Welcome to the April edition of Garrington’s UK Property Market Review. As spring unfolds, the property market enters a...

UK Property Market Resilient Amid Price Growth and Changing Trends

Welcome to this month’s UK property market review from Garrington.

As we enter the final quarter of 2024, the UK property market is once again experiencing notable changes.

With interest rates on a downward path and regional trends becoming more distinct, both home buyers and investors are adjusting to the shifting landscape.

At a headline level the market would appear to be in rude health. Nationwide has announced that September recorded the fastest annual house price growth in two years at 3.2%, with the monthly increase at 0.7%. A similar picture has been reported by Halifax, with a less attention-grabbing monthly increase of 0.3%, but nonetheless reaffirming the upward trajectory of average house values.

A similar picture has been reported by Halifax, with a less attention-grabbing monthly increase of 0.3%, but nonetheless reaffirming the upward trajectory of average house values.

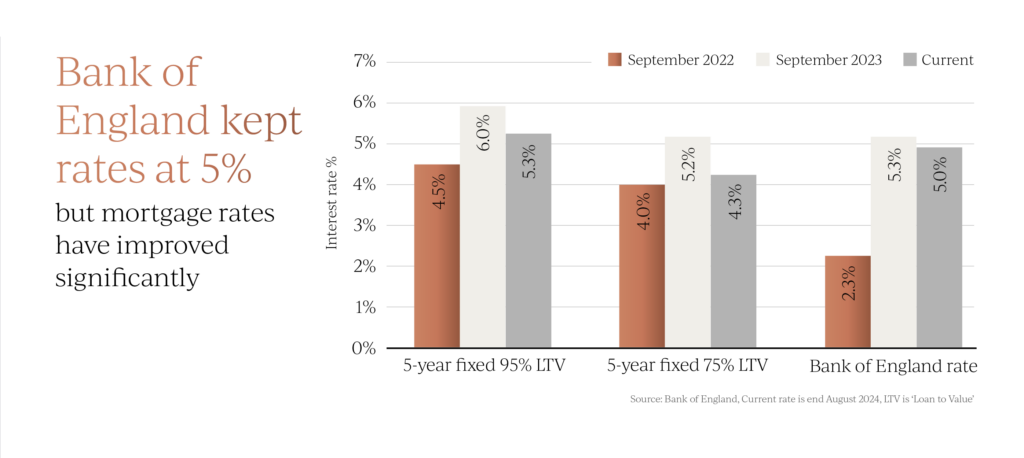

This rise in property prices comes despite the Bank of England voting to keep the bank base rate at 5% in their September monetary policy meeting, stating more cuts are on the cards if inflation stays low.

Mortgage product rates have already fallen significantly, reflecting the anticipation of potential further base rate cuts.

A 5-year fixed mortgage is now around 4.3%, down from 5.2% a year ago, and not far off the September 2022 rate.

A 5-year fixed mortgage is now around 4.3%, down from 5.2% a year ago, and not far off the September 2022 rate.

Analysts also point to the fact that income growth has continued to outstrip house price inflation, whilst at the same time, the borrowing costs for mortgage products have been slowly falling, and both factors are supporting the situation.

A layered UK property market

With distinct differences emerging by region, price sector, and location type, these are all contributing to a more nuanced UK property market.

The different characteristics by region are once again becoming quite stark based on Hometrack’s latest data. Rates of price growth in Northern regions are outperforming Southern regions as can be seen above, with Scotland and the North West topping the charts; however, London has seen the biggest turnaround over the last year.

Rates of price growth in Northern regions are outperforming Southern regions as can be seen above, with Scotland and the North West topping the charts; however, London has seen the biggest turnaround over the last year.

Regional disparities also exist when looking at the time taken to sell a home, according to Rightmove.

Property is selling fastest in Carluke in Scotland, taking 15 days on average, and Whitehall, in the South West, in 25 days. In contrast, property in Skegness and Sandown is taking over four times as long to find a buyer.

In a reverse to the trend seen during the pandemic, rural and coastal homes are proving harder to sell than city property.

Zoopla estimates that some coastal and rural markets currently have over 40% more homes for sale than a year ago.

Garrington is seeing this happen regularly in the market, typically driven by factors such as financially overstretched second homeowners and so-called ‘city rebounders’.

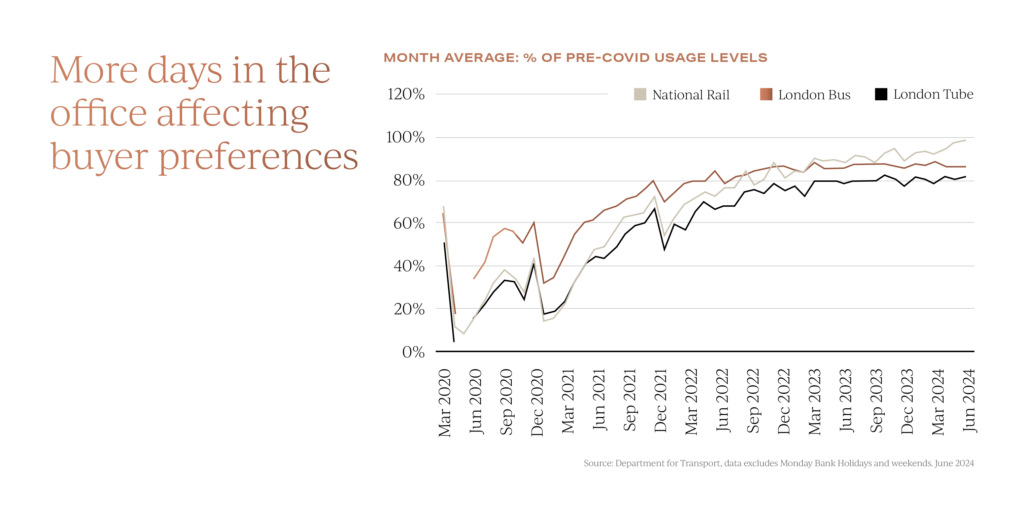

Equally, returning to more working days in the office is affecting buyer preferences.

