Welcome to the April edition of Garrington’s UK Property Market Review. As spring unfolds, the property market enters a...

UK Property News – December 2023

Welcome to Garrington’s final market review of the year, and what a year it has been for the UK property market!

The market looks set to finish the year stronger than many economists and commentators had dared to predict at the start of 2023 and this has been further buoyed after a series of events over the last month.

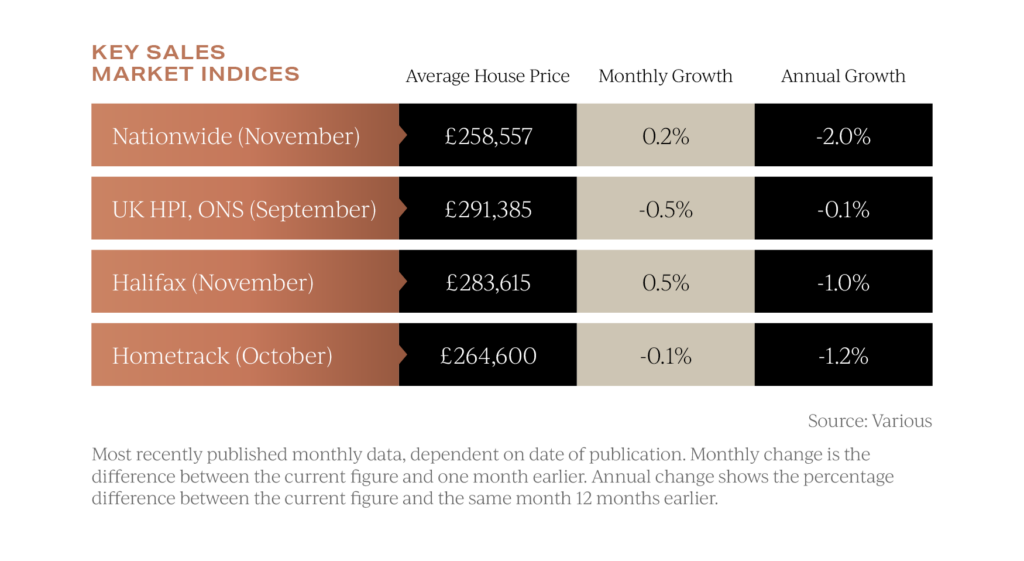

Particularly of note, and making national headlines, is the news that average house prices will have fallen by only around -1% to -2% compared to the same period 12 months ago.

As can be seen from the chart below, once again, both Nationwide and Halifax last month recorded that average asking prices had risen across the country for UK property, marking the third consecutive month of increases, and in part, reversing the falls seen earlier in the year.

For anyone amidst buying and selling a property, this data may feel at odds with the current market reality.

For anyone amidst buying and selling a property, this data may feel at odds with the current market reality.

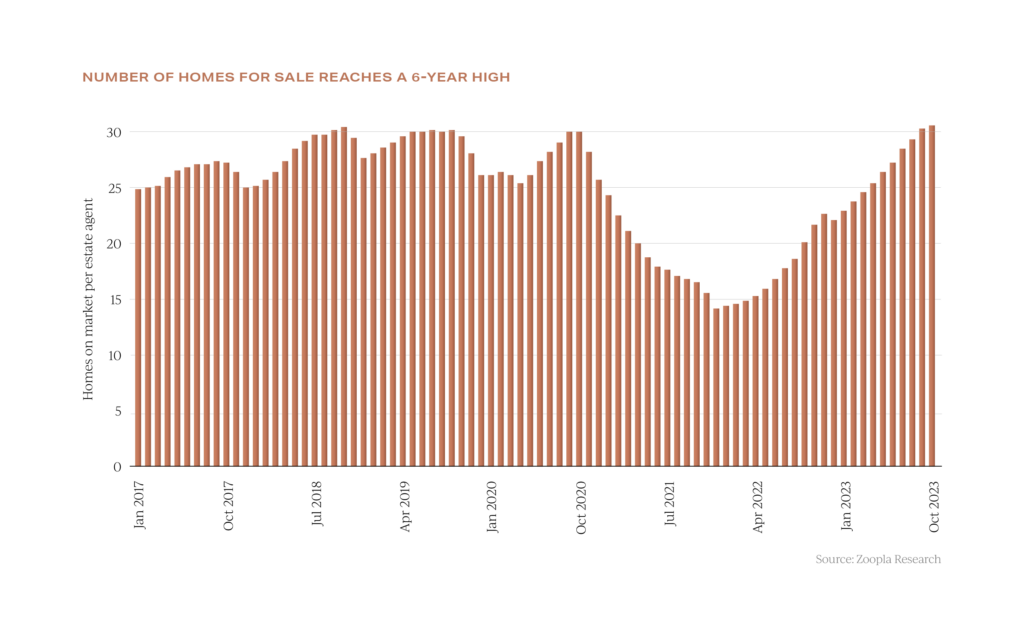

The supply of homes currently for sale is at a six-year high, and the average estate agency branch has 31 homes for sale according to Zoopla, compared to an average of 14 in the middle of the pandemic boom. With plenty of homes to choose from, buyers are frequently still being able to negotiate a discount off an asking price, but the degree to which this is possible is changing.

