Welcome to the April edition of Garrington’s UK Property Market Review. As spring unfolds, the property market enters a...

UK Property and the impact of Labour’s 1.5M homes target

Welcome to Garrington’s post-election UK property market review.

If a week in politics is said to be a long time, then the six weeks since the election date was announced has seemed like an eternity and has led to a level of hesitation and distraction in the property market and wider economy.

The newly formed government, with a large majority of seats, has seemingly wasted no time getting to grips with converting manifesto pledges into policies, and the housing market was a core theme to Rachel Reeve’s first speech in her new role as chancellor.

With housing being a perennial issue of concern for both the electorate and policymakers, the new administration’s approach and policies will be closely scrutinised for their potential impact on property prices, availability, and overall market stability.

The Green Belt turns grey

The new government has immediately reintroduced mandatory housing targets for local councils to “get Britain building again” and tackle long-standing issues in the housing market.

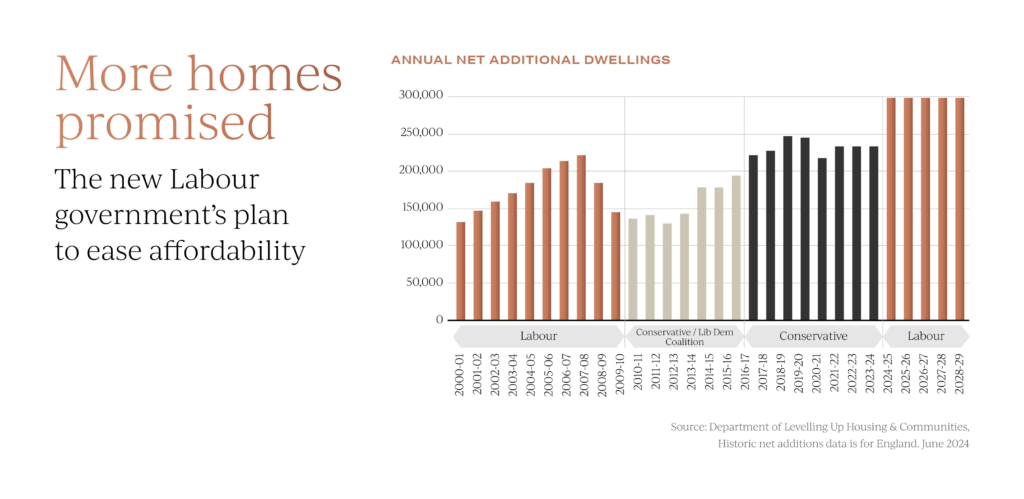

Labour has pledged to build 1.5 million homes in their first 5 years. This equates to 300,000 a year, in parallel with prior Conversative pledges, which were scrapped. Labour aims to boost the housing supply of affordable homes by lifting planning restrictions and providing incentives for developers. These ambitious plans include reforming planning, building a new generation of towns, devolving stronger powers to mayors and fast-tracking approval for urban brownfield development.

These ambitious plans include reforming planning, building a new generation of towns, devolving stronger powers to mayors and fast-tracking approval for urban brownfield development.

