Welcome to the April edition of Garrington’s UK Property Market Review. As spring unfolds, the property market enters a...

UK Property Market Update: Falling Interest Rates & Rising Prices

Welcome to Garrington’s latest review of the UK property market.

Having just entered a new meteorological season, the start of September marks a time to reset life, whether it be back to school, university, work or, for an increasing number of people, putting moving plans into action.

September historically ushers in a more active phase for the market, and early indicators suggest a cautious optimism.

The forward indicators we discussed in August have gathered pace over the last month, further supported by interest rates falling across the board, and some lenders now offering rates not seen for several years.

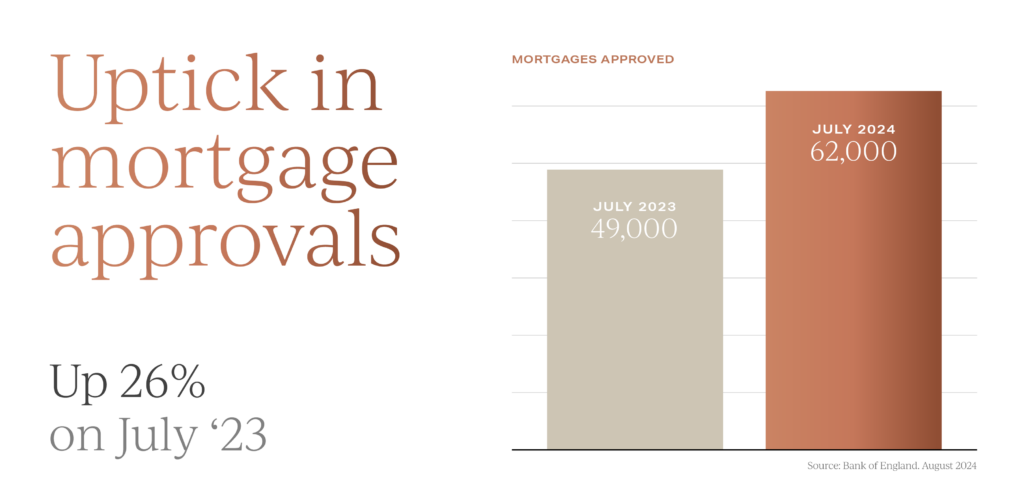

Data released by the Bank of England at the end of August recorded mortgage approvals rising to 62,000 in July, which is the highest level since September 2022 and a 26% increase compared to the same time a year ago. Average house prices are starting to rise again but all is not quite as straightforward as the headline data portrays.

Average house prices are starting to rise again but all is not quite as straightforward as the headline data portrays.

Making sense of UK property price data

We picked up on the point last month that the market may be at a tipping point with both major house price indices reporting an increase in average UK property prices.

This uniform pattern has not continued though, and Nationwide reported a modest drop in values last month of 0.2%, whilst Halifax has once again reported an increase of 0.3%, which takes the annual rate of growth to 4.3%, the strongest rate seen for two years. This upswing in demand is starting to push up prices strongly in some areas, but not all.

This upswing in demand is starting to push up prices strongly in some areas, but not all.

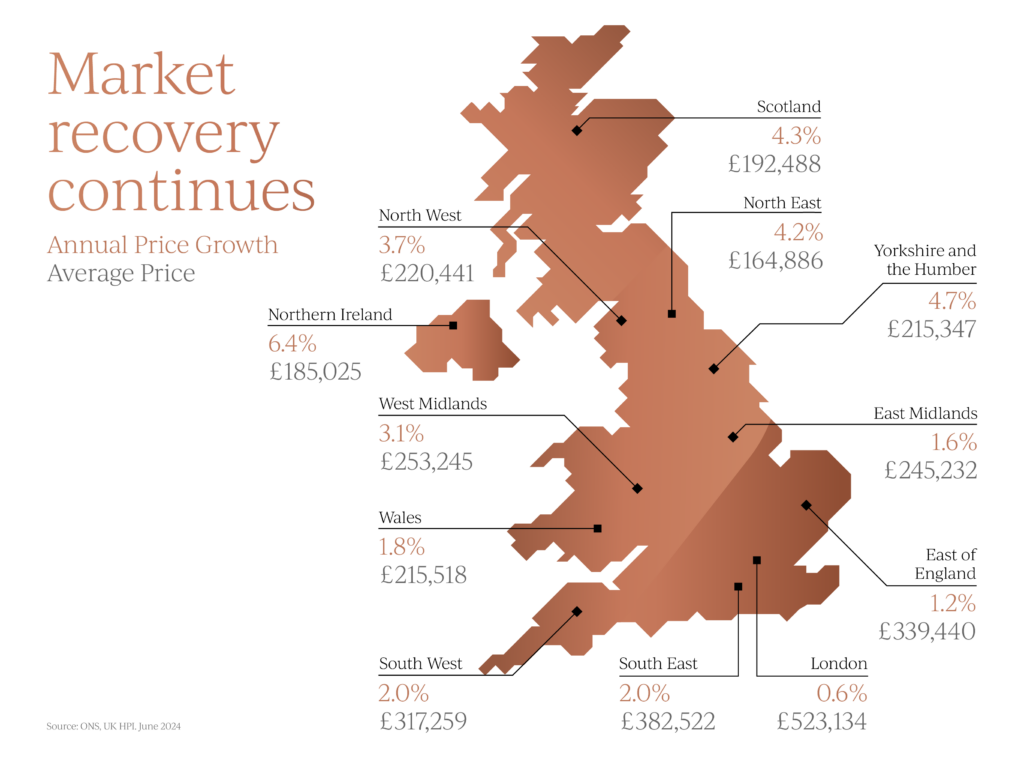

For all the momentum revealed by the national averages, prices are rising fastest in areas where value is strongest.

