Welcome to Garrington’s latest Market Review where we explore how the UK property market has performed so far this...

UK Property News – October 2021

Welcome to the October 2021 edition of Garrington’s UK property market review.

The arrival of autumn and a change of season also coincides with several milestone events over recent weeks, including the end of both the stamp duty holiday and Furlough Job Retention Scheme.

As such, there is now speculation as to what effect these and other events might have on the dynamics of the property market.

At a national level, headline data remains positive and encouraging.

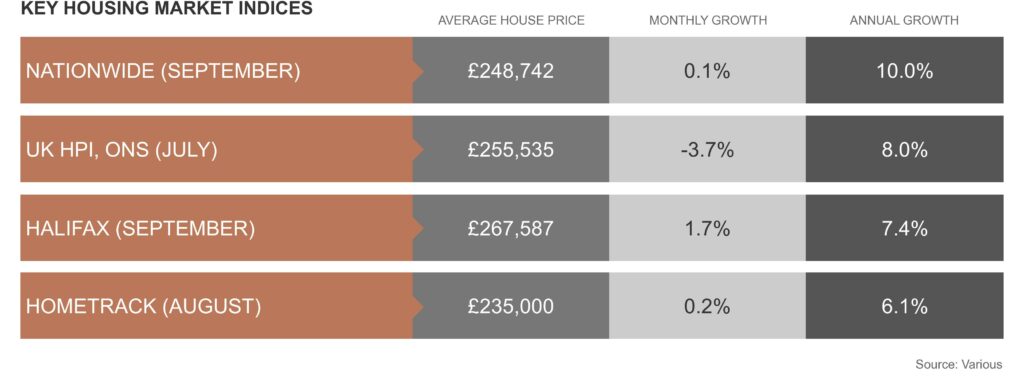

Both Nationwide and Halifax continue to record an increase in the annual rate of average house price growth, which Nationwide say stands at 10% and Halifax at 7.4%.

Halifax also recorded average house prices rising by 1.7% last month – which is the biggest monthly gain since 2007.

Which way next for prices?

Over recent weeks house prices have become a hot topic of debate. Whether from journalists, potential clients, or corporate partners, Garrington is increasingly being asked for its views.

Three key issues will largely determine the direction of prices over the coming months – consumer sentiment, interest rates and housing stock levels.

In terms of consumer sentiment, demand remains historically high.

