Welcome to the April edition of Garrington’s UK Property Market Review. As spring unfolds, the property market enters a...

UK Property News – February 2024

Welcome to the February edition of Garrington’s UK Property market review.

We reported last month that the year had started with several positive forward indicators and, thus far, these have proved reliable, transpiring into forward momentum for the market with activity levels much improved compared to recent months.

However, there is one significant unanswered question overhanging the near-term outlook: is this only temporary, or the start of a meaningful trend for the rest of the year?

Many hesitant buyers have held back their moving plans and are trying to time their purchase to coincide with favourable conditions. Recent news of changing market dynamics may well encourage some movers to accelerate their plans.

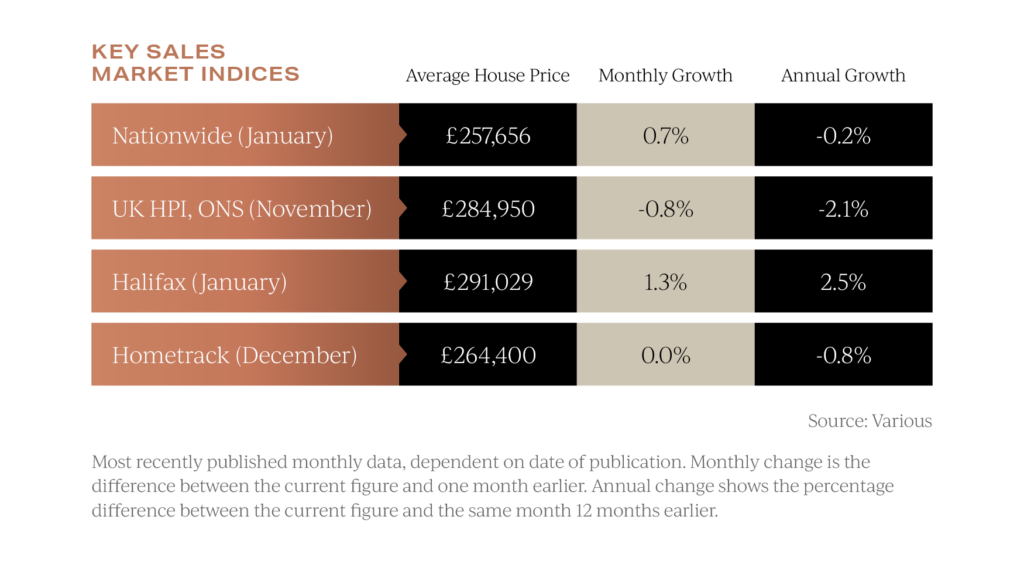

Britain’s two largest house price indices have both reported further price gains last month. Nationwide recorded a 0.7% jump in average values in January and Halifax recorded a rise of 1.3%. This is the fastest rate of price growth seen for 12 months and this was the fourth consecutive monthly increase being reported by Halifax.

As recent as last month, Halifax also reported that the average UK property rose in value by £4,800 during the whole of 2023. This new data shows that it rose by a further £4,000 in January alone, although such rapid appreciation will probably start to steady as more homes come onto the market.