For the first time since 2020, rail usage is virtually back to pre-pandemic levels, and buyers are again favouring proximity to transport over extra space.

For the first time since 2020, rail usage is virtually back to pre-pandemic levels, and buyers are again favouring proximity to transport over extra space.

Transport links were ranked as the sixth most important purchaser requirement, rising eight places from 2021 and just higher than square footage, which dropped to seventh in a recent market survey of buyer preferences.

Prime opportunities

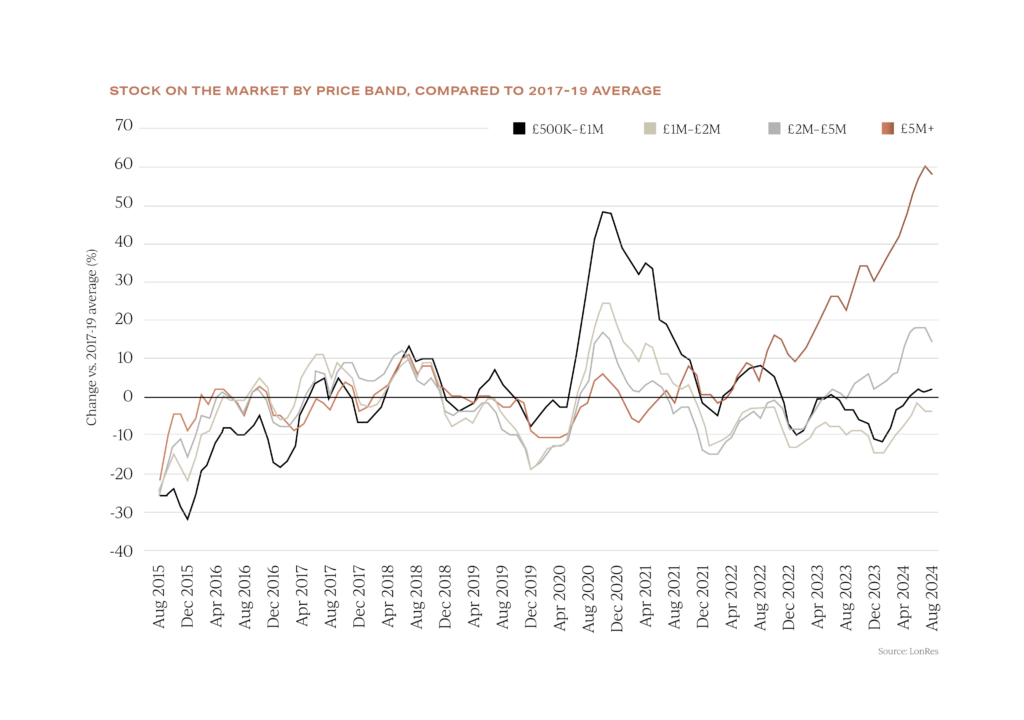

The prime property market, traditionally more resilient to economic fluctuations, is now feeling the impact of higher borrowing costs as historic sub-2% fixed-rate mortgages begin to expire and the reality of new rates take hold. With the additional looming threat of higher taxes, a growing number of affluent buyers are adopting a more cautious approach, opting to downsize or trim their budgets.

This has led to a slowdown in transactions at the top end of the market.

In London, for example, transactions above £5 million were down by 47.2% in August compared to a year ago, whilst at the same time, stock for sale has risen by over 30%. In the super-prime London market only 10 properties priced above £30 million have sold in the year to July, compared to 38 in the previous year according to industry data.

In the super-prime London market only 10 properties priced above £30 million have sold in the year to July, compared to 38 in the previous year according to industry data.

The exclusive super-prime segment of the market is particularly sensitive to geopolitical instability, with concerns on the scale of international conflicts, the upcoming autumn statement, and the US general election all contributing to a slowdown. This sector is primarily driven by discretionary buyers rather than those with an immediate need to purchase property.

All these factors are creating compelling purchasing opportunities for savvy buyers with long term ownership plans.

Last month, Garrington successfully negotiated double-digit discounts on more than 60% of the properties above £2 million that it secured for its clients.

Balancing risk and reward

As the UK property market moves into the latter part of 2024, the outlook remains cautiously optimistic.

While affordability challenges persist, particularly in high-value areas, the market is showing signs of stabilising as buyers and investors adjust to new economic realities.

For those looking to buy in the prime market, there are clear opportunities to capitalise on price adjustments and long-term investment potential, particularly in regions like prime central London.

Mainstream buyers, on the other hand, are likely to continue focusing on affordability, seeking value in regions where their budgets go further.

If you are considering your own property purchasing plans for the autumn and would like some impartial advice, do get in touch with the team at Garrington .

Equally, if you are considering selling a property and want to know more about an off-market sale, do contact us, as one of our existing retained clients may be interested in your property.

We will consider the impact of the autumn statement in next month’s update.