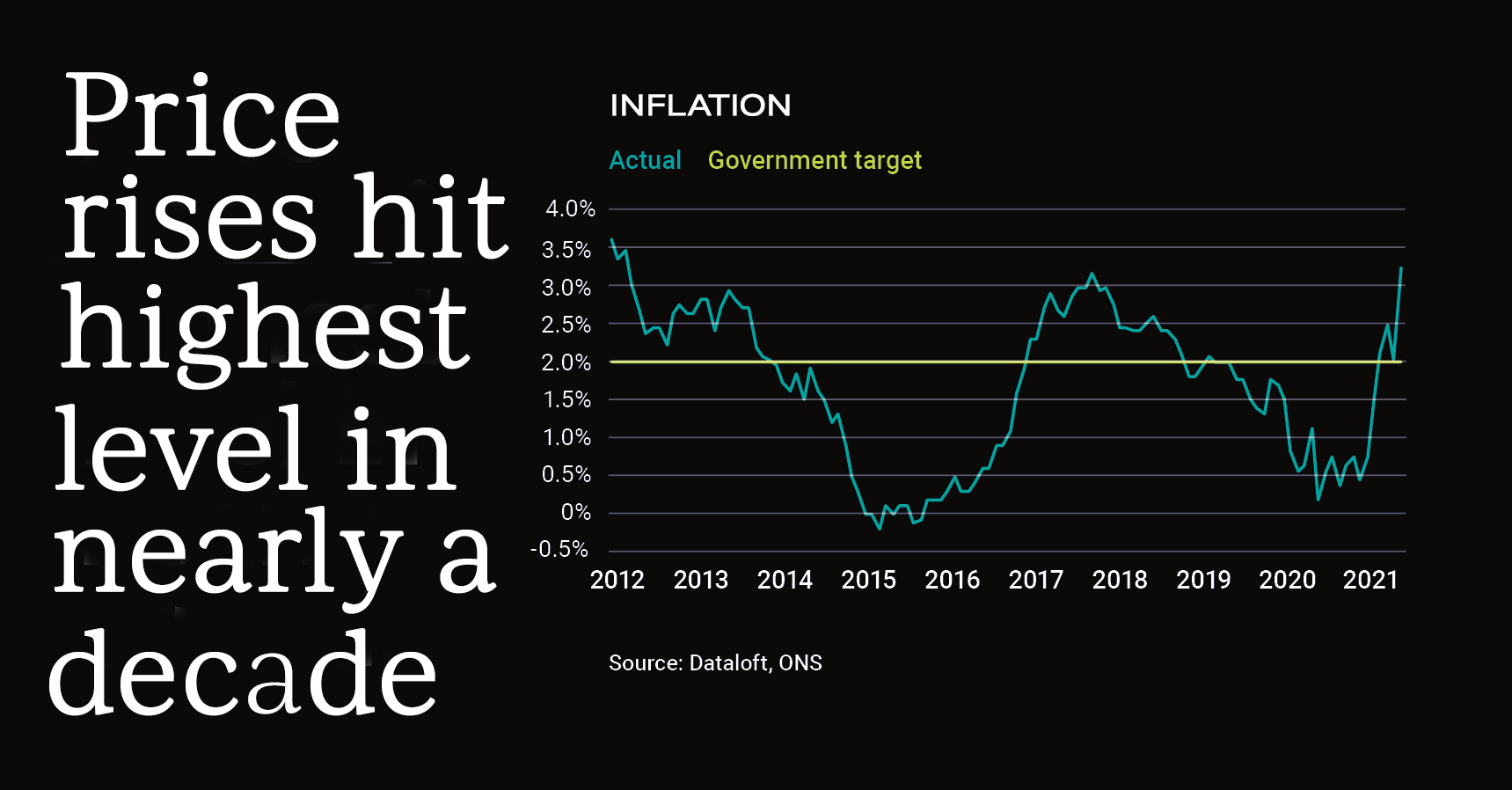

Propertymark estimate that in August there was an average of 19 buyers chasing every available property for sale. Such high levels of demand means that price rises have hit their highest level in nearly a decade.

However, wider economic headwinds cannot be ignored, with the cost of living rising sharply and disrupted supply chains across many sectors impacting day to day life.

The Consumer Price Index measuring inflation recorded a record jump in August rising to 3.2% up from 2.0% in July. The Bank of England has forecasted this to rise further in the near term to slightly above 4%.