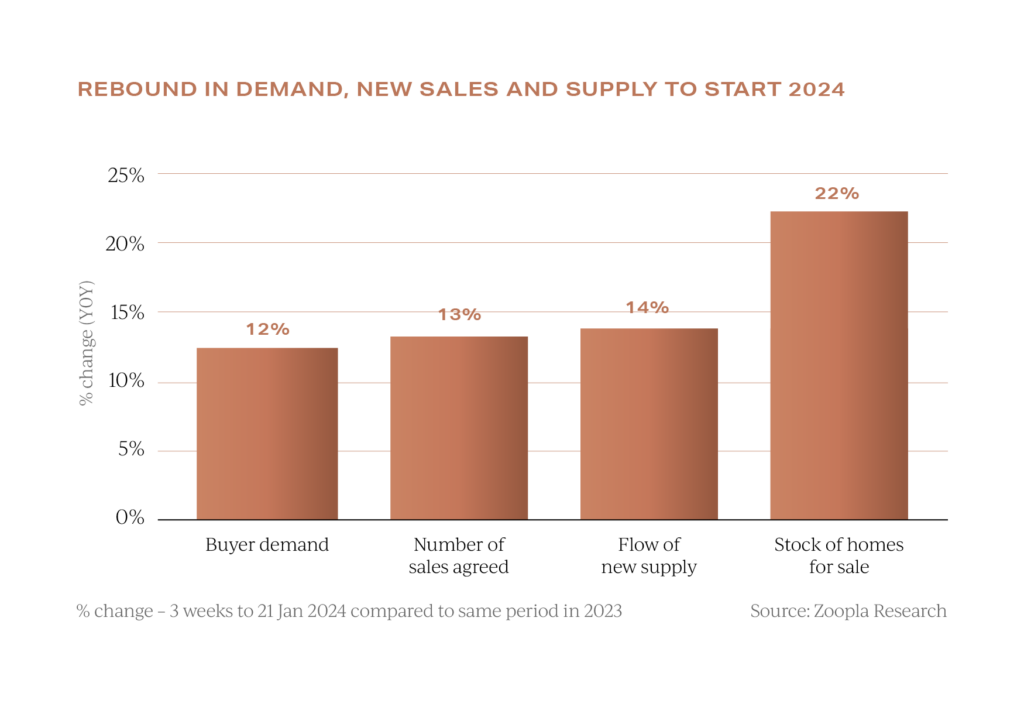

Buyer demand grew by 12% and new agreed transactions rose by 13% last month according to Zoopla, with the total stock of homes for sale in the UK rising by 22%.

These are encouraging trends, but obviously only capture a moment in time and the market remains volatile in nature.

These are encouraging trends, but obviously only capture a moment in time and the market remains volatile in nature.

Nevertheless, the market would appear to have turned a corner, with the combination of more affordable mortgages and a growing sense that prices have normalised, prompting a resurgence in activity.

The rate of change

The intertwined relationship between UK property prices and interest rates cannot be overstated. Despite a significant proportion of property transactions being cash-funded, the cost and ease of access to credit can both support and suppress consumer confidence and consequently house prices.

The Bank of England held the Bank Rate at 5.25% in its February meeting, meaning it has remained at this level for 6 months now.

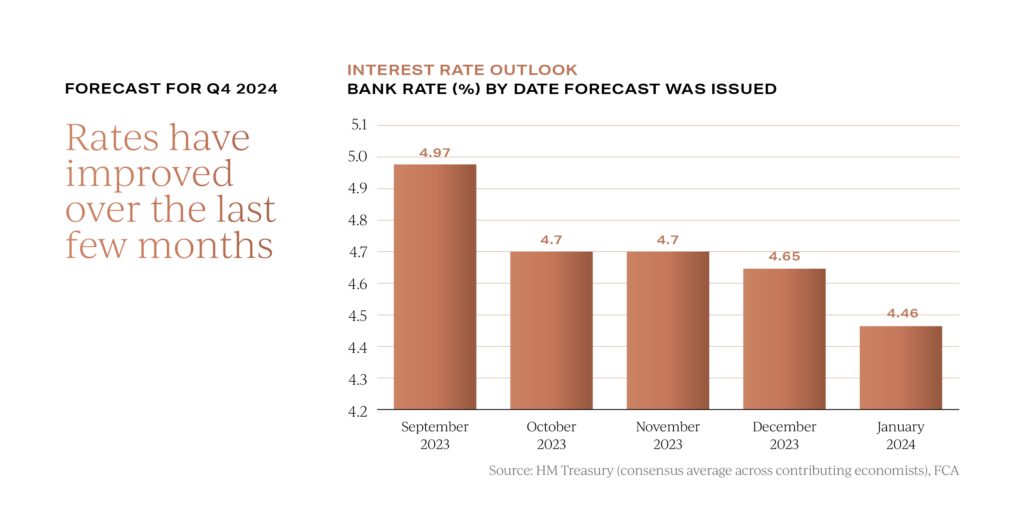

Given current economic data, it is more likely that interest rates will be cut in the second half of 2024, not the first.

The latest consensus forecast is for the Bank Rate to be 4.5% by the year end.

Looking back over recent months, the interest rate expectations in the monthly consensus forecasts have been improving. The forecast issued in September 2023 was for 5% by the end of 2024.

Looking back over recent months, the interest rate expectations in the monthly consensus forecasts have been improving. The forecast issued in September 2023 was for 5% by the end of 2024.

Many of the lenders who aggressively lowered their product rates in January have been deluged with demand from borrowers.

Consequently, some lenders have increased their mortgage rates again to cool demand.

Mixed economic indicators, including inflation remaining at 4% last month, further highlights that the exact timing of future interest rate movements will remain highly uncertain in nature for the foreseeable future.