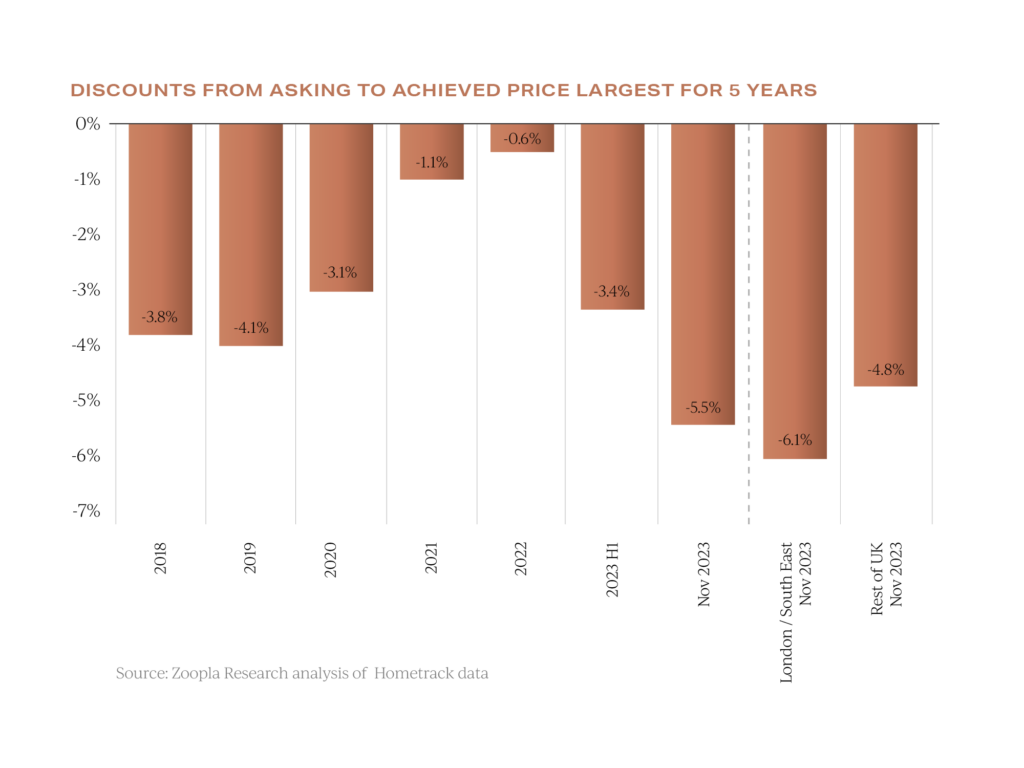

With plenty of homes to choose from, buyers are frequently still being able to negotiate a discount off an asking price, but the degree to which this is possible is changing.

As the cost-of-living crisis starts to ease, inflation continues to fall and access to relatively more affordable mortgage rates starts to improve, buyers are less able to secure the significant discounts seen earlier this year.

Will 2024 be a good year to buy a house?

The start of a new year traditionally brings a flurry of activity into the property market after a lull during December’s holiday season. Garrington has frequently been asked over recent weeks about what will happen to house prices in 2024 and whether it will be a good time to buy.

As witnessed over recent years, the safest advice may well be ‘to expect the unexpected,’ yet there are more helpful indicators from which to base assumptions upon for next year.

Last month’s Autumn Statement was a mute event in that no announcements were made that will either support or hinder the property market in the short term. However, 2024 will either see an election in the UK, or the run up to one in early 2025. Between now and then the Chancellor may well include ‘voter friendly’ policies linked to the housing market in his Spring Budget which is tipped to take place in March.

