Welcome to the April edition of Garrington’s UK Property Market Review. As spring unfolds, the property market enters a...

UK Property News – November 2023

Welcome to Garrington’s latest round up of key trends and developments in the UK property market.

Traditionally at this time of the year momentum in the market starts to slow, yet, in what has been a somewhat anaemic market for some time, there are tentative signs that confidence and clarity may slowly be returning.

We touched on this topic last month and posed the question as to whether this was a blip or the start of a trend, and several key events would appear to support the latter.

The Bank of England’s Monetary Policy Committee met at the beginning of the month and decided for the second consecutive meeting to hold interest rates at 5.25%.

They suggested that the Bank Rate may have peaked, but also cautioned not to expect significant rate cuts anytime soon.

Swap rates give us a good indication of changes in mortgage costs – reflecting the cost of borrowing for lenders.

Five-year swap rates reacted well to the Bank of England’s decision and are now at their lowest level since May. Despite the Bank’s cautionary tone, this has been seen as welcome news for many, as spiralling rates to an unknown high tide mark were suppressing demand amongst nervous movers.

Despite the Bank’s cautionary tone, this has been seen as welcome news for many, as spiralling rates to an unknown high tide mark were suppressing demand amongst nervous movers.

The current market size is significantly smaller than a year ago, but those buyers active in the market appear to be pressing on with their plans with a greater sense of urgency than seen previously, sensing that the window of opportunity to negotiate significant discounts may narrow soon.

Increasing levels of pragmatic buyers are seemingly prepared to offset short-term higher borrowing costs for generous savings off purchase prices, which may not be so readily available in 2024.

UK property price rises in a falling market

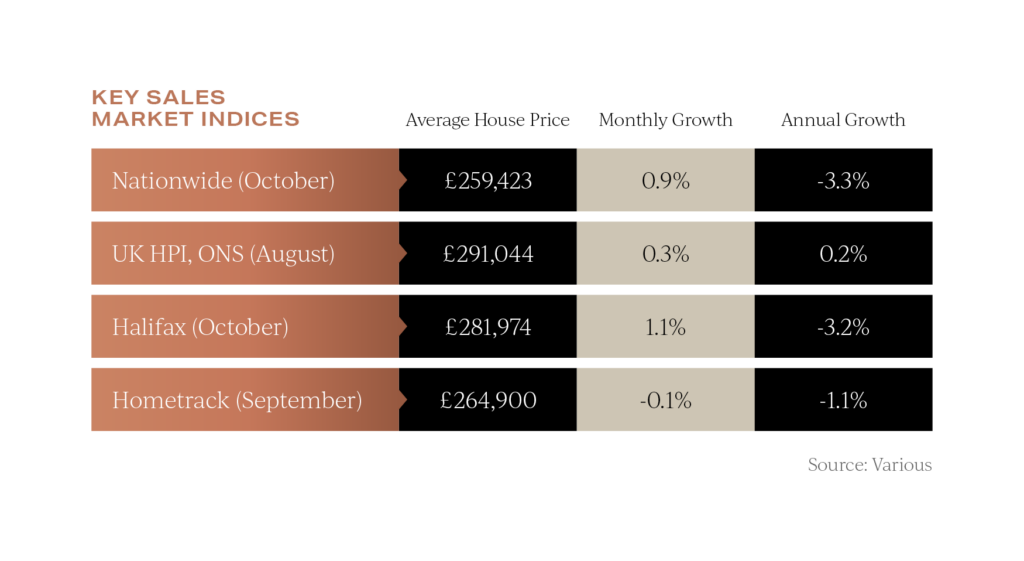

The trend of average house prices falling has been ongoing for most of the year, as the market recalibrated to higher interest rates and cost of living challenges.

However, both of the major property price indices have reported surprise rises in house prices last month.

Nationwide released its data first and recorded that average prices have gone up by 0.9% last month, meaning the annual fall in values now sits at -3.3%.

