Welcome to the April edition of Garrington’s UK Property Market Review. As spring unfolds, the property market enters a...

UK Property News – January 2024

Welcome to Garrington’s first UK property market review of 2024.

The initial weeks of the new year have been surprisingly busy in the property market and a flurry of data and statistics released over the last few weeks suggest that after months of meandering, the market is back in gear and gaining traction.

Rightmove reported a Boxing Day bonanza of activity on its portal. A record-breaking 26% increase in new sellers compared to the previous year was observed.

The platform experienced an 84% increase in website visits from Christmas Day to Boxing Day and buyer enquiries to estate agents surged by 273%, surpassing the activity levels of the same period in 2022.

Echoing this trend, Zoopla reported the first full week back after the new year saw buyer interest jump faster than the pre-pandemic period in 2019.

Lenders slash mortgage rates

The new year has also brought some much-needed cheer for mortgage borrowers. Many big lenders are in fierce competition and have started to slash rates.

Currently the average five-year fixed rate is now 5.55%, down from its peak of 6.37% in August, while two-year products stand at 5.93%, down from 6.86% in July.

However, a number of lenders are now offering sub 4% products for a five-year fixed rate, whilst some have unveiled two-year deals within touching distance of the 4% threshold.

Product choice rose for the sixth month in a row, reaching 5,899 options, a 15-year high. The average shelf life of a product has lengthened to 21 days, the highest level since June, indicating increasing stability in the mortgage market.

Purchaser intent appears to be aligning with wider market activity based on data released in December by the Bank of England. This shows that the number of mortgages approved to finance house purchases increased in November by 4.6%. Year-on-year the November figure was 9.9% above November 2022.

As forward indicators, this data, coupled with lower borrowing costs does point to a rebound in market interest, but it is obviously early days and plenty of events are expected to unfold over the coming months.

The power of politics with UK property

In the first few days of the year, it was confirmed that the Spring Budget will take place on Wednesday 6th March.

History shows us that any Government fighting to stay in power will do what they can to stimulate the UK property market, given its intrinsic link to perceived feelings of personal wealth amongst the electorate. With a seemingly reigniting market, there may be more fuel added by the Chancellor to further stoke activity.

If a budget can ignite market activity, history also shows that an election will suppress it. As such, the Prime Minister’s recent comments that a May election appears unlikely also suggests that the first half of the year appears to be clear of political obstacles for the property market.

A price led UK property market

House prices were not far from the headlines throughout the last year but, to the surprise of many commentators, remained broadly stable and did not fall anywhere near as far as some had previously predicted.

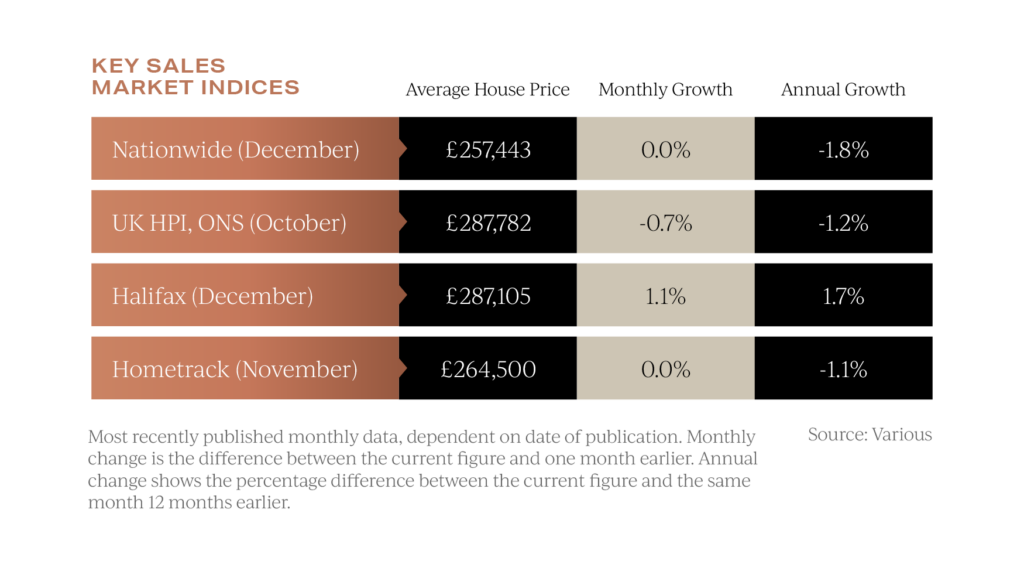

As frequently is the case, there are nuances between various house price indices, but all paint a similar picture in that price falls are slowing and, in some cases, have completely stabilised.

Nationwide and Halifax disagreed about where the year ended up though. The former recorded an annual price fall of -1.8% for 2023, whilst in contrast, Halifax recorded a rise of 1.7% for the value of an average property. Diverging opinions and data are likely to be an ongoing theme this year, as different parts of the market and locations recover and behave in a variety of ways.

Diverging opinions and data are likely to be an ongoing theme this year, as different parts of the market and locations recover and behave in a variety of ways.