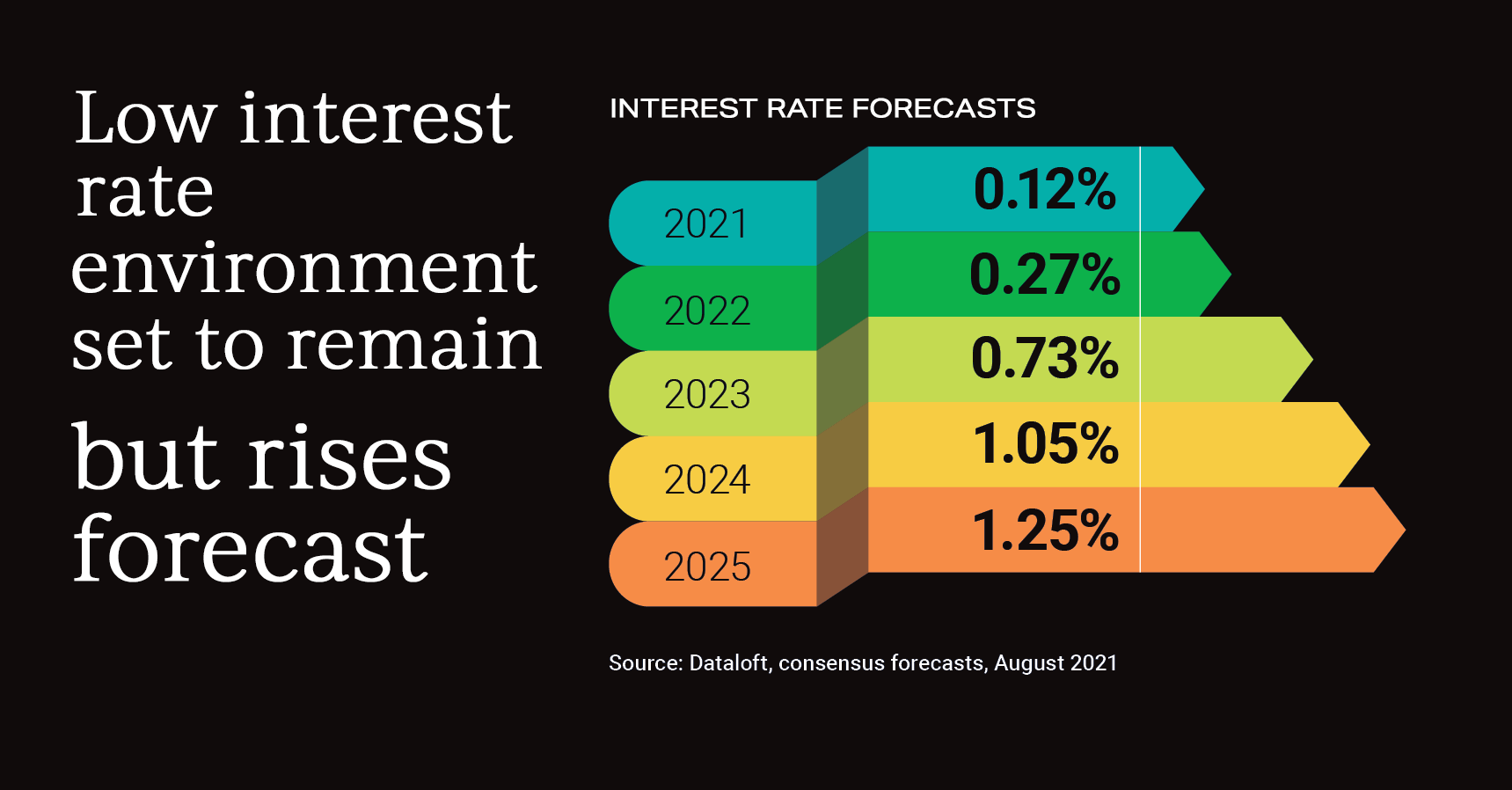

Whilst this is hoped and expected to be a temporary situation, there is however mounting speculation that persistent rising inflation will place pressure on the Bank of England to raise interest rates to curb spending.

The consensus forecast, based on the expectations of 18 different city and non-city analysts, is that interest rates will nudge slightly higher over the final quarter of 2021, ending at 0.12%.

Such a base rate would remain exceptionally low by historical standards, but nonetheless, once filtered through to the mortgage market, further increased costs to borrowers on top of other spiralling living costs is likely, at the very least, to cause pause for thought in the property market and dampen activity levels.

Despite Rightmove reporting a 14% increase in new listings at the start of September, the number of available properties for sale remains low. Some of the sales agents Garrington regularly liaise with are reporting having less than 10 homes for sale – way below normal inventory levels for the time of year. Somewhat of a vicious circle now exists with would-be sellers holding back in the absence of seeing anything suitable to move to themselves and this trend is likely to continue for some months to come.