Halifax followed with similar data, also recording rising prices last month at a rate of 1.1% and an annual rate of fall of -3.2%.

Halifax followed with similar data, also recording rising prices last month at a rate of 1.1% and an annual rate of fall of -3.2%.

This data has been met with a healthy dose of scepticism as the buyer pool remains severely depleted and, as such, any small increase in demand could have a disproportionate effect on values. Nonetheless, it does point towards improving levels of confidence and stability in the market.

The UK picture that Garrington is now hearing from sales agents is that would-be sellers are stalling bringing new stock into the market until the New Year. This trait is more pronounced in the prime market where sellers are more inherently discretionary-led.

There remains caution in the top end of the market, and the entire luxury sector, which relies on wealthy consumers, has seen a slowdown in trading conditions. From private jets to watches, consumers remain unconvinced now is the time to make significant purchases. As a case in point, supercar sales have fallen by 67% over the last year according to UHY Hacker Young.

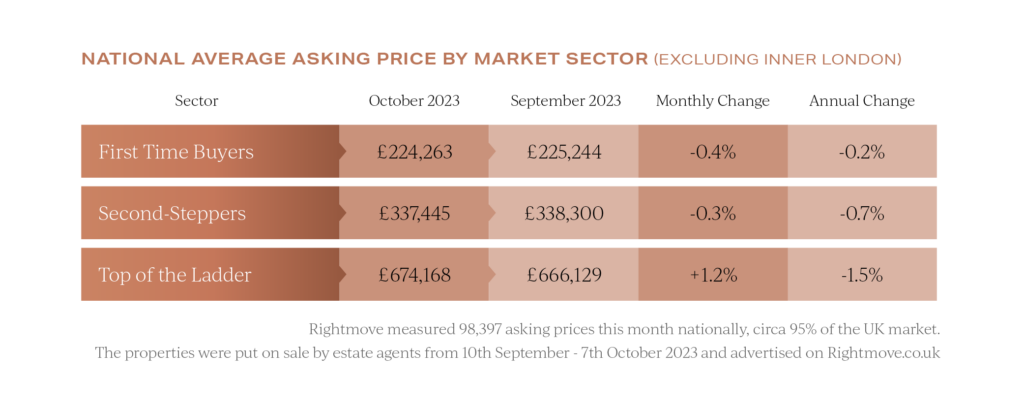

At the top of market, Rightmove reported that UK property asking prices for prime homes have fallen at twice the rate on an annual basis when compared to other sectors of the market.

However, historical trends tell us that it will be the prime market that rebounds quickest. Of note, therefore, is that asking prices for top-end homes rose significantly ahead of other parts of the market last month.

However, historical trends tell us that it will be the prime market that rebounds quickest. Of note, therefore, is that asking prices for top-end homes rose significantly ahead of other parts of the market last month.

Opening of Parliament King’s Speech

In the King’s Speech on the 7th November the Government confirmed leaseholder reforms, making it cheaper and easier for homeowners of leasehold properties to purchase their freehold and challenge excessive service charges. The Leasehold Reform Bill also will see the end of new-build leasehold properties except for flats.

Of note to existing landlords and potential property investors was that the Renters’ Reform Bill was confirmed in the King’s speech and is likely to be enacted in a matter of months, bringing with it, the sweeping changes we have previously highlighted.

A Budget winter warmer for the UK property market?

Looking ahead over the coming month, the next milestone event that could have the greatest affect on shaping the economy, and the intrinsically linked UK property market, is the Autumn Budget on 22nd of November.

Speculation is mounting that ahead of what is likely to be an election year, the Chancellor needs to better balance his fiscal prudence with injecting some confidence and growth back into the economy. With a reported surprise £30 billion budget surplus, this may just tip the odds of a package of much-needed stimulus measures being announced. We will report on the Budget and what it means for the market next month.

In the meantime, do get in touch if you require any assistance from the Garrington team with your own UK property plans and would appreciate some objective tailored advice.