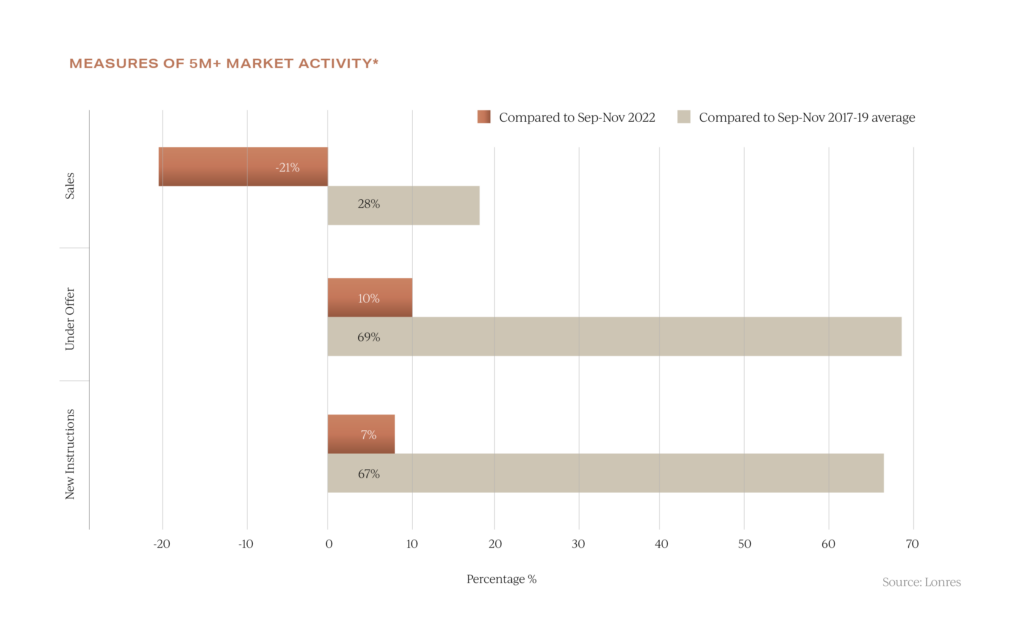

As previously reported by Garrington, the prime UK property market is gathering momentum once again and owners of higher value homes have increased asking prices of new listings by an average of 2.5% in December according to Rightmove. In prime central London, the best performing part of the market over the last year was the £5 million plus sector. Although only making up 8% of the total prime London market, sales increased by 28% compared with the 2017-2019 average.

In prime central London, the best performing part of the market over the last year was the £5 million plus sector. Although only making up 8% of the total prime London market, sales increased by 28% compared with the 2017-2019 average.

Whilst the London market is frequently decoupled from other parts of the UK, it does traditionally act as precursor to what is likely to be seen in other locations.

Optimistic yet fragile

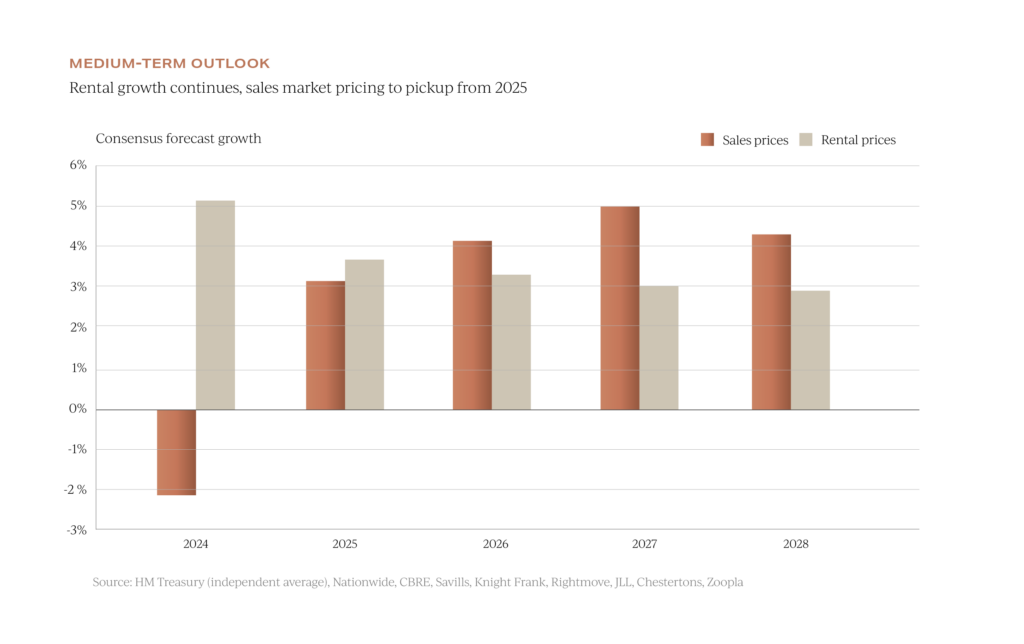

There is a growing belief and evidence that the short to medium term outlook for the UK property market looks more encouraging.

However, the consensus forecast for the year ahead is currently predicting that overall, prices could fall on average by 2.1%. Rents, in contrast, are expected to increase this year and are predicted to rise by an average of 3.6% over the next five years.

Rents, in contrast, are expected to increase this year and are predicted to rise by an average of 3.6% over the next five years.

Many of these forecasts were made at the end of last year, prior to the recent round of mortgage rate cuts and, as a consequence, are already being upwardly revised in some cases.

Forecasters at three leading institutions have suggested the inflation rate will halve to 2% by April, potentially meaning the Bank of England could bring forward the date of its first base interest rate cut. If this transpires, it will no doubt further support a stronger year for the market.

As ever, change looks to be the only certainty, and despite the wider economy remaining fragile, the new year has brought about a wave of cautious optimism for the prospect of an improving market for the year ahead.

We hope you have found our latest insights and research useful. If you are contemplating a property purchase this year and would like some expert guidance, do get in touch with the team at Garrington.