Welcome to the April edition of Garrington’s UK Property Market Review. As spring unfolds, the property market enters a...

UK Property News – October 2023

Welcome to Garrington’s October 2023 UK property market review, where we examine data and emerging trends from across the UK’s housing landscape.

As we ease into autumn and what is traditionally a busier market, the change this year has been subtle rather than stark. The various interpretations of market prospects mirror the unpredictability of the season’s weather.

Some recently released data makes for startling headlines, with 80% more property for sale in September this year compared with September 2021. Yet the market correction remains regionally polarised and meandering in nature.

A glimmer of optimism for sellers

Last month’s national house price indices brought a glimmer of optimism for sellers, as recorded average price falls have either slowed or flatlined.

Despite Halifax noting the annual rate of price falls at -4.7% as being the fastest since 2009, they also recorded a shallower rate of descent in September, with a monthly fall at -0.4%. Nationwide also recorded annual price falls at a rate of -5.3%, but importantly, said that price movements had flatlined in the UK property market last month.

Nationwide also recorded annual price falls at a rate of -5.3%, but importantly, said that price movements had flatlined in the UK property market last month.

The view that the rate of price falls has slowed may reflect renewed purchaser activity because of the Bank of England’s decision last month to pause lifting interest rates further.

The Bank’s Monetary Policy Committee does not meet again until the 2nd of November and the outcome of this meeting is considered crucial in determining whether spiralling interest rates may have peaked or have just been paused.

A dip in swap rates has fuelled speculation among lenders that they may have peaked, leading to the rollout of lower mortgage product rates in recent weeks.

Rates are now accessible at below 5%, enhancing affordability for credit-dependent buyers.

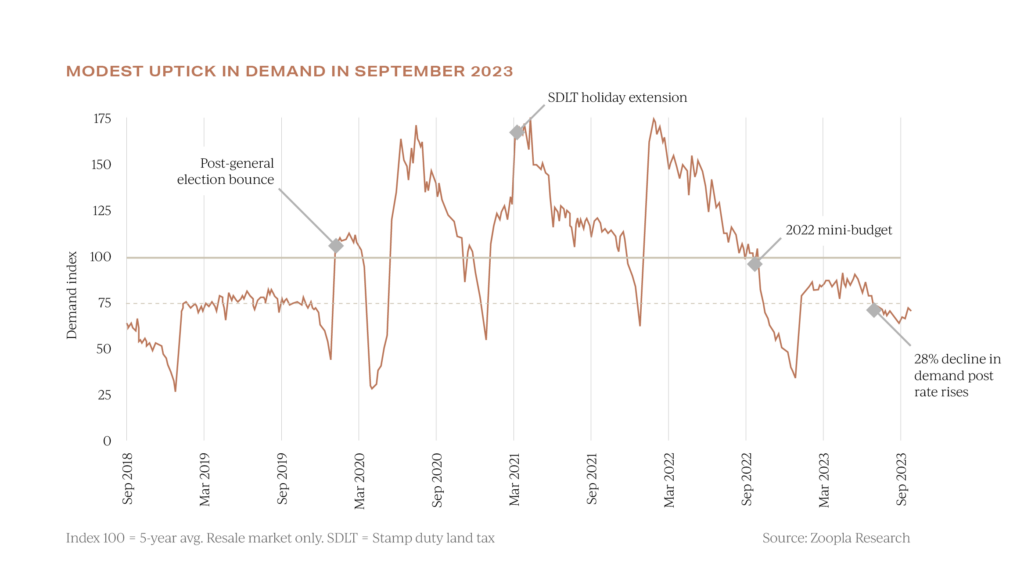

According to Zoopla, the decline in buyer demand over the summer has started to reverse with buyer enquiries to sales agents up 12% since the August bank-holiday weekend.

This improvement is off a low base; demand remains 33% lower than a year ago and in line with 2019.

This uptick in enquiries is partly seasonal, but also reflects improved consumer confidence amid expectations of lower mortgage rates.

Buyer demand for homes has seen a gentle uptick across the board with a marked increase in southern England.

Over recent weeks, there’s been a 19% jump in demand in the south-east and a 16% rise in London. Concurrently, there’s a noticeable growth in new sales agreements, reflective of sales volumes seen in 2019.

U-turns and the wrong track

Amid the bustling political conference season, the government has made a series of pivotal announcements, each bearing its own set of implications for the property market.

In his September disclosure, Prime Minister Rishi Sunak indicated a substantial trimming of the government’s green initiatives.

