Welcome to Garrington’s latest Market Review where we explore how the UK property market has performed so far this...

UK Property News – October 2022

Welcome to the October 2022 edition of Garrington’s UK property market review.

We chose not to publish our Market Review last month out of respect for the sad passing of Queen Elizabeth II, with the team at Garrington joining the country in paying tribute to the United Kingdom’s longest serving and much cherished Monarch, with immense gratitude for all she did for our nation.

Activity across the country and property market was naturally subdued and reflective at this historical time.

However, in the weeks since, both the financial and property markets have been exceptionally volatile, triggered by a crisis in confidence in the new government’s so called ‘mini-budget’ announced on the 23rd September.

The pound fell dramatically to a 30 year low against the dollar after the announcements, but by the 5th October, after the Bank of England’s intervention, it had recovered to the rate seen prior to the mini-budget. In response to the reaction seen in the financial markets and to support the pound and reduce the rate of inflation, the Bank of England issued a statement suggesting that it would not hesitate to raise interest rates prior to the November MPC meeting.

In response to the reaction seen in the financial markets and to support the pound and reduce the rate of inflation, the Bank of England issued a statement suggesting that it would not hesitate to raise interest rates prior to the November MPC meeting.

However, this statement concerned many lenders and has subsequently caused turmoil in the mortgage market.

Beyond consumer confidence

Garrington has highlighted that consumer confidence levels were starting to change earlier this year and posed the question whether the market was at an ‘affordability tipping point’.

The withdrawal by lenders of around 1,600 mortgage products over recent weeks and interest rates for loans rising at the fastest rate in over a decade, to over 6%, confirms that we have now seen a definitive change.

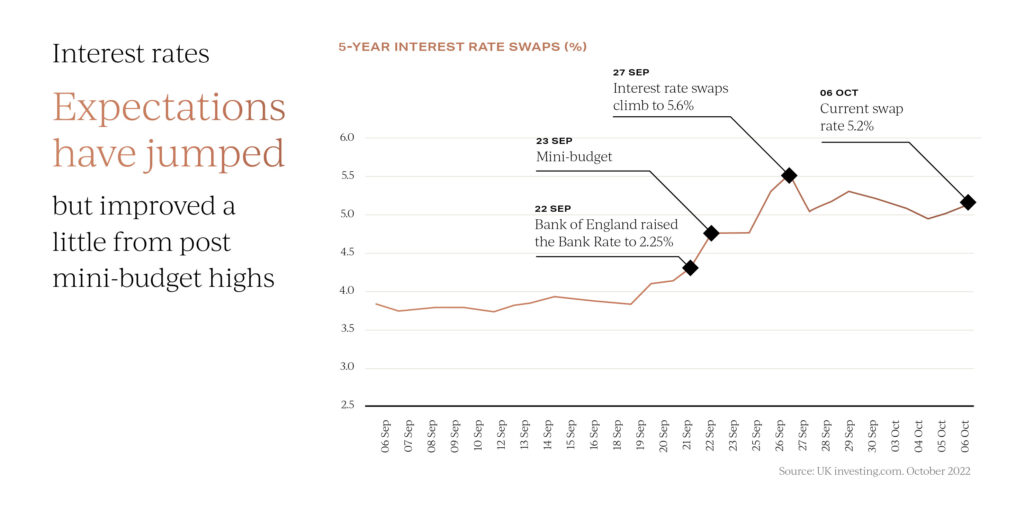

Swap rates are typically used as a forward indicator of where mortgage interest rates are likely heading.

Immediately after the mini-budget, 5-year swap rates climbed to a high of 5.6% but have since fallen to 5.2%.

Many commentators believe that lenders may have overcompensated by raising mortgage rates so high and so fast.

Many commentators believe that lenders may have overcompensated by raising mortgage rates so high and so fast.

The next few weeks are likely to remain volatile for interest rate expectations in the lead up to the Bank of England’s MPC meeting on the 3rd November and the Chancellor’s fiscal plan on the 31st October.

These meetings have the potential to either bring clarity, or create further concerns, about the strength of the UK economy and the extent to which the bank base rate is likely to increase in the months to come.

Whilst current low levels of unemployment and strong balance sheets of most major financial institutions means we are unlikely to see a repeat of 2008, the cost-of-living crisis and effective quadrupling of the cost of borrowing compared to 6 months ago, is likely to affect the market over the coming months.

