Welcome to Garrington’s latest Market Review where we explore how the UK property market has performed so far this...

UK Property News – April 2023

Welcome to the April 2023 edition of Garrington’s UK property market review where we share the latest property market news and insights from our property experts around the UK.

The spring bank holiday brought a much welcome period of rest and reflection and with it, for many would-be movers, a chance to consider their plans for the months ahead. The traditional spring bounce in the property market has been, by historical standards, more subdued this year, but nonetheless there is evidence of an increase in activity across the market.

As Garrington reported last month, establishing the true health of the market is challenging given the increasingly diverging data at present. Consequently, there are a lot of conflicting stories continuing to grab media attention with associated dramatic headlines.

For example, Nationwide reported that house prices fell by 0.8% in March, representing the fastest rate of decline for 14 years. The lender noted prices had fallen 3.1% compared with the same period last year. However, once again in complete contrast, Halifax recorded prices rising for the third consecutive month at a rate of 0.8%. TwentyCi recently reported that 68% of homes that were listed for sale in the first 12 weeks of 2023 have subsequently now gone under offer, with the south-east being the most active market in terms of new listings and sales.

TwentyCi recently reported that 68% of homes that were listed for sale in the first 12 weeks of 2023 have subsequently now gone under offer, with the south-east being the most active market in terms of new listings and sales.

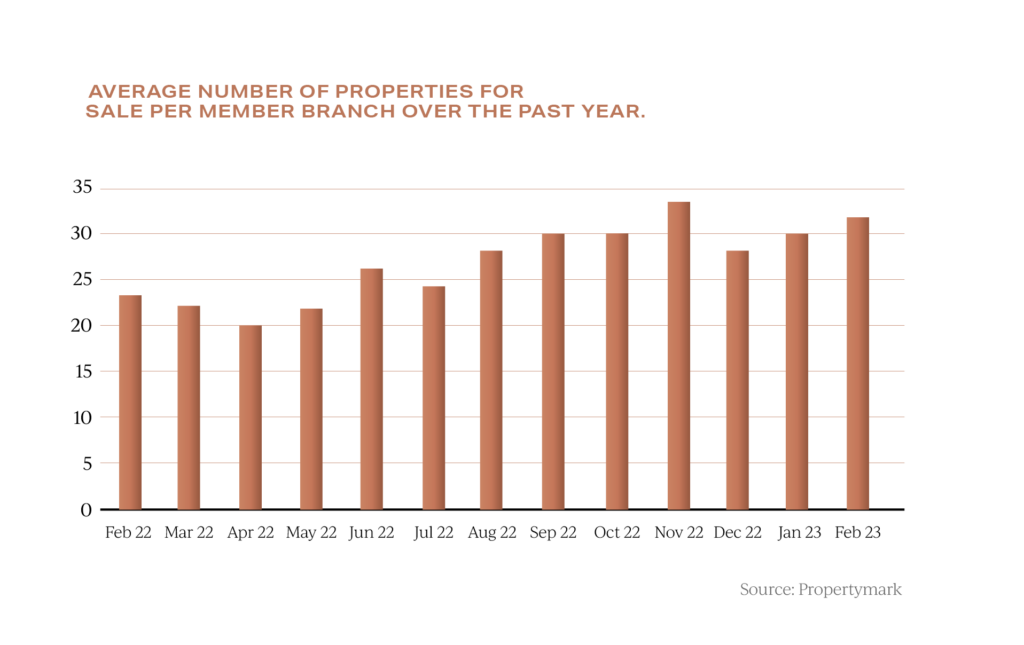

Data from Propertymark also supports TwentyCi’s findings. As can be seen below, there has been a clear pick up in the volume of listings across the organisation’s members’ branches equating to growth in listing volumes per branch since December.

These and other indicators point to a market which has finished the first quarter of the year in much better shape than many forecasters had predicted, but what should we expect next?

The calm drama to come

Based on the available latest data, the market is more balanced than it has been for many years.

Despite this, expect further dramatic headlines over the coming months as comparisons will continue to be made with how far data metrics will have changed compared with the last few years.

But it is essential to not overlook the fact that the last few years have been far from normal.

