Welcome to the April edition of Garrington’s UK Property Market Review. As spring unfolds, the property market enters a...

UK property market news – What does the General Election mean for the housing market?

Welcome to the May 2024 edition of Garrington’s monthly UK property market review.

Activity has been meandering in nature over the last month and house price indices paint a picture of a ‘good, bad and indifferent’ property market, all of which is creating conflicting headlines and some confusion as to what is really going on.

News that the UK economy has exited a recession with the fastest growth seen in two years is welcome news but, at the same time, unemployment is rising and wage inflation remains stubbornly high, which could impact any interest rate cut decisions by the Bank of England.

Rightmove reported that the average asking prices for properties increased by 1.1% last month however, for the same period, Nationwide recorded average sale prices fell by 0.4%, and Halifax, a near flat change of 0.1%, confirming that the price expectation gap Garrington referenced last month appears to be further widening.

Confirmation from the Prime Minister today that the country will head to the polling booths on the 4th July for a General Election, will undoubtedly impact the market due to the associated uncertainty. We explore how past elections have previously affected the property market below.

From trickle to flood

At a national level the UK property market remains constrained by affordability issues, causing a drag effect on average house price growth.

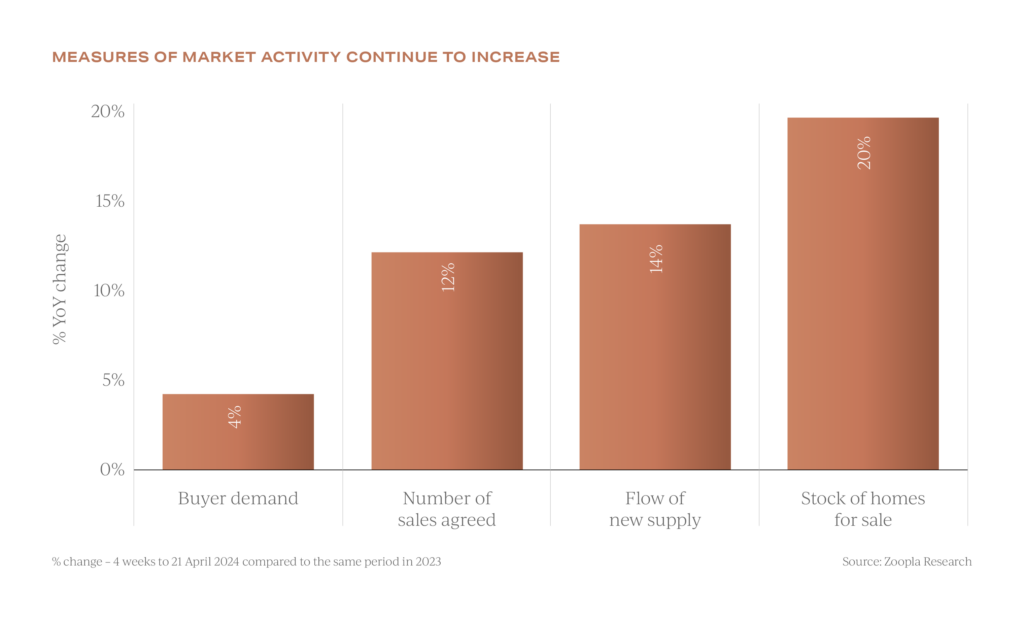

The Bank of England’s decision to leave the bank base rate unchanged at a 16-year high of 5.25% will have inevitably held back the decisions of some buyers to commence their moving plans. Price growth is being further curtailed by basic ‘supply and demand’ economics. At a national level, the flow of new property entering the market is up 14% year-on-year, whilst buyer demand to acquire such properties is only up by 4%.

Price growth is being further curtailed by basic ‘supply and demand’ economics. At a national level, the flow of new property entering the market is up 14% year-on-year, whilst buyer demand to acquire such properties is only up by 4%.

In some areas the number of homes being put up for sale has gone from a trickle to a flood.

In locations where there is now an abundance of supply, two things are happening; the balance of negotiating power is swinging back in favour of buyers, and downward pressure is being put on prices.

Renewed investor activity in UK property

After an exodus of accidental and amateur landlords leaving the rental market over recent years, uncertainty and a transitioning market has created opportunities for savvy, well-informed buyers, and Garrington is experiencing renewed interest from this profile of client.

High net worth investors are typically looking for so called ‘safe harbour’ locations, which are underpinned with proven demand, and offer upside and blended returns of yield and capital growth. London continues to appeal to such buyers.

