Welcome to the April edition of Garrington’s UK Property Market Review. As spring unfolds, the property market enters a...

UK Property News – April 2024

Welcome to the April edition of Garrington’s monthly UK property market review.

With Easter falling early this year, children back to school and lighter evenings, the spring market feels well and truly under way. Compared to a year ago the UK property market is in much better health, but activity is somewhat subdued by historical comparison.

This is reflected in the latest house price data, which shines a light on the mixed messages being seen this year. Nationwide reports that the annual rate of house price inflation was 1.6% last month, but that the monthly rate fell by 0.2% in March.

Halifax paint a similar picture, recording that the average UK house price is remains up by 0.3% year-on-year, despite average values falling in March by 1%.

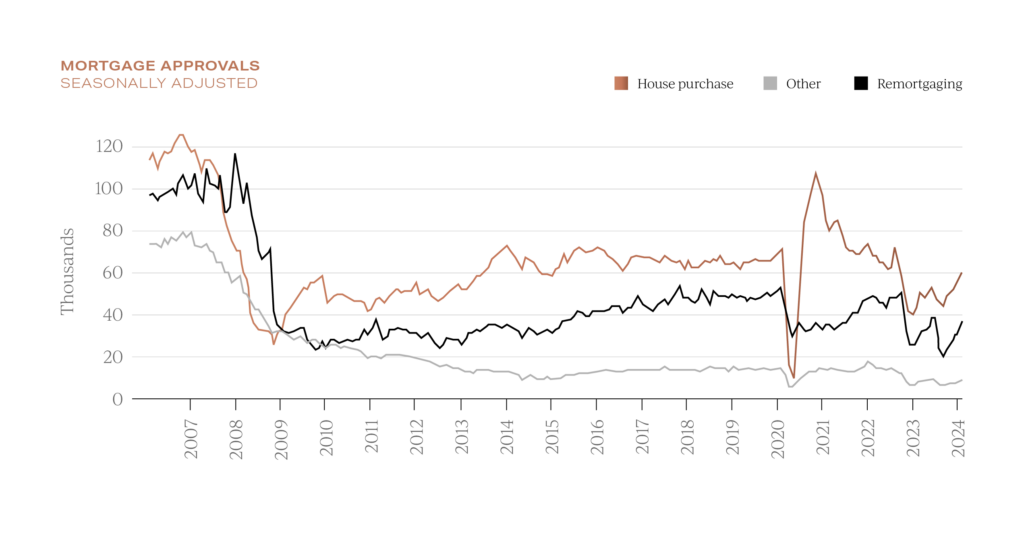

Mortgage approvals are a useful forward indicator of purchaser intentions, and data just released by the Bank of England shows that these net approvals rose to 60,400 in February. Compared to February last year this is a jump of 40%. While we may have to wait until the Bank of England’s next Base Rate decision in May for any news of potential rate cuts, the UK property market is gradually returning to a healthier state and we are seeing increasing numbers of buyers deciding that now is the time to strike.

While we may have to wait until the Bank of England’s next Base Rate decision in May for any news of potential rate cuts, the UK property market is gradually returning to a healthier state and we are seeing increasing numbers of buyers deciding that now is the time to strike.

Some of the earlier forecasts by economists of imminent cuts have had to be revised as the Bank has made it clear that it is still focused on bringing inflation down to its target level.

Quantity and velocity of UK property activity

At a headline level, market data appears more positive when measuring the volume of sales, but evaluating different aspects of the market reveals a wide range of emerging and differing trends.

Across different sectors and in most parts of the UK, more property is being listed for sale. According to Zoopla, the stock of homes being listed for sale has increased by 20% compared to a year ago.

On the face of it, this is encouraging as many sellers will in turn become buyers with onward purchases, but currently buyer demand has only risen by a mere 4%.

On the face of it, this is encouraging as many sellers will in turn become buyers with onward purchases, but currently buyer demand has only risen by a mere 4%.