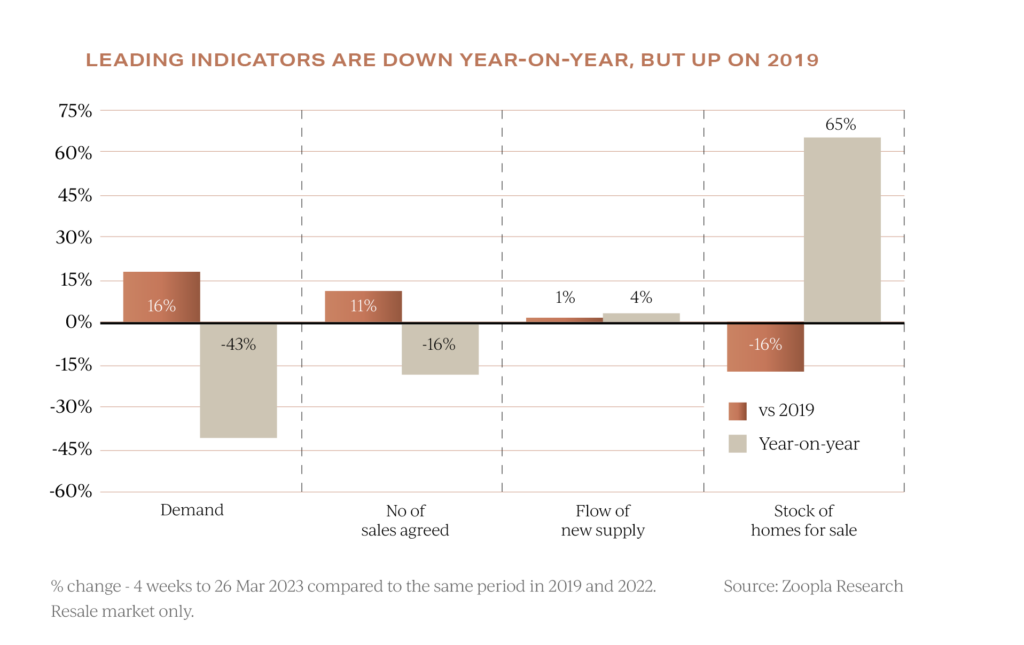

Zoopla records that the supply of homes is up 65% year-on-year and purchaser demand has fallen by 43% in the same period.

At face value this ordinarily would be cause for concern, but as seen on the chart above, look back to 2019 during an arguably more traditional market, and we can see that the supply of homes for sale today is actually 16% lower than then, and ironically, purchaser demand this year is 16% higher than in the same period in 2019.

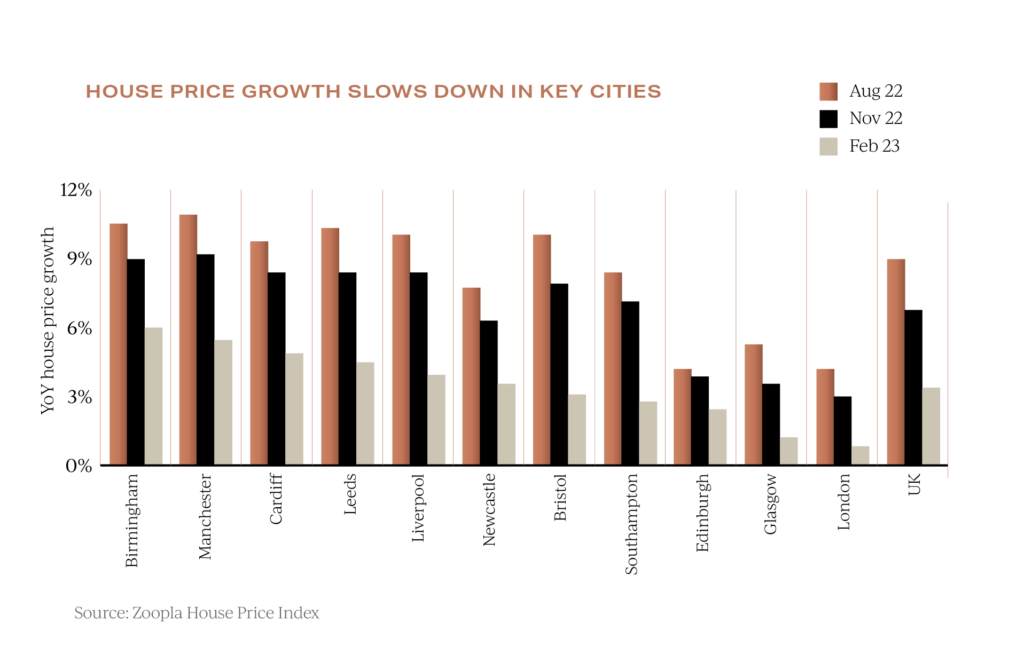

The average sales price growth rates being achieved in various parts of the country is at first glance quite disconcerting.