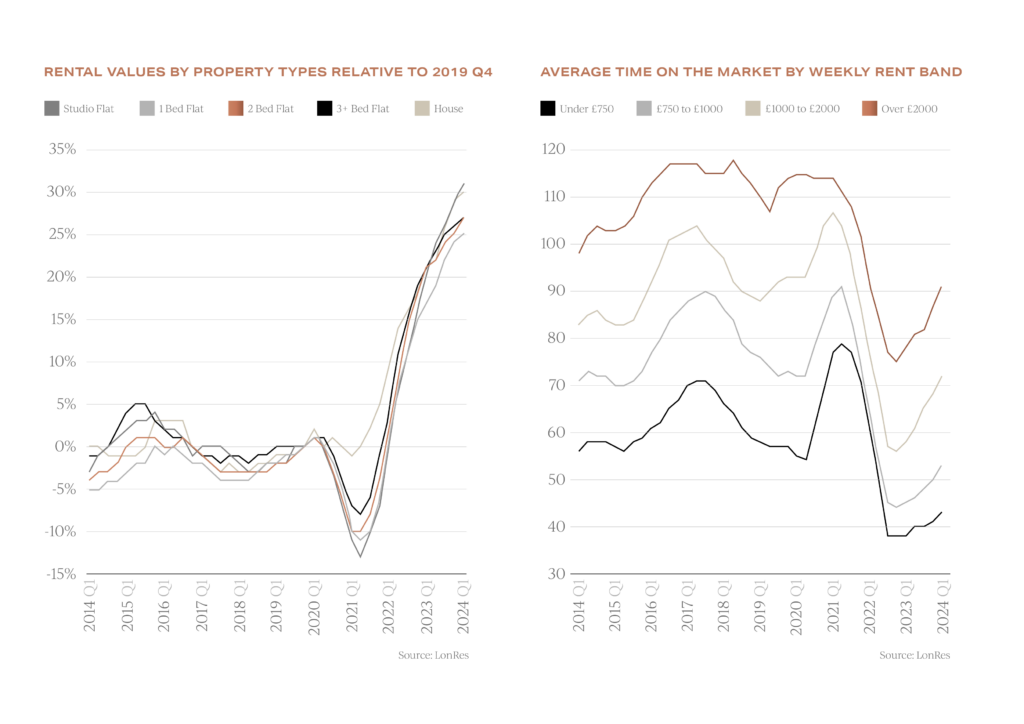

LonRes has recorded that annual rental growth stood at 2.8% at the end of Q1 in prime London and was recorded at 6.9% annual growth in London fringe. Prime London investment yields now stand at 4.53%. The London rental market has been fast paced but is once again normalising with the average time to let a property increasing as a new price equilibrium is established.

The London rental market has been fast paced but is once again normalising with the average time to let a property increasing as a new price equilibrium is established.

Looking beyond London, yields in many regions are now more than 7%, with multiple locations now offering double digit returns.

With the prospect of falling interest rates on savings, softer property values, and rising rental yields, the logic of property investment is once again starting to look compelling, particularly for cash investors.

Timing is everything

The two factors that will most likely influence the market this year are the timing of any interest rate cuts and the now announced timing of the General Election on the 4th July.

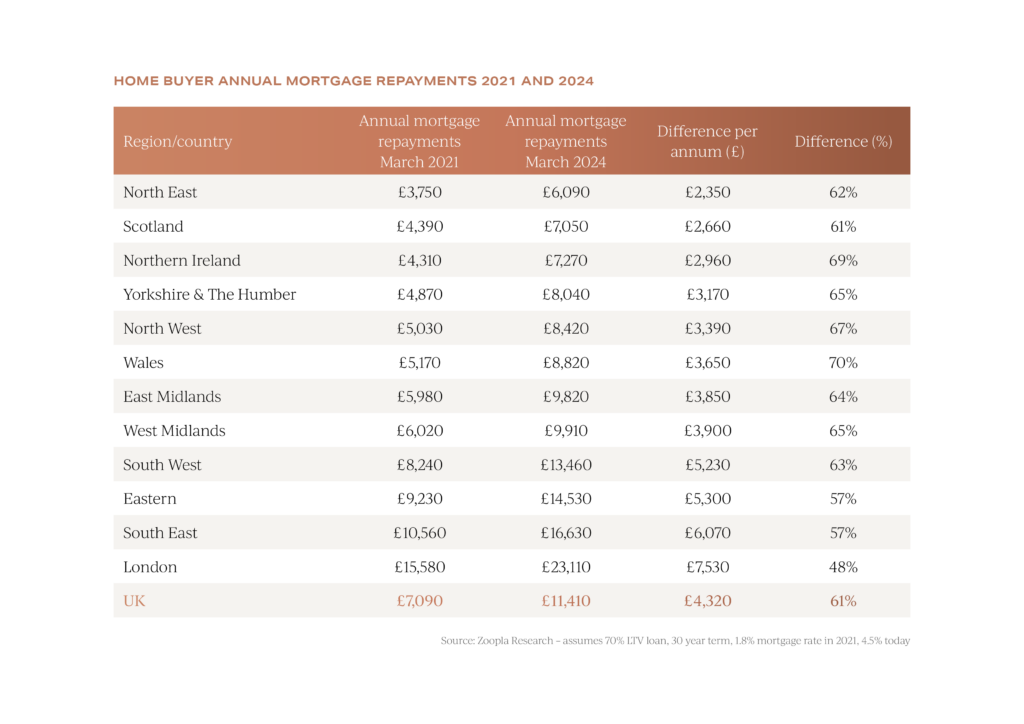

Higher interest rates have placed a drag on house prices, but the degree to which this is the case makes startling reading and explains why some buyers are waiting to time their moves in line with lower mortgage costs.