In the most expensive parts of London and the South East, we are still seeing prices coming down.

That’s why Halifax’s data shows that average prices in Wales are rising nearly four times faster than those in London, while prices in North West England are outpacing those in the capital by nearly three to one.

Regional differences are quite apparent based on ONS data too. It records that Northern Ireland is experiencing the strongest growth at 6.4%, followed by Yorkshire and the Humber at 4.7% and Scotland at 4.3%.

It records that Northern Ireland is experiencing the strongest growth at 6.4%, followed by Yorkshire and the Humber at 4.7% and Scotland at 4.3%.

Confidence is expected to increase in the housing market across the coming months, assuming inflation remains under control and interest rates continue to fall.

Is now the time to buy a home?

Many would-be buyers held back progressing property plans due to the perfect storm of higher interest rates coupled with cost-of-living increases.

These and other factors dented consumer confidence and created prolonged caution.

However, with falling mortgage rates and more upbeat economic indicators, the signs are that the market is becoming more free flowing.

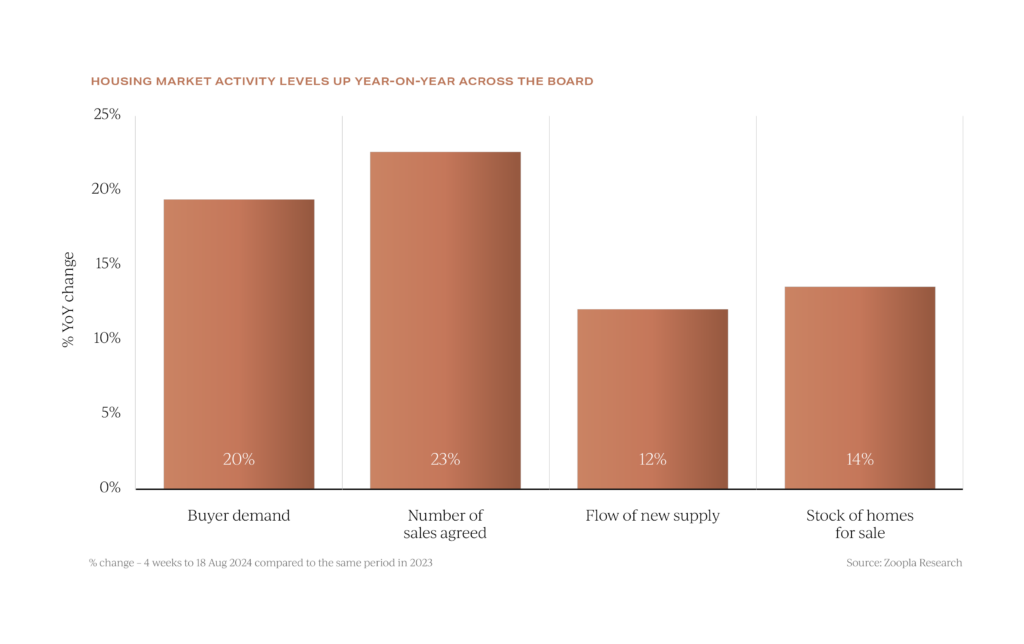

The supply of homes for sale is now at a 7-year high, and buyer demand has increased by 20% according to Zoopla, with a 23% increase in new sales transactions being agreed. Different groups of buyers and sellers are reacting to the market in different ways. In the face of diminished stock levels and rising rents, more tenants are becoming buyers and taking advantage of lower mortgage rates and softer prices than several years ago.

Different groups of buyers and sellers are reacting to the market in different ways. In the face of diminished stock levels and rising rents, more tenants are becoming buyers and taking advantage of lower mortgage rates and softer prices than several years ago.

Adjustments to household incomes and the expectation of an aggressive Autumn Budget is acting as a ‘push’ factor for some sellers to downsize, explore cheaper locations or, in the case of second homeowners, dispose of an asset before the much-rumoured expected rise in Capital Gains Tax rates.

For informed and well organised purchasers, the coming months may present opportunities in view of the threats facing some sellers.

A price sensitive UK property market

National press headlines of rising house prices simplify and distort the reality of the current market.

Across Garrington’s operating regions around the UK, we are seeing property market conditions improving but it is far too soon to call this a full recovery.

In recent weeks we’ve seen a surge of homes coming onto the market, and this jump in supply has yet to be fully absorbed. Over the next few months price rises could moderate as the market rebalances.

In the meantime, the market will remain price sensitive. 20% of homes currently for sale have had a price reduction of more than 5% and by overpricing to start with these homes are taking on average 2.6 times longer to sell at 78 days, according to Hometrack. With many buyers spoilt for choice and sellers keen to get a deal done, generous discounts are still achievable for buyers who do their homework and negotiate effectively.

With many buyers spoilt for choice and sellers keen to get a deal done, generous discounts are still achievable for buyers who do their homework and negotiate effectively.

Garrington’s view remains that a slow and steady recovery in market conditions is more likely rather than any form of significant resurgence in the near term.

If you are considering your own property plans for the autumn and would like some impartial advice, do get in touch with the team at Garrington.

If however, you are just exploring the market and some location options, don’t forget to visit Garrington’s Best Places to Live research. Simply click on the link to see our useful guide and interactive location explorer.

Next month, ahead of the Autumn Statement, we will look at how the new Government has impacted the UK property market during its first 100 days in office.