The rate of growth as seen above has fallen sharply when compared to the recent boom years.

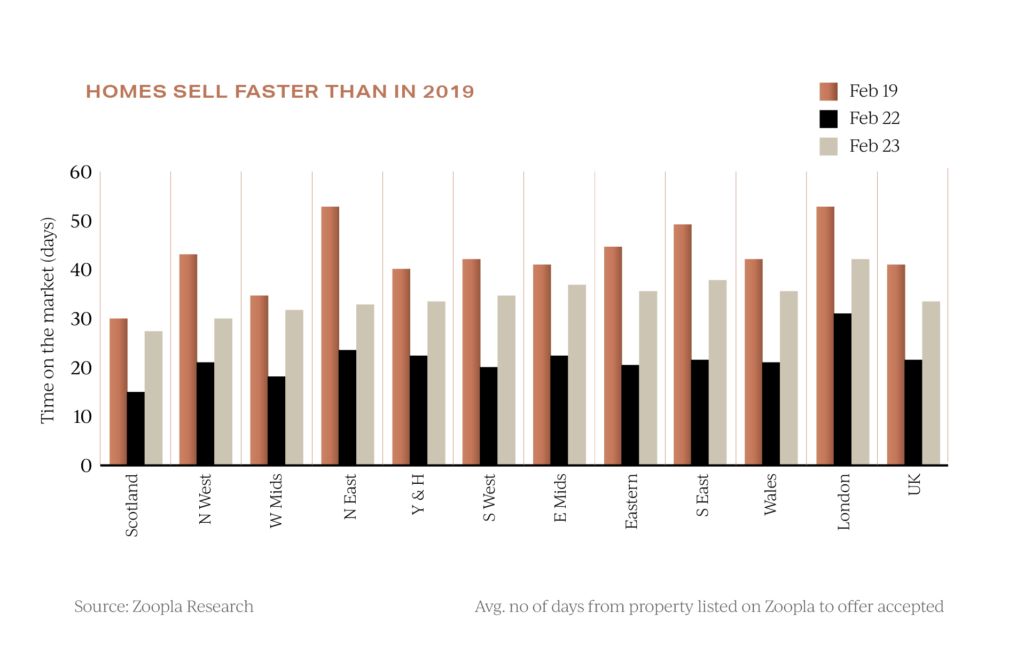

However, pragmatic sellers in today’s market are still selling their homes faster than during the same period of 2019, as in the above chart.

Looking at the months ahead, the market without question will feel very different to 12 months ago, but forecasts of a significant price crash, or indeed bounce back, both look overstated.

Instead, based on the latest data and the trends Garrington is seeing on a daily basis, if purchasers’ nerves continue to settle and the mortgage market stabilises, what we are now experiencing may simply mark the start of the ‘new-norm’.

This will be characterised by calmer and more price-sensitive purchaser demand where, moving forward, only the very finest homes and locations are capable of achieving premium values.

Homeowners’ wants and needs

At some juncture, many home movers may find their current property is no longer suitable for their lifestyle requirements.

Working from home was cited as a significant driver for home moves during the pandemic and the trend continues today.