Consequently, the mandate for landlords to elevate their rental properties to an energy efficiency standard of EPC band C by 2028 has been rescinded.

This reversal embodies a significant policy shift, the repercussions of which, on the private rental sphere, remain uncertain.

While some argue that this may decelerate the ongoing exodus of landlords from the sector, sceptics contend that it may scarcely deter some landlords from liquidating their portfolios of UK property.

In another striking political stride, the Prime Minister also unveiled his decision to terminate the northern leg of the contentious HS2 rail project.

The reverberations of this news are bound to be mixed for the regional and local property markets.

Many locations and properties, once tarnished by the looming HS2 route and consequently suffering depreciated values, may now witness a resurgence in buyer interest following the announcement.

By contrast though, investment acquisitions in the northwest, once bolstered by the anticipated influx of capital and regeneration heralded by HS2, now stand on precarious ground.

Towns such as Crewe, which had previously sprinted ahead in regional price growth fuelled by the project, now face potential headwinds in the wake of this decisive halt.

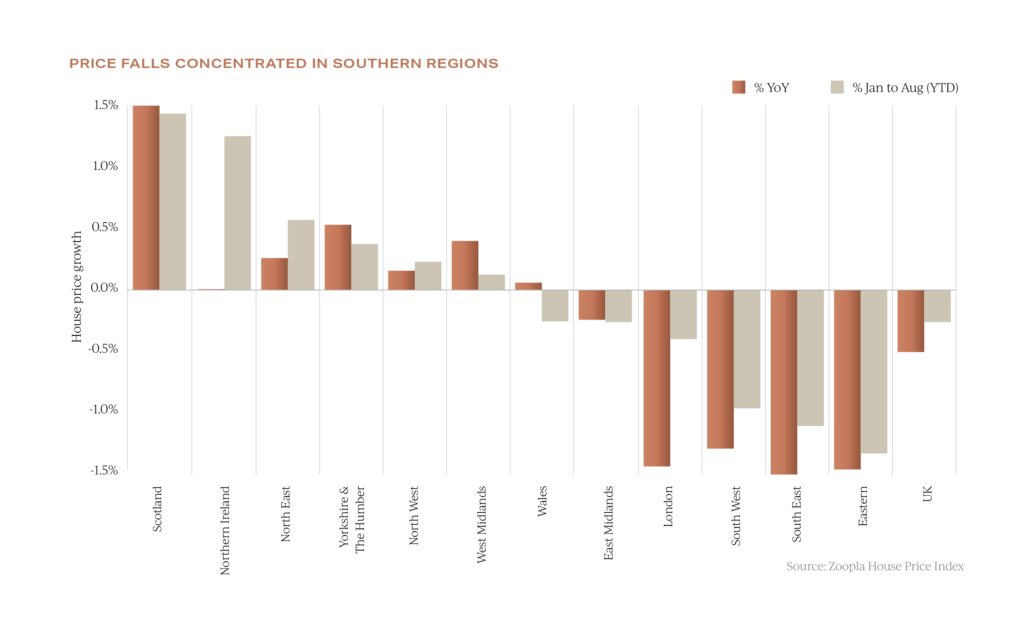

UK property market – a polarised picture

Zoopla highlights a notable activity resurgence in the south and London, regions previously hit hard by steep price drops due to higher borrowing costs.

In contrast, in Scotland, where prices are 40% below the national average, the rate of annual house price movement is still up 1.6%, albeit some other indices are recording lower levels of price movement.

At the top of the market, transactions year-to-date are broadly 80% of what they were a year ago, highlighting how buyers of prime homes at £1million and above have been able to better adapt to the new purchasing landscape.

At the top of the market, transactions year-to-date are broadly 80% of what they were a year ago, highlighting how buyers of prime homes at £1million and above have been able to better adapt to the new purchasing landscape.

Looking more granularly at transactions in London, sales at £5 million and above have been more robust than other price sectors, and despite transactions being down by nearly a third year-on-year, they are well above pre-pandemic norms according to LonRes. The tapestry of data that make up the UK property market is now more a medley of varying trends than a harmonious tune. Whether this signifies early inklings of market stability is yet to be determined.

The tapestry of data that make up the UK property market is now more a medley of varying trends than a harmonious tune. Whether this signifies early inklings of market stability is yet to be determined.

We will further evaluate this point next month. In the meantime, if we can assist you with your own property requirements anywhere in the UK, please do get in contact.