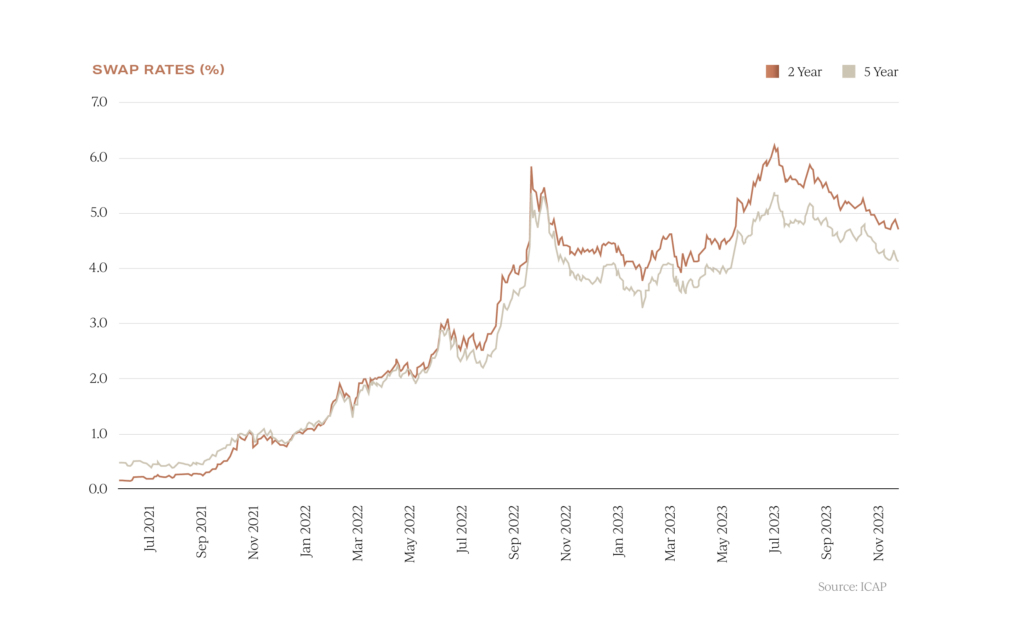

The Bank of England’s Monetary Policy Committee has now held interest rates since August and economists are predicting that despite inflation falling slower than expected, the base rate has peaked which is leading to cheaper mortgage rates.

As can be seen on the chart above, swap rates which underpin mortgage pricing for two-year and five-year rates are both falling. Both Goldman Sachs and Capital Economics predict that whilst the base rate may be held steady for longer, it could be down to 3.5% by the middle to end of 2025.

As can be seen on the chart above, swap rates which underpin mortgage pricing for two-year and five-year rates are both falling. Both Goldman Sachs and Capital Economics predict that whilst the base rate may be held steady for longer, it could be down to 3.5% by the middle to end of 2025.

As the year ahead progresses, comparatively lower borrowing rates combined with higher rates of wage inflation should support renewed activity in the market.

The prime UK property market in 2024

In the prime market, which is more intrinsically linked to wider global influences, there is an emerging picture of a more settled outlook.

Garrington is seeing renewed purchaser interest from international buyers, particularly those who are dollar backed and from the Middle East.

Economic conditions and central bank responses both sides of the Atlantic could heavily influence foreign buyer activity next year. Dollar backed buyers are not only enjoying a discount of around 17% in prime central London from the 2015 peak, but also a secondary discount of around 12% from exchange rates. Currently, the negotiating power of buyers is strongest in London and the south-east, with the average discount off asking prices being recorded at 6.1% according to Hometrack.

Currently, the negotiating power of buyers is strongest in London and the south-east, with the average discount off asking prices being recorded at 6.1% according to Hometrack.

For savvy buyers who are less credit reliant, it could be that the most attractive UK property purchasing opportunities are seen in the earlier months of 2024, prior to the market gaining further traction.

Will house prices fall in 2024 or increase?

Economic conditions at the start of this year led to a near uniform pattern of price falls and subdued activity due to the shock factor of successive mortgage rate rises and spiralling inflation levels.

