Welcome to the April edition of Garrington’s UK Property Market Review. As spring unfolds, the property market enters a...

UK Property Market Update & Outlook for Spring 2025

Welcome to the March edition of Garrington’s Market Review, where we explore the latest shifts in the UK property market.

The arrival of meteorological spring has brought a welcome change in the seasons, mirroring an improving property landscape. While confidence remains fragile, encouraging signs of renewed activity suggest that both buyers and sellers are beginning to adjust to evolving market conditions.

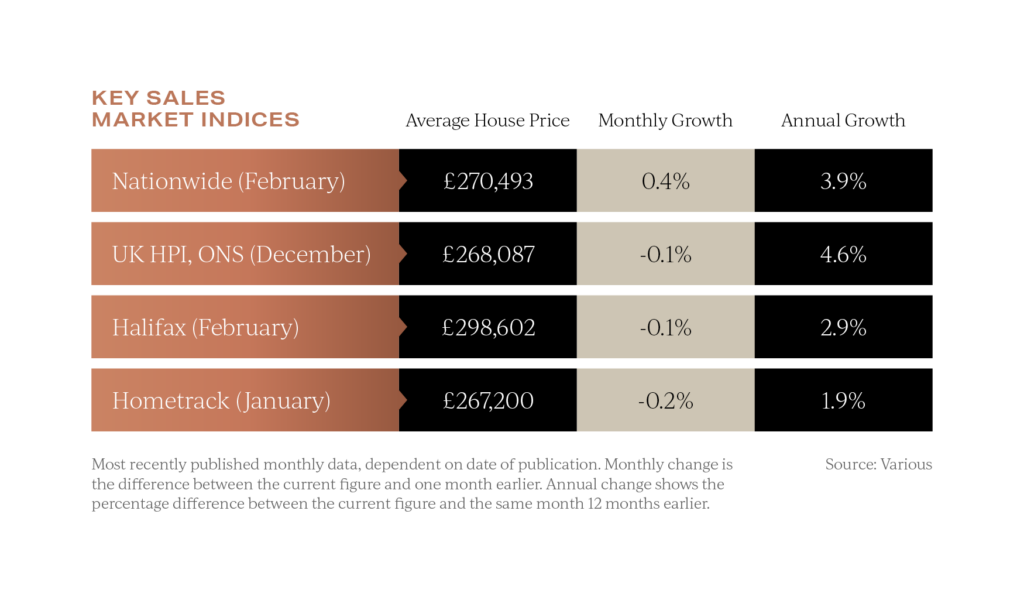

The latest house price data reflects this mixed sentiment. Nationwide reported that UK property prices edged up by 0.4% in February, marking an annual increase of 3.9%. Meanwhile, Halifax’s index painted a more subdued picture, recording a slight monthly dip of 0.1%, bringing the average property price to £298,602. However, annual growth remained steady at 2.9%, unchanged from the previous month.

Meanwhile, Halifax’s index painted a more subdued picture, recording a slight monthly dip of 0.1%, bringing the average property price to £298,602. However, annual growth remained steady at 2.9%, unchanged from the previous month.

Beneath these headline figures, regional variations remain stark, with Scotland recording its fastest house price growth in over a year at 3.8%, while London’s rate of increase slowed notably to just 1.6%.

