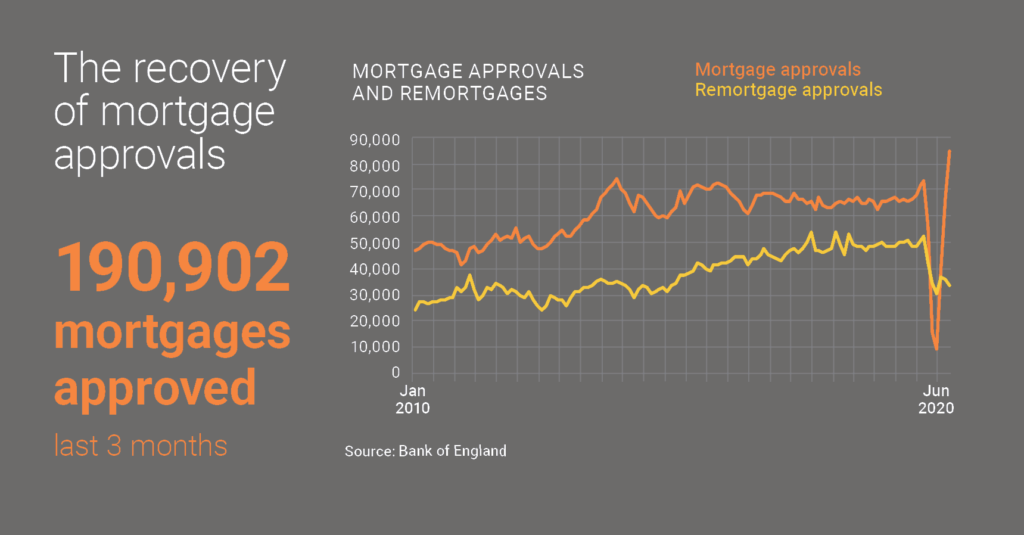

190,902 mortgages for home purchases have been approved in the last 3 months, which is just 4% below the same time last year.

So, whilst mortgage approvals are almost back to ‘normal’ levels, newly agreed property sales are much higher, suggesting cash buyers and older equity-rich buyers are a huge part of the surge in demand.

This theory aligns with recent research from Zoopla. They cite sellers from wealthier sectors of society as some of the most active movers at the current time.

These research findings further explain why some parts of the property market appear to have decoupled from economic reality.

Over half of these homeowners have no mortgage, and a significant percentage of the remainder have substantial levels of equity in their existing homes.

As such, this group of buyers are less affected by affordability constraints or concerns relating to job security.

One of the unexpected legacies of the pandemic appears to be a substantial re-evaluation of lifestyle, work and property requirements.

This appears to be the catalyst for a lot of the current activity in the market which has been further compounded by the financial benefits offered by the Stamp Duty holiday.

Autumn trends

Across Garrington’s operating areas, markets are busy, but the frenzied conditions seen at the start of the summer seem to have been replaced by calmer, more considered buyers.

In a world where any form of new norm remains yet unknown, traditional seasonal market trends are unlikely to be seen this year.

Conversely, far from seeing any form of gentle slowdown heading through autumn into winter, it is widely predicted that activity levels will remain brisk.

On the front-line, sales agents are reporting 40% more agreed sales transactions being progressed than this time last year.

With only 554,760 sales estimated to have completed so far this year and industry forecasts of 1.1 million total transactions in 2020, there are clear expectations for high sale volumes in the months ahead.

Of course, the rising number of local lockdowns have the potential to suppress market activity in affected areas, albeit current government guidance does still permit home moves to proceed, notwithstanding the obvious associated logistical challenges.

By any measure, the autumn market is likely to be a very different one this year and we will report the latest developments as they happen.