Green premiums

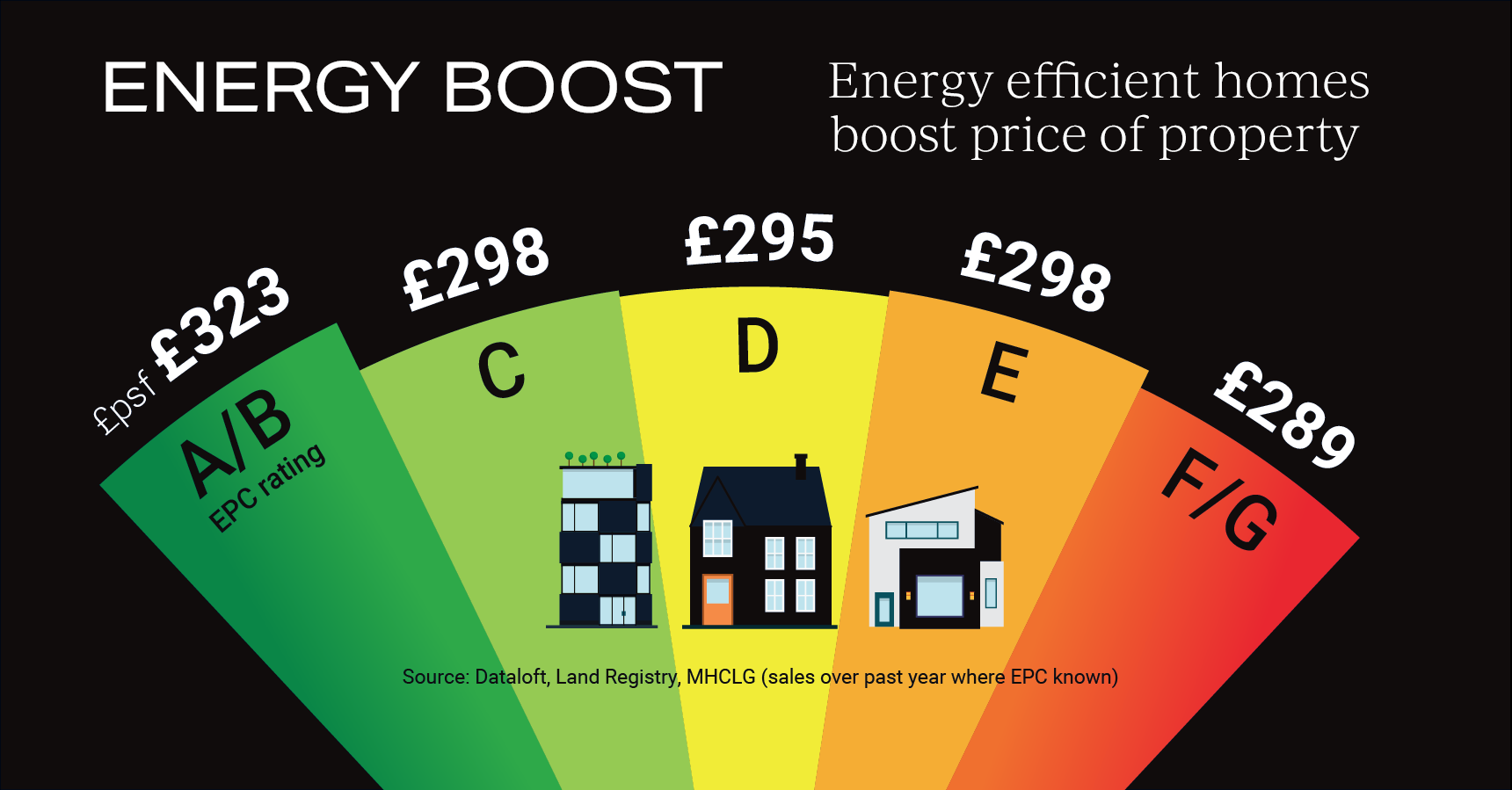

Environmental issues and rising energy costs are currently never far from the headlines, with more coverage expected as the Cop26 UN climate change conference will be hosted in Glasgow later this month. Improving the energy efficiency and sustainability of each country’s housing stock forms part of net-zero plans. Awareness of this important issue is

gathering significantly amongst movers and influencing prices and purchasing trends.

Homes sold with an EPC rating, A or B over the past year achieved a 10% price premium over properties with an EPC energy efficient rating of D. One in every 12 properties sold achieved an energy efficiency rating of A or B on its EPC, with 47% of properties selling with a D rating.

Just 6% of the re-sale properties sold achieved the A or B rating on their EPC. However over 60% of re-sale properties have the potential, with improvements, to hit that grade.

In the prime market, Garrington has seen first-hand growing interest from clients in either acquiring an energy efficient home or new owners allocating a refurbishment budget for energy efficiency improvements for older homes.

Autumn outlook

There is a growing sense in the property industry that market dynamics are on the cusp of change, the degree to which remains uncertain and dependent on many wider factors.

For now, after several months of recalibration, the property market resembles a half-drunk cappuccino – still hot but the froth has gone. As such, instead of a uniform trend of national price growth, greater regional variations are likely to continue to emerge.