First-Time Buyers unlock market momentum

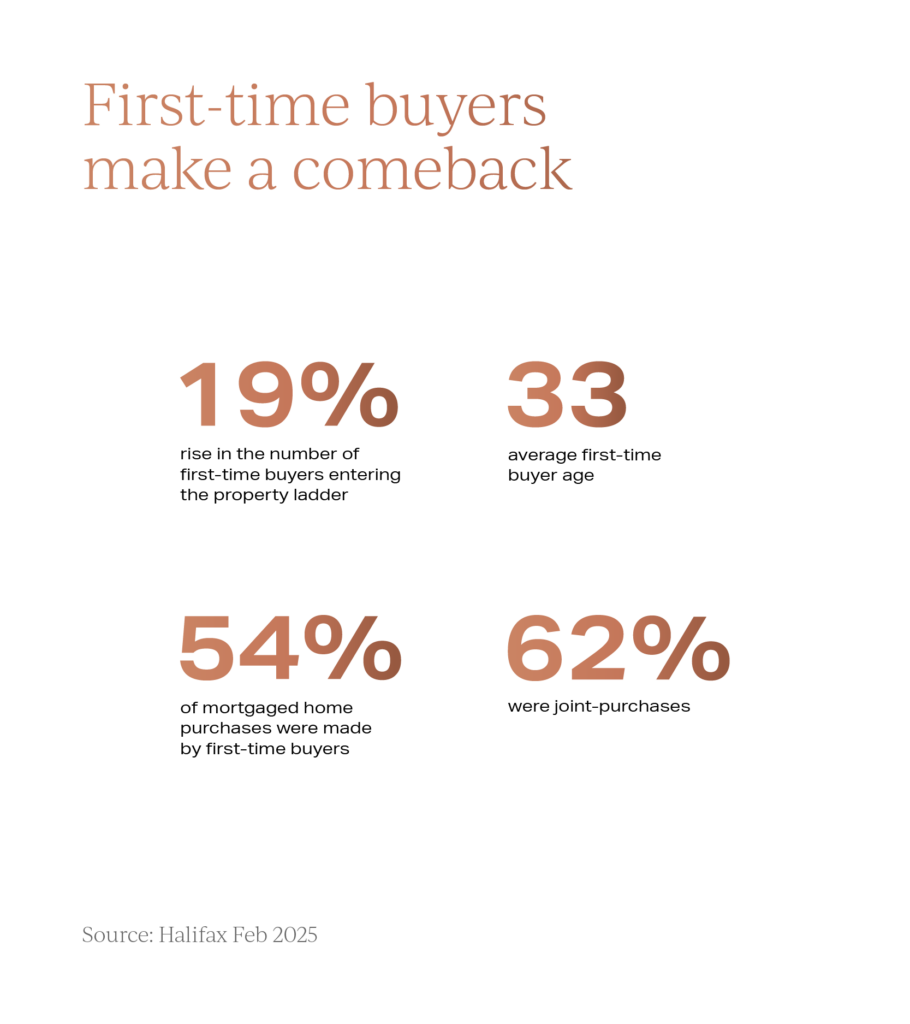

The increase in market activity over recent months has been driven in part by first-time buyers rushing to complete purchases ahead of the upcoming stamp duty changes.

From 1st April, the tax-free threshold for first-time buyers will revert from £425,000 to £300,000, prompting many to act before higher tax costs take effect.

This urgency has fuelled transactions, with first-time buyer numbers already having risen by nearly a fifth during 2024 compared to the previous year. Notably, first-time buyers now account for 54% of all mortgaged home purchases, the highest proportion on record, demonstrating resilient demand despite affordability pressures.

Notably, first-time buyers now account for 54% of all mortgaged home purchases, the highest proportion on record, demonstrating resilient demand despite affordability pressures.

The average age of a first-time buyer has risen from 31 to 33, reflecting the financial hurdles many face in stepping onto the UK property ladder.

While this wave of first-time buyer activity has provided a temporary uplift to market liquidity, the question remains whether this is a fleeting rush, or the catalyst for broader market recovery in all sectors.

Not a flat market

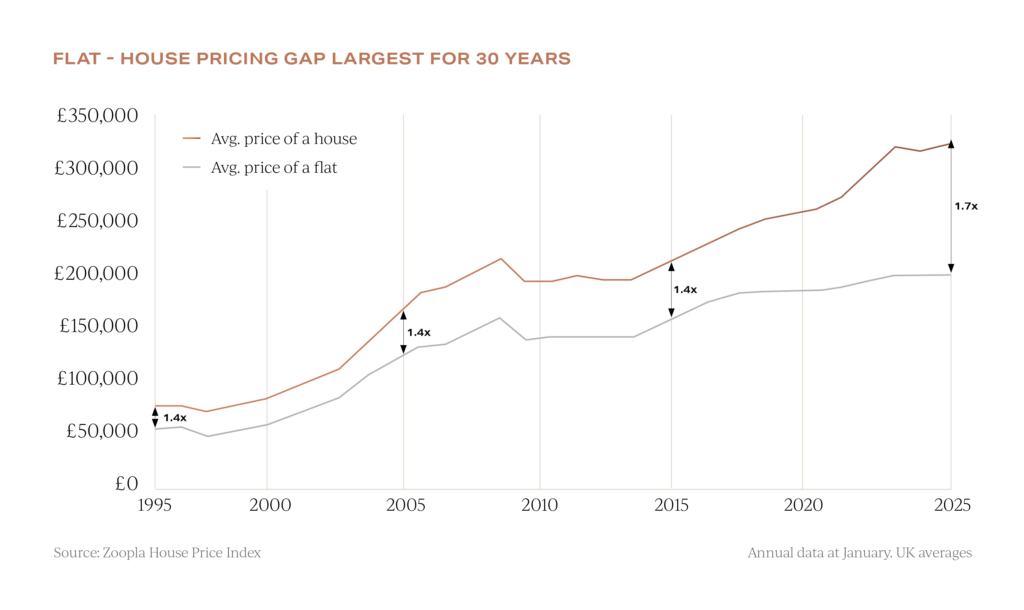

Newly published research from Hometrack highlights a stark contrast in buyer demand between houses and flats, with sales activity diverging significantly in early 2025.