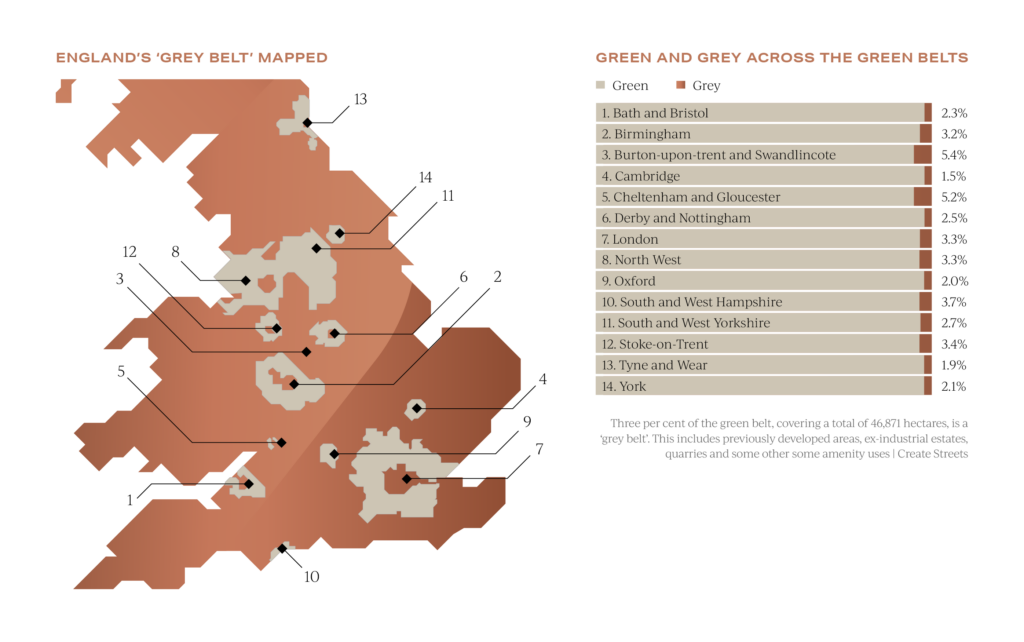

Additionally, just under 47,000 hectares of so-called ‘lower quality’ protected Green Belt land is to be reclassified ‘grey belt’, thus potentially making it easier for developers to obtain permission to build on it. Whilst this strategy will create new housing opportunities, it will also undoubtedly pose threats to established locations.

Whilst this strategy will create new housing opportunities, it will also undoubtedly pose threats to established locations.

The addition of new homes may change the dynamic of the surroundings and place extra pressure on public services and transport infrastructure.

As ever, the devil will be in the detail, but buyers will need to be increasingly alert to this factor when searching for their ideal place to live.

Half time – change ends

The start of July marks our entry into the second half of the year and, with it, a hope and expectation amongst many movers and industry commentators alike for more favourable and predictable UK property market conditions.

Price and transaction activity over the last month has been as unspectacular as the weather of late, largely due to the shadow of uncertainty cast by the election and the stalling by the Bank of England to hold interest rates ‘higher for longer’, but nonetheless the market has further demonstrated its resilience. On a monthly basis, both Halifax and Nationwide paint a fairly static picture on price movements at -0.2% and +0.2% respectively, and virtually an identical rate of annual house price inflation.

On a monthly basis, both Halifax and Nationwide paint a fairly static picture on price movements at -0.2% and +0.2% respectively, and virtually an identical rate of annual house price inflation.

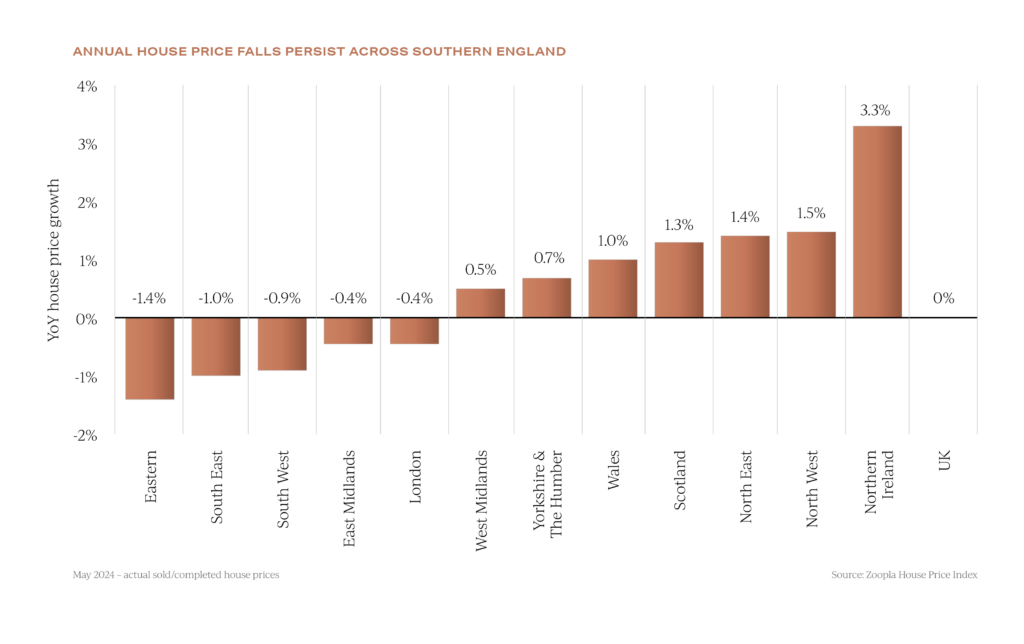

As Garrington has reported previously, national indices mask a more complex and nuanced set of trends across different regions and sectors of the UK property market.

