Welcome to Garrington’s latest Market Review where we explore how the UK property market has performed so far this...

UK Property News – Winter 2021

Welcome to the winter edition of Garrington’s National Market Review, where we share some of the highlights from our latest research report.

Whilst the market was effectively closed for almost two months last spring, few commentators were expecting to be reporting record levels of house price growth by the end of the year.

Prime Market Review

The property market defied all expectations in 2020.

National house price indices all recorded substantial annual growth.

Nationwide reported prices rising by 7.3% in the 12 months to December.

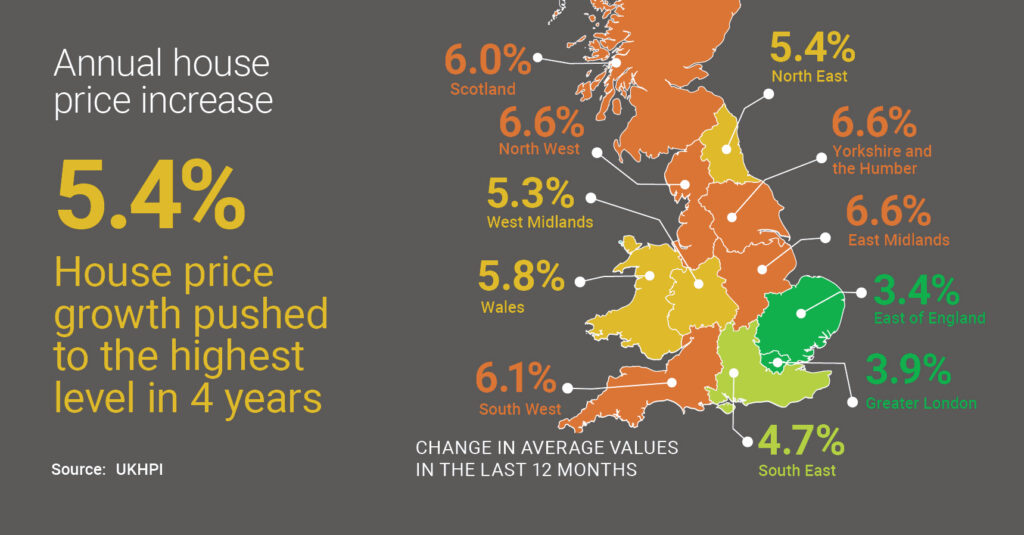

ONS also reported in December annual house price growth of 5.4%, the largest rise in 4 years, with many northern and more rural locations topping the charts.

However, with unemployment levels rising and the country in recession, the apparent strength of the market is seemingly at odds with the economic backdrop.

Demand has not been evenly distributed across the market, with wealthier buyers leading the way.

These are buyers with equity in their existing homes and are less likely to be employed in the more vulnerable sectors of the economy.

The biggest increase in sales agreed since the end of lockdown has been in the prime market.

The number of properties sold subject to contract above £1 million was 100% higher than the same week in 2019, and properties priced between £750,000 to £1 million saw a 119% increase.

As Garrington has previously reported prime coastal and country markets have been the main beneficiaries.

Sales of larger London homes have also increased though. For example, in the year to September 2020, homes over £2 million across London accounted for 3.1% of transactions, up from 2.4% in 2019.

Outlook for 2021

After decoupling from the wider economy last year, questions are naturally being asked about what to expect from the UK property market in 2021.

Opinions are firmly divided to a degree which has not been seen in recent years.

A delta of some 12% exists between the most bullish growth prediction of 4% from Rightmove and the bearish prediction of price falls of 8% made by the Office for Budget Responsibility.

Dataloft’s pole of poles records the consensus average UK house price growth for 2021 at 0.9%.

Activity immediately after Christmas is normally brisk and indeed both Rightmove and Zoopla reported significant growth in visitors to their portals over the holiday period.

Ordinarily this is a reliable forward indicator of likely purchaser demand, but now with the news of a third national lockdown, and despite the property market remaining open, the coming weeks look anything but predictable.