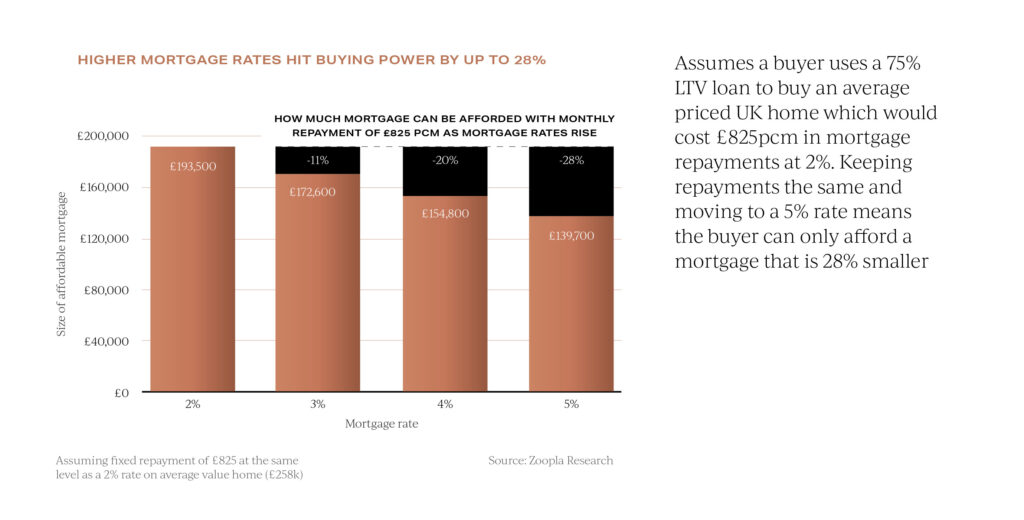

Zoopla’s latest research eloquently illustrates this point, showing that an average mortgage rate rise from 2% to 5% reduces buying power by up to 28% for a purchaser requiring a 75% loan to value mortgage.

With an estimated seven out of ten property purchasers needing, or choosing, to have a mortgage, Garrington believes that this, beyond any other factor, will influence market dynamics most over the coming months.

With an estimated seven out of ten property purchasers needing, or choosing, to have a mortgage, Garrington believes that this, beyond any other factor, will influence market dynamics most over the coming months.

Market reaction

The speed at which interest rates have risen has thrown many movers off-balance, triggering a ‘hard reset’ on what is affordable and new assumptions on house prices moving forward.

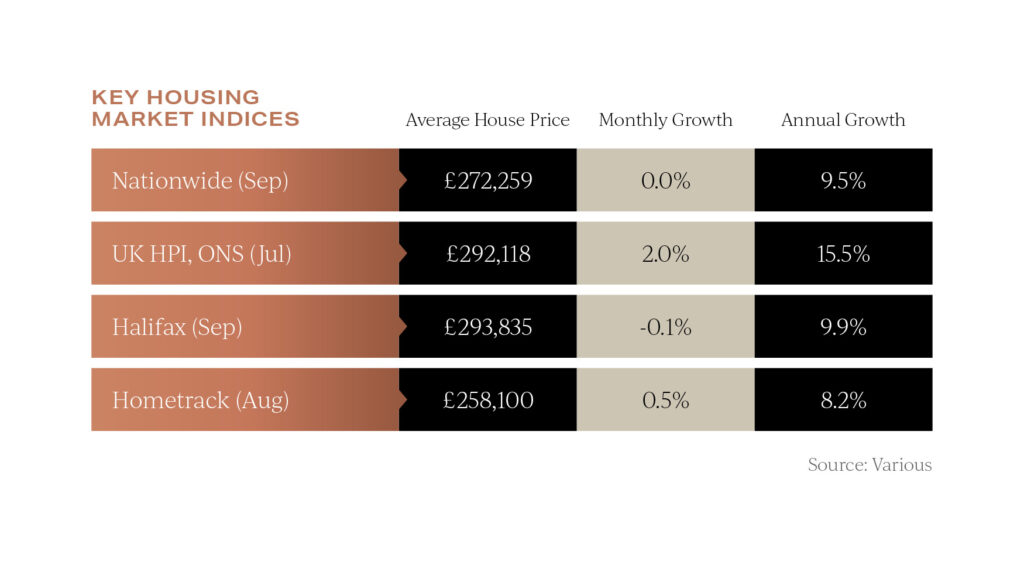

Economists and forecasters currently have wildly differing views on what the future holds. On an annual basis house prices are still rising according to Nationwide and Halifax.