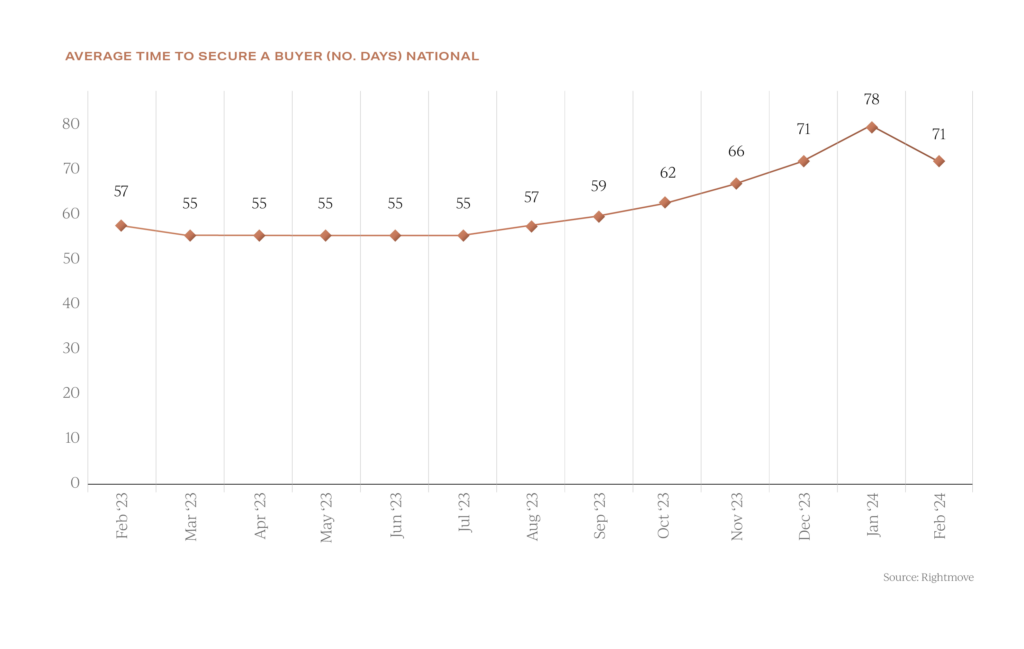

This number helps to explain why in many locations it remains a buyer’s market as supply is far outstripping demand. This factor is also affecting the time taken to secure a buyer. Rightmove report that on average this is now taking 71 days, which is the longest period at this time of year since 2019.

This factor is also affecting the time taken to secure a buyer. Rightmove report that on average this is now taking 71 days, which is the longest period at this time of year since 2019.

Having agreed a sale, getting a transaction exchanged is also taking longer according to Propertymark.

The duration of deals taking over 13 weeks or more to exchange is up considerably when compared to the long-term average and indicative of the underlining fragility in the current market.

The duration of deals taking over 13 weeks or more to exchange is up considerably when compared to the long-term average and indicative of the underlining fragility in the current market.

Views among buyers and sellers as to what represents ‘fair market value’ appear to be heading in opposite directions. Most buyers remain price-sensitive and are not afraid to walk away from a deal if they perceive that it does not offer good value.

Having heard about a more buoyant UK property market, a number of sellers are pricing too optimistically relative to real world conditions.

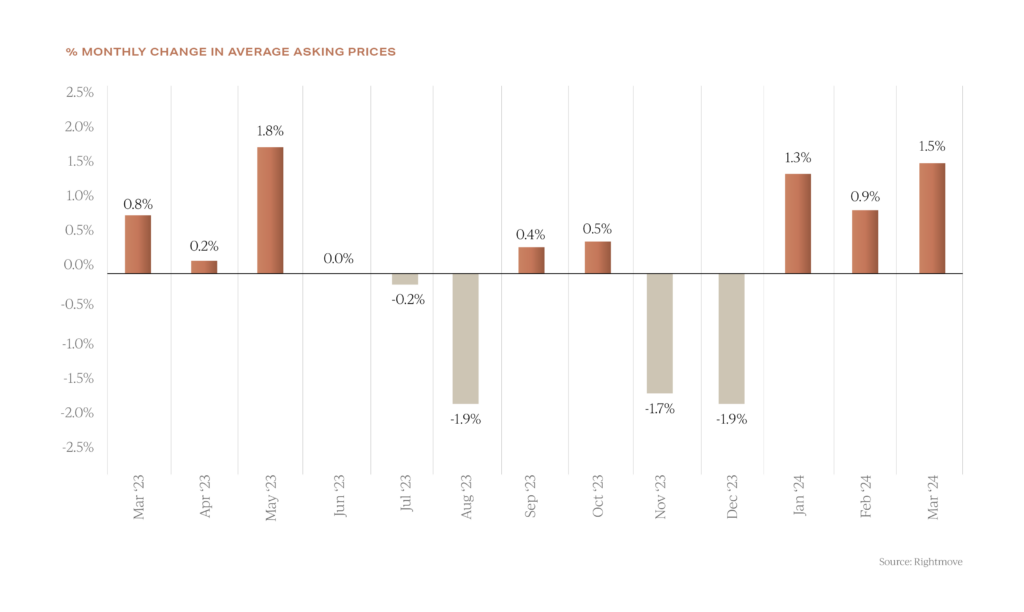

The jump of 1.5% in asking prices of new listings last month was 50% higher than the 22-year average according to Rightmove.