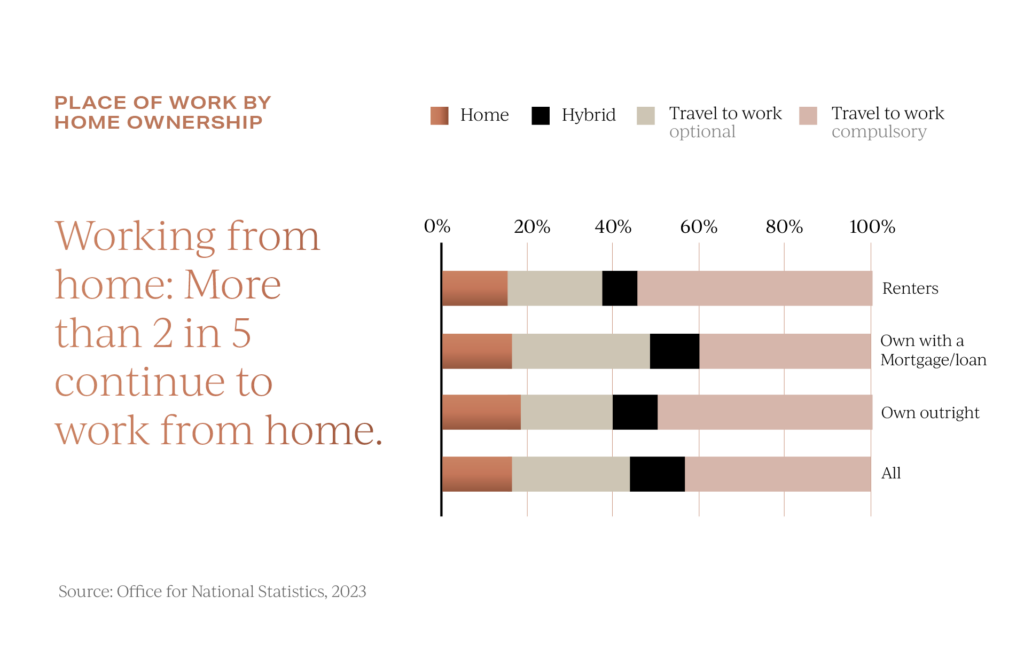

44% of people continue to work from home, either full time or on a hybrid basis, according to the latest data released by the Office for National Statistics. Home or hybrid working is more common for home owners than renters, for the self-employed and for those with dependent children.

Garrington continues to be approached by clients who work from home and as such are looking for a property which suits this requirement but, on many occasions, this is coupled with a requirement for good transport connections for the essential days in the office.

This trend has opened up many search briefs to offer more flexibility on locations as buyers seek better value for money.

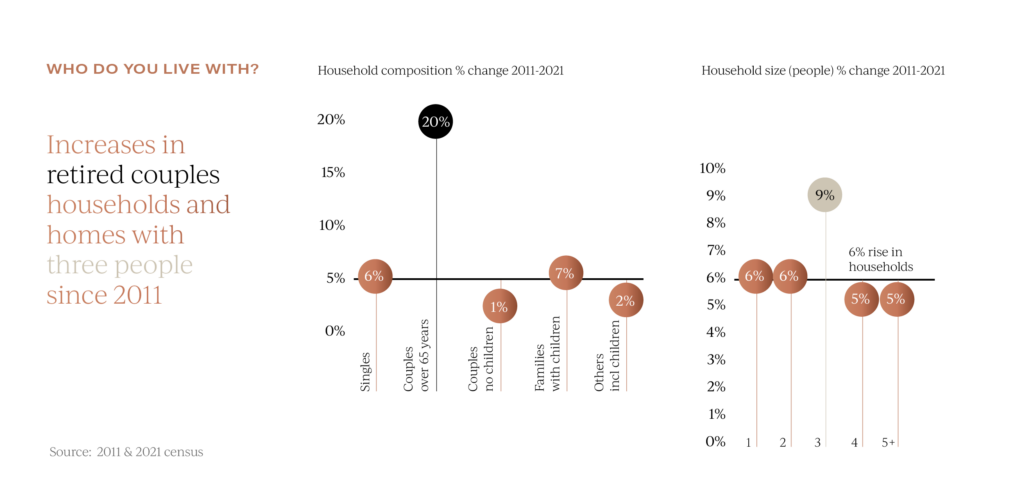

Another group of buyers increasingly active in the market are those looking for a more suitable home for retirement.

There are now 20% more households where couples are above the retirement age.

This change has driven demand for more property variety in the market, particularly purpose-built retirement homes, which are able to command premiums of 32% in popular places such as Cornwall.

The spike in early retirement caused by the pandemic coupled with cost-of-living pressures is fuelling demand from some homeowners in this segment who are down-sizing from larger homes that are more expensive to run.

Outlook for the UK property market

The coming weeks are likely to bring further mixed conditions. Certain sectors of the market are likely to shine more brightly than others, such as the family home market where pressure mounts to move during the school summer holidays in readiness for the new academic year.

Other areas such as the buy-to-let sector are likely to languish in the coming months and see further investors exit the sector due to onerous government policies.

The mortgage market is likely to further stabilise.

The decision by the Bank of England to raise the base rate of interest to 4.25% last month was largely expected and there has been little movement in long-term swap rates since the announcement.

With a seemingly calmer outlook, this may well be the moment many would-be purchasers have been waiting for, to begin, or restart their moving plans.

If we can assist you with your own property requirements anywhere in the UK, please do get in contact.