While demand for houses has risen by 16% year-on-year, the market for flats has lagged.

The number of flats listed for sale has surged by 14%, far outpacing the 5% increase in houses, yet agreed sales of flats has grown by just 4%.

This mismatch has contributed to weak price growth, with flats appreciating only 0.5% annually compared to a 24% increase in house prices over the past five years.

Despite the affordability advantage, with mortgage repayments on flats 43% lower than the cost of renting, many buyers remain hesitant due to concerns over service charges, ground rents, and lingering building safety issues. As can be seen above, the price gap between houses and flats has now reached a 30-year high, with houses commanding 1.7 times the price of an average flat. Sellers of flats are also facing challenges in achieving capital gains, with 40% of listings showing an asking price of less than £20,000 above the last purchase price and 15% priced lower than their previous sale value.

As can be seen above, the price gap between houses and flats has now reached a 30-year high, with houses commanding 1.7 times the price of an average flat. Sellers of flats are also facing challenges in achieving capital gains, with 40% of listings showing an asking price of less than £20,000 above the last purchase price and 15% priced lower than their previous sale value.

With this growing disparity, there may be opportunities for savvy buyers willing to capitalise on a sector that is currently being overlooked.

Mortgage market improves

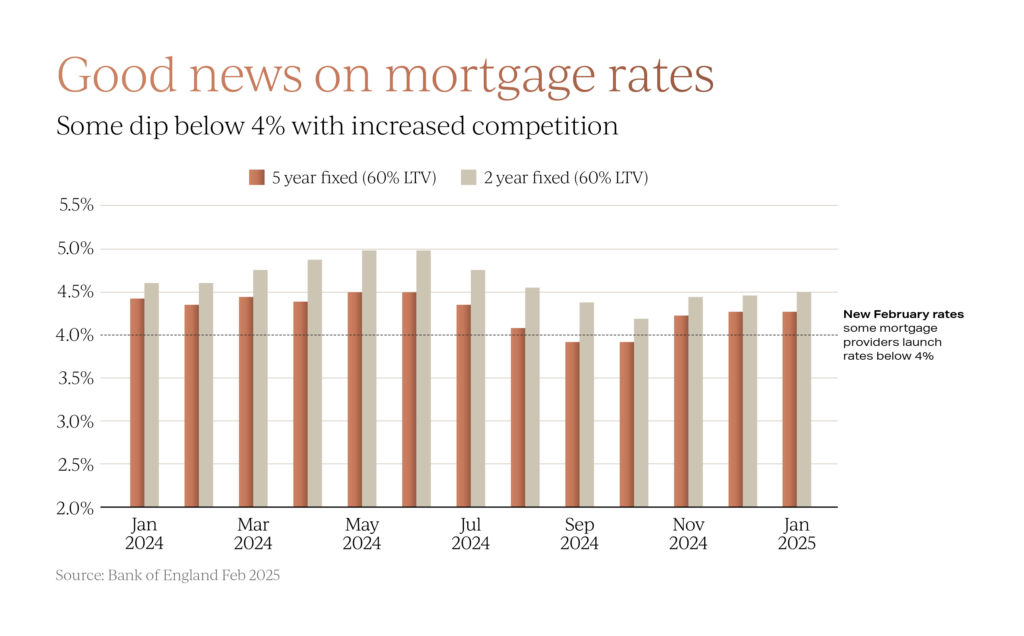

Lenders have become increasingly competitive over recent weeks, with several major banks now offering sub-4% mortgage deals at 60% loan-to-value.

This marks a shift from the past year, where even borrowers with large deposits struggled to secure rates below 4%, particularly on two-year fixed products. As shown above, mortgage rates remain above historical lows but have now fallen below key levels seen over the past 12 months, providing welcome relief for borrowers. This has coincided with a rise in mortgage approvals, up 18% in January compared to a year earlier.

As shown above, mortgage rates remain above historical lows but have now fallen below key levels seen over the past 12 months, providing welcome relief for borrowers. This has coincided with a rise in mortgage approvals, up 18% in January compared to a year earlier.