The jump of 1.5% in asking prices of new listings last month was 50% higher than the 22-year average according to Rightmove.

Garrington enjoys open and positive working relationships with sales agents across the UK and many have shared with our search teams that to secure new listings they are having to accept vendor-led prices to ‘test the market’ prior to either offering price reductions or accepting a lower offer. Zoopla record that 41% of agreed transactions are being discounted by 5% or more off asking prices.

As such, what could be a ‘spring surge’ in activity, could turn into a ‘spring standoff’ as the market recalibrates and a new equilibrium is found.

Heroes and zeros

Activity in London has outperformed many other parts of the UK for several months, albeit Garrington is already seeing a pause for thought in the super-prime sector because of the recent budget announcements on non-dom taxation rules.

Agreed sales of homes at £5 million and above are 11.5% lower than a year ago, but in contrast still some 40% higher than the 2017-2019 average according to LonRes.

At lower price levels in the capital, competition is fierce for quality homes which has given rise to the return of competitive bidding for certain purchasing opportunities.

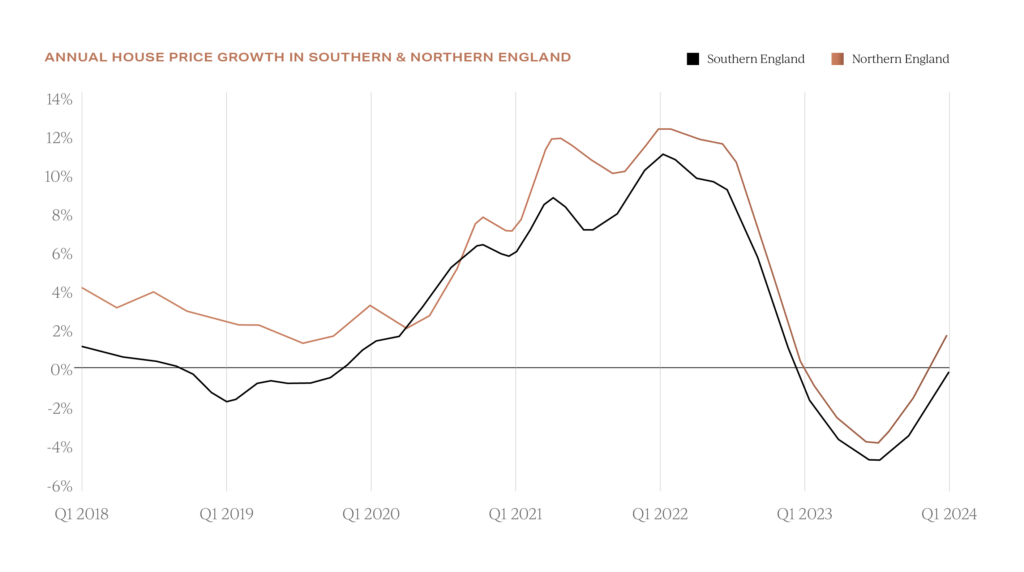

Elsewhere, leading the price growth tables across the UK is Northern Ireland, Scotland and parts of northern England.

Average UK property price to earnings ratios are typically lower in these locations, in contrast to southern England where prices fell by 0.3%.

Average UK property price to earnings ratios are typically lower in these locations, in contrast to southern England where prices fell by 0.3%.

While making sense of the twists and turns of the latest trends can be difficult for some buyers, the evidence is that the market is in recovery.

Greater choice of property options and the ability to agree attractive terms on many occasions could offer well informed buyers an interesting window of opportunity over the coming months.

If you are exploring your moving options, don’t forget to visit Garrington’s Best Places to Live research.

As ever, if you are contemplating a property purchase this year and would like some expert guidance, do get in touch with the team at Garrington using the contact details below.