On an annual basis house prices are still rising according to Nationwide and Halifax.

However, after three successive months of slowing momentum, the pace of price growth has slipped into single figures for the first time since January.

Whilst this data is useful, it does not capture the real ‘here and now’ of the market or paint a clear picture of what may be about to happen.

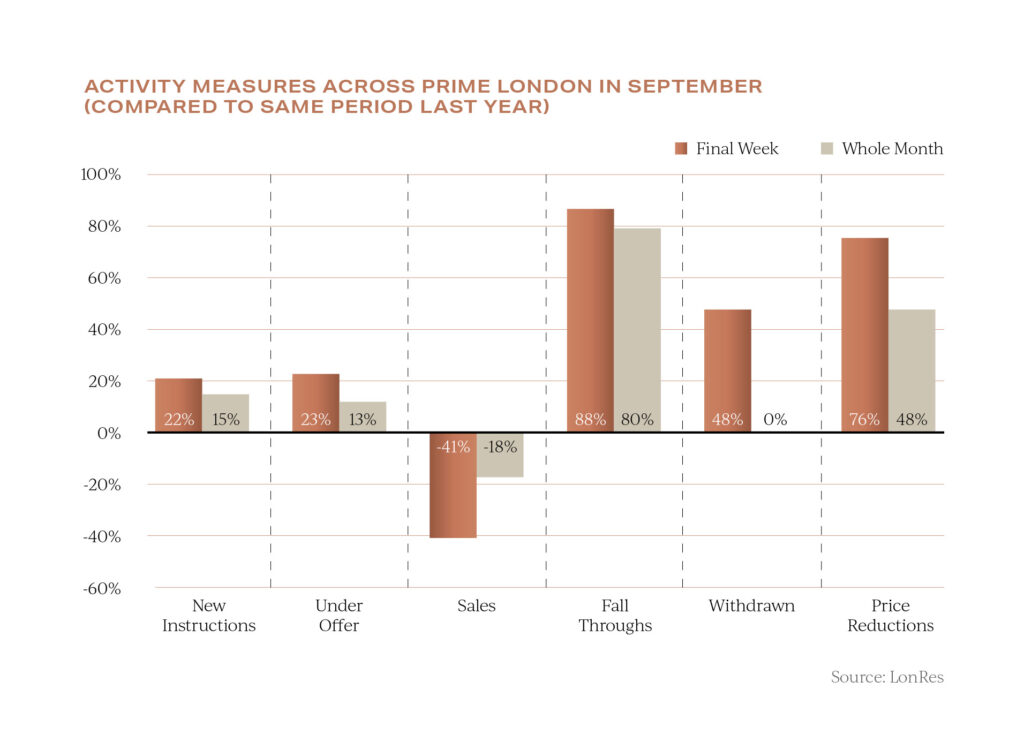

Capturing data from sales agents across the London market, LonRes has just published research confirming that the number of sales falling through increased by a staggering 88% in the last week of September. In the same week sales were down 41% compared with the same time 12 months ago.

In the same week sales were down 41% compared with the same time 12 months ago.

A number of transactions have since been reinstated after being helped by increasingly pragmatic sellers, with a lot of price negotiation taking place up and down chains to keep these and other sales together.

UK property autumn outlook

Accurate forecasting is particularly difficult at the present time with so much volatility in the market and the speed by which shock events keep influencing wider economics.