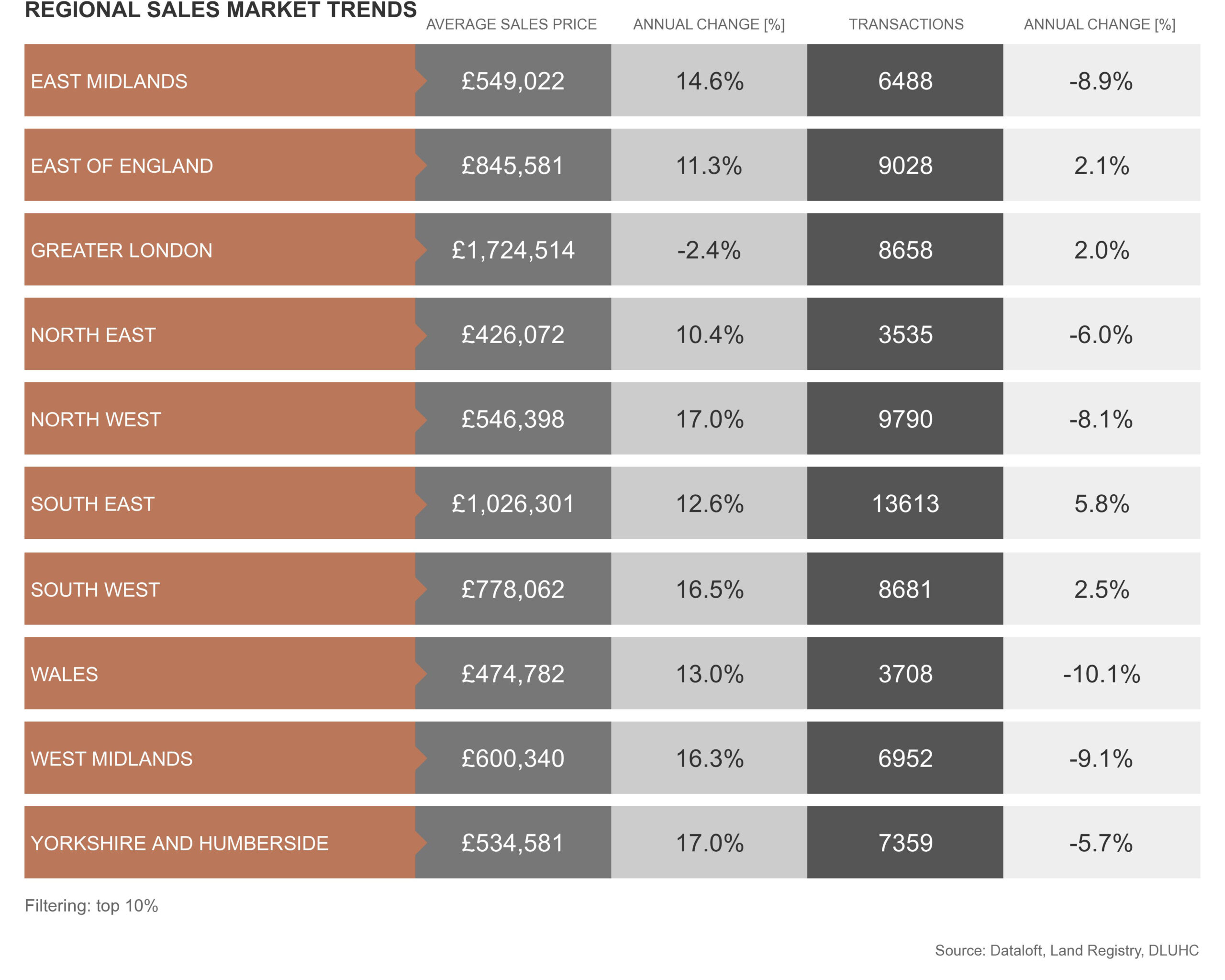

Equally, as can be seen from the following table, the top 10% of the prime market has already outperformed many mainstream markets over the last year – and this trend is likely to be exacerbated further over the Autumn, as prime and mainstream markets decouple further.

Key events such as the Chancellor’s Autumn Statement and forthcoming Bank of England policy announcements will start to provide clues over the coming weeks as to the rate and nature of changes to the UK property market.

If you would like to discuss your own property plans, please feel free to get in touch using the contact details below.