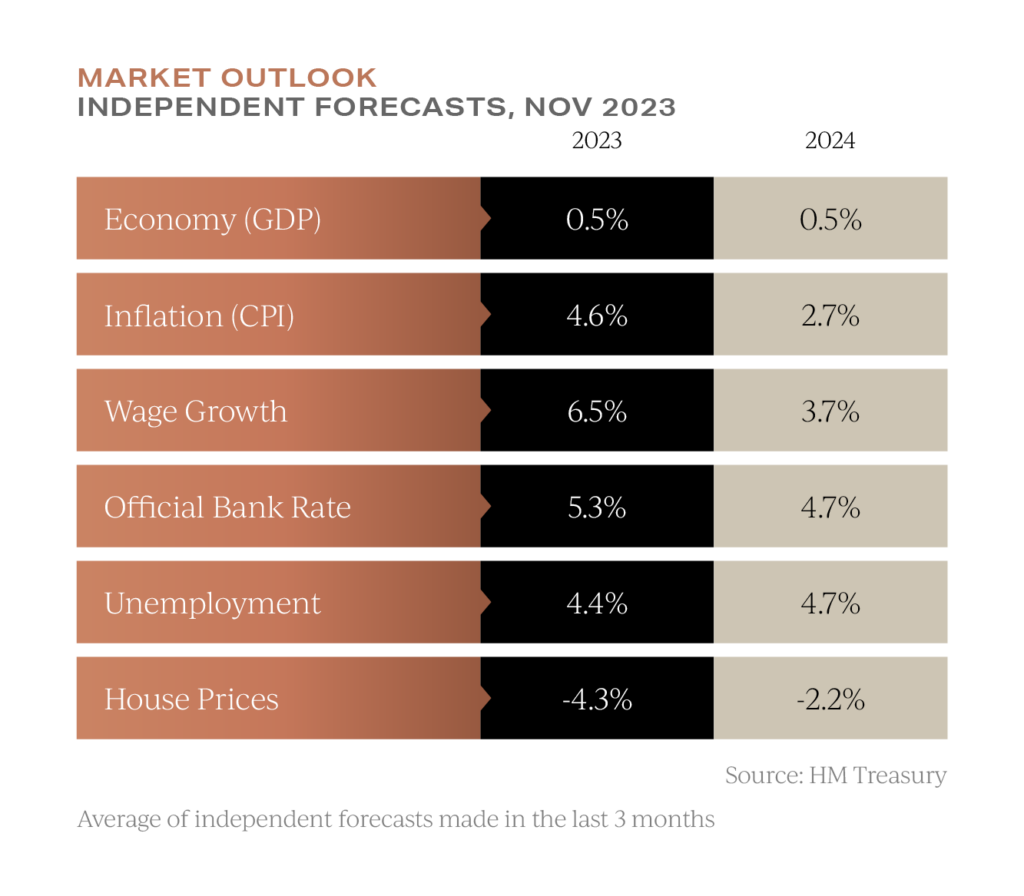

As we head into next year, economic conditions have improved and as can be seen below, this trend is forecasted to continue, albeit the picture remains a fragile one. Several think tanks are predicting further house price falls in 2024. However, as already seen over recent months, the market is increasingly splintering and performing quite differently by location, price band and purchaser group and therefore the chances of seeing such a pattern of uniform price falls, as seen this year, is more unlikely.

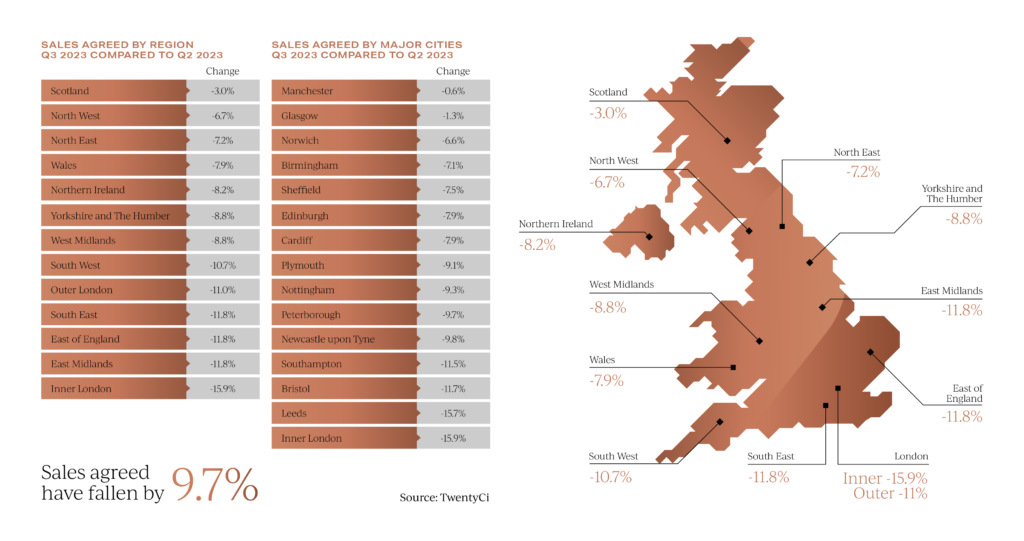

Several think tanks are predicting further house price falls in 2024. However, as already seen over recent months, the market is increasingly splintering and performing quite differently by location, price band and purchaser group and therefore the chances of seeing such a pattern of uniform price falls, as seen this year, is more unlikely. On a regional basis, sales transaction volumes have fallen this year anywhere between 3% in Scotland to being down as much as 15.9% in central London.

On a regional basis, sales transaction volumes have fallen this year anywhere between 3% in Scotland to being down as much as 15.9% in central London.

The timing of the election will have a significant impact on market dynamics and accordingly price volatility next year. If a snap election were called in the first half of the year, this would severely impinge what many are predicting could be the moment when the market will gain most traction from pent-up demand.

It looks set to be another ‘interesting year’ for UK property, with many twists and turns. In such a polarised market, obtaining tailored advice will be prerequisite to making clear and confident purchasing decisions in 2024.

In the meantime, do get in touch if you require any assistance from the Garrington team with your own UK property plans and would appreciate some objective tailored advice.