With borrowing costs easing and competition among lenders increasing, conditions for buyers are improving in some areas of the market.

Spring outlook for the UK property market

As spring approaches, the UK property market continues to show signs of improvement, but the nature of this recovery remains highly polarised. As explored earlier in this review, houses continue to outpace flats in market performance, and while mainstream properties are seeing increased activity, the prime sector remains more subdued.

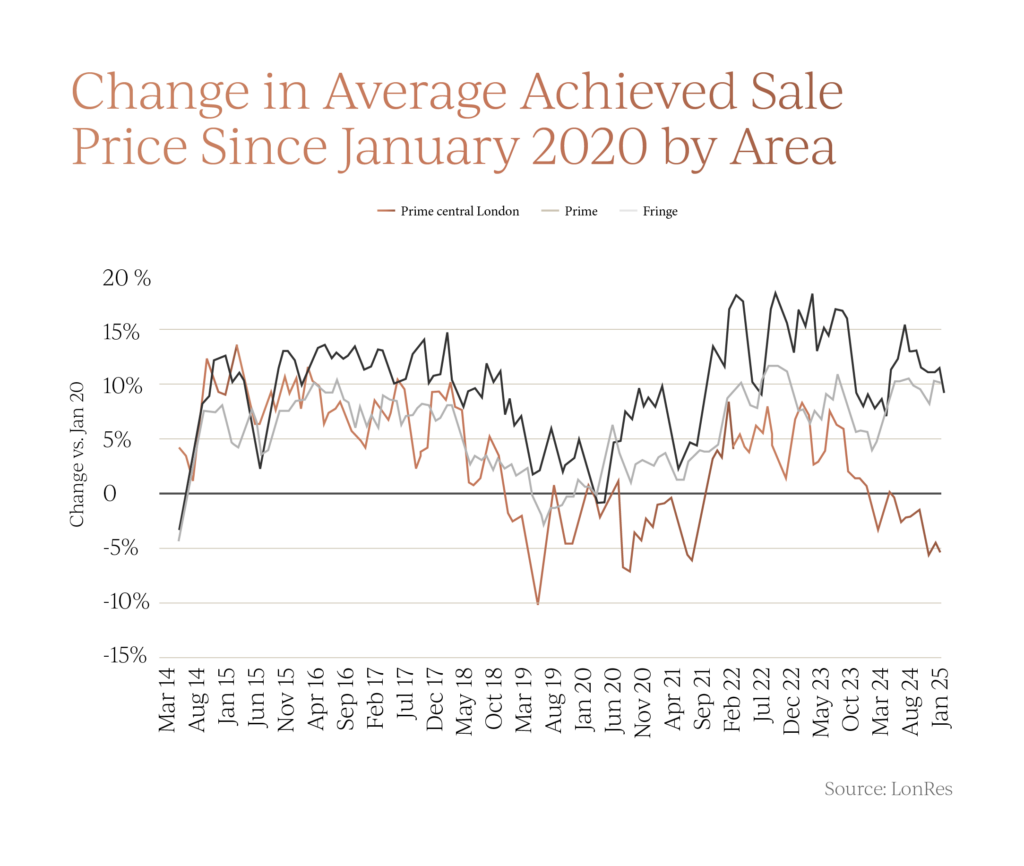

Garrington is observing a growing trend among buyers seeking better value, aiming to rebalance their finances while still prioritising space. In many cases, this means looking beyond historically high-priced locations towards areas where affordability and long-term potential are more attractive. Nowhere is this shift more evident than in London. As illustrated above, price growth across the capital has been highly fragmented, with outer prime areas demonstrating resilience while traditionally expensive central locations continue to see price adjustments.

Nowhere is this shift more evident than in London. As illustrated above, price growth across the capital has been highly fragmented, with outer prime areas demonstrating resilience while traditionally expensive central locations continue to see price adjustments.

The landscape is evolving as buyers adapt to rising costs and shifting market conditions, unlocking new opportunities in locations that may have been previously overlooked.

Adding to the uncertainty is the forthcoming Spring Budget, which could introduce fiscal measures that impact sentiment. Meanwhile, global geopolitical tensions continue to ripple through financial markets, influencing buyer confidence and the broader economic outlook.

With so many moving parts, the market remains in flux, and agility will be key for those looking to make property decisions in the months ahead.

If you are considering your property plans for 2025 or have been searching for the perfect home without success, the Garrington team is here to assist. For expert guidance on your next move, do get in contact with us.