For example, assuming a national average house price and applying a 70% loan-to-value, mortgage, borrowing costs have risen by 61% across the UK according to new research by Zoopla. A noticeable proportion of large country homes that Garrington is seeing being brought to market are from sellers looking to downsize, either for financial or practical reasons, or invariably both.

A noticeable proportion of large country homes that Garrington is seeing being brought to market are from sellers looking to downsize, either for financial or practical reasons, or invariably both.

For some buyers, property requirements outrank their location needs and Garrington is seeing first hand more buyers exploring new options that offer value. Hometrack records that 33% of movers are willing to move out of area to secure the home they want, thus further evidencing this growing trend.

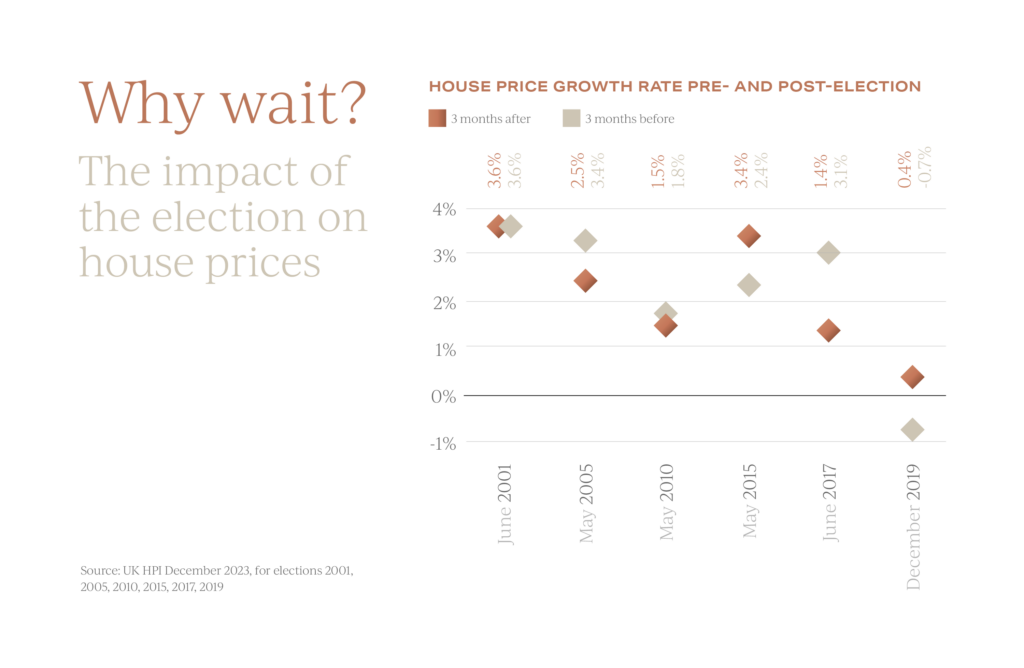

Traditionally, general elections create uncertainty in the UK property market and some buyers pause their plans until the outcome becomes known.

Evaluating the impact of the past six elections on house prices shows that the average price growth in the three months leading up to an election was 2.2%, whilst the three months following showed a similar increase at 2.1%. Price growth in the three months following an election only outperformed the preceding period in two out of the last six elections, however this was the last two elections. If interest rates start falling in the second half of the year, could history repeat itself? Only time will tell.

Price growth in the three months following an election only outperformed the preceding period in two out of the last six elections, however this was the last two elections. If interest rates start falling in the second half of the year, could history repeat itself? Only time will tell.

UK property – summer outlook

The summer outlook looks cautiously optimistic, but not without its challenges including of course the distraction which will be caused by the July General Election.

Average prices are likely to remain subdued where only the best homes in the best locations will command top prices.

Outside of this group, it is likely to remain a price-sensitive buyers’ market.

However, many of the sellers who have brought their homes to market will, over time, become onward buyers and if this coincides with mortgage rate cuts, pent-up demand will drive activity in the latter months of the year.

The Bank of England Governor recently gave his strongest hint yet that rates may fall soon, and City analysts have chalked in a 50% chance of this happening in June.

If this materialises, the cut won’t stimulate the market instantly, but confirmation that rates are falling will undoubtedly bring renewed confidence into a still fragile market.

If you are exploring your moving options, don’t forget to visit Garrington’s Best Places to Live research.

As ever, if you are contemplating a UK property purchase over the coming months and would like some expert guidance, do get in touch with the team at Garrington .