As such, the market is likely to be grounded by threats and headwinds, whilst equally being buoyed by opportunity.

Which factors will have the greatest effect on the market will become much clearer over the coming weeks.

On the front line Garrington has seen unwavering demand for property but tinged with a healthy dose of caution and sensitivity to paying too much in a volatile market.

Where to live in 2021?

The possibility of ‘work from anywhere’ for some people opens up a very different set of opportunities.

Freed from the tyranny of the train timetable, or the traffic news, it is possible to draw up a whole new set of priorities causing some buyers to ask; where are the best places to live in 2021?

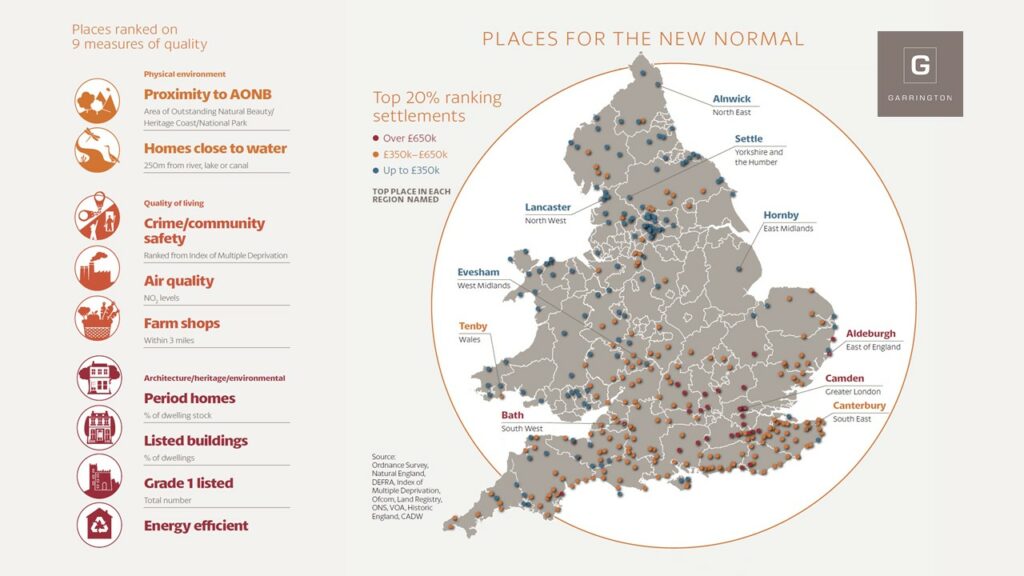

In Garrington’s latest research we assessed nearly 1400 cities, towns and villages across England and Wales.

These places were then measured on nine criteria in three categories and ranked by their average score to create a league table of next generation places for 2021 and beyond.

If you would like to see how different locations performed around the country, we now have a location search tool on our website which you can access by clicking here: Location Search Tool

To read our full report please click on the front cover below:

Which way next?

The severity of the current disruption to everyday life and the economy caused by the pandemic cannot be overstated.

The economy was 7.9% smaller in October than it had been pre-lockdown, and any recovery since is expected to have slowed as increased UK restrictions were put in place.

However, with the vaccine rollout under way and a Brexit deal agreed, 2021 is looking far more optimistic despite a new lockdown.

As such, the coming weeks are likely to be characterised by a hive of activity to progress existing agreed transactions prior to the currently confirmed Stamp Duty holiday deadline.

By contrast, lockdown restrictions are likely to supress viewings and sales levels over the coming few months.

Previous predictions have suggested a quieter market in Q2 this year after the Stamp Duty holiday and furlough period ends, but with the potential of delayed sales activity in Q1 due to the new lockdown, there is growing logic supporting that this may now happen in Q2 when it is hoped that some form of meaningful return to normal life may start to emerge.

We hope you found this article with the latest property news interesting and if you would like further information about our property finder services, please do get in touch.