From a supply perspective, Garrington is already seeing a flurry of new listings enter the prime market, which had been deliberately held back pending the election result.

Particularly for the UK property’s prime market, the second half of the year will be a pivotal time as to whether buyer demand increases and absorbs this influx of supply.

According to Twenty Ci, the volume of £1 million plus homes for sale between January to May is 23% higher than a year ago and 38% higher than the same period in 2022. In areas with a greater concentration of higher valued homes, this factor is continuing to cause regional disparity on house prices, as can be seen above, with the South and East languishing behind. There is now a 4.7% difference in the rate of price movements between the highest and lowest performing regions in the UK.

In areas with a greater concentration of higher valued homes, this factor is continuing to cause regional disparity on house prices, as can be seen above, with the South and East languishing behind. There is now a 4.7% difference in the rate of price movements between the highest and lowest performing regions in the UK.

Many so-called ‘next time’ buyers have been stifled by increased borrowing costs, so the announcements over recent days by many of Britain’s biggest lenders of reduced product rates for mortgages will be welcome news and could be the catalyst for some buyers to now act.

A rosier outlook for UK property

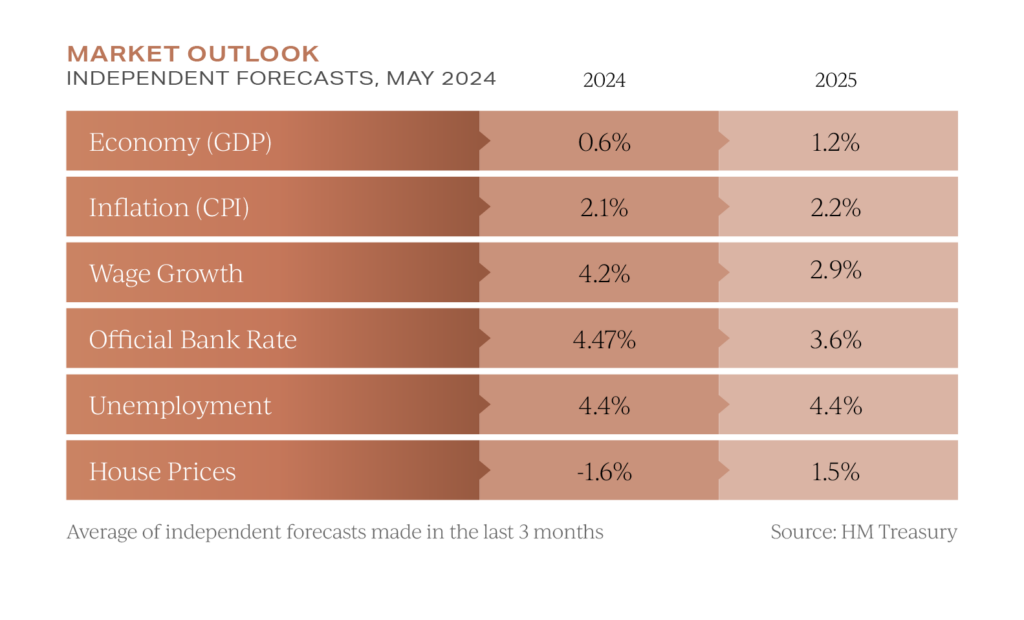

Whilst we undoubtedly live in uncertain times geopolitically, there appears to be a growing consensus view, that the economic outlook for the UK looks brighter for the months ahead, and in turn, the prospects for the property market too.

Forecasters at Capital Economics believe Labour is set to benefit from a combination of lower interest rates and faster economic growth than many are expecting. They are equally more optimistic than the already positive data released by HM Treasury on key economic indicators, stating that if inflation drops to around 1.5% by the end of the year, it could result in the Bank of England lowering the bank base rate to 3% next year.

They are equally more optimistic than the already positive data released by HM Treasury on key economic indicators, stating that if inflation drops to around 1.5% by the end of the year, it could result in the Bank of England lowering the bank base rate to 3% next year.

