Welcome to Garrington’s final market review of the year, and what a year it has been for the UK...

UK Property News – September 2021

Welcome to the September 2021 edition of Garrington’s UK property market review.

Activity levels in the property market have remained brisk over the last month with new and emerging trends.

We posed the question last month as to what extent the market had been supported by the Stamp Duty holiday.

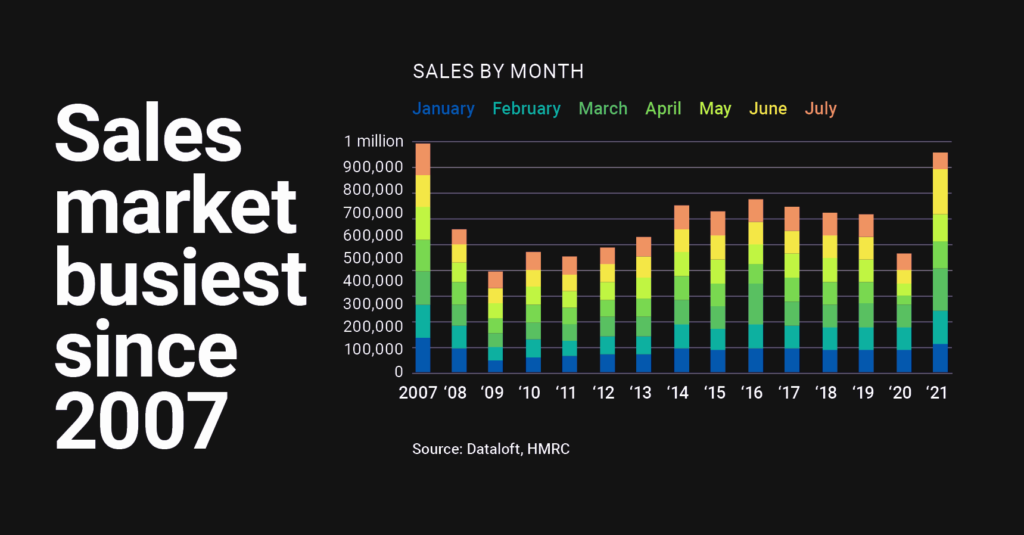

Data just released by HMRC highlights more than a 62% monthly fall in the volume of residential property transactions since the end of June.

There were 73,740 sales in July compared with 198,420 transactions in June, underlining the sheer volume of purchases that were brought forward to benefit from the tax saving.

Over 950,000 sales are estimated to have taken place across the UK in the first 7 months of 2021 which is over 30% higher than in any year since 2007, other than 2016 when the 3% surcharge on second homes was introduced.

Despite a fall in transactions in July, property prices have continued to rise, with data from both Halifax and Nationwide recording a monthly jump in average values by 0.7% and 2.1% respectively. Nationwide say the month-on-month jump is the second largest gain in 15 years.

Despite rising average values and busy market conditions, Rightmove reported in August that asking prices of new stock entering the market had edged back by 0.3% on a monthly basis.

The top of the market dragged down the national average with a cooling of the upper-end four-bedroom-plus sector, down by 0.8% in the month, with buyers no longer making larger stamp duty savings.

Educated buyers

One group of buyers currently out in numbers are family buyers, looking for the right property in the right school catchment area. Garrington has seen a noticeable rise in enquiries from this type of client over recent weeks.

Despite the new school term only just commencing, applications are now only open until the 15th January 2022 for parents wishing to secure places for their children in their chosen catchment area for the following academic year.

Traditionally, this factor has had a bearing on the property market, as school catchments play an important role for many when choosing a home.

This is borne out by figures which show that across England and Wales nearly 4.3 million homes, or 17%, have an OFSTED rated ‘Outstanding’ primary school as their nearest school.

With catchment areas for secondary schools generally larger, it is no surprise a higher proportion of homes, nearly 20%, have an outstanding secondary school as their nearest school.

Property price growth in catchment areas around top schools can often exceed other areas and living close to a top school can attract a significant price premium.

Foundations for investment

Property has always been a trusted asset class by investors, but residential landlords have been in decline over recent years, deterred by tax changes and new complex legislation.

A further wave of amateur landlords has also been tempted to cash-out recently based on the ease of sale over the last year.

Despite this, activity in the residential investment sector is once again picking up with Zoopla recording a 21% rise in demand year on year.

Garrington is however seeing a different profile of buyer in the sector.

A perfect storm of less competition from amateur landlords and rising yields has enticed more sophisticated investors into the market.

Such individuals frequently have no appetite to become landlords per se and instead are turning to professionals to maintain their portfolios so they can maintain a more ‘arms-length’ investor status.

Whilst letting a property has become more complex with 168 pieces of legislation governing buy-to-let, done correctly, the investment credentials are compelling.