Calm, considered purchases

At face value, rising average prices, falling mortgage rates and increased transaction volumes suggest it is simply back to ‘business as usual’ for the property market, but this would be a massive simplification of what is a far more complex picture.

The trend Garrington is seeing in the market is rising levels of confidence to proceed with a purchase, but not at any cost. Buyers remain price-sensitive, well informed and may have adapted their plans to move in the current climate.

Garrington’s recently published Best Places to Live in 2024 research highlights how the property map has been redrawn because of price falls, and an increase in buyers looking for good quality locations that offer more for their budget. If you have not seen our research do follow the link below.

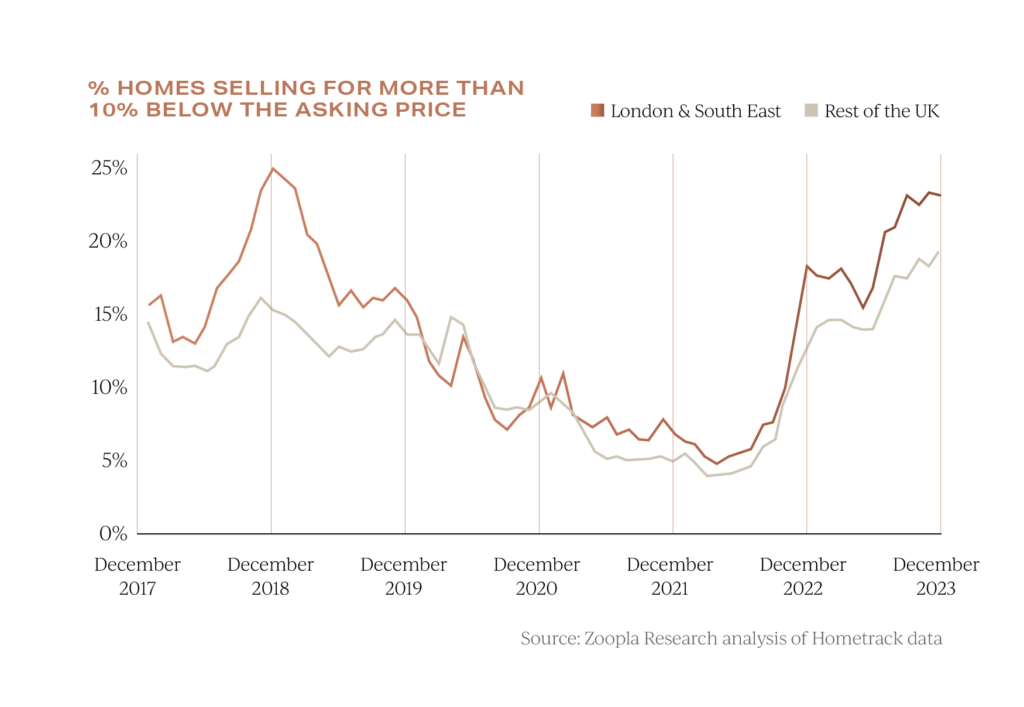

Despite rising average values, Hometrack notes that over 1 in 5 sellers are having to accept more than 10% off their home’s asking price to agree a sale.

This figure is close to 1 in 4 sellers in London and the south-east and rising across other parts of the UK.

This figure is close to 1 in 4 sellers in London and the south-east and rising across other parts of the UK.

Apart from best-in-class homes in the most desirable locations, much of the market remains tilted in favour of proceedable buyers who can unlock a seller’s moving plans with the right compelling offer.

Outlook for UK Property

All eyes will be on the Chancellor on the 6th of March as he announces his Spring Budget. Not only is there the potential for several key announcements that could further support the UK property market, but it will also contain crucial information as to the true health of the UK economy.

Such data from the Office of Budget Responsibility will feed straight into decision makers at the Bank of England, in turn, offering further clues on fiscal policy and the timing of any lowering of interest rates.

Assuming the Prime Minister holds true to his previous comments of not planning a snap election in May, there is every prospect of a busy spring market based on the current patterns and trends witnessed so far this year.

Garrington is already seeing a healthy volume of off-market property that will be launched in spring, if not sold beforehand, and levels of cautious optimism are rising for a more buoyant year ahead.

We hope you have found our latest insights and research useful. Don’t forget to click the link below to see our Best Places to Live research.

As ever, if you are contemplating a property purchase this year and would like some expert guidance, do contact us to learn how Garrington can assist you.