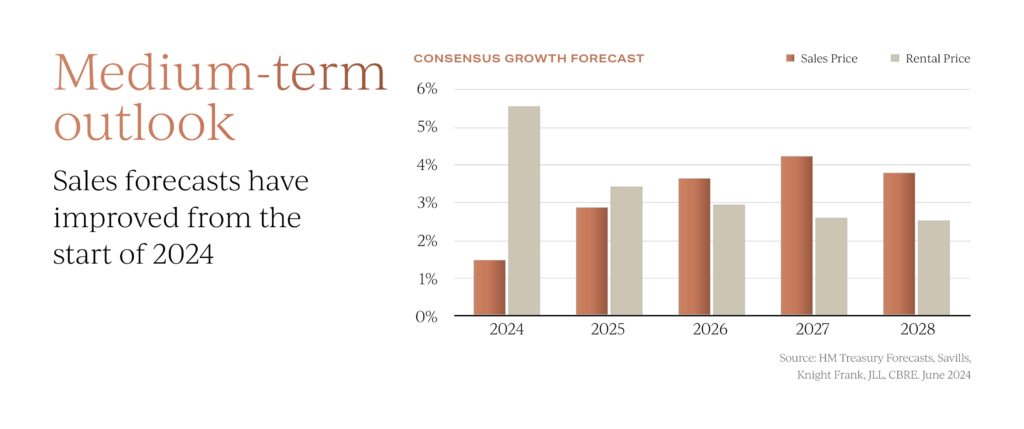

In keeping with this trend, UK property industry forecasters have also revised their expectations. The consensus forecast is now for price growth in both the sales and rental sectors, given the improving interest rate expectations and an improved economic outlook, which would create more capacity for house price growth this year.

The consensus forecast is now for price growth in both the sales and rental sectors, given the improving interest rate expectations and an improved economic outlook, which would create more capacity for house price growth this year.

The intertwined relationship between household incomes and mortgage rates will be a critical factor in the months ahead.

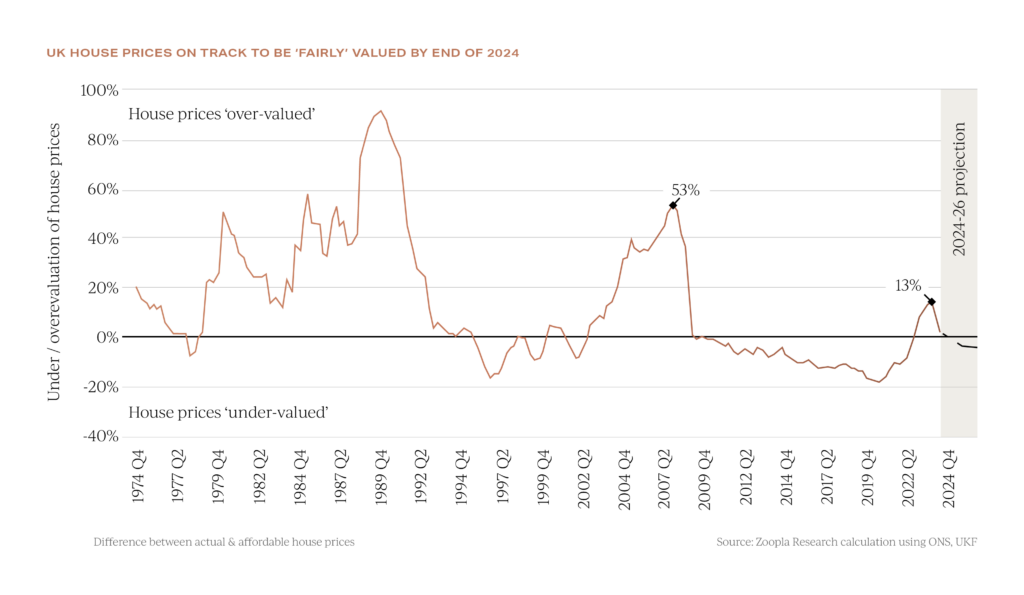

Hometrack notes that faster wage growth over the last 3 years has boosted household incomes but, in affordability terms, higher mortgage rates still make the UK property market overvalued.

However, if borrowing rates fall to 4.5% or below by year end, a more fluid market is likely to follow as ‘fair value’ is once again reached.

However, if borrowing rates fall to 4.5% or below by year end, a more fluid market is likely to follow as ‘fair value’ is once again reached.

Garrington will be closely monitoring further developments over the coming weeks to see if green shoots of an improved market are starting to emerge.

If you have been contemplating your own property plans and feel you could benefit from some tailored impartial advice, do get in touch with the team at Garrington .

If this feels premature, and you are just starting to explore your moving options, don’t forget to visit Garrington’s Best Places to Live research. Simply click on the link to see our guide and interactive location explorer.

We will be back next month to share our latest insights.