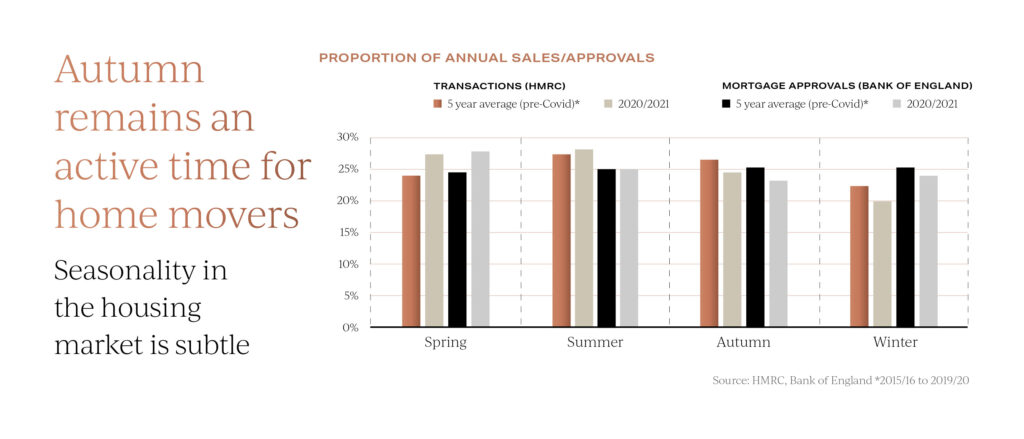

Traditionally, in the 5 years pre-pandemic, summer and autumn have recorded the highest proportion of sale completions. This year we expect a break from tradition and different trends to emerge.

This year we expect a break from tradition and different trends to emerge.

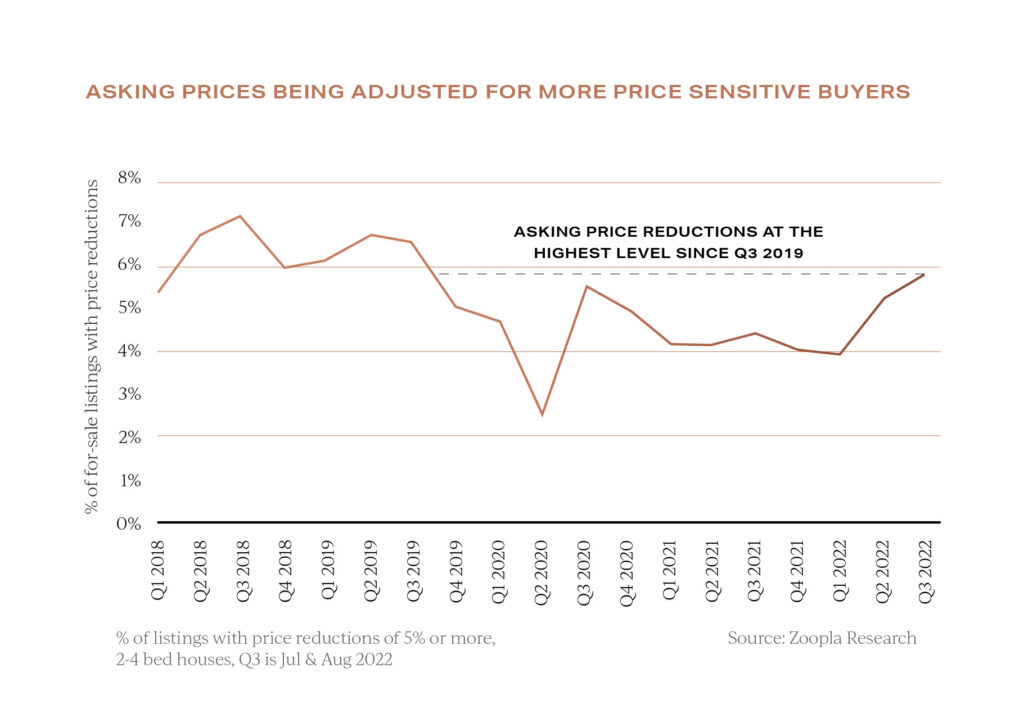

Zoopla are already reporting that the number of asking prices being reduced is at the highest level since before the pandemic.

The latest data records 6% of listings as having their asking price reduced as the market transitions from a seller’s market to a buyer’s market. In many ways this should not come as a surprise, as locations such as Wales, parts of the North West and Scotland have seen what normally would be ten years’ worth of house price growth in just two years.

In many ways this should not come as a surprise, as locations such as Wales, parts of the North West and Scotland have seen what normally would be ten years’ worth of house price growth in just two years.

The short-term outlook is likely to remain tainted with uncertainty and concern because of recent events, but as has been seen previously with shock events such as the Referendum result and start of the pandemic, a calmer market will follow once there is greater clarity on what the new normal really looks like.

For now, we will see a price-sensitive market being driven by budget-restricted buyers seeking fair value.

We hope you found our latest update helpful.

If we can assist you during this period of change in the market with your own property requirements anywhere in the UK, please do get in contact.