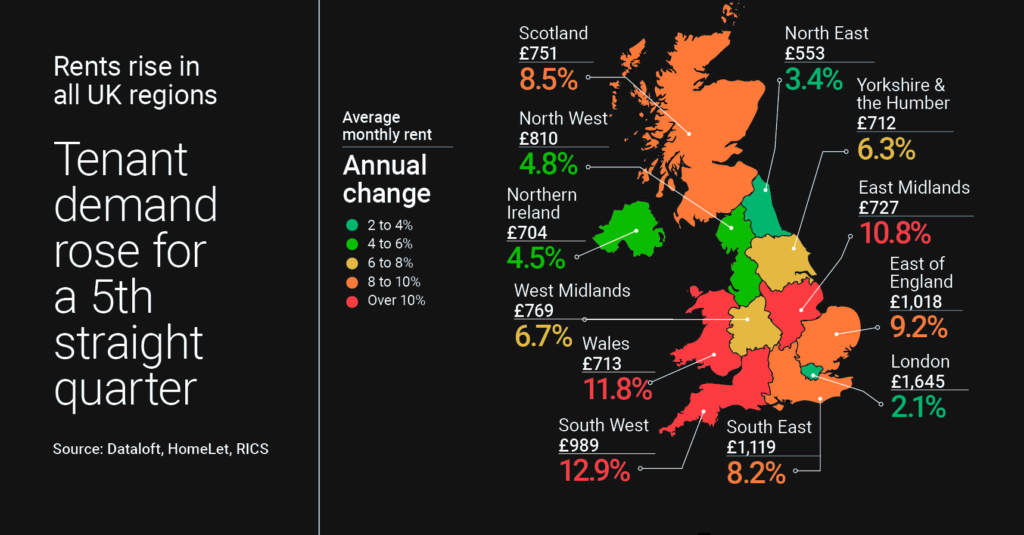

According to the RICS residential survey, tenant demand rose for a fifth straight quarter and all regions in the UK saw an annual increase in monthly rent in July.

The South West experienced the biggest increase at 12.9%, followed by Wales at 11.8% and the East Midlands at 10.8%.

The imbalance between supply and demand has put upward pressure on prices, and rents are expected to further increase by 3% over the next year.

These rising rents, the ability to secure attractive fixed rate mortgages at historically low rates, and double digit 5-year price growth forecasts are all adding to the appeal of residential property investment once again.

Outlook

The Chancellor has now confirmed the Autumn Budget will take place on 27th October which marks another crossroads which could trigger opportunities or threats to the property market based on policy announcements.

In the near term, the market remains exceptionally busy in most locations.

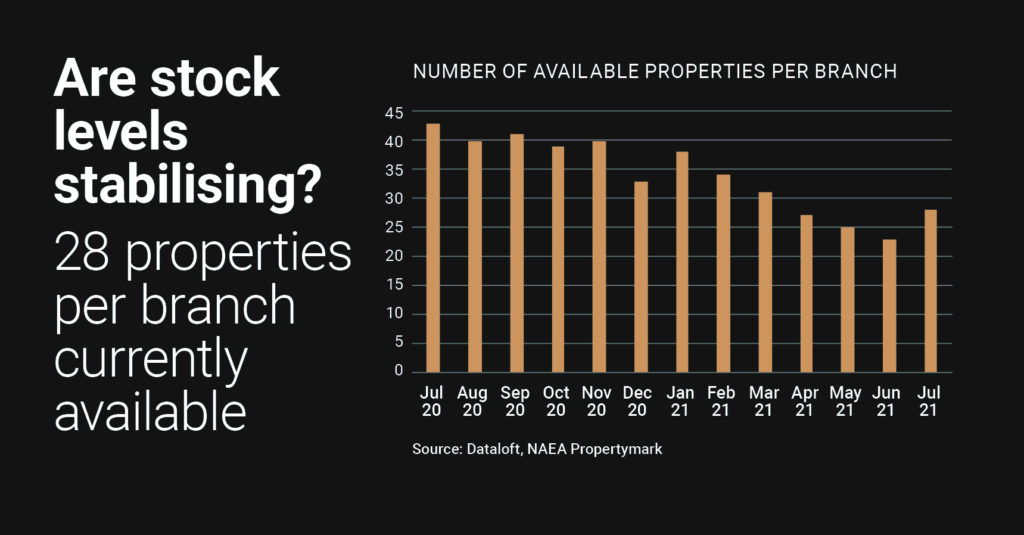

There are early signs that stock levels may have started to stabilise over the summer as more property has been listed for sale, but by historical standards, it still remains low.

If new listings do pick up, this will further support transaction momentum as we head into the autumn.

As always, Garrington will continue to closely monitor and report emerging trends and market activity.

If you would like to discuss your own property plans, please feel free to get in touch using the contact details below.